It appears that after April Fool’s Day, April 1st, Bitcoin decided to wake-up from hibernation as it surged double digit and sucked many of its peers up with it. Welcome back everyone to this week’s edition of my Bitcoin - Forex Combo Strategy! What a start to the week we have had and it appears that we could push a bit further. There have been no major fundamental developments which warranted the sudden surge in price action and many analysts have already dismissed this as nothing more than a temporary surge in enthusiasm surround the cryptocurrency sector.

While the sudden surge may not be explainable, it could lead to a bigger rally as there are many institutional traders who follow technical trading signals and if this rally can survive a bit longer, then we could see the emergence of a Golden Cross, where the 50 DMA will move above the 200 DMA. This is all but guaranteed to provide a surge in buy orders across the board. Sometimes all it takes is an unexplained event to occur for a market to surge, especially if it has been looking for a catalyst in order to accelerate to the upside. Today I want to focus on what has happened to WEG Bank, a German based bank, as it is another example of the growth in cryptocurrency acceptance which is key for the entire sector.

I stared this year by talking about 2019 being a year where acceptance of cryptocurrency will grow. You can read my post on it here “Bitcoin - Forex Combo Strategy: Cryptocurrency Acceptance Grows”. WEG Bank, which is part of the SEPA Instant Banking Network, a Europe wide network which spans 20 countries and over 2,000 banks, has found its banking niche as it appears to be a key go-to-partner for crypto-currency firms. Nimiq, a browser based blockchain payment service, has acquired a 9.9% stake in the German bank as part of its Nimiq Oasis program.

Nimiq also partnered with Agora Trade which is a Swiss-Maltese decentralized cryptocurrency exchange. Together with WEG Bank, the trio now plans to connect different cryptocurrency markets through Agora Trade to WEG Bank. The aim is to create a crypto-to-fiat bridge in order to integrate the exchange of cryptocurrencies from different markets to fiat currencies and vice versa. This will also cut out any third-party which needs secure private keys of cryptocurrency holders. The partners also want to integrate fiat payments through the WEG Bank blockchain in order to offer a seamless service to the cryptocurrency market.

Nimiq added that “Establish the Euro itself as the programmable counterparty to a non-custodial cross-chain transaction. In simple terms, it means that in a transaction to buy or sell Crypto, the counterparty could now be a Euro account holder.” The timetable for the launch is not entirely clear, but is expected before the end of 2019. What makes WEG Bank even more interesting is that the Litecoin Network and TokenPay both own a 9.9% stake in WEG Bank which is the maximum allowed under German law without applying for a banking license. According to Nimiq, this also opens up the possibility for future collaboration between Nimiq, the Litecoin Network and TokenPay. Overall, this has definitely been an exciting development for the cryptocurrency market and will hopefully inspire more beneficial partnerships like this one. Competition is always great for the end-user.

As you can imagine, the surge in price action has been great for my cryptocurrency portfolio. I am now eyeing the $6,160 level for Bitcoin should this rally be able to push above $5,000 and maintain this level. A drop below $4,700 may cause me to exit my 200 Bitcoins which carry an average entry price of $4,315, but I will surely re-enter the market if I do decide to sell. I will monitor price action closely. For now I plan to keep hodling. Positive developments in the crypto-banking sector bode well for Ripple where I continue to see great potential moving forward. I currently hodl 6,000,000 Ripple which carry an average entry price of $0.2975.

I am currently the least bullish on Ethereum which is why I closed my 7,500 Ether strong position today, April 3rd 2019, at 160.00 for a profit of $300,000. I will look at smart entry positions in Ethereum as they arise. Ethereum started out to be a lot more promising than what it turned out to be and there are now a lot of fundamental issues with it. Competitors such as EOS have capitalized on the flaws in Ethereum and are now ahead in the race to build the next generation of “internet”. I have touched on this topic in last week’s post where EOS was named the best cryptocurrency for 2019 by Weiss Crypto Ratings. While Ethereum developers try to patch the issues, the much hyped Constantinople release turned out to be a non-event and the sole reason for the rally in Ethereum was the rise in Bitcoin. Maybe developers will fix the flaws, but there are now better alternatives out there. The three images below show my Bitcoin and Ripple positions as well as my Ethereum exit.

