Central bankers and finance ministers of the G-20 will meet in Buenos Aires this weekend, on July 21st through July 22nd. The G-20 controls 85% of the global economy and this marks the first gathering since US President Trump imposed tariffs on the European Union and on China, which sparked retaliation in kind. Many economists and market participants try to determine if this was the first salvo in a new global trade war or if the damage can be contained and relations repaired. Global GDP is predicted to increase in 2018, but a full blown global trade war could derail the expansion moving forward.

Global GDP is set to expand by 3.9% this year as well as in 2019. The anticipated growth will come on the back of emerging markets and developing economies which are expected to pose GDP growth rates of 4.9% in 2018 and of 5.1% in 2019 while advanced economies are called to expand by 2.5% and 2.2% respectively. The current GDP forecasts don’t account for how a global trade war will impact global economic expansion and the actual figures could come in well below current forecasts. The last time global GDP contracted was in 2009, by 0.1%, in the aftermath of the 2008 financial crisis.

Warnings from the private as well as public sector are amassing, but that has not stopped the US from firing the first shot and imposing tariffs on the EU and China. Chua Hak Bin, Senior Economists at Maybank Kim Eng Research, stated that 'Global growth has reached an inflection and tipping point, with signs that the escalating US-China trade war is starting to disrupt business and investment.' The first sign of a potential trade war was delivered at the end of the G-20 meeting in March 2017, held in Germany, when the pledge to avoid protectionism was dropped from the official announcement.

The timing of the US tariffs intersects with a slowdown in developed economies and is further set to disrupt supply chains, damage confidence and boost prices. The G-20 is set to ring trade alarms, but is your forex portfolio ready to profit from the ripple effects? Will the Japanese Yen, Swiss Franc and Gold deliver on their safe haven status? Open your PaxForex Trading Account today and join our growing community of profitable forex traders!

The IMF, in its July forecast, already lowered GDP forecasts for the Eurozone and Japan in order to account for the potential of a 0.5% reduction to its global GDP forecast if trade barriers are erected. South Korea already reported a 0.1% contraction in exports year-over-year, another warning sign that global GDP may disappoint moving forward. The Head of Emerging Markets Economics at Nomura Holdings, Robert Subbaraman, noted that 'If this growth cushion starts to give way, as we expect, watch for Asia’s market risk premium to rise more sharply.' The G-20 is set to ring trade alarms and here are three forex trades to load your portfolio with.

