Time continues to tick down and there has been no progress made on Brexit. Some analysts have waited for any catalyst which may change the current deadlock and a small number believe that the Brexit process may have just received what they were looking for. Two events in UK politics which may change the face of the Labour party, its Brexit approach and in the same process a new political party may rise. A lot of moving parts in the fragile, divided political arena started to move a lot faster and recent developments only add momentum as well as more uncertainty.

The biggest event was a split in the Labour Party as seven MP’s quit over the way Jeremy Corbyn has handled Brexit. They belonged to a group of 41 Labour MP’s which voted against party lines and voted last week to delay Brexit. After their resignation, they formed a new Independent Party. Their resignation will not change the dynamics in the House of Commons as they voted against Labour to begin with, but they may now reach out to the remaining 34 Labour rebels and try to recruit them. In such even, the UK political landscape is ready to change.

Despite any potential defections from Labour, party leader Corbyn may have to rethink his strategy which could result in changes in the House of Commons. Strathclyde University Professor of Politics, John Curtice, pointed out that “The potential for parties that are not part of our traditional framework of two-party politics to do well is now well established. The question is whether this group can use the particular opportunity and the particular stance that they’re going for.” Some now eye what will happen in the Tory camp with their own rebels, but it is unlikely that Chuka Umunna’s new pro-EU Independent Group will attract non-Labour politicians.

The British Pound was able to launch a rally off of strong support levels, but how much longer can this rally last? Is this a short-covering rally which can turn into a more powerful advance or will it reverse at the next resistance level? Open your PaxForex Trading Account today and start building a profitable forex portfolio with the help of our expert analysts who work hard so you can profit easy!

Paul Flynn, a veteran MP out of Wales from a pro-Brexit constituency, passed away on Sunday. This means that a by-election needs to be held and Labour hopes their policies will cause a shift in their favor. Queen Mary University of London Professor of Politics, Tim Bale, noted that “By-elections can play a massive role in altering people’s perceptions of political reality. Labour don’t need to call the by-election immediately, but if they’re confident their strategy is the right one they should do it.” Is a Labour Party Brexit shift in the making? Here are three forex trades to make your portfolio rise in value.

