Learning how to trade pin bars can help a trader grab trade entries just as the balance of power is shifting between the bulls and bears. Trading pin bars is one of those forex trading strategies that can be learned quite easily and is great for swing trading because you may have caught a turning point in the market. You can bring up any forex chart and see how a pin bar reversal can often highlight important turning points although a higher time frame carries more weight than a small time frame when using any type of candlestick pattern.

Knowing how to trade pin bars is one of the key skills you need to acquire as a forex trader because they’re one of the most common price action patterns you’ll be seeing form on your charts. Luckily, trading pin bars on their own is not that difficult and only requires that you have a small amount of knowledge on why pin bars form in the market, which you can easily gain by reading my article on understanding pin bars.

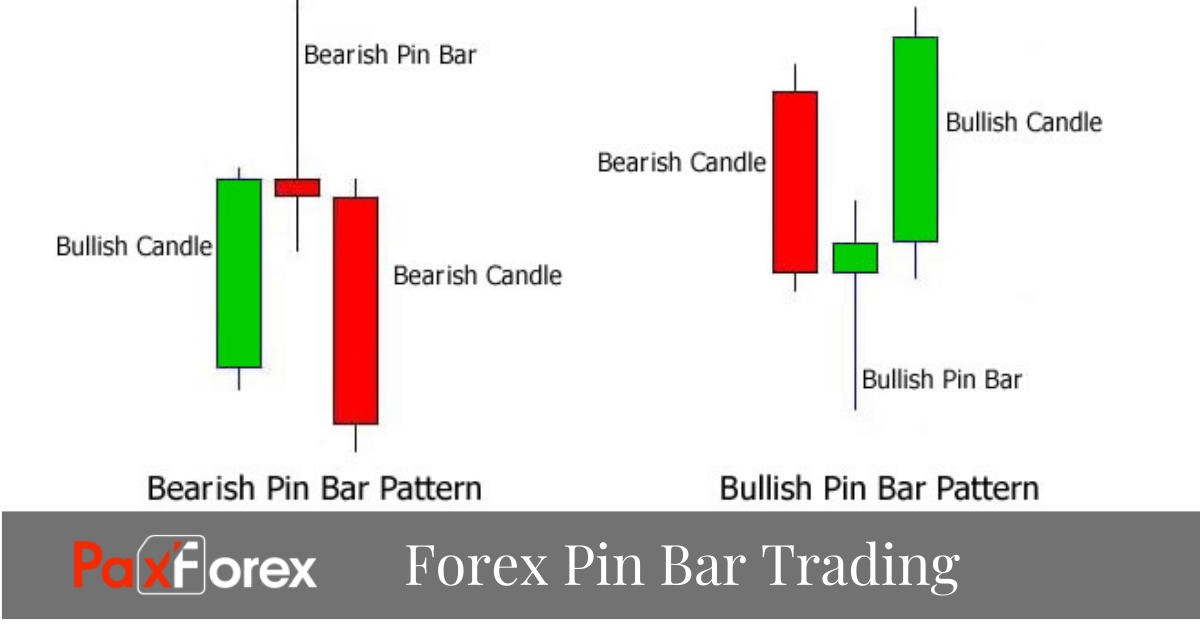

Identifying trend continuation or reversal in advance is the key to profiting with pin bars. Typically, a pin bar will stick out from price action, with the pin wick at least two times the length of the candle body. You can usually identify the context by looking at prior price action near the price of the pin bar. If the pin bar pushes higher or lower than the recent price action or there is no recent price action, it is most likely a reversal – a real pin bar.

The pin bar strategy is based on a simple, yet proven assumption that forex pairs (and other assets) come into resistance during a rally, but are often able to break through it. When this occurs, the former resistance becomes the new support. Once the market finds support at a former resistance, a bullish pin bar is formed in the process. The pin bar set up is an easy way to visualize trend reversals in the market. If used right it may be your ticket to more successful trades in the future.

The ideal timeframes for pin bar trading are four-hour, daily and weekly. It is always best to trade pin bars in conjunction with other price action strategies such as Fibonacci levels, trend lines as well as swing analysis. The reliability of a pin bar is much higher if it emerges near some critical support or horizontal level. In conclusion, it is recommended to trade pin bars on higher timeframes ideally on daily & weekly with tight money management. Only counter-trend pin bars generate reversal signals, therefore, avoid trading pin bars that are emerged within the same trend.