The US is falling behind in the cryptocurrency sector as other parts of the world, led by Europe and Asia, have taken a leadership role. This has led to the reintroduction of the US Token Taxonomy Act in the US House of Representatives. This bill was originally proposed in December of 2018 and is sponsored by Republican Representative Warren Davidson and by Democratic Representative Darren Soto. The US Token Taxonomy Act will exclude cryptocurrencies from being classified as a security under US law and amend the Securities Act of 1933 as well as the Securities Act of 1934.

The reintroduced bill itself was amended from its initial publication in order to clarify the regulatory framework and jurisdiction for the Commodity Futures Trading Commission or CFTC and for the Federal Trade Commission or FTC. Should the US Token Taxonomy Act be passed, it would supersede state legislation such as New York’s BitLicense which has created confusion and obstacles in the crypto-community. The Securities and Exchange Commission or SEC will therefore not have jurisdiction over cryptocurrencies. The exemption of cryptocurrencies from federal securities laws would make it easier for transactions to take place with the aim to invite more companies to the US in order to innovate in this field.

Europe has emerged as a leader in the blockchain and cryptocurrency space with the latest example being Germany’s WEG Bank as I outlined in my post “Bitcoin - Forex Combo Strategy: WEG Bank”. The explosive growth and great start to 2019, as I have initially discussed in my post “Bitcoin - Forex Combo Strategy: Cryptocurrency Volume Alert”, has resulted in the surge of lobby groups in the US which currently stand at 33 as of the fourth-quarter of 2018, up from 12 reported in the fourth-quarter of 2017. This shows that the entire sector is gathering more support which is expected to continue moving forward.

As news of the reintroduction of the US Token Taxonomy Act, the Acting Head of Blockchain Association, Kristin Smith, noted that “In light of the recent SEC staff guidance, the open blockchain industry needs regulatory clarity more than ever. We believe that blockchain technology has tremendous potential and that we need smart, simple, and supportive legislation to make sure that the United States continues to be a leader in this ecosystem. We are grateful for the bill’s sponsors for their continued support for this vital technology.” The aim of the US Token Taxonomy Act to create a light regulatory framework which will allow entrepreneurs to realize their dreams.

Cosponsor of the US Token Taxonomy Act, Republican Representative Warren Davidson, pointed out that “Digital tokens are a new asset class, and we need to define them in order to regulate a market that can compete with Singapore, Switzerland, and others who are aggressively growing their blockchain economies.” Second cosponsor, Democratic Representative Darren Soto, added “After months of public input, our Token Taxonomy Act and the Digital Taxonomy Act add critical definition and jurisdiction to create certainty for a strong digital asset market in the United States. This is an important step to promoting innovation and maximizing the potential of virtual currencies for the US economy, all while protecting customers and the financial well-being of investors.”

There is opposition to this bill, but I think it is a step in the right direction. The US has fallen behind in competitiveness in the cryptocurrency space, but clearing confusing regulation may allow it to narrow the gap which may create even more exciting solutions. Price action remained stable at elevated levels and bullishness is on the rise which could push prices higher.We are approaching key resistance levels and could see some choppy price action ahead as a breakout above it will be attempted.As bullish momentum is on the rise, I would recommend that those on the sidelines waiting for a buying opportunity use any short-term retreat in price action as a buying opportunity. This is especially true for Ripple under $0.3500 and for Bitcoin under $4,750

I continue to hodl my 200 Bitcoins which carry an average entry price of $4,315 as well as my 6,000,000 Ripple which carry an average entry price of $0.2975. I am waiting for a pull-back in Ethereum before entering this troubled cryptocurrency. While I have not given up on Ethereum, there are a lot of issues which need to be fixed and other coins represent a better hodling opportunity. The two images show the entry levels to my current cryptocurrency portfolio.

I did re-enter my Gold trade on April 4th 2019 and purchased 100 lots at $1,282.00. My margin requirement was $130,347 with a pip value of $100.00. I believe Gold will overall increase in value this year and could breach the $1,500.00. The global economy continues to cool down and we may enter a recession this year. While this is a longer-term prediction, those who want to trade Gold short-term could follow this trading recommendation “Gold Fundamental Analysis – April 4th 2019”. The below image shows my re-entry into the Gold trade.

