Until the most recent meeting of British Prime Minister Theresa May’s inner cabinet which took place yesterday, the dynamics were split right down the middle. May had five voices for a soft Brexit and five voices for a hard Brexit which gave the PM the deciding vote. May initially voted to remain in the EU and while she has vowed to respect the vote of the British public, she has been leaning towards a softer Brexit. Four days ago Home Secretary Amber Rudd resigned and was replaced by Sajid Javid who himself campaigned for the UK to remain in the EU, but since then was swayed by the pro-Brexit camp.

According to sources, ministers voted 6-5 against her proposals. It is safe to assume one of the five votes was from May herself which means that she currently has four ministers who side with her and six against her. Some claim that this new shift may challenge May’s career as a PM. May’s team put forward two proposals which were both voted down. The new majority demands a clean exit from the EU customs union which would allow the UK to strike its own trade deals. May has less than a week to find a compromise.

Support from her inner circle currently comes from Philip Hammond, the Chancellor of the Exchequer, Greg Clark, the Business Secretary, David Lidington, the Cabinet Office Minister, and Karen Bradley, the Northern Ireland Secretary. Hammond and Clark have kept a low profile as of late which doesn’t bode well for May. The four supporting ministers are outweighed by May’s opposition which consists of Boris Johnson, the Foreign Secretary, David Davis, the Brexit Secretary, Liam Fox, the Trade Secretary, Michael Gove, the Environment Secretary, Gavin Williamson, the Defense Secretary and Sajid Javid, the Home Secretary.

The British Pound has retreated over the past week. Is this a great buying opportunity or should forex traders expect more downside? Open your PaxForex Trading Account today and grow your capital trade-by-trade with the help of our expert analysts. Join our growing family of profitable forex traders now and find out how you can earn more pips per trade at PaxForex.

Theresa May has a very hard task ahead of her as she faces rebels within her own party which could side with the opposition on a softer version of Brexit. Inside her own party, besides opposition from top ministers she needs to watch out for the 92 Group which consists of right-wing conservatives as well as the 60 member strong European Research Group, led by Jacob Rees-Mogg. The House of Lords is in favor of a soft Brexit, but has no influence on the discussions. Right now pro-Brexit ministers have the upper hand and here are our three forex trades which will give you the upper hand in the market.