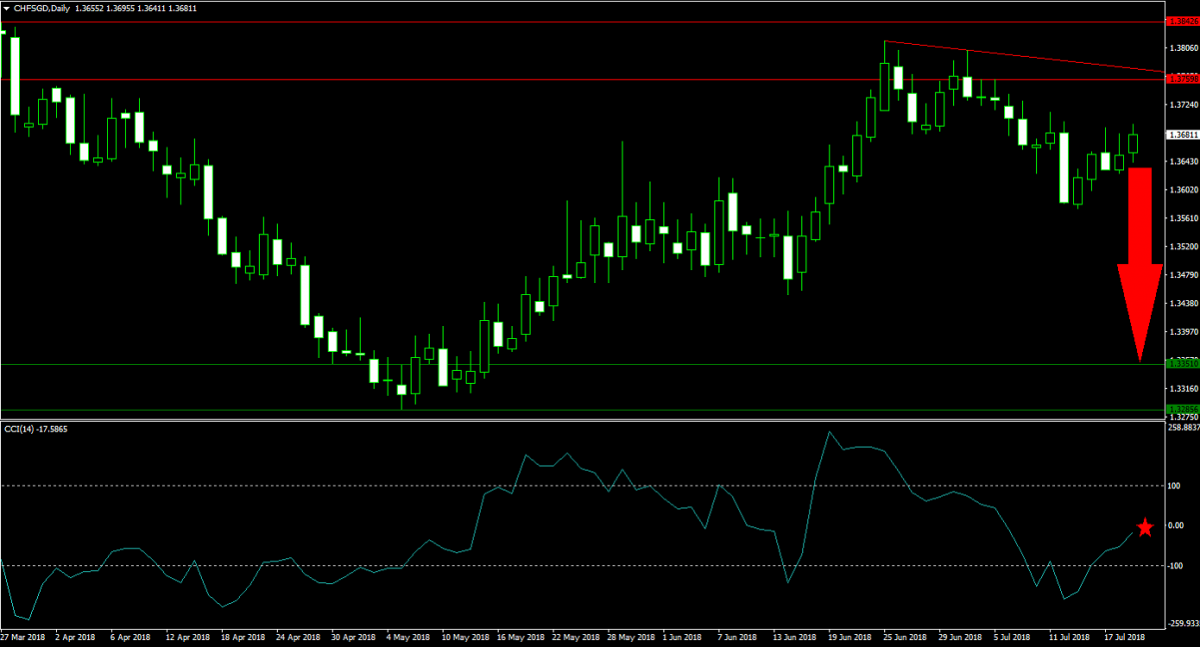

Forex Profit Set-Up #1; Sell CHFSGD - D1 Time-Frame

The Swiss Franc, although a safe haven currency which tends to perform well when risk-off sentiment is on the rise, is extremely exposed to the fallout from a global trade war. The Swiss currency is primarily exposed to the commodity sector which is dependent on solid global GDP expansion and therefore face bearish pressures in unison with tariff related hardship. The CHFSGD already completed a breakdown below its horizontal resistance area and a descending resistance level is additionally increasing bearish pressures. Forex traders are advised to sell the rallies in the CHFSGD.

The CCI confirmed the breakdown with a short plunge into extreme oversold territory, but has since recovered into neutral conditions while remaining below the 0 level which indicates bearish momentum. Subscribe to the PaxForex Daily Forex Technical Analysis section and receive our technical trading set-ups as soon as our expert analysts publish them, never miss a trading opportunity again!

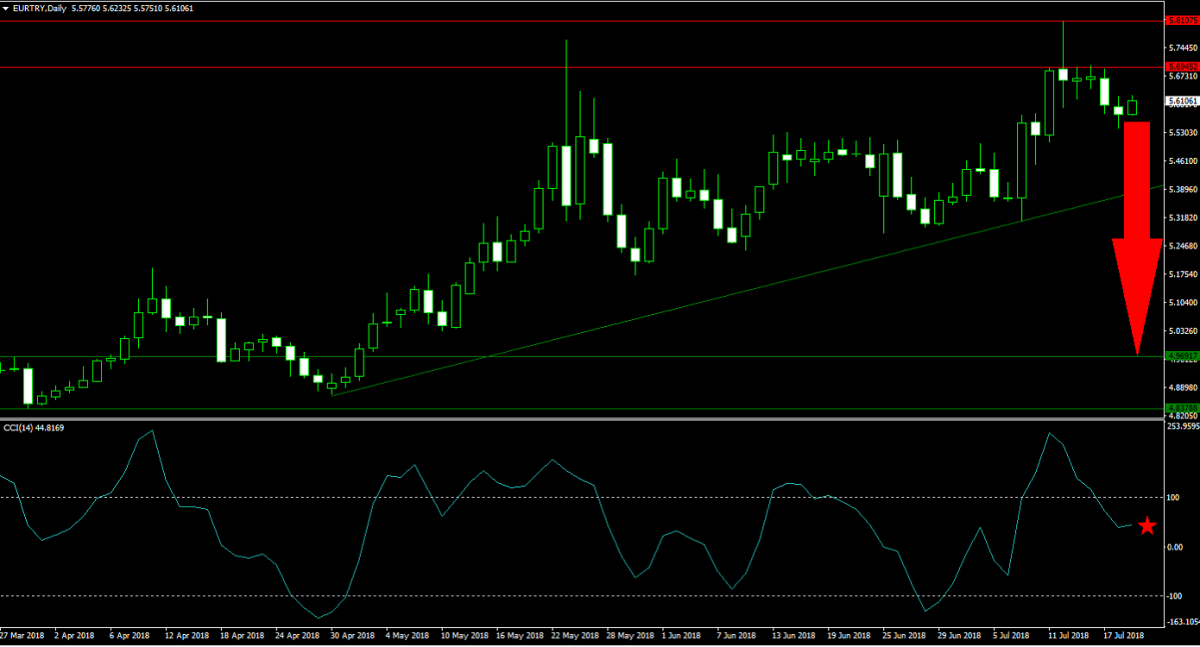

Forex Profit Set-Up #2; Sell EURTRY - D1 Time-Frame

While many traders are cautious with the Turkish Lira in response to the power consolidation under President Erdogan, the move has been exacerbated which makes the EURTRY vulnerable to a counter-trend move. The Euro is in the cross-hair of US tariffs and as global trade tensions are set to rise, strong leadership is required to navigate rough waters in which case Turkey is much better positioned. The EURTRY already pushed below its horizontal resistance area with bearish pressures strong enough for a breakdown below its ascending support level. Forex traders are recommended to seek short entries just below the lower band of its horizontal resistance area.

