Theresa May, the British Prime Minister, faced a series of defeats in the House of Lords on key Brexit legislation. The Tories don’t have a majority in the House of Lords and decisions taken there are not binding in Parliament. It can give an insight on where current proposals stand and where there is room for improvement or adjustments in order to reach a broader consensus. PM May does have a razor thin majority in Parliament thanks to her allies the DUP. This has been countered by so-called Tory rebels which may vote with the opposition, the Labour Party, which makes May’s job a precise balancing act as well as mathematical problem to solve.

Two days ago, pro-Brexit Conservatives held talks with May in her office in order to demand that she will deliver a clean Brexit from the European Union. With less than twelve months away, Brexit negotiations are not moving as fast as needed and some euroskeptics worried that the PM will give in on her red lines such as leaving the customs union. Leaving the customs union would allow the UK to strike its own trade deals and control the flow of goods, services and people which were key reasons behind the Brexit vote.

Attendants of this secret meeting included Boris Johnson, the Foreign Secretary, David Davis, the Brexit Secretary, Michael Gove, the Environment Secretary, and Liam Fox, the Trade Secretary. PM May has faced the potential of a leadership challenge which could throw current negotiations in dismay, but according to a source familiar with the meeting the Tories who attended were satisfied with May’s assurance, at least for now. All eyes may now be on a key vote next month in regards to the customs union and how the UK and the EU will solve this problem.

The British Pound has retreated from its strong rally. Was this a healthy pause which will drive the British currency higher or the start of a longer correction? Find out the most market moving insights now at the PaxForex Daily Fundamental Analysis section and earn over 500 pips per month through the work of our expert analysts who deliver their analysis every day fresh from their desks!

PM May was also asked to abandon her approach to solve the customs union issue which she called a customs partnership. This is her favorite approach and would have the UK collect tariffs for the EU and afterwards issue refunds to UK companies who sold their goods and services outside the trading bloc. This plan has been criticized as to complex to implement which is why she was asked to drop this approach. Next week on Wednesday will be the next crucial meeting between PM May and key figures from her party. May assures core of party of clean Brexit and here are three forex trades which will reap the rewards.

