Brexit is just over twelve months away, but many unresolved issues remain. In the headlines now is the type of trade deal the European Union (EU) and the United Kingdom (UK) will strike. After British Prime Minister Theresa May and her government agreed on a divorce settlement bill of €40 billion, which the EU negotiators insisted on before moving to trade discussions, things were supposed to move alone more swiftly. While numerous summits have been held in an attempt to move along discussions, the only swift parameter which moved was time which is ticking down.

Today, Brexit Secretary David Davis will promote mutual trust in Vienna to the 27 member countries of the EU with a promise not to just tear up all regulation. He will stress the importance of mutual recognition of regulatory standards between the EU and the UK. Sources familiar with his speech noted that Davis will state that 'A crucial part of any such agreement is the ability for both sides to trust each other’s regulations and the institutions that enforce them.' He will further add that 'A crucial part of any such agreement is the ability for both sides to trust each other’s regulations and the institutions that enforce them. Such mutual recognition will naturally require close, even-handed cooperation between these authorities and a common set of principles to guide them.'

Trust, or the lack of it, is likely to play a key role moving forward. While the EU has made trade promises, they are not legally binding which has several key figures in the UK parliament worried. PM May is scheduled to deliver a major speech next week where she will outline a detailed trade accord the UK is seeking from the EU. The final deal is aimed to be drafted in October and signed into law right after Brexit. The EU is holding firm to their position that a trade deal by October is not possible and that it will be fully negotiated during the two-year transition period. This resulted in a contingency plan by the UK to withhold cash payments, the UK is one of the largest contributors to the EU budget, until the trade deal it wants has been finalized.

As the Brexit situation heats up, the UK floating its secret weapon as a last resort if the EU tries to manipulate discussions in its favor and the EU fortifying its ‘impossible stance’, volatility is set to increase the closer March 2019 gets. This will create many profitable trading opportunities and forex traders should embrace them. Open your PaxForex Trading Account today and enter the world of countless earning opportunities.

The EU could be stalling until Brexit, which would take away leverage from the UK and bind them to financial contributions is agreed on. Currently the EU and the UK are discussion the terms of the transition period which is set to be finalized during next month’s summit. The next stop after that will be the trade deal. According to Davis, ‘'The certainty that Britain’s plan, its blueprint for life outside of Europe, is a race to the top in global standards, not a regression from the high standards we have now, can provide the basis of the trust that means that Britain’s regulators and institutions can continue to be recognized.' Will the UK be forced by the EU to deploy their secret Brexit weapon or will both sides manage to strike a deal in time? Here are 3 ways to profit from this trading opportunity.

Forex Profit Set-Up #1; Sell EURGBP - W1 Time-Frame

The EURGBP is under most influence from Brexit as it pegs the two currencies of the EU and the UK against each other. After this currency pair rallied into its horizontal resistance area, it quickly reversed and a descending resistance level emerged which is pressuring the EURGBP to the downside. As the UK is prepared to use it secret Brexit weapon and as the UK appears to gain the upper hand on negotiations, the British Pound is set to strengthen further. Forex traders should expect this currency pair to retrace back down into its horizontal support area and therefore sell any potential rallies in the EURGBP above 0.8900.

The CCI briefly plunged below -100 which indicated extreme oversold conditions, but has spiked higher since then with a quick move above the 0 mark. It was unable to sustain bullish momentum and crossed back down which allowed bearish pressures to remain in control. Fund your PaxForex Trading Account today and add this currency pair to your forex portfolio before it will accelerate to the downside.

