Happy New Year! As traders will take a break from trading today due to the markets being closed, many will start to prepare their portfolios for the 2019 trading year which will kick off tomorrow. The following four themes are very likely to have an impact on price action across asset classes and every forex traders need to remain informed about them. One key area of focus will be the US-China trade war. Ripple effects have been felt around the global economy already and are likely to continue until it will be resolved. There is a chance that both sides will agree to reverse the announced tariffs this year, but traders should not expect a quick resolution.

US President Trump tweeted on December 29th “Just had a long and very good call with President Xi of China. Deal is moving along very well. If made, it will be very comprehensive, covering all subjects, areas and points of dispute. Big progress being made!” This is not the first-time such a claim has been made. In the meantime the US continues to deal with a partial government shutdown as Trump seeks financing for his border wall. In that regards Trump noted that “We have no choice, we have to have border security and a wall is part of border security. I’m in the White House. I’m ready to go. They could come over right now.”

Brexit will play a key role in the first-quarter of 2019 as the UK is set to leave the EU on March 29th, but both sides have so far failed to reach an agreement. Divisions in Prime Minister May’s cabinet run deep and no agreement has been reached so far. May tried to rally them behind her and commented that “The referendum in 2016 was divisive but we all want the best for our country and 2019 can be the year we put our differences aside and move forward together, into a strong new relationship with our European neighbors and out into the world as a globally trading nation.” May is trying to secure more reassurances she needs in order to bet the support in Parliament for the Brexit deal she negotiated with the EU. Forex traders are likely to remain very nervous trading the British Pound over the next few weeks.

May added that “We have all we need to thrive and if we come together in 2019 I know we can make a success of what lies ahead.” Will the EU and the UK negotiate a deal or will forex traders navigate through a no deal Brexit? Open your PaxForex Trading Account today and join our vibrant community; find out why more and more forex traders prefer to trade their accounts at PaxForex!

While Italy’s populists government made concessions to the EU, this episode of EU drama may be an early indicator of what Brussels will face in May during the elections while Italy may reset the current populists coalition in 2019. A wave of populists may sweep into office and change the current course of the European Union. It is not just the EU which will face key elections in 2019 as emerging markets will head to the polls from India to South Africa. New populist governments in Latin America, far right in Brazil and far left in Mexico, will spice things up in the region. Let’s not forget a potential US Treasury Yield Curve Inversion on the 2-Year/10-Year and an overall global economic slowdown with tumbling oil prices and surging Gold prices and forex traders have plenty of opportunities to chose from. Another area of concern will be the US Fed and its interest rate policy as well as how the Eurozone economy will be able to cope with the end of QE from the ECB. Here are three forex trades which will help you start 2019 on a profitable note!

