Welcome everyone! Before we dive a bit deeper into today’s topic of Bitcoin ETFs, let me take a moment and look at the price action recovery in cryptocurrency assets since last week’s update. During last week’s post, which you can read up on at “Bitcoin - Forex Combo Strategy: Digital Gold”, I pointed out that Bitcoin could quickly advance towards the $6,000. The first step for this rally to materialize is a breakout above $4,000 and price action is currently in the process to attempt such a breakout. Once we push above it, it will attract new net buyers into Bitcoin and we could quickly accelerate to the upside. Again, the fundamental news flow has been great and price action lagged the developments.

Now let’s get back to the often talked about topic of Bitcoin ETFs. Proposals have been made to the SEC, but were withdrawn. The latest US partial government shutdown which lasted 35 days has further delayed new approvals. Today’s edition of the SEC Federal Register features the VanEck/SolidX Bitcoin ETF proposal filed with the CBOE BZX Exchange. This means that a 45-day period officially starts today for an initial decision. The VanEck Director of Digital Asset Strategy, Gabor Gurbacs, noted that “The company has been actively working with regulators, as well as other major market participants, to bring simplicity, transparency and professional market standards to digital assets.”

He further added that “I hope that our investment in regulatory and market education, hard work and commitment will be honored when the time comes.” The VanEck/SolidX Bitcoin ETF proposal is joined by the proposal filed by Bitwise Asset Management with NYSE Arca. Bitwise Global Head of Research, Matt Hougan, stated that “A year ago there was maybe one qualified crypto custodian and now there are half-a-dozen, and that number will go up from here.” He added that “A little more than year ago, we didn’t have futures. A year ago we didn’t have nearly as many firms making markets. A few months ago, you didn’t have folks like Fidelity announced in the space. It’s evolving really, really quickly.”

Approval of one or both ETFs will not only pave the way for more, but it will also bring in plenty of capital from institutional investors which will boost the price of Bitcoin. This is especially true for the VanEck/SolidX Bitcoin ETF proposal which will purchase Bitcoin and therefore increase actual demand. It will also further increase acceptance of crypto assets as I outlined in this post “Bitcoin - Forex Combo Strategy: Cryptocurrency Acceptance Grows”. I expect Bitcoin to slowly trade above the $4,000 level and challenge the $4,600 mark. Should the SEC grant approval to any of the ETF’s, we could quickly accelerate to the upside and test the $6,000 mark.

Caution is required despite the official start of the 45-day evaluation period. I fully believe that we will see an ETF approved in 2019, but it may not be until this summer. Jake Chervinsky, attorney at Kobre Kim, pointed out that a few more months of developments in the cryptocurrency ecosystem may be required for an ETF approval by the SEC. Hougan summed it up adding that “The SEC has been extraordinarily clear in the Dalia Blass letter and in the Winklevoss rejection letter in what they will require before you can list a product. It’s up to folks in the industry to meet those standards. All you can ask for a regulator is to lay out clear bars you have to clear before they will approve something.”

The most recent rally in cryptocurrencies has boosted my portfolio rather nicely. I decided to make some changes and sold my 4,500 Ethers which carried an average entry price of $131.22 at $141.22 yesterday on February 19th 2019 for a profit of $45,000. I plan to re-enter my Ethereum trade during the next pull-back. I expect to lower my overall entry price and increase my holdings. I continue to hold my 200 Bitcoins which carry an average entry price of $4,315 and my 600,000 Ripple which carry an average entry price of $0.3250. The first image shows my Bitcoin positions, the second image my Ethereum exit and the third image my Ripple holdings.

Gold joined the rally in cryptocurrencies and following a breather, accelerated to the upside. I expect this trend to continue and for prices to challenge the $1,500 level this year. In case we see some unexpected pull-back in cryptocurrencies I may sell some of my Gold holdings and add to my cryptocurrency assets. I currently hold 100 lots of Gold which I purchased at $1,195.00 for a margin requirement of $123,179 with a pip value of $100. I did move my stop loss to $1,325.00. The image below shows my Gold trade.

