Just as the majority of economists, analysts, investors and traders got comfortable with the progress in trade talks between the US and China in order to resolve the issue, US President Trump reminded everyone that nothing is certain. He took to Twitter on Sunday and fired off two tweets which caught many by surprise. Mass media has lulled everyone into the misguided believe that a trade deal is imminent. Trump has vowed to increase tariffs on $200 billion worth of Chinese Goods if no trade deal has been reached and the original deadline was March 1st 2019. The deadline passed and no deal has been reached. He now simply delivered on his promise with a delay.

On May 10th 2019 the new tariffs are set to kick-in. Trump tweeted that “....of additional goods sent to us by China remain untaxed, but will be shortly, at a rate of 25%. The Tariffs paid to the USA have had little impact on product cost, mostly borne by China. The Trade Deal with China continues, but too slowly, as they attempt to renegotiate. No!” Trump’s discontent with trade negotiations came after his top negotiator, Robert Lighthizer, told him from Beijing that China informed the US side that it will not agree to a trade deal which required a change in Chinese law.

While the media has reported that the latest round of talk between the US and China have been productive, sources familiar with the negotiations on both sides have anonymously stated that this is not the case. The next round of talks are scheduled for May 9th in Washington and China’s top negotiator, Vice Premier Liu He, is set to attend a fresh round of talks. He was invited by Trade Representative Lighthizer and Treasury Secretary Steven Mnuchin. Lighthizer added that “We felt we were on track to get somewhere. Over the course of last week we have seen an erosion of commitments by China. That in our view is unacceptable.”

Mnuchin stated that “We are not willing to go back on documents that have been negotiated in the past.” It appears that most market participants have discounted real progress in trade talks and already priced in a positive outcome. How will this impact the forex market? Open your PaxForex Trading Account today and create a profitable forex portfolio with the help of our expert analysts!

China understands the issues Trump is facing on the home front when it comes to his trade policy and is therefore in no rush to sign a trade deal beneficial to him. Trump’s own party is against the way he handles trade and is drafting a law which will prevent him from invoking tariffs on the basis of national security as he did with aluminum and steel imports. Furthermore, his own party seeks the elimination of all tariffs before a deal with pass Congress. This is opposed by the Trump administration which seeks to keep certain tariffs in place even if a deal has been agreed on. Is Trump trying to force the US Fed to cut interest rates as he demands? Trump delivers tariff increase and here are three forex trades to increase your balance!

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

The longer the trade war between the US and China lasts, the bigger of a fundamentally negative impact it will have on the US economy. Trump’s tariffs are essentially a tax increase on consumers which may show up in retail sales figures soon. This would apply downward pressure on the US Dollar, especially if the Fed feels it is forced to cut interest rates. The EURUSD just pushed out of its horizontal support area and further bullish momentum is injected by its primary ascending support level. This is expected to result in a breakout above its secondary descending resistance level from where a further breakout above its next horizontal resistance level is favored to take price action into its primary descending resistance level. Forex traders are advised to buy any dips down into the lower band of its horizontal resistance area.

The CCI accelerated out of extreme oversold conditions and momentum was strong enough to push it above the 0 mark fro a bullish momentum crossover. This is expected to attract more buy order in the EURUSD. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month in profits!

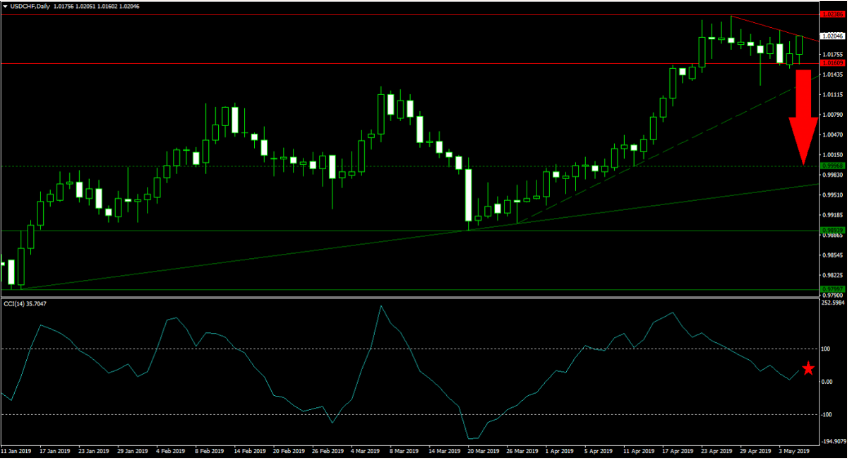

Forex Profit Set-Up #2; Sell USDCHF - D1 Time-Frame

Bullish momentum is weakening in the USDCHF as this currency pair has reached a very strong horizontal resistance area. A newly formed primary descending resistance level is further adding downside pressure to the overall weakening fundamental set-up. Price action is expected to complete a breakdown below the lower band of its current resistance area as well as below its secondary ascending support level. This would clear the way for a sell-off in the USDCHF until price action can challenge its next horizontal support level. Selling rallies into the upper band of its horizontal resistance area is the favored trading approach.

The CCI is losing bullish momentum after completing a breakdown from extreme overbought territory. This technical indicator is now racing towards the 0 level and bearish momentum is suffice to push for a bearish momentum crossover which is likely to add more selling pressure. Download the PaxForex MT4 Trading Platform now and join our fast growing community of profitable forex traders!

Forex Profit Set-Up #3; Buy AUDUSD - D1 Time-Frame

The surprise decision by the RBA not to cut interest rates was enough to support the Australian Dollar which quickly stabilized or rallied against all major currency pairs. The AUDUSD was able to complete a breakout above its horizontal support area with a sharp increase in bullish momentum. The primary descending resistance level, which has been turned into temporary support, added to bullish sentiment. Price action is now cleared to advance until it can challenge its next horizontal resistance level which is being approached by it secondary descending resistance level. Forex traders are recommended to buy any dips down to the lower band of its horizontal support area.

The CCI ascended out of extreme oversold conditions and this momentum indicator is now accelerating further to the upside. This is anticipated to result in a bullish momentum crossover and further push the AUDUSD to the upside. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts; we do the hard work so you can reap the easy profits!

To receive new articles instantly Subscribe to updates.