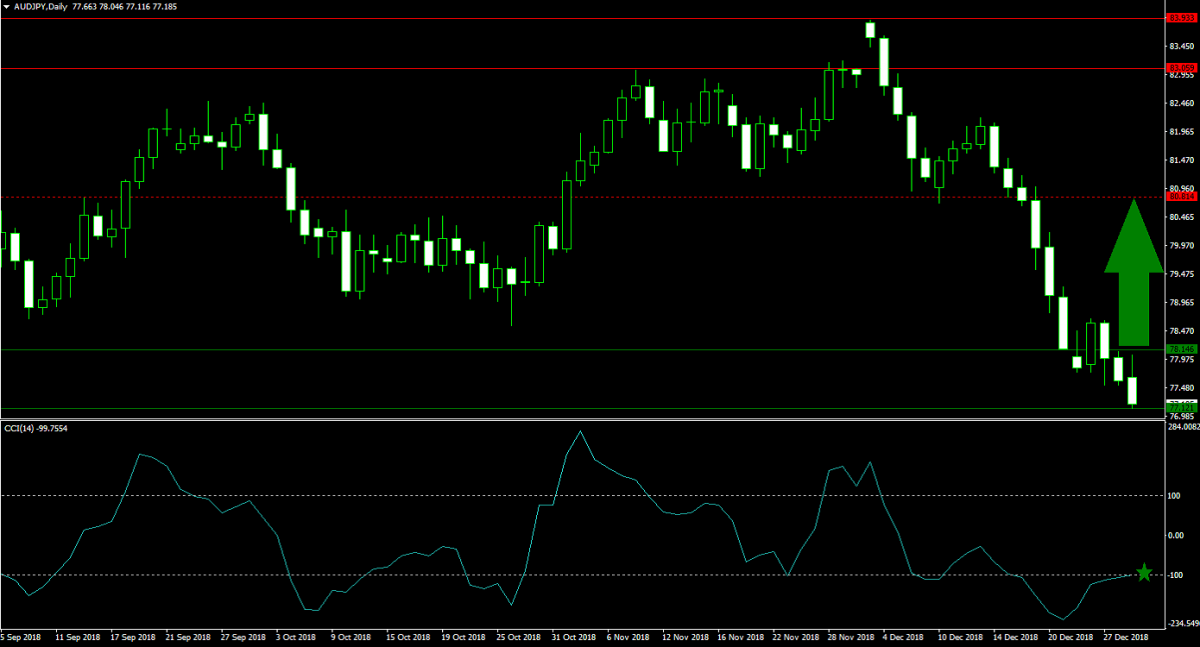

Forex Profit Set-Up #1; Buy AUDJPY - D1 Time-Frame

Hopes are on the rise that the US and China will find a solution to the trade war started by the US. The Australian Dollar, a Chinese Yuan Proxy, has come under heavy selling pressure over the past five weeks which pushed the AUDJPY into its horizontal support area. This currency pair is now ripe for a short-covering rally as forex trader may start 2019 locking in solid profits. A breakout is anticipated to take the AUDJPY back into its next horizontal resistance level. Forex traders are recommended to spread their buy orders inside its current support area.

The CCI descended deep into extreme oversold conditions, but momentum started to recover and this technical indicator is now trading just above and below the -100 level. A sustained move above -100 is likely to initiate the short-covering rally. Download your PaxForex MT4 Trading Platform now and build your 2019 portfolio with our help!

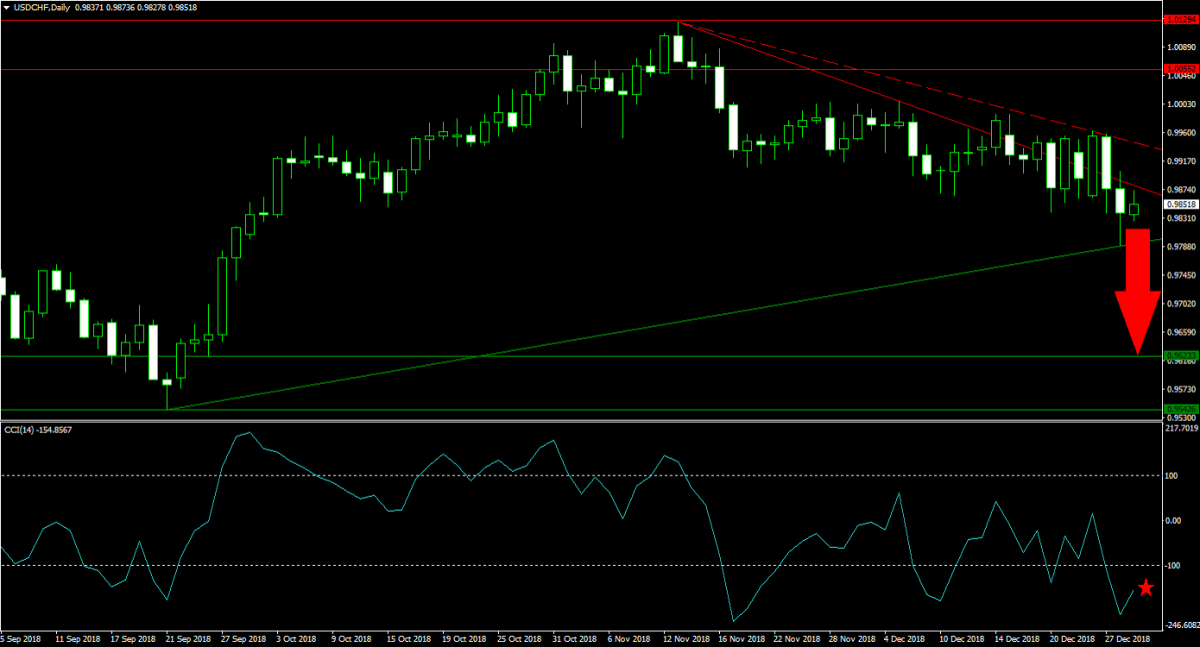

Forex Profit Set-Up #2; Sell USDCHF - D1 Time-Frame

With the US government partial shutdown adding to the overall uncertainty about the US in 2019, the breakdown in the USDCHF is expected to extend until price action will test its horizontal support area. Following the breakdown below its horizontal resistance area, this currency pair is facing downside pressure from its primary and secondary descending resistance level. This is expected to result in a breakdown below its primary ascending support level and forex trades are advised to sell the rallies in the USDCHF, up into its secondary descending resistance level.

