UK Prime Minister May and opposition leader Corbyn have suggested that they may be close to reaching a Brexit compromise which could have enough parliamentary support to pass. Despite the extended deadline until October 31st 2019 to leave the EU, the race is on in order to deliver Brexit by May 22nd 2019. This is the eve of EU parliamentary elections which the UK wants to avoid as May herself stated it would not be right for the UK to participate in shaping the next EU government as the UK is preparing an exit from the world’s largest trading bloc. Many of May’s own Tory party are frustrated and seek her ouster and calls for her replacement have increased since she asked for a second delay to Brexit.

After both sides hinted that a Brexit compromise could be imminent, more talks will be held over the next few days. May’s Tory rejected the idea of a permanent customs union with the EU as it would prevent it from striking trade deals on its own, but Labour’s Corbyn insists that one is needed. Mat stated that “There is a greater commonality in terms of some of the benefits of a customs union that we’ve already identified between ourselves and the official opposition. Looking at the balance of these issues is part of the discussion. Can we come to an agreement on that? I hope we will be able to.” Details are scarce and May is avoiding a direct answer to the customs union as talks are ongoing, but heavy resistance remains as May’s deal was rejected three times in parliament.

In an attempt to win over critics from her own party, May wants to call the customs union something else as she promised to take the UK out of the EU customs union. She further noted that “It’s all too often framed in terms of existing language. Often people will use the term ‘customs union’ but have in their mind different things. The important thing is to sit down and talk through, what is it we are trying to achieve here?” Renaming the customs union is unlikely to convince MP’s to change their mind, but with the clock ticking down the alternative of no Brexit is also on the rise. A growing number of Tory’s are now trying to pick the best of two bad options which is where May could pick up some votes.

Talks of a May-Corbyn Brexit compromise has further added bullish momentum in the British Pound, but a failure to deliver is likely to crash the currency as the situation would revert back to the status quo. A no deal Brexit is still on the table, despite efforts to minimize such an event. Where is the British Pound headed over the next few months? Open your PaxForex Trading Account now and start building a profitable forex portfolio with the help of our expert analysts!

Voters in the UK are also growing increasingly frustrated of May’s handling of Brexit. The Labour party has to deliver as well as 158 of its constituencies votes in favor of Brexit against only 108 who voted against it. In addition, Nigel Farage and his new Brexit Party aim to steal pro-Brexit votes from the Labour camp. The clearest sign of voter frustration may come as soon as today as local elections across mostly rural areas are expected to see heavy losses for May’s Tories. Over 8,000 council seats are up for elections and some early estimates see a loss of over 800 for May’s Tories amid protest votes against May. Nick Morgan, a powerful Tory backbencher, added “It’s going to be a really difficult night. Anybody who’s been on the doorstep recently will know that the national politics is having a difficult impact" on local politics.” Is a May-Corbyn Brexit Deal imminent? Plenty of hurdles remain, but here are three forex trades to pip your balance over the hurdles and boost your forex account!