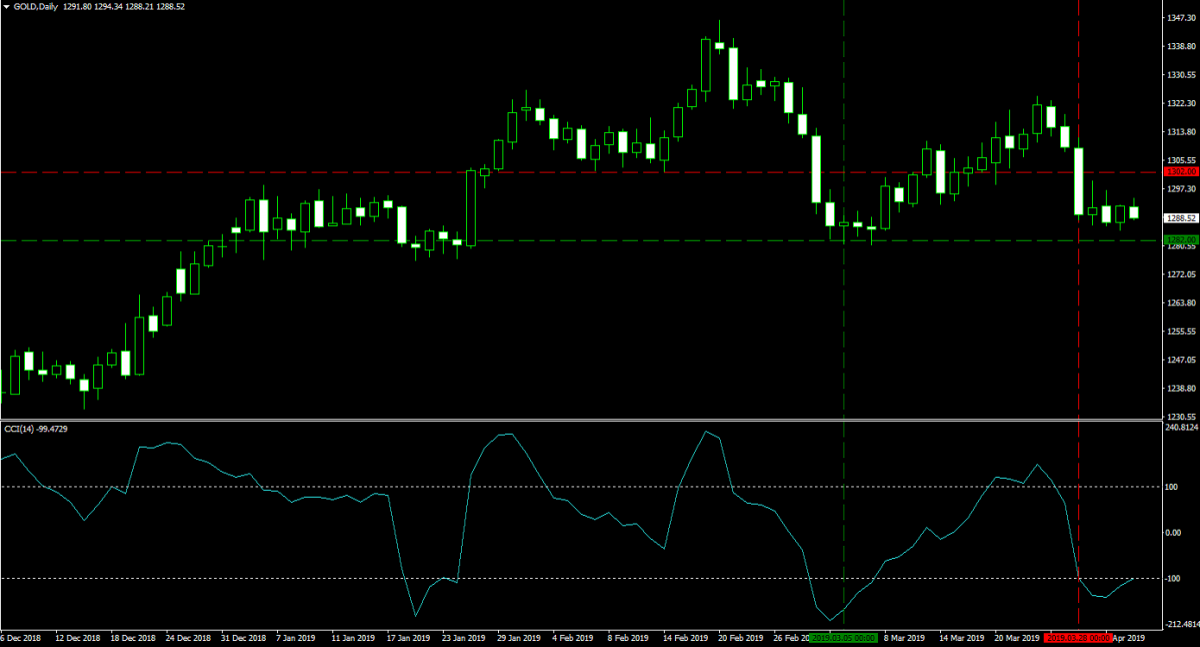

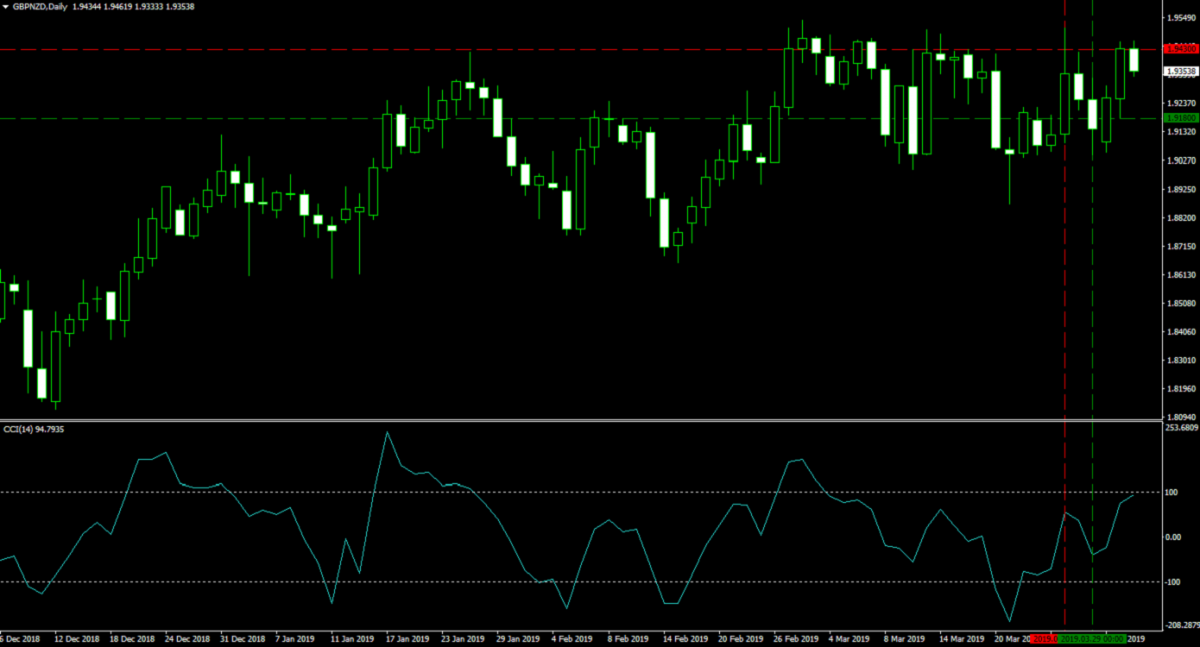

Since last week’s update, “Bitcoin - Forex Combo Strategy: And The Best 2019 Crypto Is…”, Gold retreated as hopes for a trade deal between the US and China have increased. This resulted in the closure of my 40 lots long position, opened at $1,282.00, as my stop loss was triggered at $1,302.00. I booked a profit of 2,000 pips or $80,000 on this trade and am now looking for my next entry level into this previous metal. Last week I only had one open forex position, a 100 lots short positions taken at 1.9430, which was closed on March 29th 2019 as my stop loss was triggered at 1.9180. This resulted in a profit of 250 pips or $170,098. The two images below show my completed trades.