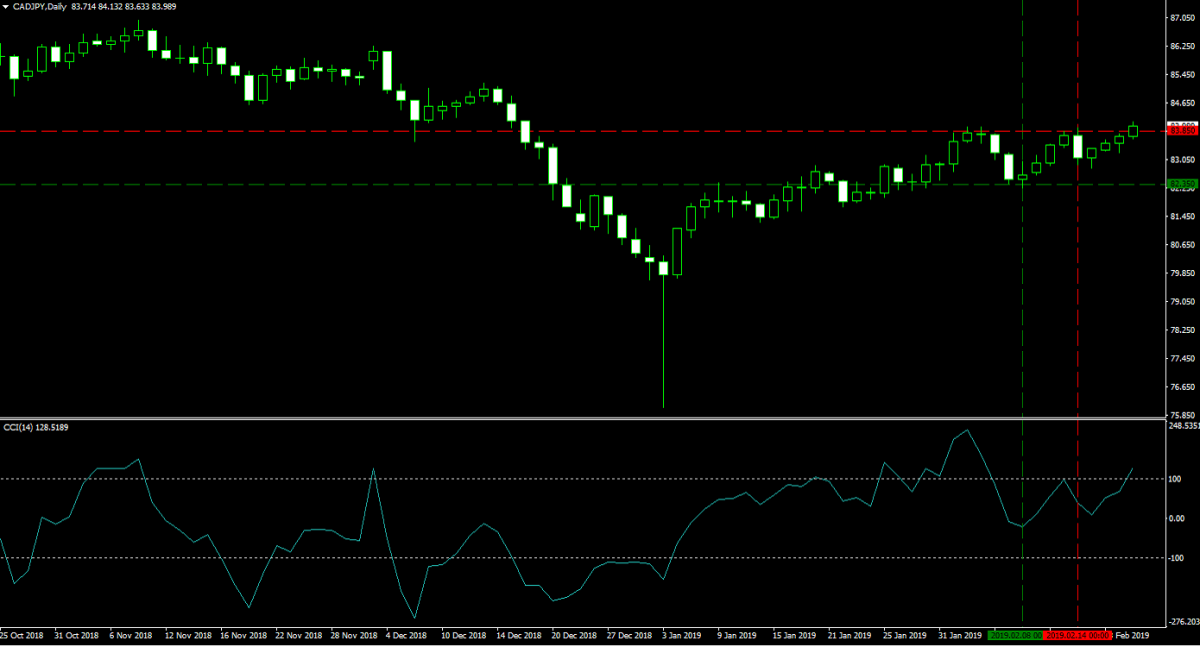

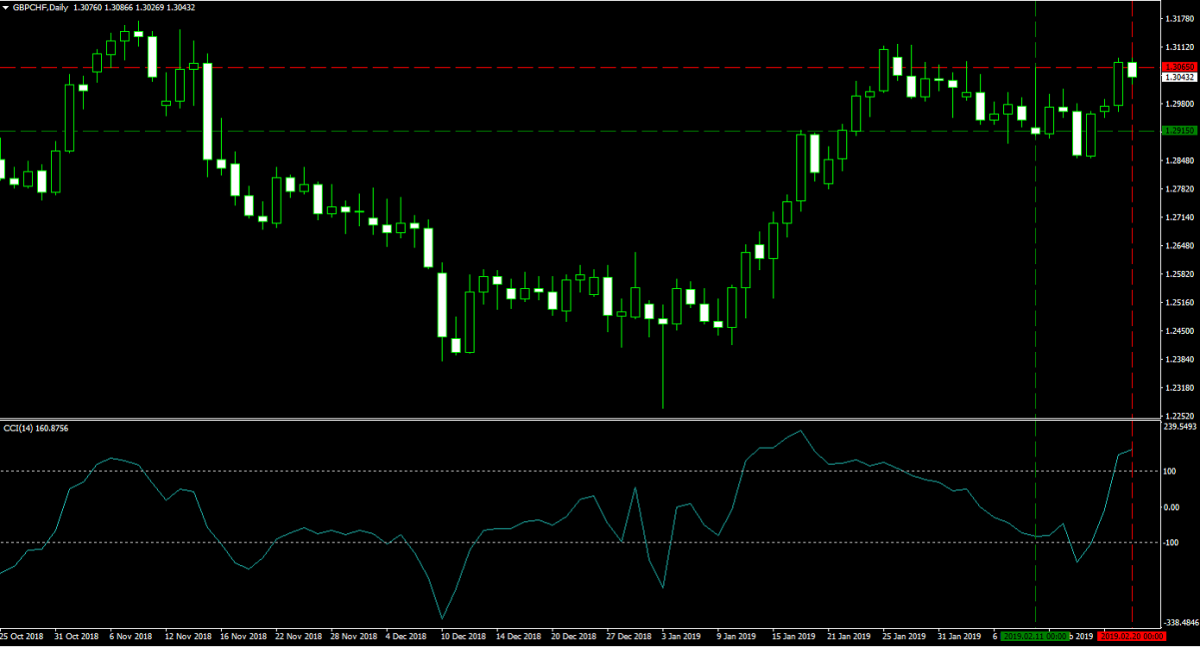

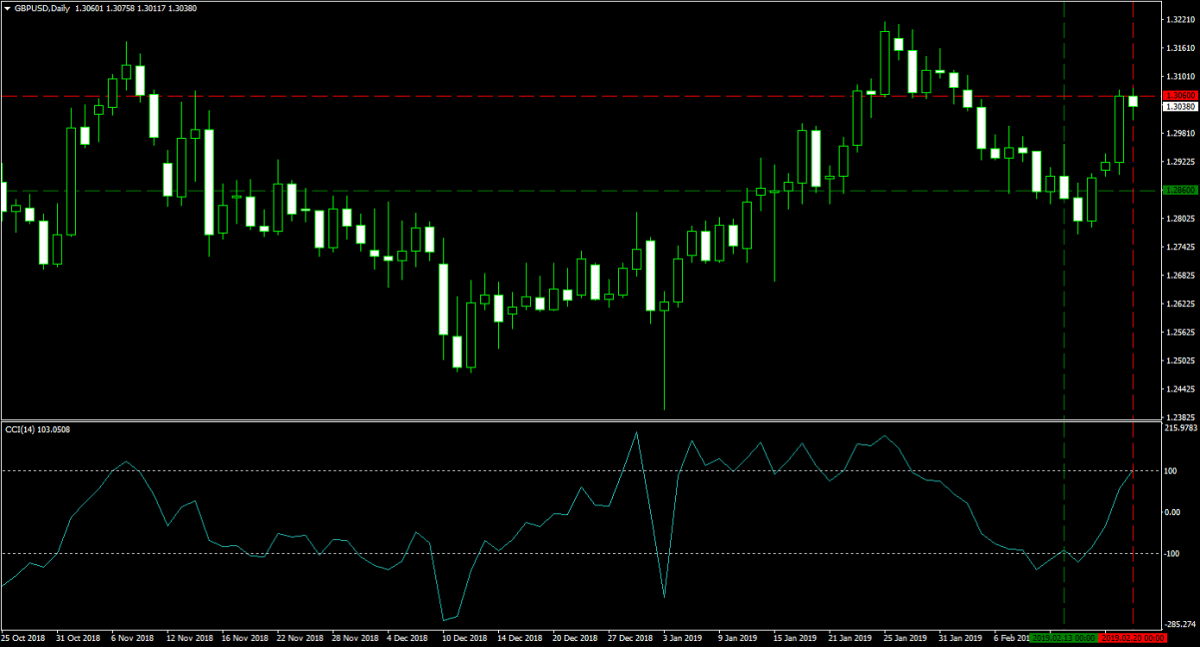

Last week I had three open forex positions which I closed all for a profit. On February 14th 2019, my stop loss in my 50 lots CADJPY long position was triggered at 83.850 and I exited this trade for a profit of 150 pips or $67,623. Earlier today I closed my 50 lots long position in the GBPCHF as my adjusted take profit level was hit at 1.3065 for a profit of 150 pips or $74,368. The same holds true for my 50 lots long position in the GBPUSD which was closed at 1.3060 for a profit of 200 pips or $100,000. The three images below show my closed positions.