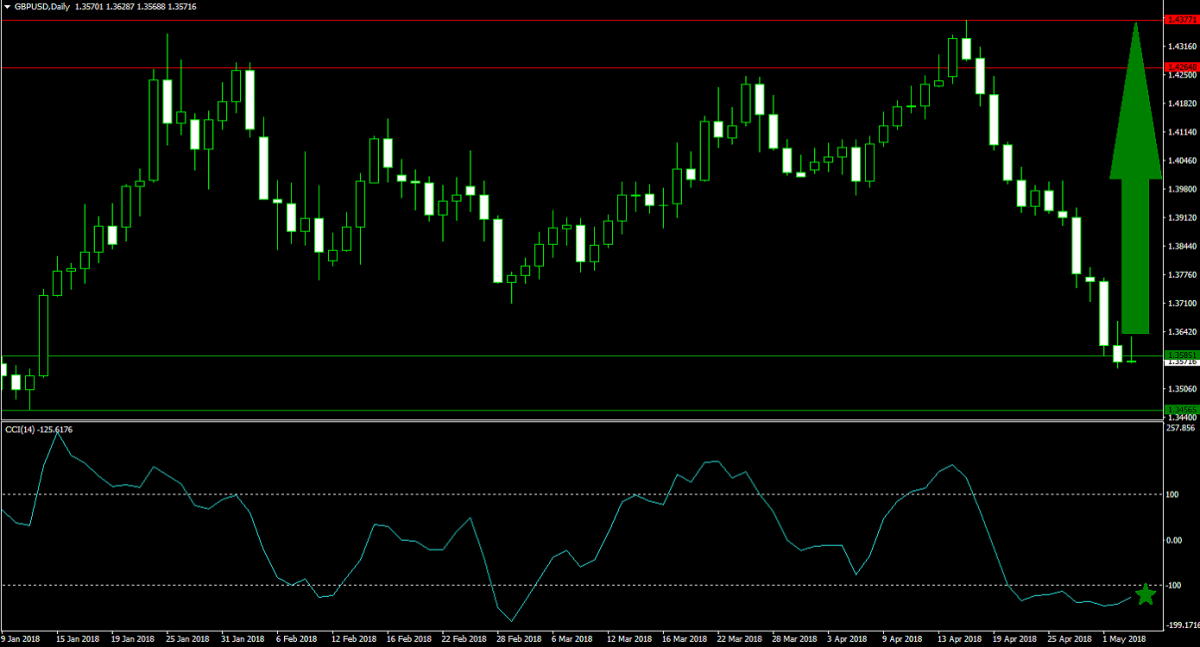

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

After a very sharp advance, the GBPUSD was hit by a double dose of bearish pressures which resulted in a healthy correction from its horizontal resistance area into its horizontal support area. Forex traders should now be prepared for a counter-trend advance in this currency pair which will align it with its long-term up-trend. A short-covering rally could provide the spark and forex traders are advised to place their buy orders inside its horizontal support area.

The CCI has dropped into extreme oversold conditions below -100, but has flattened out since then with an upward bias. A move above -100 could initiate the expected short-covering rally. Make a deposit into your trading account today and add this GBPUSD trade before it will accelerate to the upside.

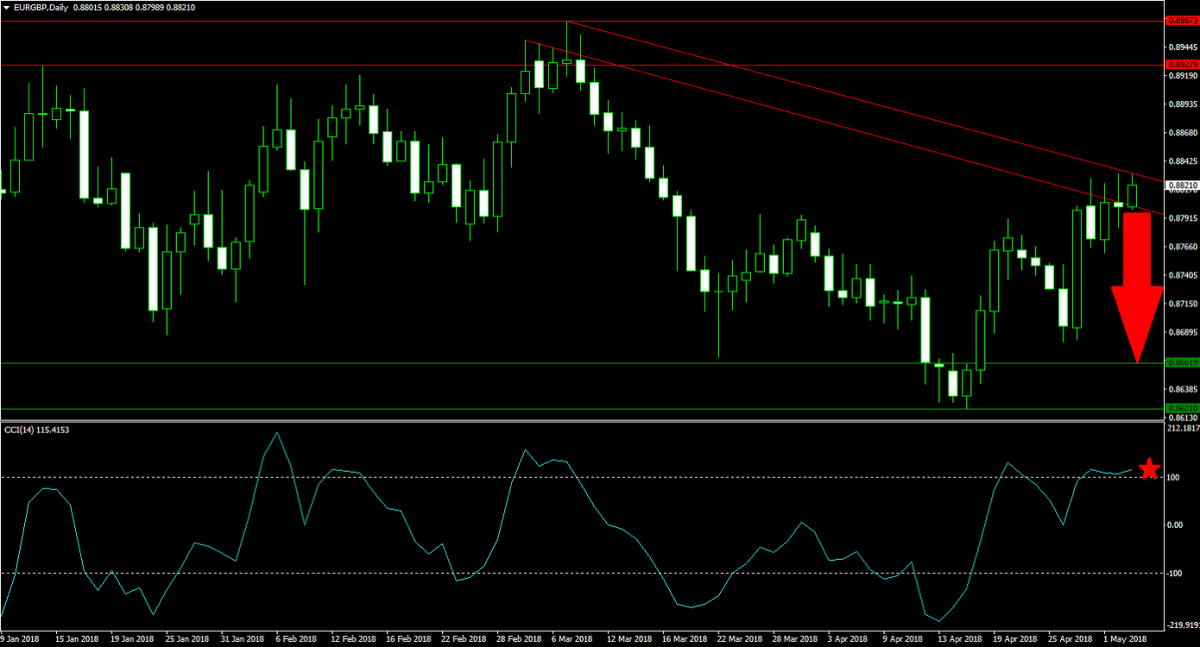

Forex Profit Set-Up #2; Sell EURGBP - D1 Time-Frame

The EURGBP spiked higher from its horizontal support area, but price action is facing an increase in bearish pressure provided from two descending resistance levels. With the Eurozone facing economic questions of its own, forex traders may opt to take profits. The EURGBP has been rejected by its current resistance composition over the past four trading sessions. Forex traders are recommended to sell the rallies.