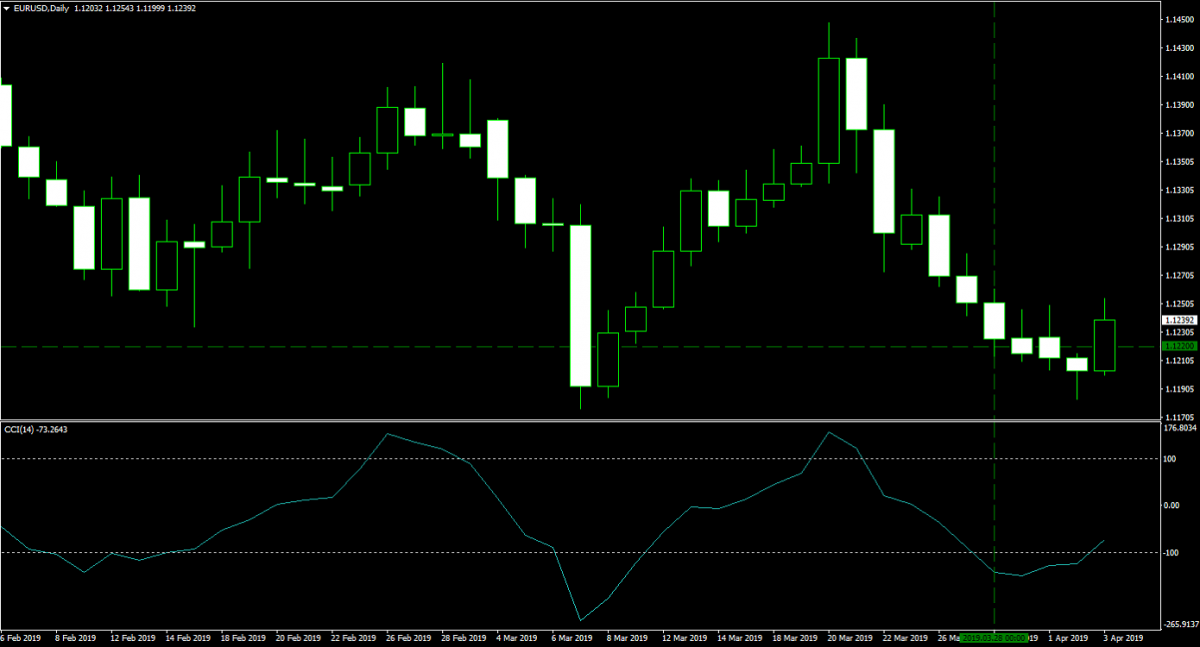

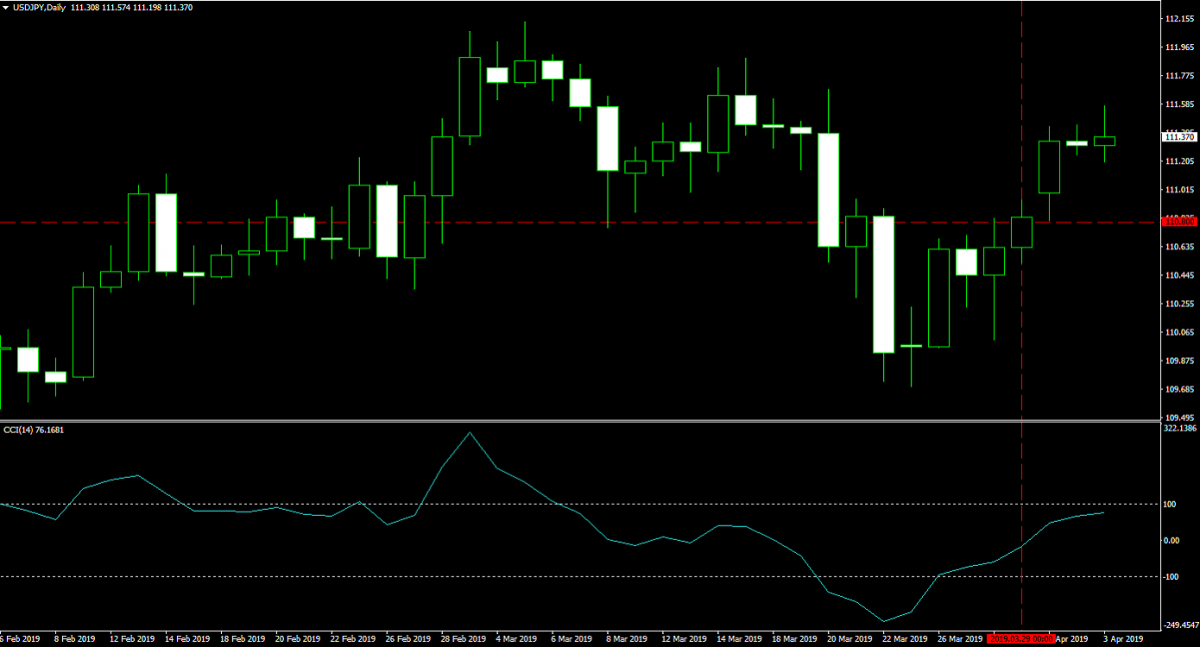

On March 28th 2019 I followed this trading recommendation “EURUSD Fundamental Analysis – March 28th 2019” and bought 125 lots at 1.1220 for a total margin requirement of $28,087 with a pip value of $1,250.00. On March 29th 2019 I added a 125 lots short position in the USDJPY at 110.800 for a margin requirement of $25,000 and a pip value of $1,122.49. You can find the trading recommendation at “USDJPY Fundamental Analysis – March 29th 2019”. The two images below show my entries into last week’s forex trades.

