Many traders have put Brexit on the back-burner as the Italian political crisis has taken the center stage for the time being. As a populist government is likely the outcome for Italy, the EU needs to come to an understanding with it. Even new elections will not reverse the choice made by Italian voters as polls suggest that the populists would win even more seats than during the March election. The Euro has a wall of worries to climb as the European Union as well as the Eurozone have to start a long war in order to simply survive. An Italian exit from either one, which populists in Italy claim is not what they seek, could result in the death of both.

While the Italian situation has been front and center over the past few trading sessions, traders must not ignore Brexit as time is ticking down and it appears that the EU and the UK are no closer to a deal than at the beginning of 2018. With British Prime Minister May under extreme pressure and trying to hold on to her job as some speculate a snap election may be on the horizon, many market participants may be bind-sided with a surprise move. On the positive side for the UK, business as well as consumers seem to get more comfortable with Brexit as confidence as well as spending is on the rise, partially due to a very solid labor market.

Deutsche Bank is a dark cloud over the European financial system and some started to draw comparisons to the collapse of Lehman Brothers which caused the previous global financial crisis to unravel. Deutsche Bank is ten time the size Lehman Brothers was which is definitely a concern. Traders need to also pay attention to the issues across the Atlantic. The US still plans to pull out of NAFTA and while the trade war with China has been temporarily suspended, nobody knows what will happen if talks between both countries collapse. The special exemption the Trump administration gave the EU in regards to steel tariffs will expire June 1st with no deal in sight.

The forex market is the quickest market to react to geopolitical events and has a finger on the pulse of the global economy. As tensions rise and issues turn into hotspots, price action across the forex market will become more volatile. This also creates a lot more trading opportunities which forex traders can realize. Access the forex market now by taking the first step and opening your PaxForex Trading Account!

Central banks may have to delay their pledge to normalize the interest rate environment as problems are on the rise which are most likely to cripple economic output. The issues are not only evident in developed market, but emerging markets face their own debt problems with hundreds of billions worth of debt due for repayment. Given the timing, debt defaults may once again make the headlines and more and more portfolio managers are asking themselves if this is the next big global financial crisis. In addition China is slowly losing its role as the global financier which begs the question: Has the next financial crisis already arrived? Here are three trades every forex trader needs to have in their portfolio in order to profit from uncertain times ahead.