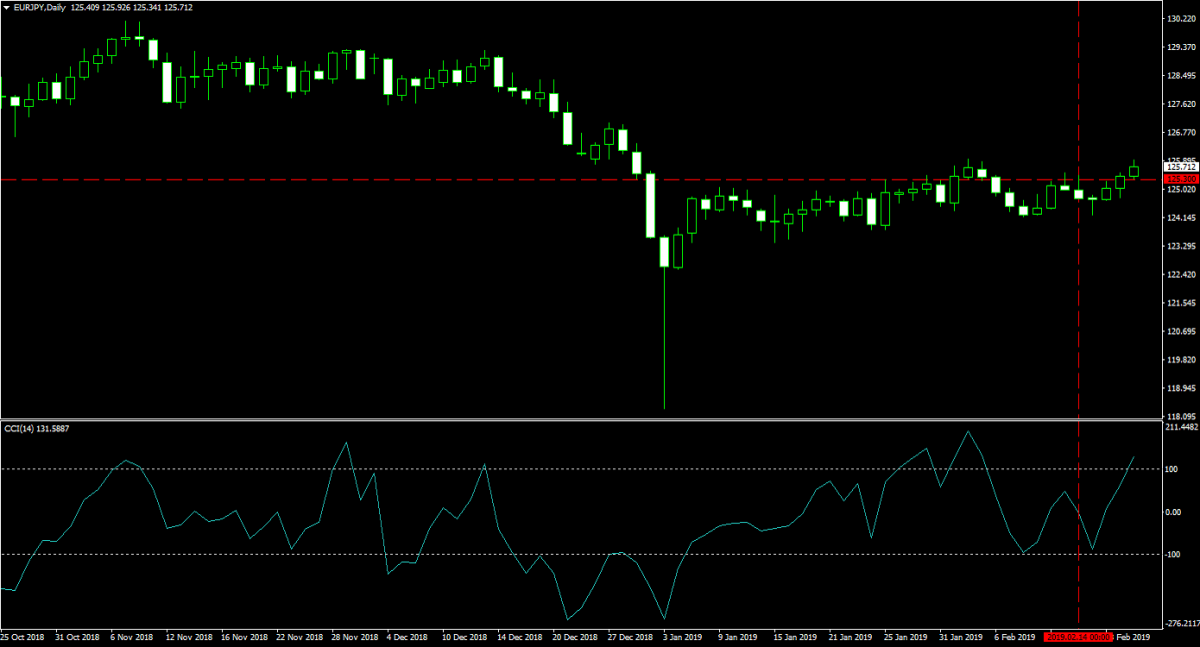

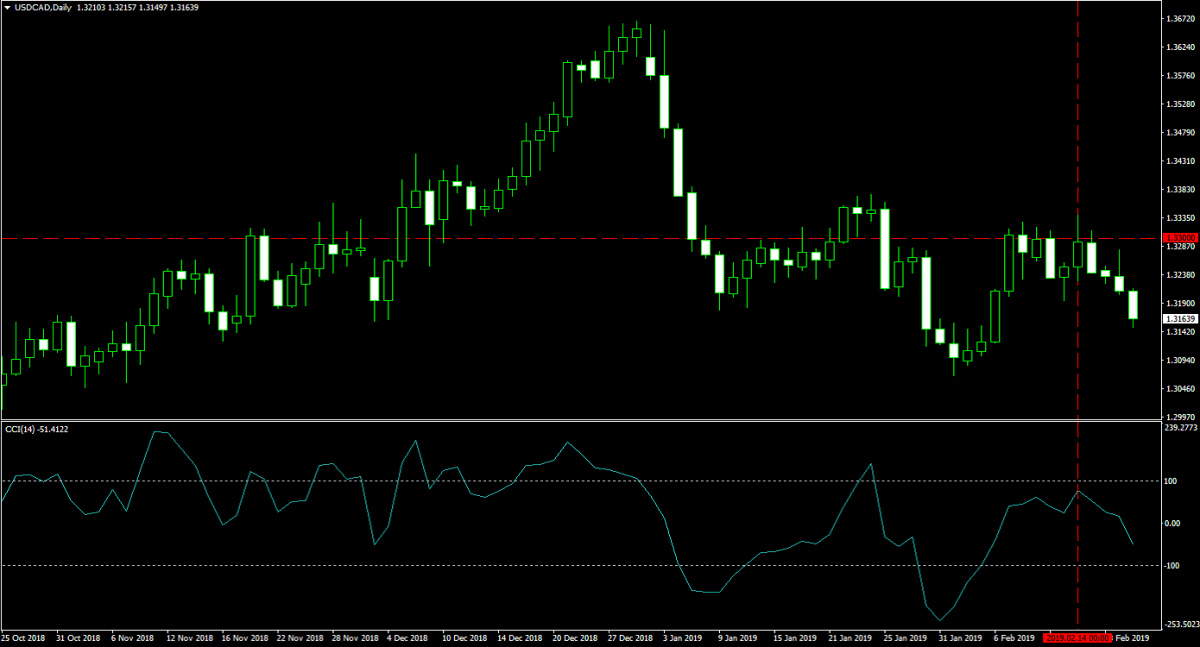

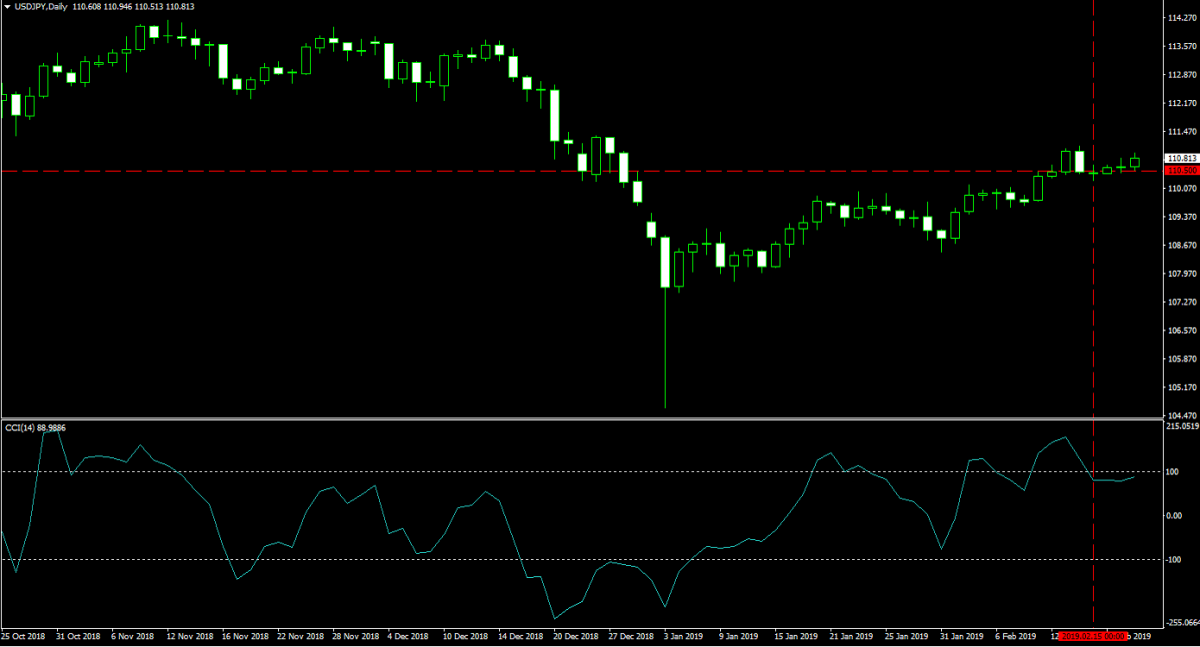

On February 14th 2019 I sold 50 lots in the EURJPY at 125.300 for a margin requirement of $11,337 with a pip value of $451.13. You can read the trading recommendation at “EURJPY Fundamental Analysis – February 14th 2019”. On the same day I also took a 50 lots short position in the USDACD at 1.3300 according to this trading recommendation “USDCAD Fundamental Analysis – February 14th 2019”. My margin requirement was $10,000 with a pip value of $379.79. On February 15th 2019 I added to my Japanese Yen long position by taking a 50 lots short in the USDJPY at 110.500 for a margin requirement of $10,000 with a pip value of $451.13. You can find the original trading recommendation at “USDJPY Fundamental Analysis – February 15th 2019”. The images below show the three forex trades I took last week.