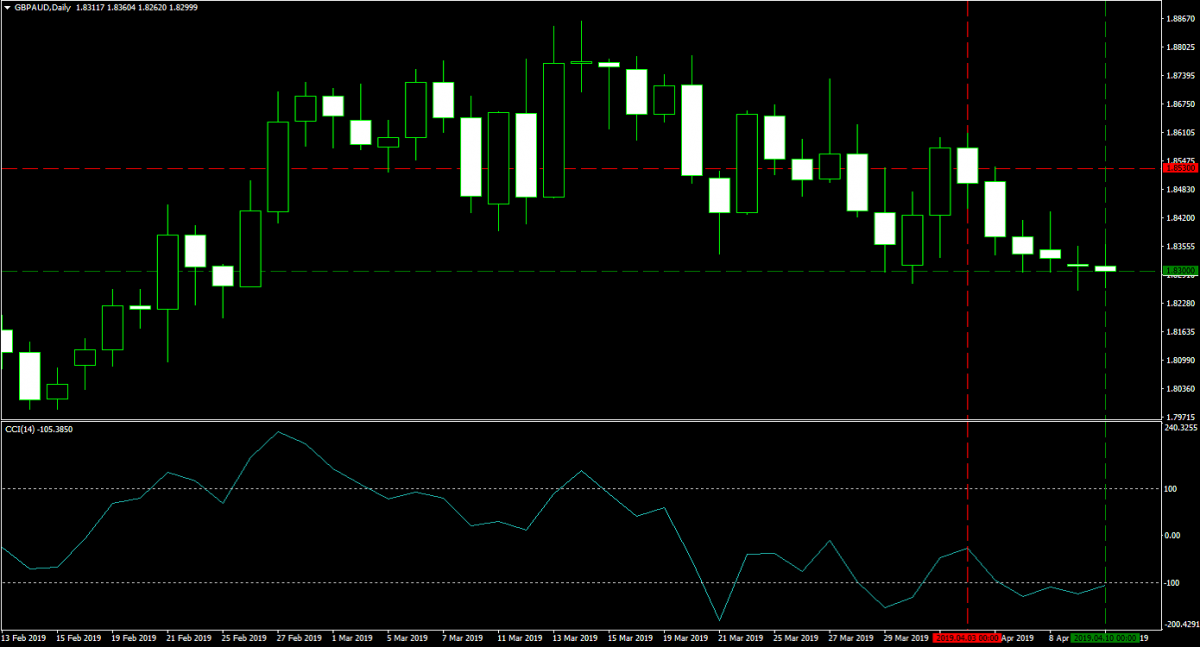

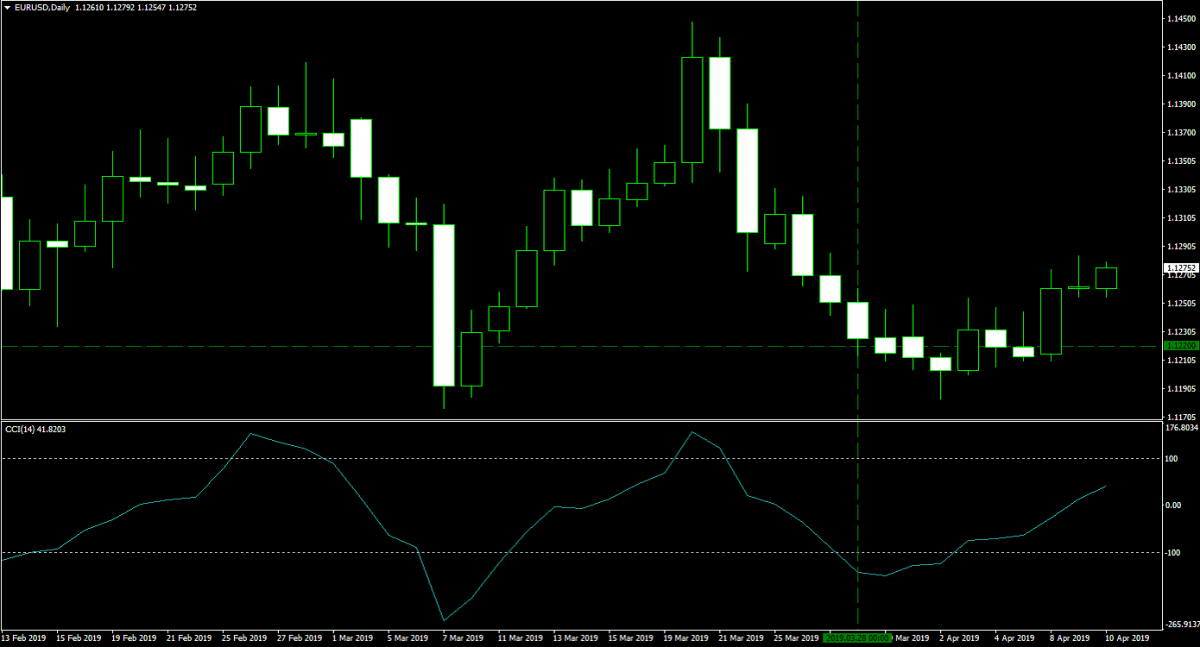

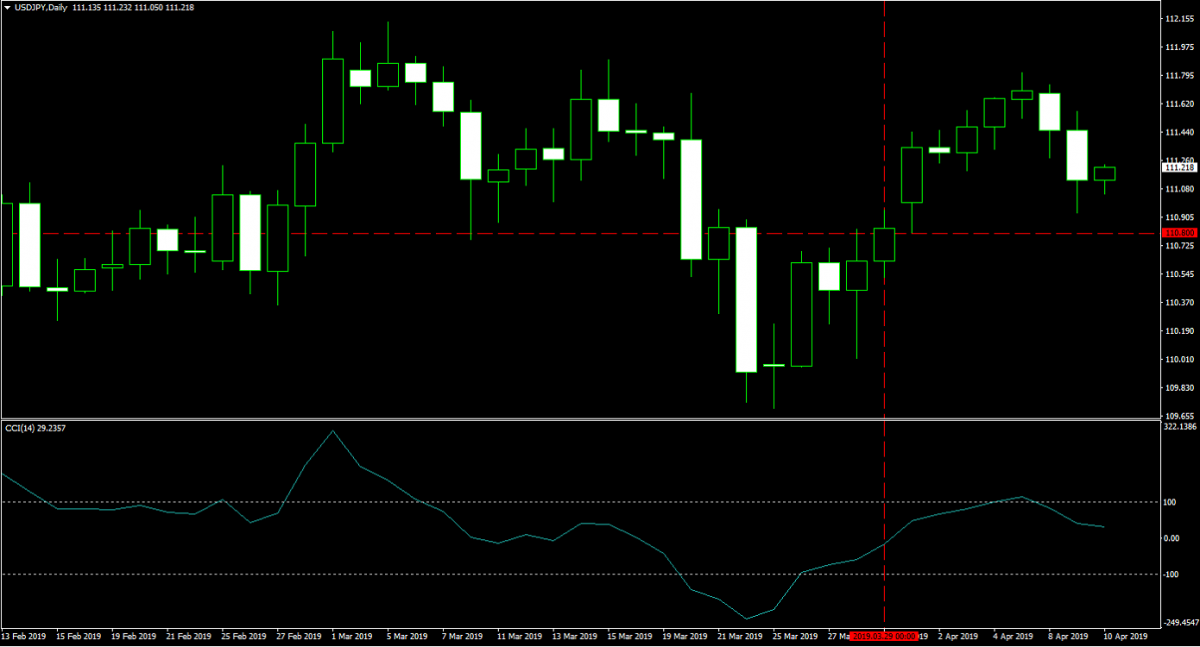

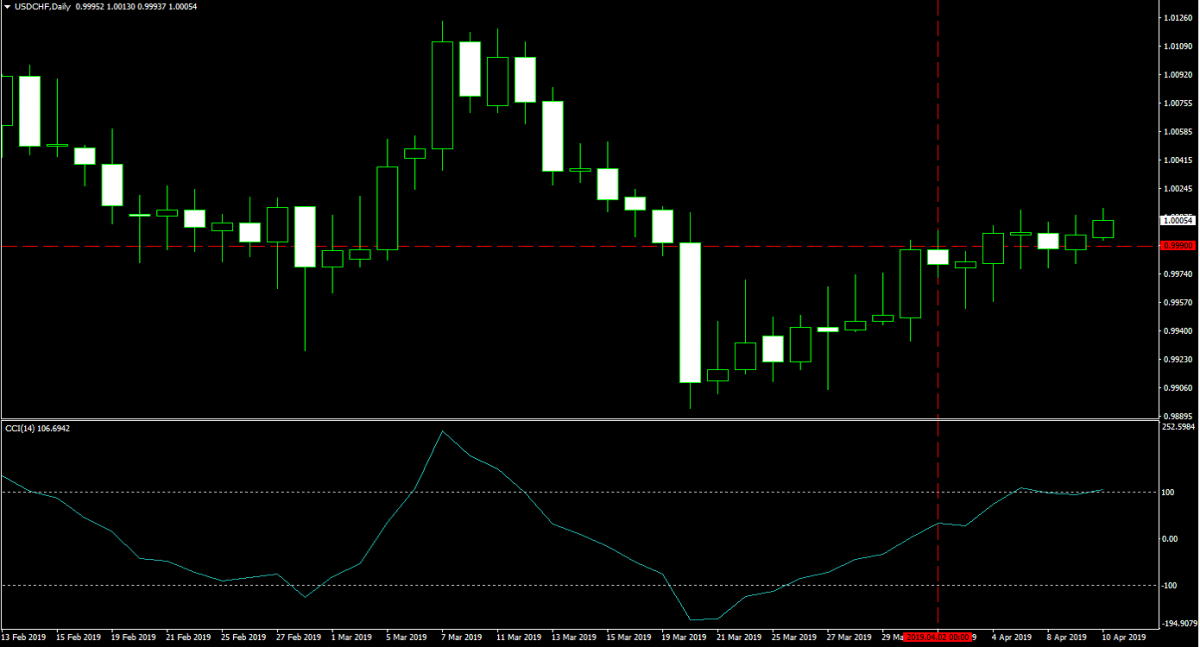

Last week I ended my update with five open forex positions of which four remain open and on was closed. A few moments ago my 125 lots GBPAUD short position was closed through my stop loss at 1.8300 for a profit of 230 pips or $204,783. The following four, 125 lot size each forex positions remains open: a EURUSD long position opened at 1.1220 for a margin requirement of $28,087 with a pip value of $1,250.00, a USDJPY short position opened at 110.800 for a margin requirement of $25,000 with a pip value of $1,122.49, a AUDUSD long position opened at 0.7100 for a margin requirement of $17,807 with a pip value of $1,250.00 and a USDCHF short position opened at 0.9990 for a margin requirement of $25,000 with a pip value of $1,255.17. The five images below show my closed trade as well as my four open positions.

