The House of Commons voted on a bill yesterday which makes the even of a no-deal Brexit less likely. The measure passed by a single vote, 313-312. PM May voted against the bill, but she did reach out to opposition leader Corbyn, the Marxist leader of the Labour Party, in order to seek a Brexit compromise which will win over enough votes to pass a Brexit deal before May 22nd 2019. The EU stated that cross-party talks between May and Corbyn are a positive development as Corbyn seeks a soft Brexit which includes a customs union with trading bloc.

Following yesterday’s initial meeting between both party leaders, an agreement was reached to dispatch teams in order to extend talks. This is May’s final road to travel in order to push her Brexit deal through Parliament, which was rejected three times already. Even her offer to resign the Premiership was not enough to win over votes. Two of May’s ministers resigned in protest for her reaching out to the Marxist Corbyn. While the EU appreciates a soft Brexit or no Brexit at all, Corbyn may be their closest bet. He seeks a customs union, access to the single market and regulation for workers, consumers and the environment in line with EU rules.

The area of compromise which appears most likely is the customs union. UK Attorney General Geoffrey Cox, a Brexiteer, noted that he could work on a customs union if the alternative would be to remain in the EU. Philip Hammond, the Chancellor of the Exchequer, further raised hopes for a customs union compromise by adding that “Both parties have to give something up: there’s going to be pain on both sides. Some kind of customs arrangement is clearly going to be a part of the future structure.” May has ruled out to agree to a deal which would keep the UK in a customs union with the EU, because it would betray one key pillar of Brexit: the ability to strike trade deals.

Only 36 Tories, May’s political party, voted in favor of a customs union with the EU during indicative votes while the majority would prefer a no deal Brexit over a customs union. The British Pound advanced leading into yesterday’s vote in the House of Commons, but started to retreat from its highs. Is now the right time to buy the British currency? Open your PaxForex Trading Account now and take the first step into a profitable future.

It will be tough for May to keep her party together as Brexiteers were angered by her cross-party talks with Corbyn and by how the House of Commons rushed this bill through in less than four hours. Bill Cash, Tory MP, pointed out that this bill was an “utter rubbish dump” while Mark Francois added that “That is not, sir, a considered debate. That is a constitutional outrage.” May has until April 10th to persuade the EU that a plan is place, but requires more time. May-Corbyn cross-party Brexit talks have once again started, but have failed in the past. Here are three forex trades which will push your portfolio to new highs in the wake of Brexit uncertainty.

Forex Profit Set-Up #1; Buy EURGBP - D1 Time-Frame

Current developments point to a victory for the pro-EU side, but the Euro does remain depressed as a result of the ongoing slowdown in the economy. Economists have underestimated the negative impacts of current EU policy. Despite the long-term negative Euro outlook, the EURGBP is ripe for a counter-trend reversal on the back of short-covering. Price action is expected to push above the upper band of its horizontal support area and complete a double breakout, above its primary and secondary descending resistance level. This will clear the path for the EURGBP to advance into its next horizontal resistance level.

The CCI has formed a narrow positive divergence and is trading above the -100 mark as bullish momentum is on the rise. A move back above the 0 mark is likely to occur as this technical indicator is set for more upside from current levels. Download your PaxForex MT4 Trading Platform today and build a profitable forex portfolio with the help of our expert analysts!