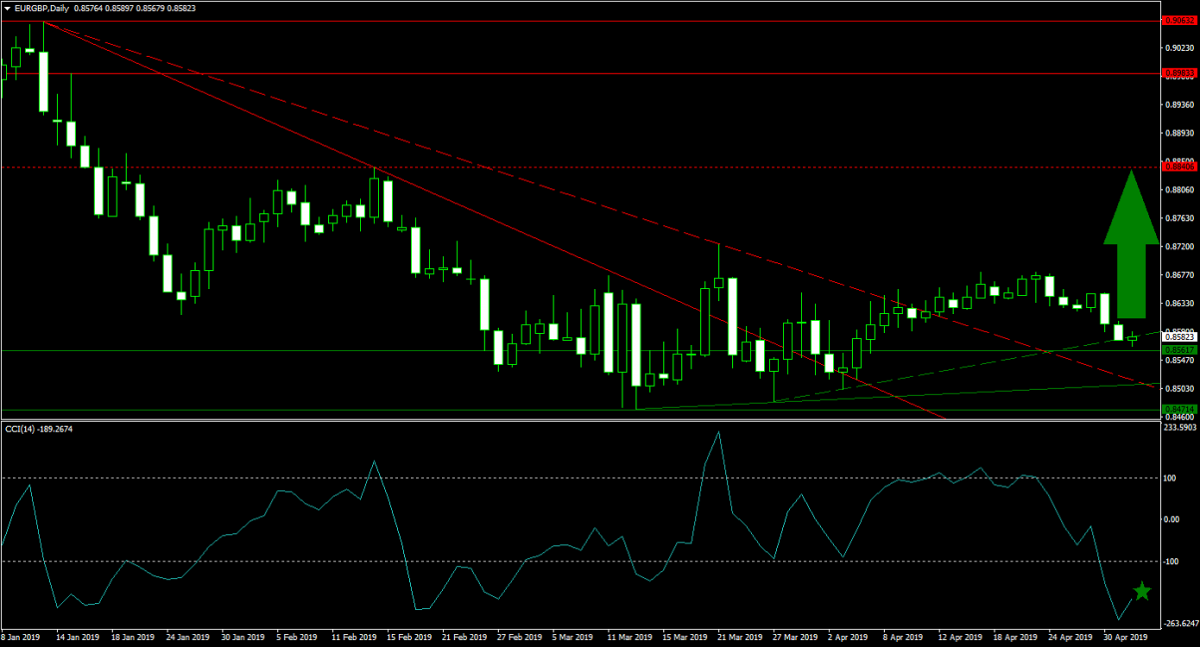

Forex Profit Set-Up #1; Buy EURGBP - D1 Time-Frame

At the same time as hopes for a Brexit compromise increased, so have the hopes for an economic recovery in the Eurozone. As the economic recovery is not subject to a political compromise, the EURGBP is poised for a recovery in the short-term. Price action has closed in on the upper band of its horizontal support area. The narrow trading range over the past two months has also lifted this currency pair above its primary as well as secondary descending resistance levels and turned them into support. Adding to bullish pressures are the primary and secondary support levels and with no resistance in its path, the EURGBP is favored to accelerate to the upside until it can challenge its next horizontal resistance level. Forex traders are recommended to buy any dips down to the lower band of its horizontal support area.

The CCI plunged deep into extreme oversold territory, but has started to recover from its lows. The build-up in bullish momentum is expected to extend the recovery. A move above -100 is expected to initiate a short-covering rally and attract more buy orders. Download your PaxForex MT4 Trading Platform today and join our growing community of profitable forex traders!

