The biggest news story in financial markets today is the chaos in which UK Prime Minister May found herself after announcing yesterday that the text for a draft agreement has been reached between the EU and the UK. While her press conference yesterday evening was lackluster, those few who cheered the text only had a few hours of joy. Today she was faced with more resignations from her inner circle in protest of her handling Brexit negotiations. The British Pound plunged this morning, but has started to stabilize near solid support levels following the initial knee-jerk reaction.

Two of the most prominent resignation came from Dominic Raab, the UK Brexit Secretary, and Esther McVey, the UK Work and Pension Secretary. Raab is the second Brexit Secretary to resign in protest over May’s Brexit approach. David Davis was the first one to resign, also in protest over May’s Brexit proposals, and is a close friend of Raab as well as previous mentor. Raab stated that “Today, I have resigned as Brexit Secretary. I cannot in good conscience support the terms proposed for our deal.” This was one loss May could not afford.

Shortly after Raab’s resignation, McVey handed in hers. Sources noted that she was in tears during Wednesday’s session when May first announced that she secured approval of her Cabinet to move forward with Brexit. Raab and McVey are both pure Brexiteers who want to deliver on the vote of the UK public which was for a clean break. Over the summer Boris Johnson and David Davis led a series of resignations for the same reasons. A handful of other ministers, often in junior roles, have resigned throughout the day. May has continuously ignored opposition and wanted to force a soft Brexit onto the public.

The British Pound dropped sharply as many now view May’s Brexit blueprint as unworkable. This has raised the spectre of a no deal Brexit next March. Traders tend to overreact to headline news, a move which is often reversed in the day’s to follow. Is the British Pound presenting traders a great long entry opportunity? Open your PaxForex Trading Account now and start creating a market beating forex account with our help!

The resignations have added fuel to Tory members who want to push through a confidence vote. Jacob Rees-Mogg has now submitted a letter for a confidence vote in May which could lead to her ouster. Her replacement is very likely to be a pro-Brexit Tory who will deliver on the Brexit the UK voted for. May has lost over 13 key ministers this year in protest over her Brexit blueprint and now even pro-EU ministers, who previously support her, are distancing themselves over her deal she proposed. May is being reject by Parliament and her own Tory party. May cabinet chaos, no confidence vote is next and here are three forex trades to consider in the midst of the turmoil.