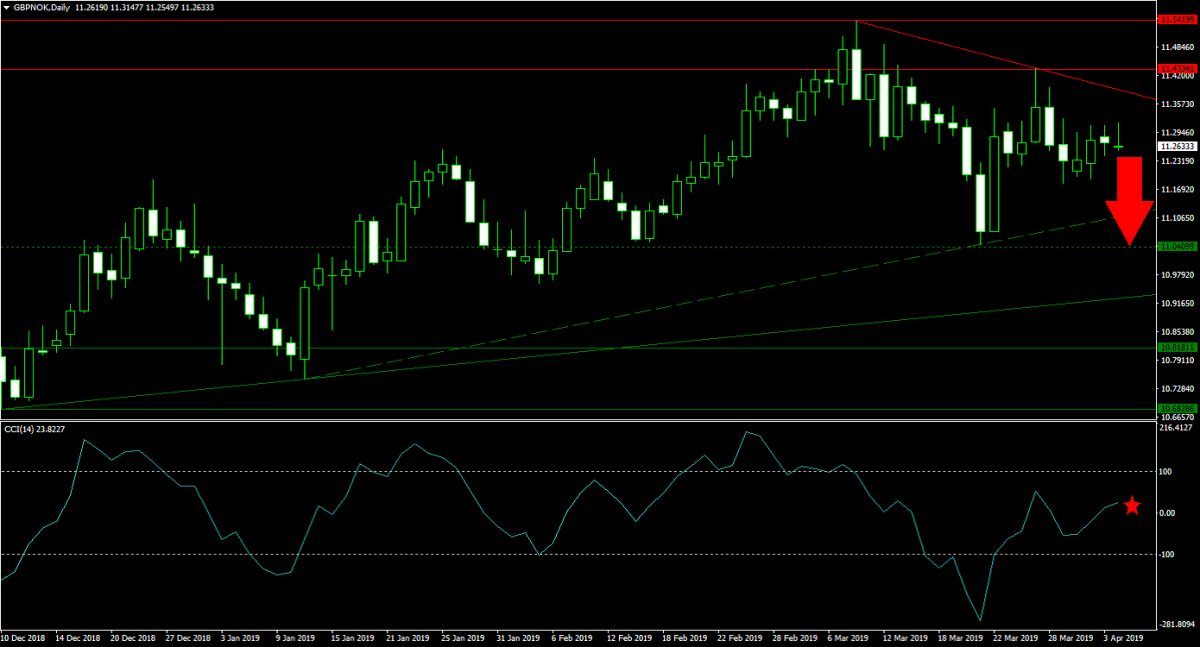

Forex Profit Set-Up #2; Sell GBPNOK - D1 Time-Frame

While the Norwegian economy is not as dependent on the price of oil as other commodity exporting nations, the global economic slowdown will have an impact on Norway. As more traders who favor a soft Brexit turn bullish on the British Pound, the GBPNOK could extend the current contraction which originated following the breakdown below its horizontal resistance area. Its primary descending resistance level is further adding bearish pressures which could force a move below its secondary ascending support level and back down into its next horizontal support level which is being approached by its primary ascending support level. Forex traders are therefore advised to sell the rallies in the GBPNOK into its primary descending resistance level.

The CCI, after dropping deep into extreme oversold territory, accelerated to the upside and pushed above the 0 level for a bullish momentum crossover. Price action was unable to follow through and advanced far less. This momentum indicator is now on the verge to reverse and drop back below 0. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own portfolio!

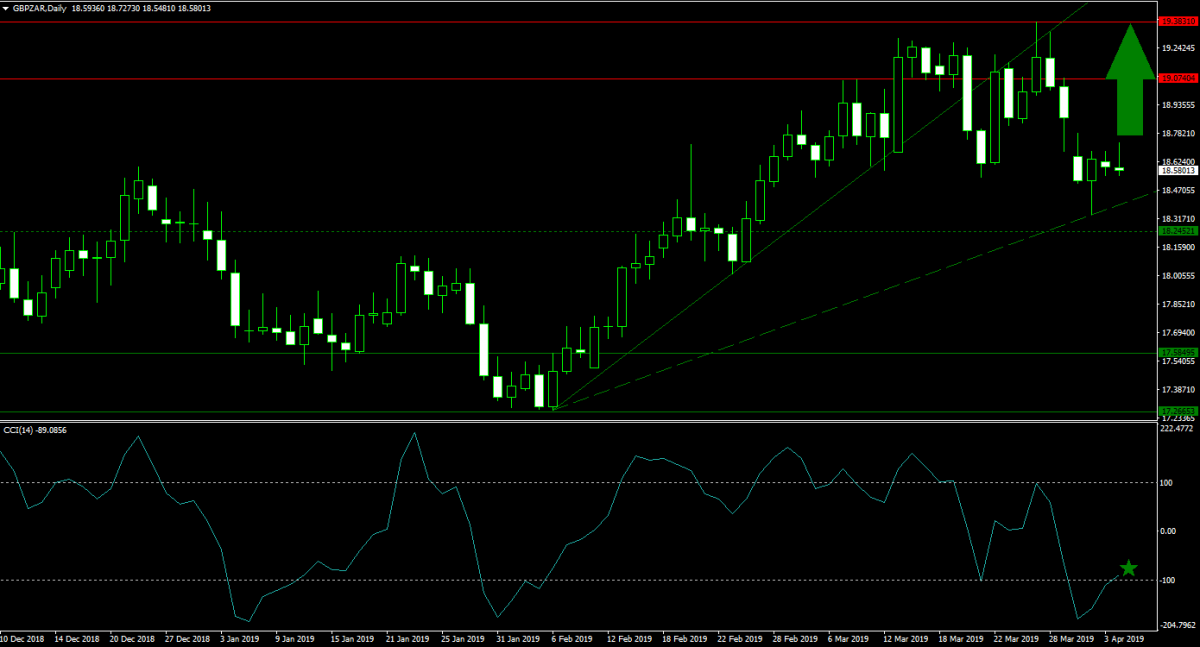

Forex Profit Set-Up #3; Buy GBPZAR - D1 Time-Frame

While the British Pound is surrounded by Brexit uncertainty, the South African Rand is faced with a range of economic woes of its own. The most recent drop in the GBPZAR into its secondary ascending support level represents a great buying opportunity. The global economic slowdown will do more damage to South Africa’s economy than any potential hurdles for the UK economy due to Brexit. Price action is likely to accelerate to the upside and challenge its horizontal resistance area once again. Forex traders are recommended to buy any potential dips in the GBPZAR down to its next horizontal support level.

The CCI has already pushed out of extreme oversold conditions as bullish momentum continues to build. A further move above the 0 mark is likely which supports an increase in price action from current levels. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month through the hard work of our analysts and earn the easy profits!

To receive new articles instantly Subscribe to updates.