While the CCI contracted well below -100 and far into extreme oversold territory, new lows cannot be ruled out. Any advance in price action will temporarily spike this momentum indicator and potentially set it up for further contraction. Follow the PaxForex Daily Fundamental Analysis and allow our expert analyst to guide your forex account through a profitable 2019!

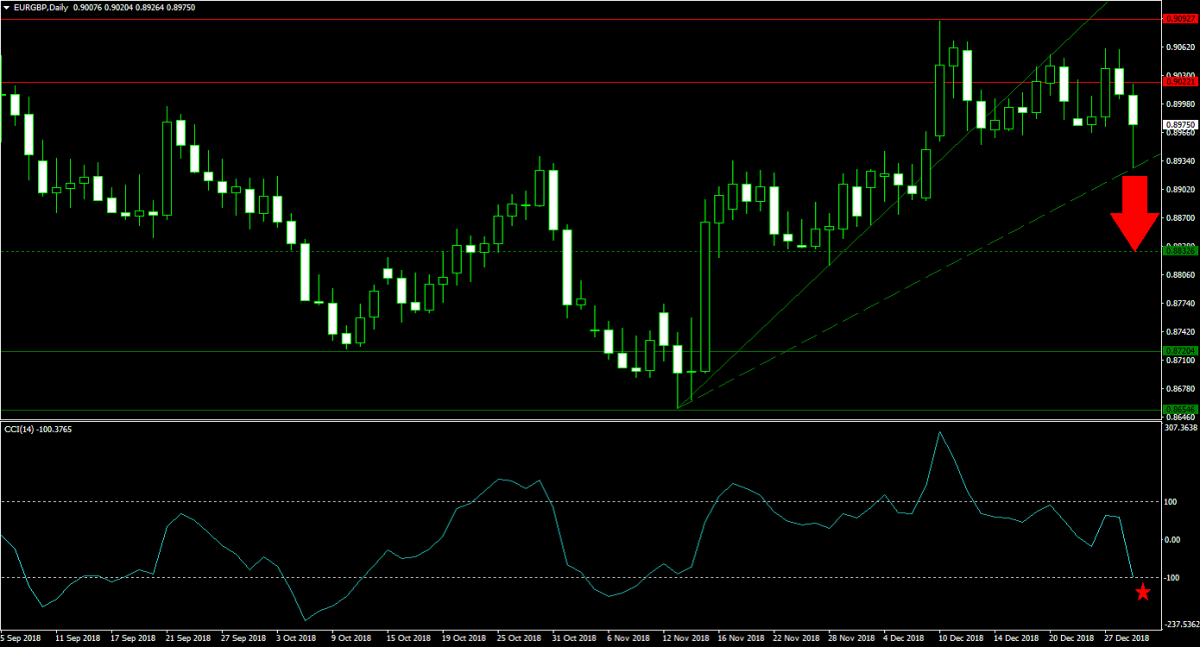

Forex Profit Set-Up #3; Sell EURGBP - D1 Time-Frame

As the Brexit deadline approaches, volatility in the British Pound is anticipated to increase. Adding the uncertainty in the Eurozone, especially with the EU election in May, and the EURGBP is on track to create plenty of trading opportunities. Price action already completed a breakdown below its horizontal resistance area as well as below its primary ascending support level. A second breakdown below its secondary support level is expected to take the EURGBP down into its next horizontal support level. Selling the rallies is favored.

The CCI quickly descended from extreme overbought conditions into extreme oversold territory, but remains well off its lows which allows for more downside as bearish momentum is building. Subscribe to the PaxForex Daily Forex Technical Analysis and start 2019 by boosting your profits simply by copying the recommended trades by our expert analysts!

To receive new articles instantly Subscribe to updates.