Many still debate if we have a trade war on our hands already, or if it is more of a trade conflict or just trade fears. Regardless of where one stands in the assessment of the current trade environment, global markets have already started to to show signs of disruptions in the supply chain. Since last week, a currency war may be sniping down currencies before the full impact of a trade war can start counting casualties. US President Trump didn’t only single out China and the Eurozone, but also attacked the US Fed for their policies.

During the European morning trading session, IHS Markit released its Manufacturing PMI, its Services PMI and its Composite PMI for the Eurozone, Germany and France. The cumulative report pointed towards an economic slowdown which is set to create headaches for the continent. Beyond the headline figures which painted a mixed economic picture, companies reported an increase in the price of raw materials. In addition, delivery shortages as well as delays were mentioned which suggests that the current tariffs and the threat of more tariffs are already disrupting the global supply chain.

The IHS Markit report comes just days after the G-20 finance ministers and central bankers issued a warning from Buenos Aires that trade tensions will threaten the global economic expansion. As trade tensions grow into conflicts and then into full-scale trade wars, inflation is likely to increase. The primary reason being companies who will pass on at least a portion of the higher costs to consumers. Royal Philips NV already stated that they are unsure about the future impact from tariffs, but that the higher costs will have to be passed onto consumers.

Forex traders can profit from the rise and fall of currencies and should be excited about the countless trading and profit opportunities which arise from price action swings created by trade wars. Are you positioned to take full advantage of future trading opportunities? Open your PaxForex Trading Account now and allow our expert analysts to guide you through the forex market with a profitable outcome.

China has already announced contingency plans to support their economy from the ripple effects of its trade war with the US. The Euro could be the next trade war victim. The IHS Markit Eurozone Composite PMI decreased more than expected, but even more worrisome is the expectations index which plunged to a 20-month low. IHS Chief Business Economists Chris Williamson noted that 'For now, the health of domestic demand seems encouragingly solid, but any feed-though of trade worries to other sectors will be a key area of concern to an already cloudier-looking outlook.' Here is the next trade war victim: the Euro and three forex trades which will keep your forex account pipping!