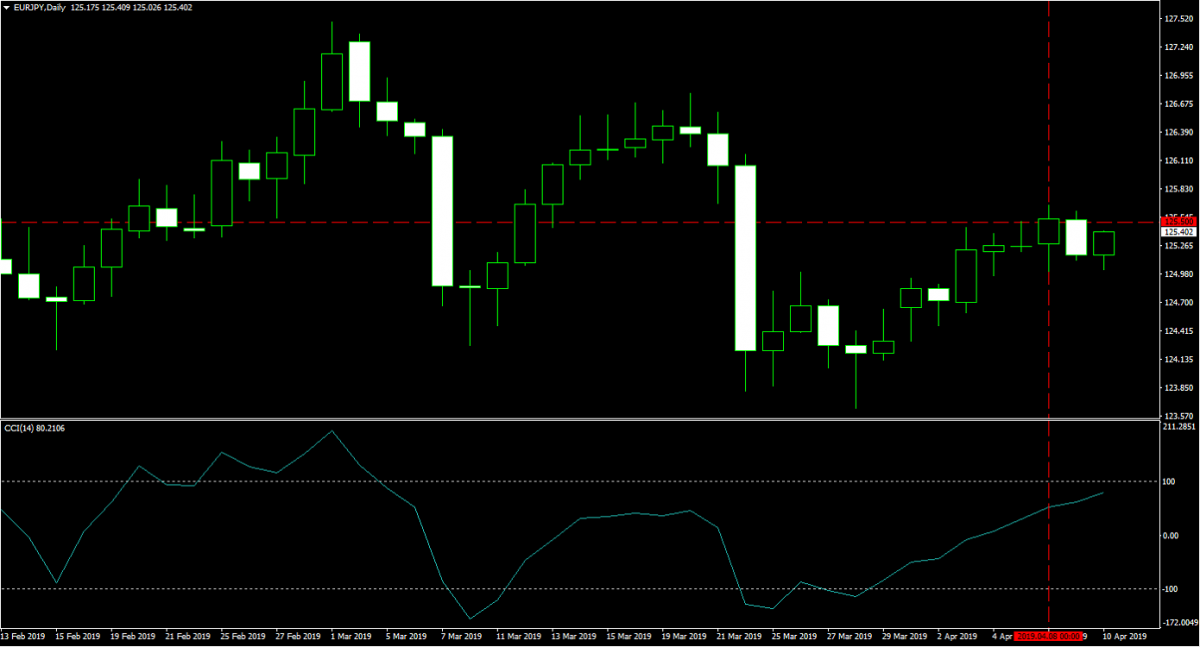

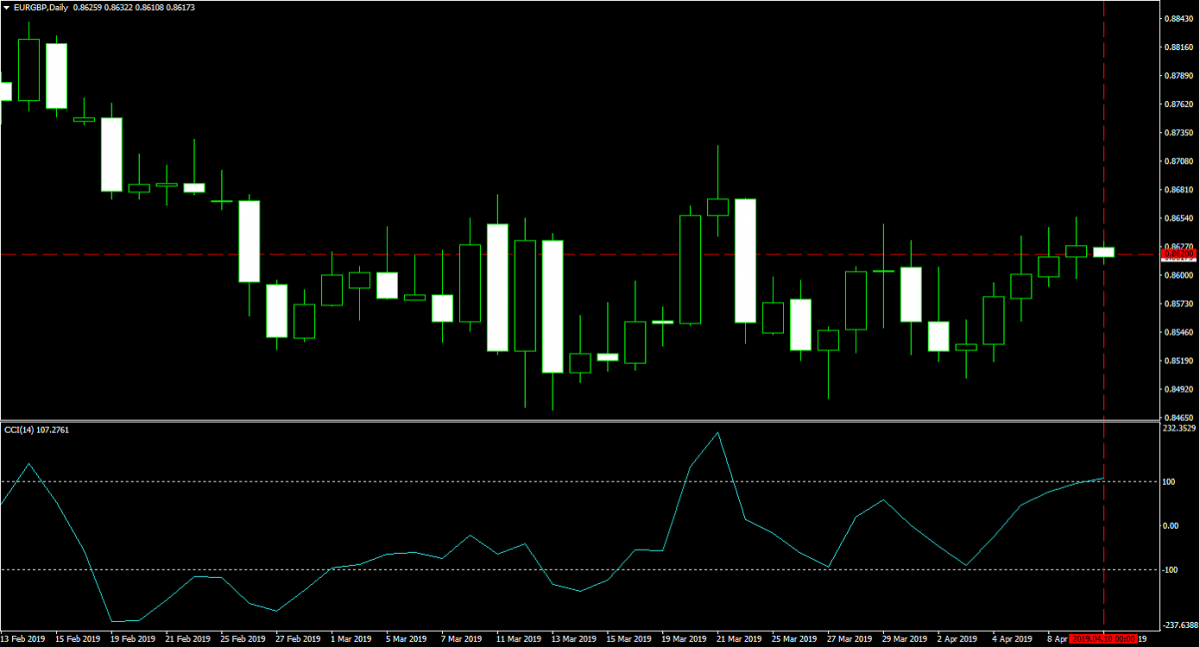

Given my overall exposure to US Dollar currency pairs, I didn’t add any further currency pairs to my current forex portfolio which had the US currency as either a base or quote currency. It is not smart to be overexposed to a specific currency and I will wait to exit some exiting trades before adding US Dollar related trades. On April 8th 2019 I did add a 125 lots short position in the EURJPY at 125.500 according to this trading recommendation “EURJPY Fundamental Analysis – April 8th 2019”. The margin requirement was $28,187 with a pip value of $1,124.04. Earlier today I added a 125 lots short position in the EURGBP at 0.8620 for a margin requirement of $28,187 with a pip value of $1,635.52. You can find the trading recommendation at “EURGBP Fundamental Analysis – April 10th 2019” and two images below show both new additions to my forex portfolio.

Here is a summary of my Bitcoin - Forex Combo portfolio: I hodl 200 Bitcoins worth $1,039,882 and 6,000,000 Ripple worth $2,095,200 with a total cash portfolio worth $3,540,107 and 100 lots of Gold worth $339,747. I also have the following six 125 lots forex positions open: a EURUSD long position worth $95,587, a USDJPY short position worth -$22,145, a AUDUSD long position worth $76,557, a USDCHF short position worth $6,172, a EURJPY short position worth $43,924 and a EURGBP short position worth $39,636. My total Bitcoin - Forex Combo portfolio is worth $7,254,667, up $459,967 as compared to last week and at a new all-time high. Join me today at PaxForex by opening your own trading account and follow me and my Bitcoin - Forex Combo portfolio as you start your own path to a successful 2019 and beyond!

To receive new articles instantly Subscribe to updates.