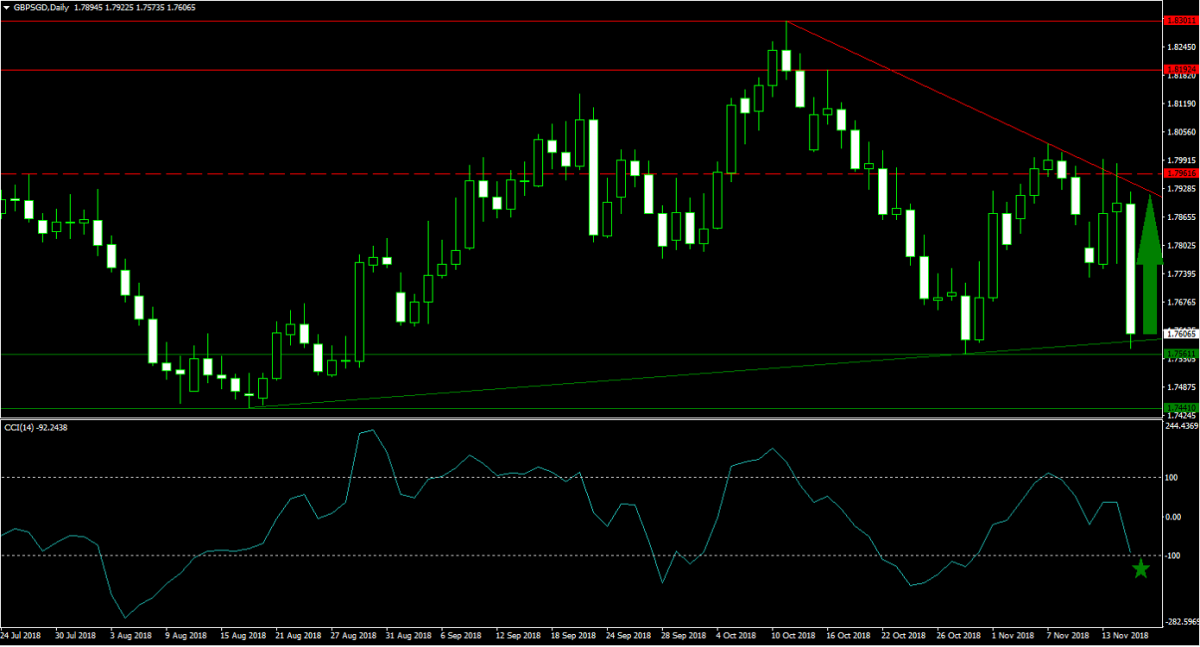

Forex Profit Set-Up #1; Buy GBPSGD - D1 Time-Frame

Following May’s catastrophic day in Parliament and the drop in the British Pound which followed, the GBPSGD became an attractive long target. The Singapore Dollar is struggling as many traders use it for proxy Chinese Yuan trading. The GBPSGD has dropped into its primary ascending support level which is located just above its horizontal support area from where a short-covering rally is expected. Forex traders are advised to buy at current levels and down into its horizontal support area.

The CCI contracted from a brief spike into extreme overbought conditions down to just above extreme oversold territory. Price action may briefly dip into its support area which will take this indicator below the -100 mark. A recovery above it is likely to start a short-covering rally. Download your PaxForex MT4 Trading Platform now today and plant the seed for tomorrow’s profits!

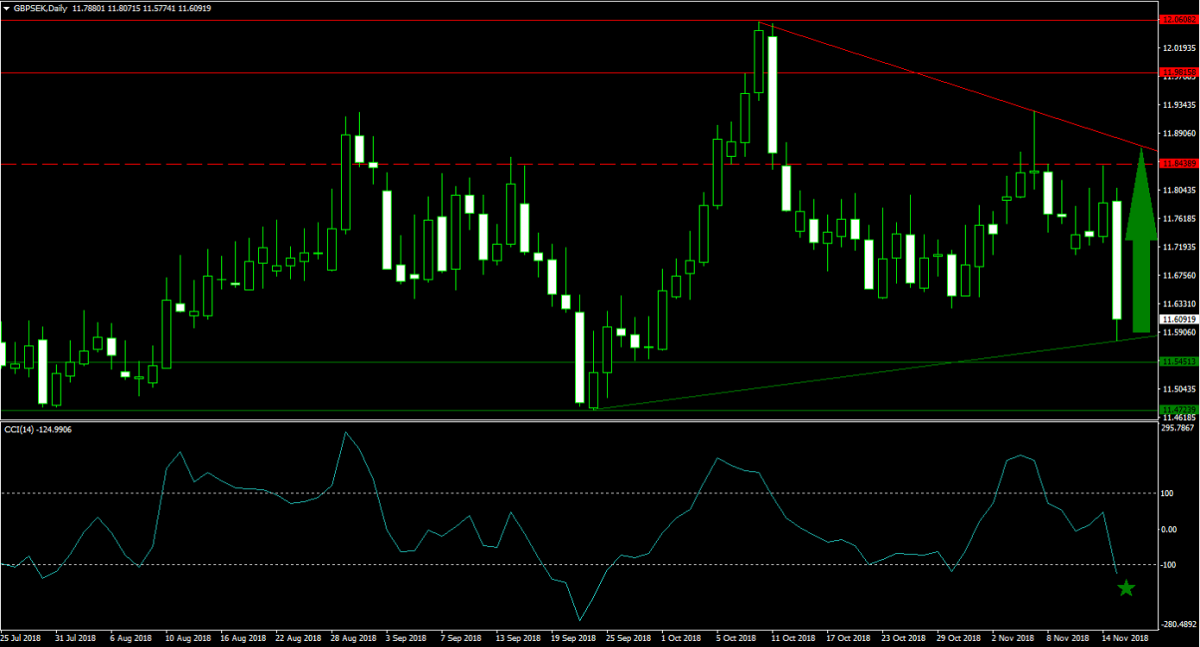

Forex Profit Set-Up #2; Buy GBPSEK - D1 Time-Frame

Similar to the previous trading recommendation, the Swedish Krona faces more issues that the Pound and today’s drop created a great buying opportunity in the GBPSEK. Sweden still lacks a government and after price action reached its primary ascending support level, bearish sentiment started to fade. This currency pair is expected to reverse its sell-off until it will reach its next horizontal resistance level which is being enforced by its primary descending resistance level. Buying the dips in the GBPSEK is favored from current levels.