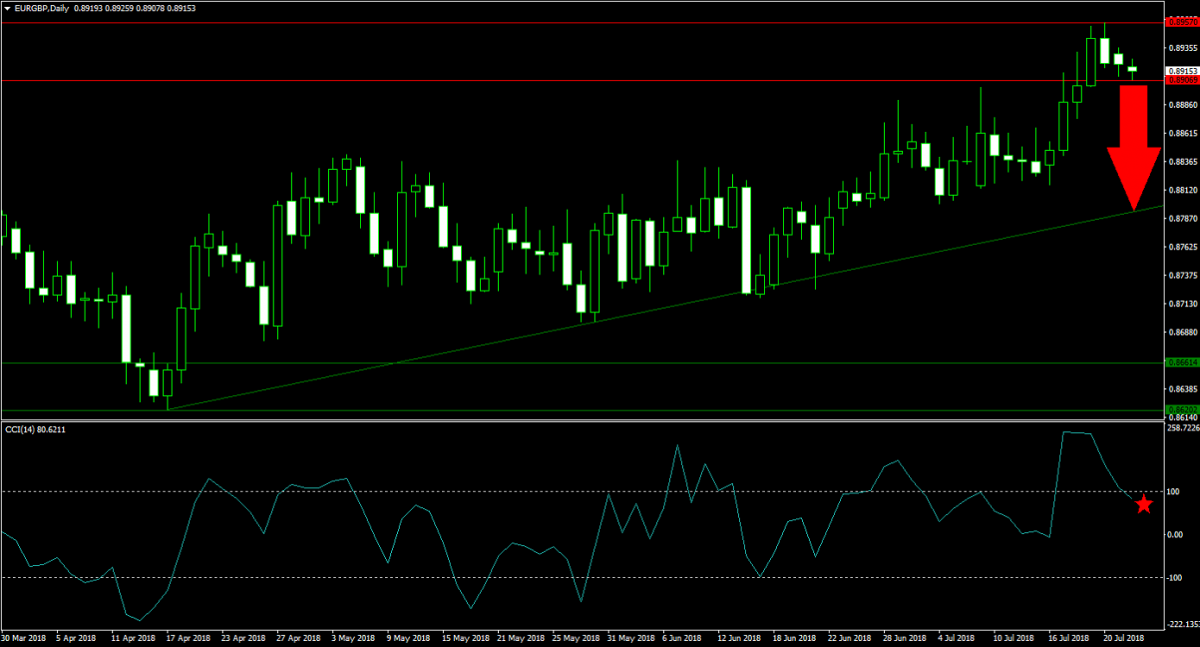

Forex Profit Set-Up #1; Sell EURGBP - D1 Time-Frame

The EURGBP advanced into its horizontal resistance area as Brexit turmoil caused investors to overreact and panic. After being rejected by the upper band of its horizontal resistance area, price action is now flirting with a breakdown which could lead to a sell-off inspired by profit taking. The Euro is now coming under pressure, especially since US President Trump is contemplating to impose tariffs on car imports. Forex traders are advised to place their sell orders just above and below the lower band of its horizontal resistance area.

The CCI has already pushed below the 100 mark and out of extreme overbought conditions. This has weakened bullish momentum and a move below 0 will result in a momentum change to bearish. Make a deposit today, you can even use your Bitcoin or Ethereum assets, and enter the EURGBP to your portfolio before it will accelerate to the downside.

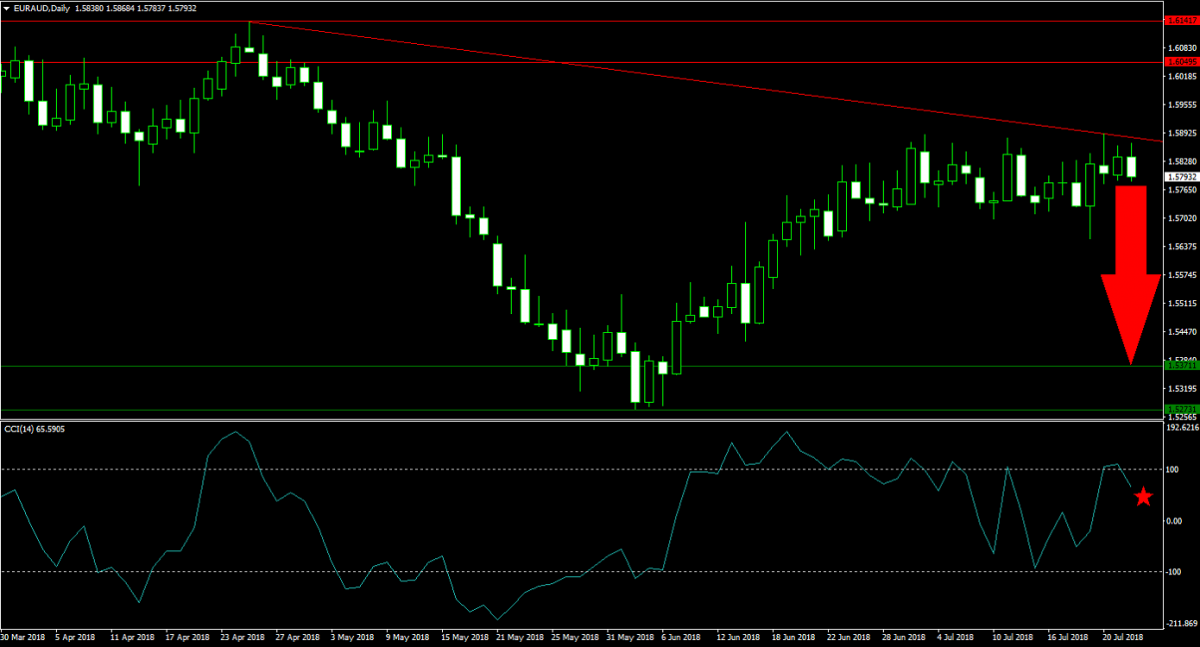

Forex Profit Set-Up #2; Sell EURAUD - D1 Time-Frame

The most recent rally in the EURAUD ran out of steam as price action slammed into the descending resistance level which originated at the upper band of its current horizontal resistance area. The Australian Dollar may also benefit from the new Chinese policies which are meant to boost domestic demand and therefore currencies of commodity exporters like Australia. Forex traders should sell the rallies from current levels up to the descending resistance level.