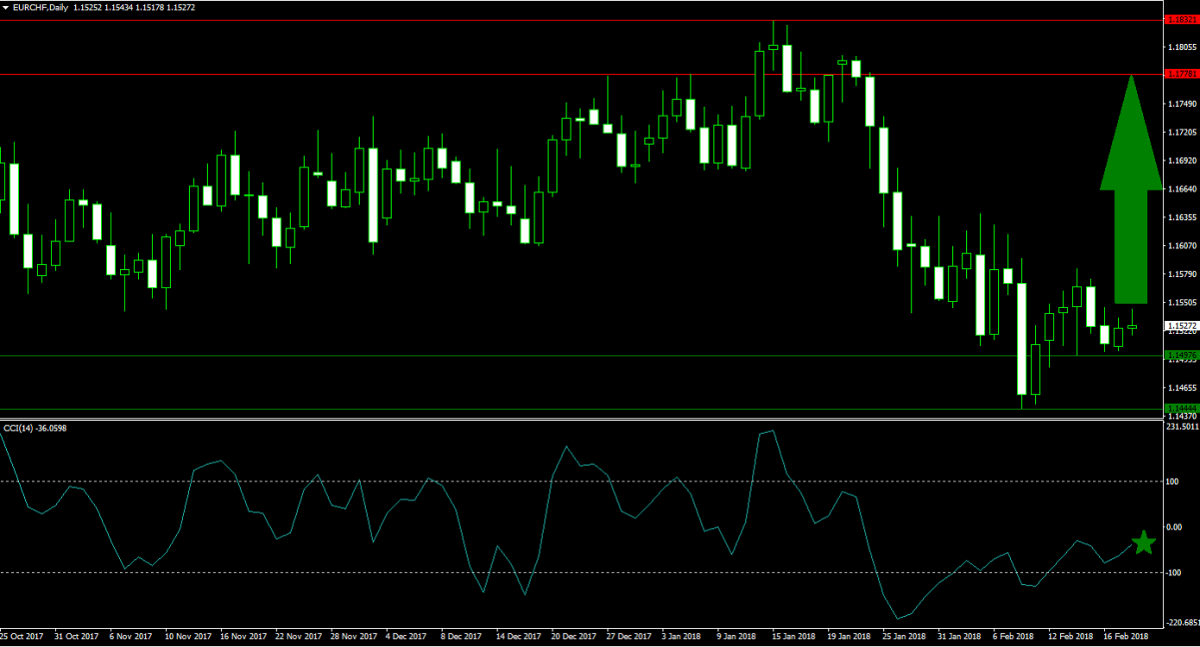

Forex Profit Set-Up #2; Buy EURCHF - D1 Time-Frame

While the EURGBP is predicted to slowly descend amid an increase in volatility, Euro bulls should look towards the EURCHF which just completed a breakout above its horizontal support area. This resulted in a momentum change from bearish to bullish and this currency pair is now set for an advance until it can challenge its horizontal resistance area. Forex traders are advised to buy any dips and spread their entries inside the 1.1445 and 1.1500 zone. This trade offer limited downside risk, but good upside potential.

The CCI has formed a positive divergence and as it broke out from extreme oversold conditions, below the -100 level. This momentum indicator is now on an upward trajectory towards the 0 mark from where a further breakout is anticipated. The Daily Forex Technical Analysis outlines the best technical trading set-ups every day in order to help all forex traders maximize their profits.

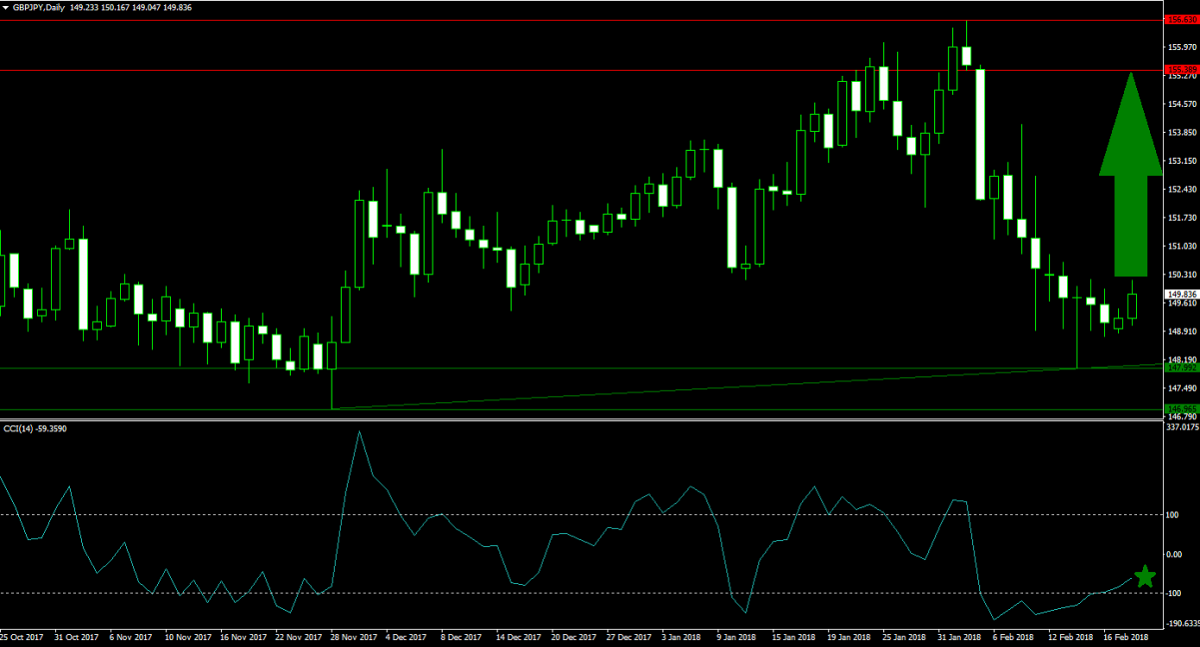

Forex Profit Set-Up #3; Buy GBPJPY- D1 Time-Frame

The GBPJPY collapsed from its horizontal resistance area, after a failed breakout attempt, into its horizontal support area in a few trading sessions. The violent sell-off halted as support levels prevented a continuation of the contraction in price action. An ascending support level formed which is now applying upside pressure on the GBPJPY as a momentum change is pending. Forex traders are recommended to seek buy entry opportunities during potential moves below the 149.000 level and spread their orders inside the 149.000 and 150.000 area for a reduction in risk and an increase in profit potential.

The CCI moved deep below the -100 mark which identifies extreme oversold condition, but has since drifted higher following a breakout. Another breakout above the 0 level is expected which will further add buy orders and allow the advance to be extended. The Daily Fundamental Analysis highlights the trading day’s most important trade set-ups; follow our experts an earn over 500 pips per month with PaxForex.

To receive new articles instantly Subscribe to updates.