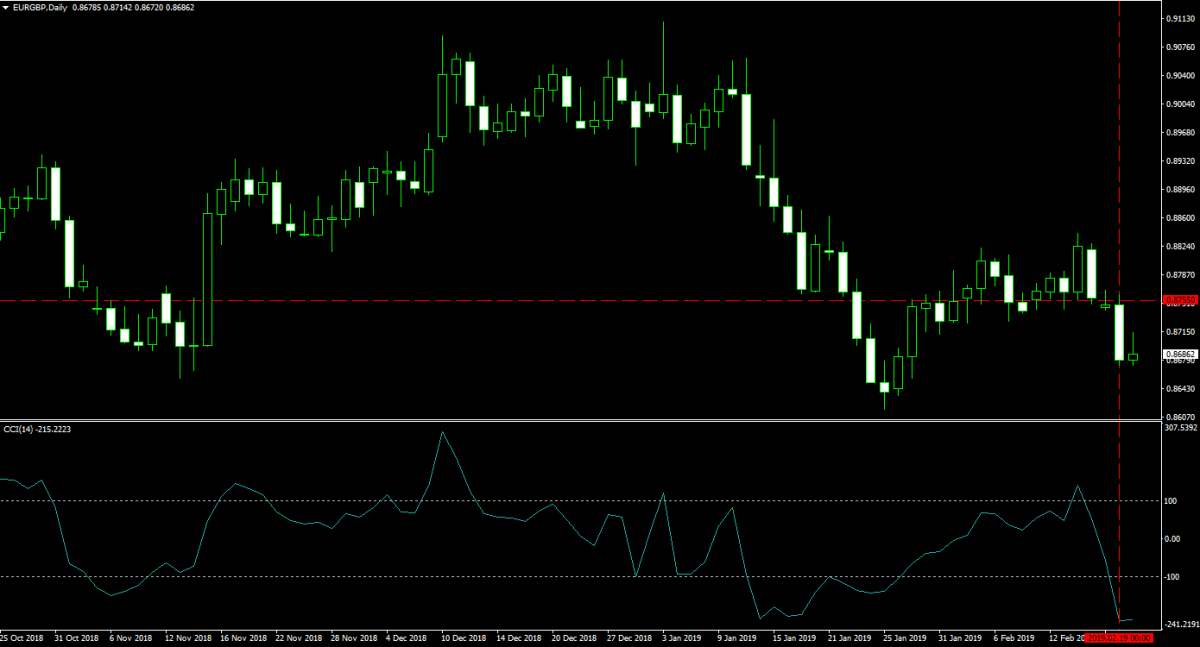

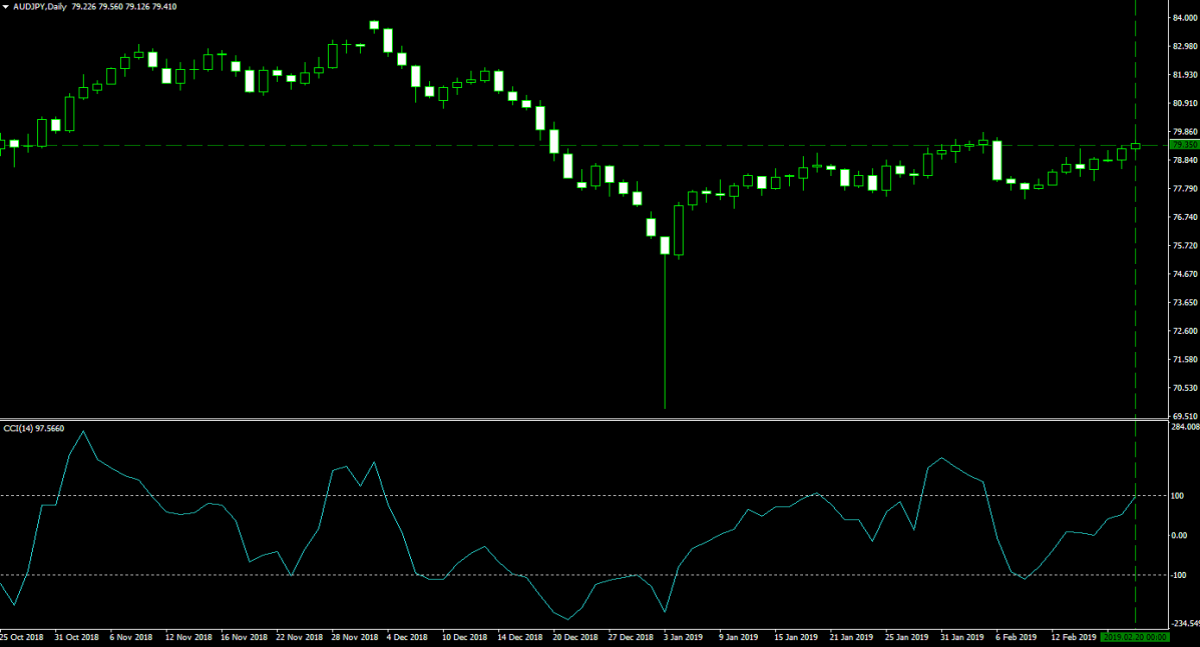

This week I added a 50 lots short position in the EURGBP on February 19th 2019 at 0.8755. The margin requirement for this trade was $11,337 with a pip value of $652.88. The trading recommendation can be found at “EURGBP Fundamental Analysis – February 19th 2019”. Earlier today, February 20th 2019, I took a 50 lots long position in the AUDJPY at 79.30 according to this trading recommendation “AUDJPY Fundamental Analysis – February 20th 2019”. My margin requirement for this position was $7,166 and each pip is worth $451.13. The two images below show my entries.

Now let’s take a look at my portfolio. I have 200 Bitcoins worth $774,320 and 600,000 Ripple worth $189,120. My 100 lots of Gold are worth $1,579,179 and I have a cash position worth $1,179,143. My forex portfolio consists of five position, 50 lots each. My EURJPY short position is worth -$10,317, my USDCAD short position is worth $63,930, my USDJPY short position is worth -$3,082, my EURGBP short position is worth $53,744 and my AUDJPY long position is worth $12,128. The value of my total portfolio stands at $3,838,165, up $710,300 as compared to last week and a new all-time high. I am now approaching the $4M level. Open your PaxForex Trading Account now and use my Bitcoin - Forex Combo Strategy in order to boost you performance with my help!

To receive new articles instantly Subscribe to updates.