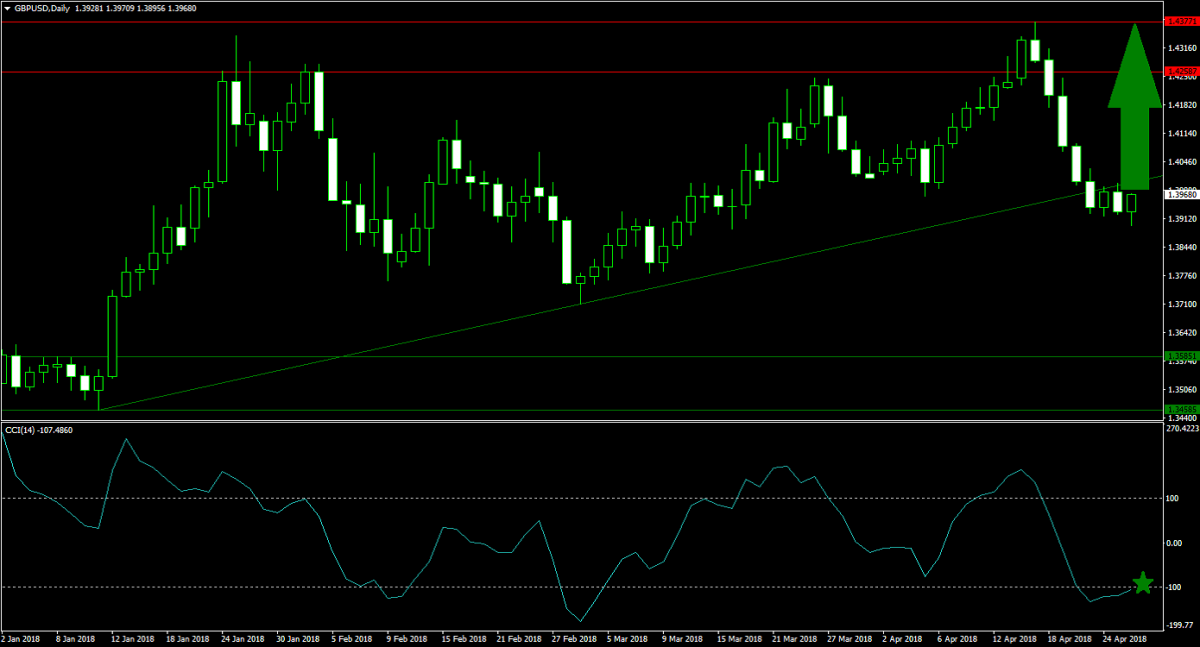

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

This currency pair started a small counter-trend correction after failing to push above its horizontal resistance area. The move to the downside took the GBPUSD just below its ascending support level which can trace its origin to its horizontal support area. Price action has now stabilized and the latest candlestick formation gives us bullish trading signal. Forex traders are recommended to enter their long positions just below the ascending support level as the GBPUSD is ripe for a breakout.

The CCI drifted down into extreme oversold conditions below -100, but shows signs of a rebound. A push above -100 could trigger a short-covering rally. Make sure to get the latest developments from a technical trading perspective from the PaxForex Daily Forex Technical Analysis section where you get each day’s best trading set-ups.

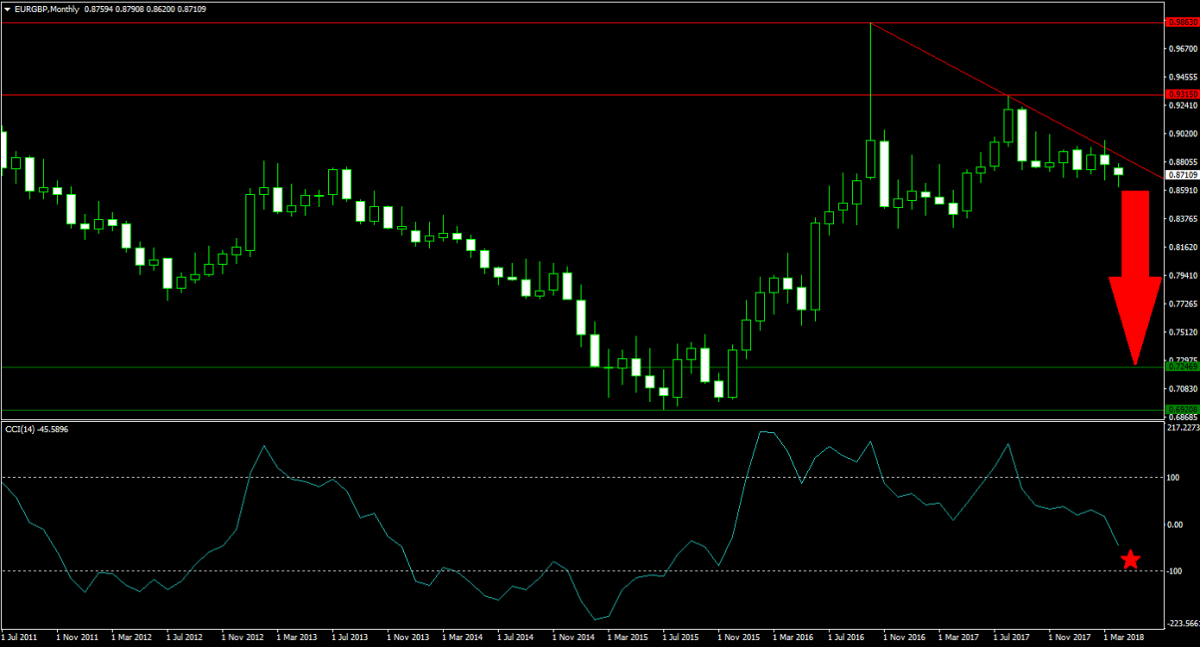

Forex Profit Set-Up #2; Sell EURGBP - MN Time-Frame

The EURGBP has been driven by bearish sentiment following a spike into the upper band of its horizontal resistance area which was followed by a sharp reversal and one final advance into the lower band of its horizontal resistance area. A descending resistance level is additionally applying downside pressure on this currency pair. Forex traders are advised to sell the rallies in the EURGBP which are set to be limited to its descending resistance level.