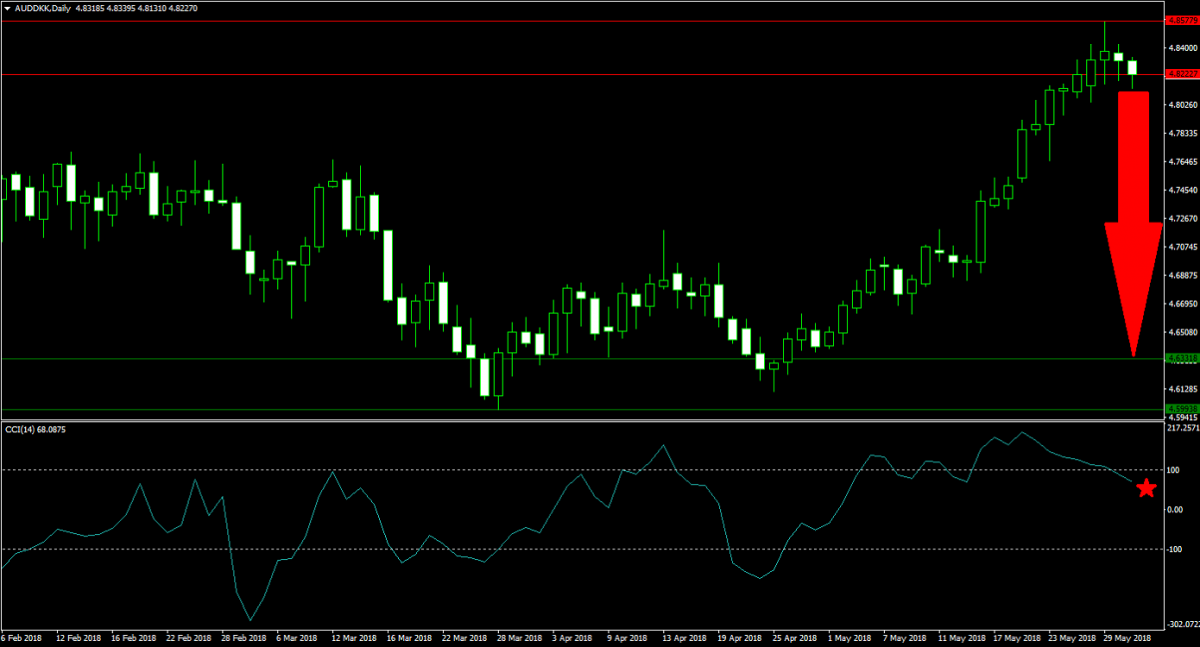

Forex Profit Set-Up #1; Sell AUDDKK - D1 Time-Frame

The Australian Dollar is very vulnerable to a correction as the Australian economy is heavily dependent on commodity exports. The AUDDKK has not reacted to the pending slowdown and is now starting to catch up the the trend. Price action is currently in the process to complete a breakdown below its horizontal resistance area from where a profit taking inspired correction is likely to follow. Forex traders are advised to stagger their short entries above and below the lower band of its horizontal resistance area.

The CCI has already retreated from extreme overbought conditions and has pushed below the 100 mark which resulted in an increase in bearish momentum. More downside from current levels is expected. Download your PaxForex MT4 Trading Terminal today and start your forex journey in order to live an independent and free life.

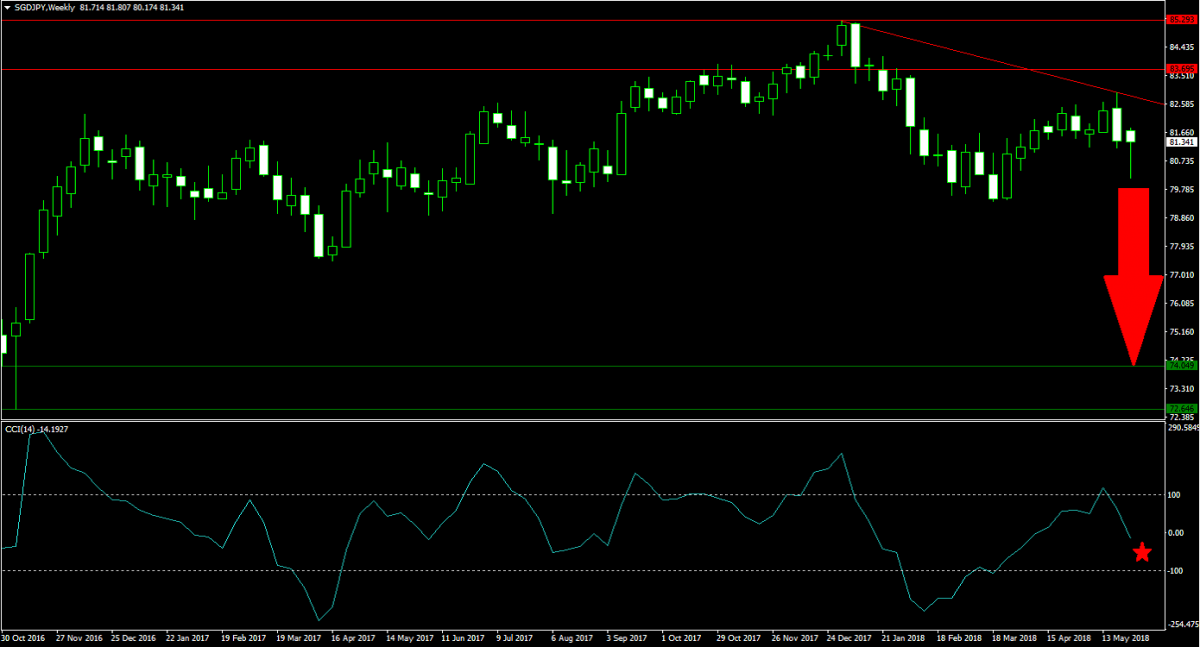

Forex Profit Set-Up #2; Sell SGDJPY - W1 Time-Frame

As global financial market jitters rise, the Japanese Yen is set to outperform its peers. The SGDJPY has already completed its breakdown below its horizontal resistance area and is now under increased bearish pressures. A descending resistance level is further applying downside momentum which is expected to extend the trend until this currency pair will reach its horizontal support area. Forex traders should sell any potential rallies into the descending resistance level.