The CCI briefly advanced into extreme overbought territory, but has since reversed direction and momentum may suffice to push it into negative condition and confirm short orders in the EURAUD. Never miss a profitable trading opportunity and follow the PaxForex Daily Forex Technical Analysis. Simply follow the technical trading recommendations of our expert analysts and fill your forex account with pips.

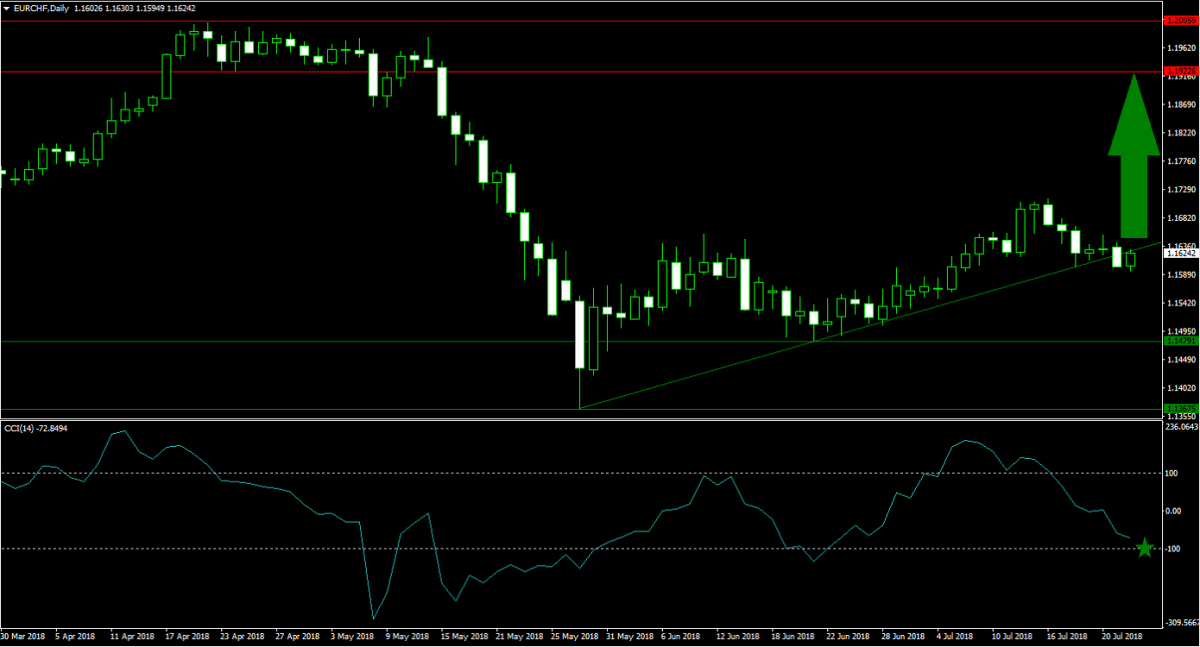

Forex Profit Set-Up #3; Buy EURCHF - D1 Time-Frame

A great hedge to the above two short trading recommendations against the Euro is a long order in the EURCHF. Price action has been guided to the upside by its ascending support level, and the current pause in the advance has created a great entry opportunity. This currency pair is now trading just below its ascending support level and forex traders are recommended to place their buy orders at current levels. The upside potential remains very attractive with limited downside risk.

The CCI has descended from extreme overbought levels above 100 to below the 0 mark and is now approaching extreme oversold conditions. The EURCHF is expected to reverse after a short excursion below -100. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 500 pips per month by following the fundamental trading recommendations published by our seasoned team of expert analysts who take the guess work out of forex trading.

To receive new articles instantly Subscribe to updates.