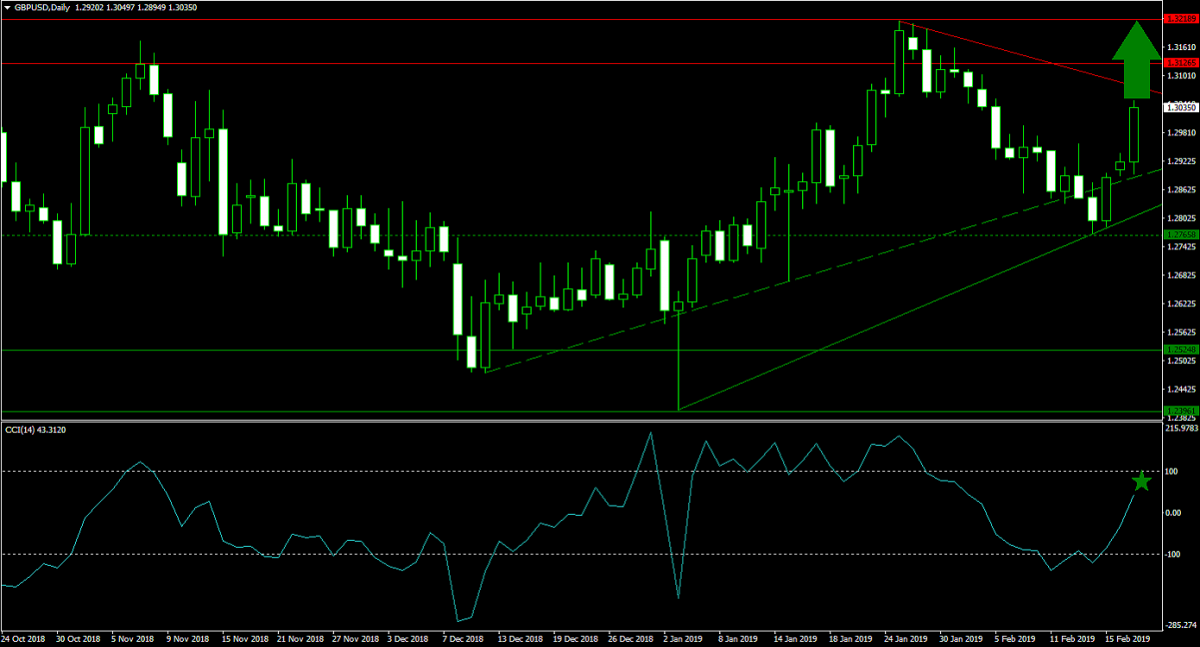

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

Bullish momentum in the British Pound has accelerated as more analysts believe that Brexit will go through with a trading deal. After price action in the GBPUSD reached its horizontal support level, enforced by its primary ascending support level, a short-covering rally materialized. The advance gathered further momentum after this currency pair completed a breakout above its secondary ascending support level. The GBPUSD is now on course to spike into the upper band of its horizontal resistance area and forex traders are advised to buy the dips down into its secondary ascending support level.

The CCI briefly grazed in extreme oversold conditions before a sharp increase in bullish momentum took this technical indicator above the 0 level. More upside is now expected as a bullish momentum shift has occurred. Follow the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account!

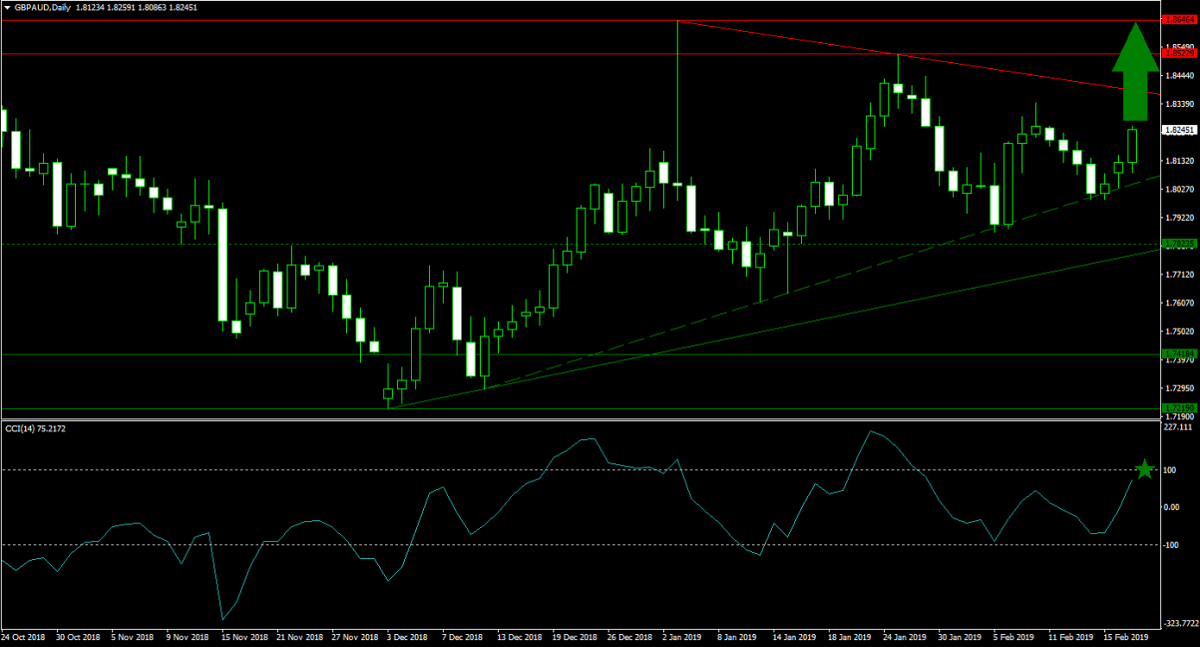

Forex Profit Set-Up #2; Buy GBPAUD - D1 Time-Frame

Another excellent buying opportunity for British Pound bulls comes in the form of the GBPAUD. The Australian Dollar remains hostage to the US-China trade war negotiations as a Yuan proxy trade. This currency pair continues to enjoy the bullish pressures from its secondary ascending support level which have pushed price action to the upside. Momentum from the current rally is likely to result in a breakout above its primary descending resistance level which will extend the current advance into its horizontal resistance area. Buying the dips from current levels is favored.