The CCI dropped into extreme oversold territory, but remains well off its previous lows. A reversal in this momentum indicator is anticipated to push this currency pair into a short-covering rally. Subscribe to the PaxForex Daily Forex Technical Analysis and follow the trading recommendations posted by our expert analysts to a profitable outcome.

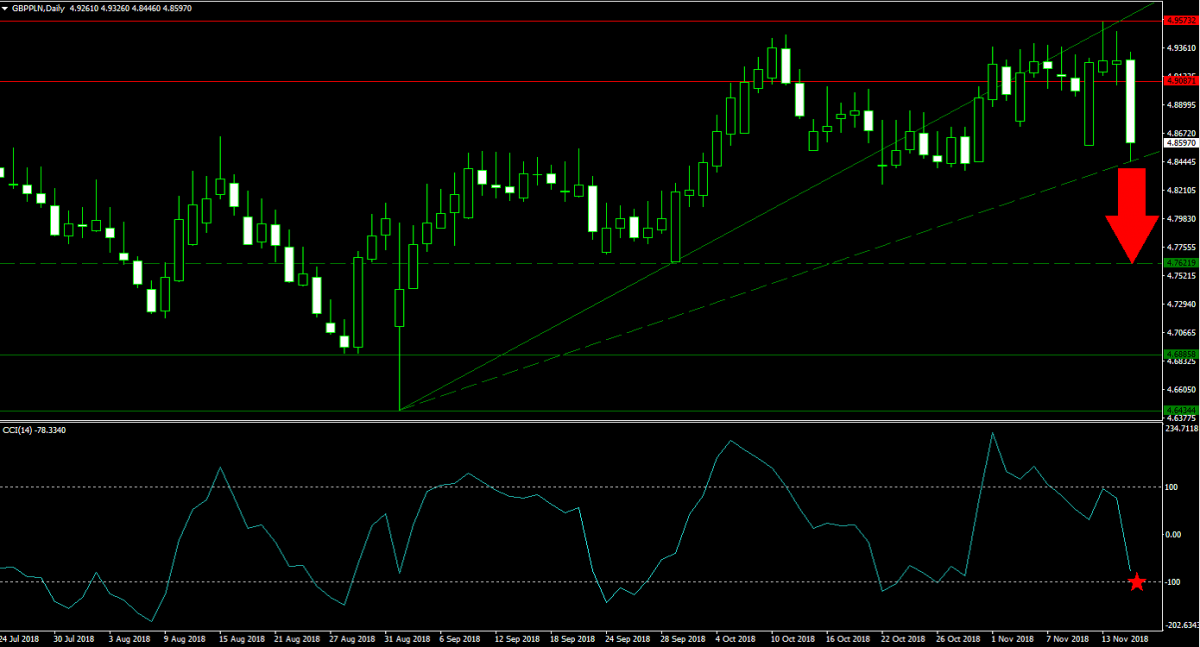

Forex Profit Set-Up #3; Sell GBPPLN - D1 Time-Frame

Despite today’s developments, the GBPPLN was on the verge of a price action reversal as price action was trading above-and-below the lower band of its horizontal resistance area and below its primary ascending support level. Today’s drop took this currency into a secondary ascending support level from where a further breakdown is expected which will take the GBPLN down to its next horizontal support level. Forex traders are recommended to sell the rallies in this currency pair.

The CCI is contracting from extreme overbought levels and is predicted to extend its slide until it will drop into extreme oversold conditions. A new low cannot be ruled out which leaves attractive downside in this currency pair. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market with over 500 pips in profits per month.

To receive new articles instantly Subscribe to updates.