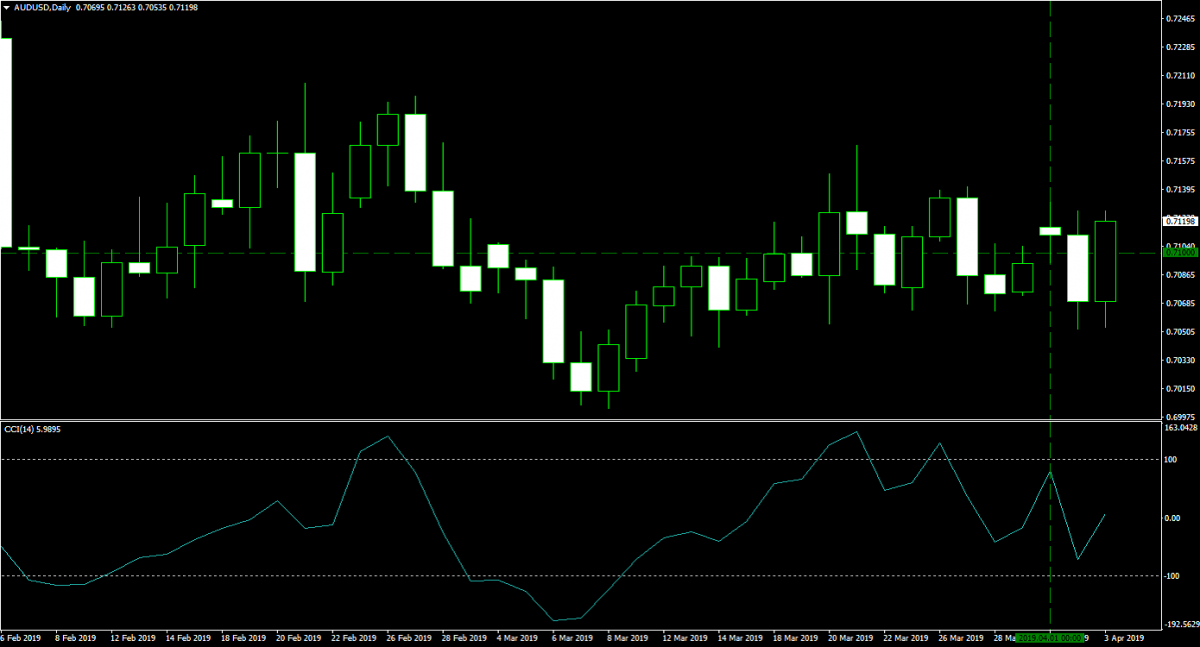

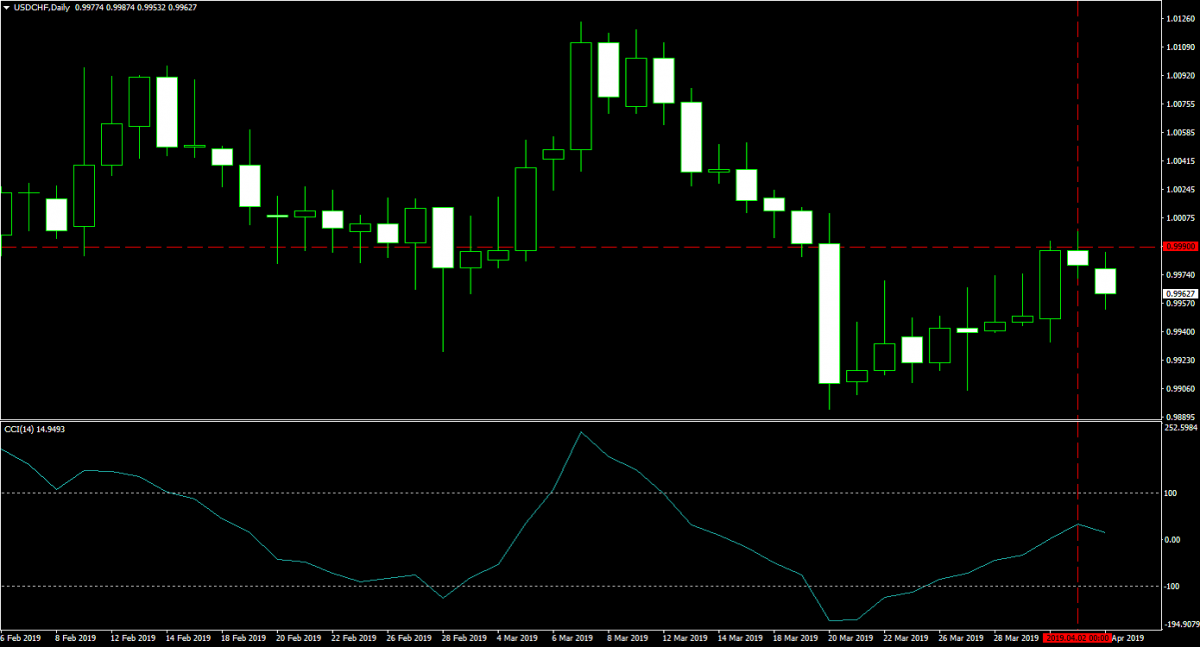

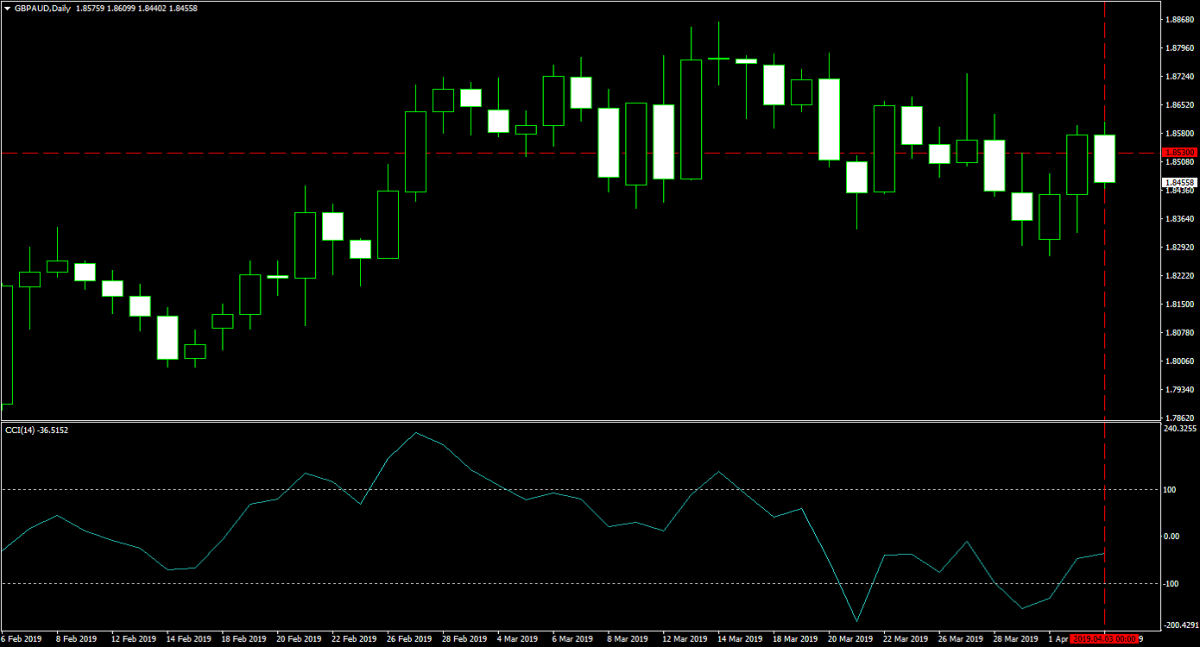

I added a 125 lots long position in the AUDUSD at 0.7100 on April 1st 2019. The margin requirement was $17,807 and each pip is worth $1,250.00. The original trading recommendation can be found at “AUDUSD Fundamental Analysis – April 1st 2019“. Yesterday, April 2nd 2019, I sold 125 lots in the USDCHF at 0.9990 according to this trading recommendation “USDCHF Fundamental Analysis – April 2nd 2019”. The margin requirement was $25,000 with a pip value of $1,255.17. Earlier today, April 3rd 2019, I acted on this trading recommendation “GBPAUD Fundamental Analysis – April 3rd 2019” and sold 125 lots at 1.8530. The margin requirement was $32,863 and each pip is worth $890.36. The three images below show my entry levels into each forex position.

Let’s see what happened to my overall portfolio: I hodl 200 Bitcoins worth $998,040 and 6,000,000 Ripple worth 2,131,200 plus a total cash portfolio worth $3,489,182. My forex portfolio consist of the following five open positions, each with a lot size of 125: a EURUSD long position worth $36,837, a USDJPY short position worth -$47,962, a AUDUSD long position worth $40,307, a USDCHF short position worth $53,869 and a GBPAUD short position worth $93,227. My total portfolio is worth $6,794,700, up $919,419 as compared t last week and at a new all-time high. 2019 has been a great year so far as I managed to build on the great gains from 2018. The second-quarter just started and you can join me right now at PaxForex where I run my portfolio and get my forex trading recommendations from. Follow my weekly updates, open your PaxForex Trading Account and use my Bitcoin - Forex Combo Strategy to turn 2019 into a great year for you!

To receive new articles instantly Subscribe to updates.