The CCI, following a bullish momentum shift, is now on track to extend its acceleration to the upside until it will reach extreme overbought territory above the 100 mark. This further supports a rise in the GBPAUD. Download your PaxForex MT4 Trading Platform now and add this recommended trade to your forex portfolio; join our growing community of profitable forex traders!

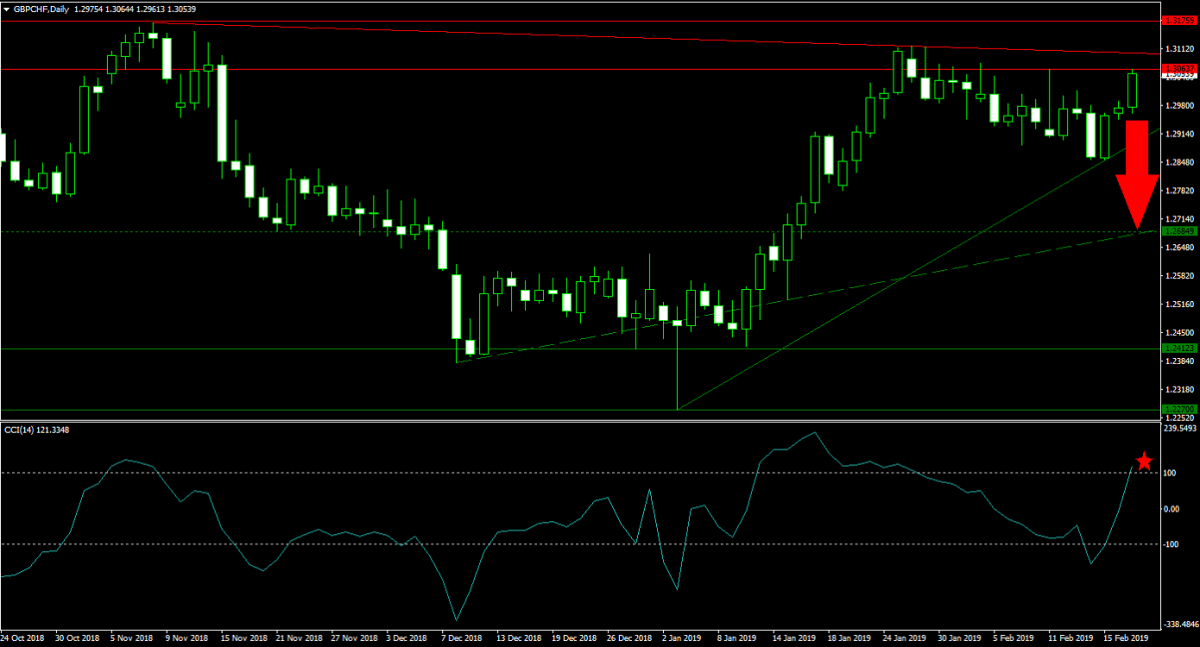

Forex Profit Set-Up #3; Sell GBPCHF - D1 Time-Frame

Those looking to either hedge the two above long British Pond recommendations or looking for a smart short trade can find one in the GBPCHF. This currency pair pushed into the lower band of its horizontal resistance area where its primary descending resistance level is applying further bearish pressures. A price action reversal is expected to result in a breakdown below its primary ascending support level and lead the GBPCHF back down into its next horizontal support level, enforced by its primary ascending support level. Forex traders are recommended to place their sell orders just above and below the lower band of its horizontal resistance area.

The CCI spiked from extreme oversold conditions into extreme overbought levels. While this momentum indicator remains off of its previous highs, bullish momentum is anticipated to collapse. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month by following our trading recommendations!

To receive new articles instantly Subscribe to updates.