The CCI has followed price action to the downside with a series of lower highs. This technical indicator is now on a clear downward trajectory and expected to descend into extreme oversold conditions over the next few trading months. Use your Bitcoin and Ethereum assets and make a deposit into your PaxForex Trading Account now in order to diversify your revenue stream.

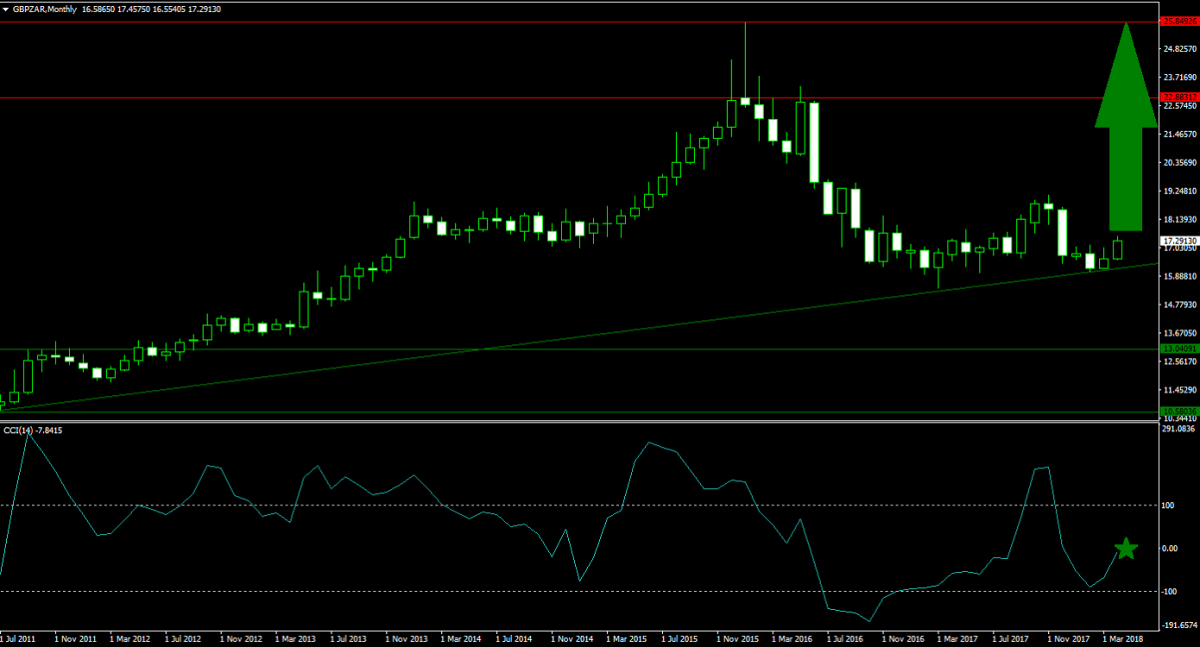

Forex Profit Set-Up #3; Buy GBPZAR - MN Time-Frame

Price action in the GBPZAR has ended its corrective phase after moving from the upper band of its horizontal resistance area down into its ascending support level. This currency pair has now stabilized and bullish momentum is on the rise following a confirmation of its ascending support level. Forex traders should buy the dips in the GBPZAR as this trade has limited downside risk with very attractive upside potential.

The CCI, a momentum indicator, is recovering and confirms the sentiment shift from bearish to bullish. A push above the 0 mark will further attract buy orders into this trade. Open your PaxForex Trading Account today and find out why traders prefer to manage their forex accounts at PaxForex, where regardless if you are a new trader or a seasoned professional, you will enjoy great trading conditions which will allow you to earn more per trade.

To receive new articles instantly Subscribe to updates.