The CCI briefly spiked into extreme overbought conditions, but quickly reversed this move and dropped below 0 and into negative territory. This resulted in a sentiment change from bullish to bearish. Follow the PaxForex Daily Forex Technical Analysis in order to get the latest technical trading recommendations which will boost your profitability.

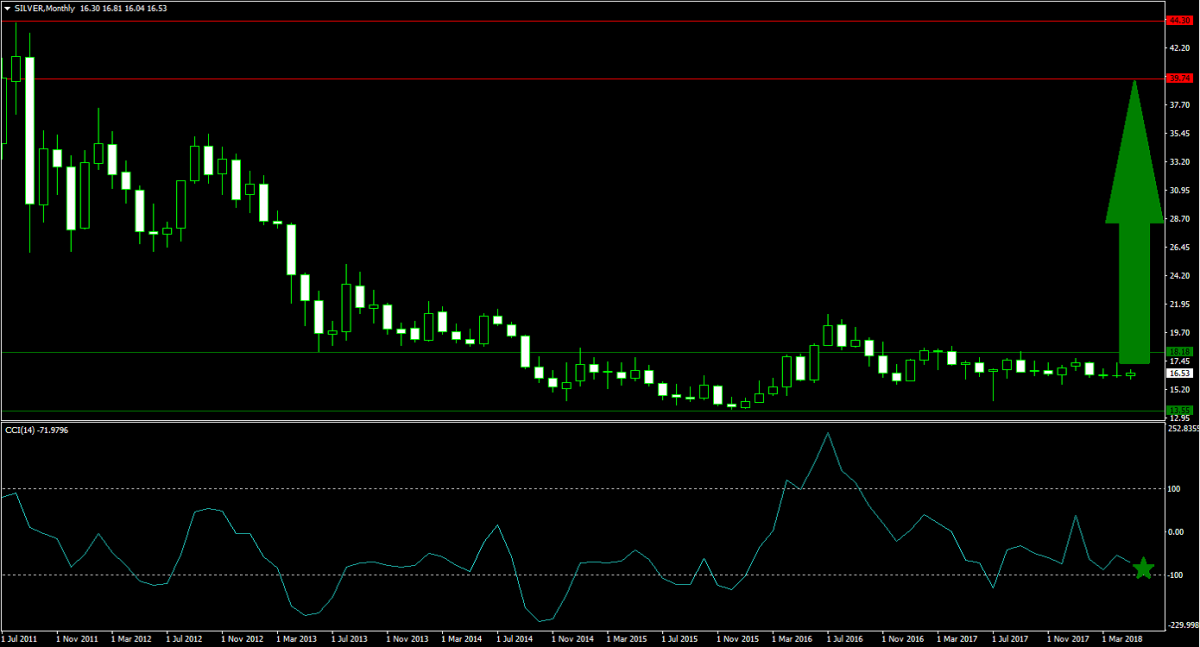

Forex Profit Set-Up #3; Buy Silver - MN Time-Frame

Silver has been confined to a narrow trading range inside its horizontal support area for over 42 months as this commodity is waiting for a spark which will ignite its next major move. Given the current global climate it is expected that this will be a sharp advance as problems mature. A breakout above the upper band of its horizontal support area could result in the doubling of the price of Silver. Forex traders are recommended to spread their buy orders across its horizontal support area.

The CCI, a momentum indicator, has recovered from extreme oversold conditions below -100. A shallow uptrend has emerged and a push above 0 is expected to attract more buy orders. Subscribe to the PaxForex Fundamental Analysis and get each trading day’s most profitable fundamental trading set-up. Let our expert analysts do the hard work which will allow you to earn over 500 pips per month.