The CCI, a momentum indicator, is trading in extreme overbought conditions above 100 and a move below this level could result in a profit-taking inspired corrective phase. Get the latest fundamental trading recommendations from our expert analysts at PaxForex Daily Fundamental Analysis and add over 500 pips per month to you forex portfolio.

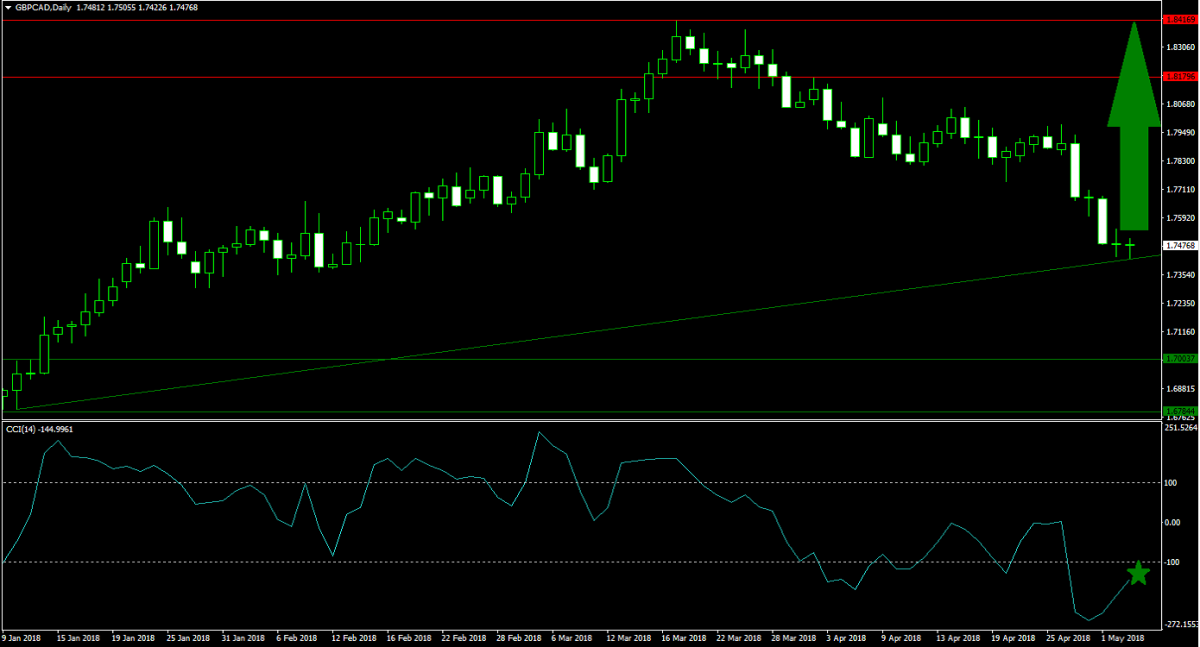

Forex Profit Set-Up #3; Buy GBPCAD - D1 Time-Frame

This currency pair retreated in unison with other currency pairs where the British Pound was the base currency, but the move was halted by its ascending support level. Price action in the GBPCAD is now stabilizing and the last two candlestick formations confirm this process. Forex traders should place their buy orders along the ascending support level in order to capitalize from the expected advance.

The CCI plunged deep into extreme oversold conditions, but this technical indicator is now in the midst of a recovery. Momentum should carry it above -100 from where more buy orders may force an advance. Don’t miss out on trades and subscribe to the PaxForex Daily Forex Technical Analysis in order to get the best technical trading set-ups delivered to you.

To receive new articles instantly Subscribe to updates.