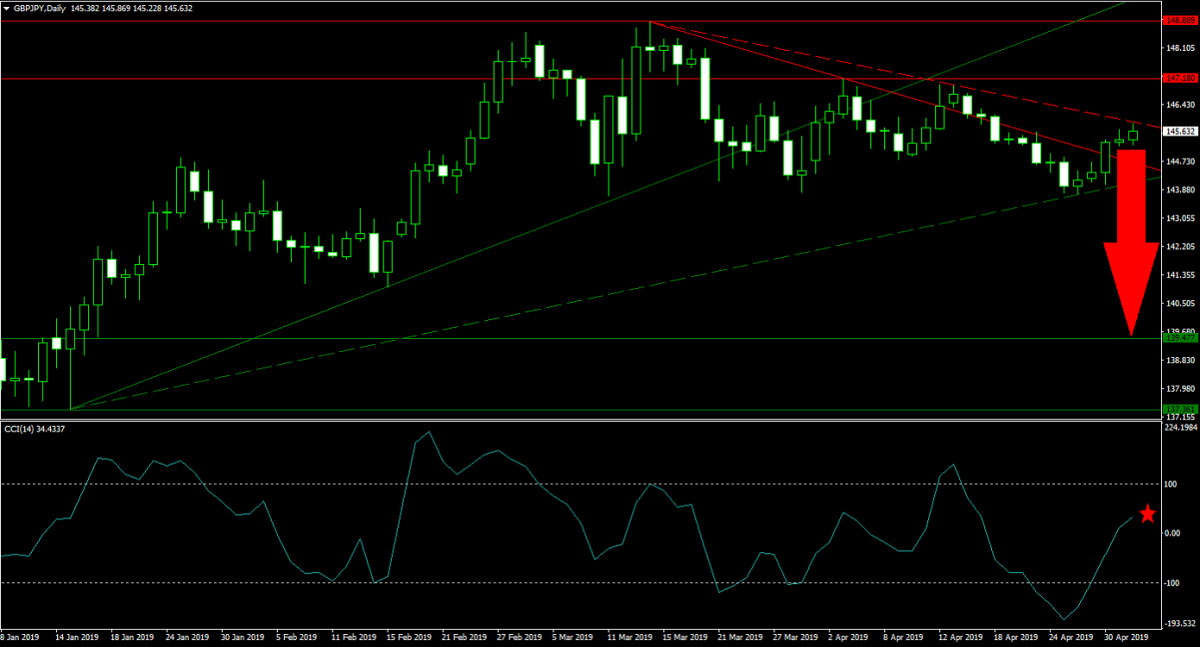

Forex Profit Set-Up #2; Sell GBPJPY - D1 Time-Frame

After the GBPJPY completed a breakdown below its horizontal resistance area, bearish momentum has steadily increased. Price action, following its breakdown below its primary ascending support level, was able to recover off of its secondary ascending support level. This currency pair pushed above its primary descending resistance level, but is now being challenged by its secondary descending resistance level which is anticipated to force the next move to the downside. A breakdown below its secondary ascending support level will clear that path for a slide into the upper band of its next horizontal support area. Forex traders are advised to sell any rallies into the upper band of its horizontal resistance area.

The CCI has accelerated from extreme oversold conditions and bullish momentum carried this technical indicator above the 0 level. As price action in the GBPJPY has approached solid resistance level, a push below the 0 mark is favored which is likely to bring the next wave of sell orders. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month with ease!

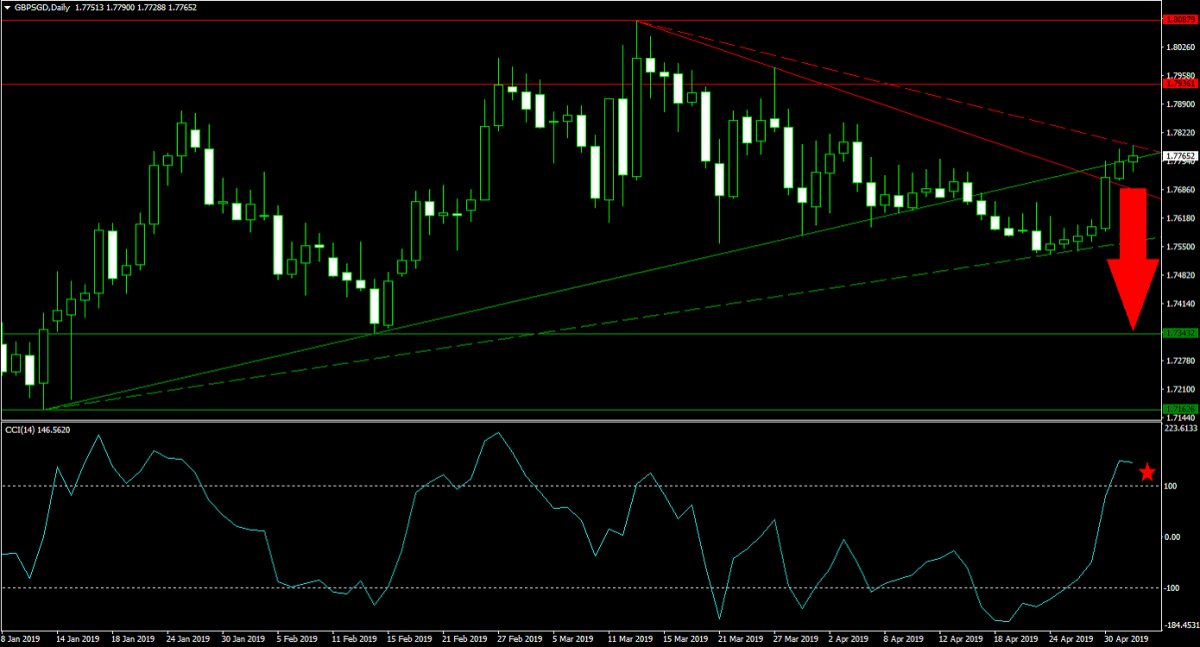

Forex Profit Set-Up #3; Sell GBPSGD - D1 Time-Frame

A recover off of its secondary ascending support level has taken the GBPSGD back into its primary ascending support level which is acting as temporary resistance. In addition the secondary descending resistance level is adding to bearish pressures which is predicted to lead to a price action reversal. Forex traders are likely to book floating trading profits in the British Pound which will further add selling pressure. A breakdown below its primary descending resistance level, which acts as temporary support, is expected to lead to a sharp rise in bearish momentum and result in a breakdown below its secondary ascending support level. From there, there is no support level in the path of the GBPSGD which can descend into the upper band of its horizontal support area. Selling rallies into the lower band of its next horizontal resistance area remains the favored trading approach.

The CCI is trading deep in extreme overbought territory, but has started to move away from its peak. A breakdown below 100 is expected to result in a sharp rise in bearish sentiment which will push this momentum indicator to the downside. Follow the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.