The CCI already completed a breakdown from extreme overbought conditions with momentum accelerating to the downside. This could lead to a further move below the 0 mark and confirm a momentum change to bearish. Download your PaxForex MT4 Trading Platform now and enter this trade to your forex portfolio before price action will accelerate to the downside.

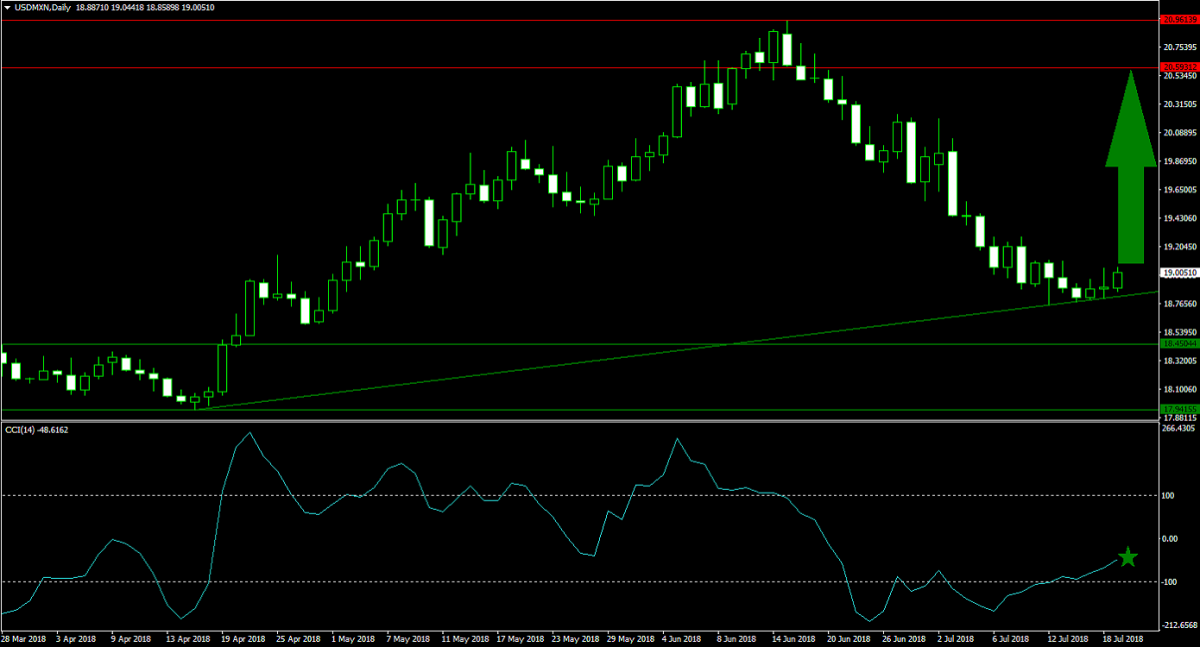

Forex Profit Set-Up #3; Buy USDMXN - D1 Time-Frame

The Mexican Peso enjoyed a relieve rally over the past few trading weeks, but with a NAFTA negotiations essentially stuck and uncertainty on the rise the move may be short-lived. The US tariff threat on car imports is set to have a negative impact on the Mexican economy and its currency. The USDMXN contraction was halted by its ascending support level from where an advance is expected to materialize. Forex traders should spread their buy orders just above and below the ascending support level in order to minimize risk while capitalizing on the attractive upside in the USDMXN.

The CCI, a momentum indicator, confirmed the pending momentum change as it advanced from extreme oversold territory and is now on an upward trajectory. A breakout above the 0 level will further spike bullish momentum and confirm a move to the upside. Follow the PaxForex Daily Fundamental Analysis and let our expert analysts guide your through the forex market which will yield you over 500 pips per months and more!

To receive new articles instantly Subscribe to updates.