Welcome back to this week’s edition of my Bitcoin - Forex Combo Strategy. Let’s address the elephant in the room before we dive into Ethereum 2.0. Hackers stole 7,000 Bitcoins from Binance. CEO Zhao Changpeng stated “The hackers had the patience to wait, and execute well-orchestrated actions through multiple seemingly independent accounts at the most opportune time. We must conduct a thorough security review. The security review will include all parts of our systems and data.” Binance clients will not face personal losses as the company will cover the theft in full from its Secure Asset Fund for Users. The hack occurred in Binance’s hot wallet which accounts for roughly 2% of all its holdings, while the rest is stored in cold wallets. Storage is critical to your digital wealth and you may read more on it in my post “Bitcoin - Forex Combo Strategy: Cryptocurrency Storage”.

Now let’s take a look at Ethereum and what is going on at the world’s second largest cryptocurrency by market capitalization. A distant second I may add. Last year I was a lot more bullish on Ethereum, but things have changed in my opinion and I am not sure if this cryptocurrency will remain in the Top 5 for much longer. I think there are plenty fundamental issues with Ethereum and that while developers are working hard to fix them, other coins don’t have those issues and fixed them pre-launch. That’s the drawback of being a pioneer, while you lead the way you also highlight issues which were not expected. The next generation can implement solutions and issue a better coin faster than you can fix your problems. I think the Ethereum Constantinople upgrade was a great example of this. There was plenty of hype, but after it was implemented price action barely nudged. Some hardcore Ethereum supporters ask for more time and upgrades which are needed in order for Constantinople to function properly.

A long awaited new version of Ethereum, simply called Ethereum 2.0, is bringing some changes as it seeks to abandon the proof-of-work (PoW) concept which is also used by Bitcoin and several other cryptocurrencies and implement a proof-of-stake (PoS) concept. Staking, as the process is known, is expected to be profitable, but several issues already arise. The proposal calls for validators, the new name for miners in Ethereum 2.0, to earn 5% annualized on a minimum stake of 32 Ethers. This means that unless the price of Ethereum goes back up substantially, it will barely register a profit. Let’s take the price today at roughly $160, 32 Ethers would cost you $5,120 and 5% would translate into $256 per year in gross profits.

According to a new study by Consensys, once the costs of running the equipment required to validate transaction is factored in, the profit can drop down to roughly $40 per year for an estimated ROI of just below 0.80%. Collin Myers, Global Token Strategist at Consensys, noted “When you include the expenses of running your own machine in your own home, the net yield is 0.80%. So, it’s low but it’s positive compared to the last time it was not positive.” While many support this new proposal which currently claims that the first 1,000,000 validators will become profitable, up from 300,000 just a few weeks ago, I think this will hardly address the issues in Ethereum. Ultimately people want to earn money and unless you are a die-hard believer who takes one for the greater good, Ethereum 2.0 may see an exodus of capital to other coins. I am sure there will be 1,000,000 validators in the network holding on to hope that prices will rise to new all-time highs.

Two areas where Ethereum 2.0 will make improvements will be network security as well as true decentralization as validators are encouraged to operate in their homes rather than to use cloud services which essentially centralizes the process. According to the Consensys analysis, validators who want to use a cloud service providers such as Amazon, Alphabet or Microsoft, will run an annual loss of over $780 as compared to the $40 profit. Myers added “You want to be promoting people to do it in their own home. What that says is this model favors true decentralization which is a human being running machines in their own home instead of relying on someone else to do it for them.” On the network security front, estimates show that currently 4.8 million Ether are paid to miners. This number will drop to roughly 100,000 Ether under Ethereum 2.0. There are positives for sure, but I think it is way too early to judge and patience is required. We may be headed in the right direction as well as decentralization is concerned, but for the time being there are much better opportunities in the market for cryptocurrency traders like me. Ethereum 2.0 details have done little to get me back in the bullish camp and unless something changed drastically, I believe Ethereum will bleed capital moving forward.

Let’s jump right into what happened to my portfolio since last week’s update “Bitcoin - Forex Combo Strategy: India’s Cryptocurrency Path”. Bitcoin pushed higher and so did the value of my 200 Bitcoins which carry an average entry price of $4,315. I think we can extend this advance and pop above $6,000, but I will not hesitate to book my profits if we enter a correction. Ripple continues to struggle below the key $0.3000 level and while I do not see major downside from current levels, it appears that Ripple may have a tough few weeks ahead of itself. I will continue to hodl my 6,000,000 Ripple which carry an average entry price of $0.2975. The two images below show price action in my cryptocurrency portfolio.

As more economic data points towards a slowing global economy and as the Trump administration plan to increase existing tariffs on $200 billion worth of Chinese goods from 10% to 25%, Gold extended its gains. Bullish momentum is gathering steam and I think we can push back above $1,300. I currently hold 100 lots of Gold which I bought at $1,275 for a margin requirement of 127,367 with a pip value of $100. The image below shows my Gold trade.

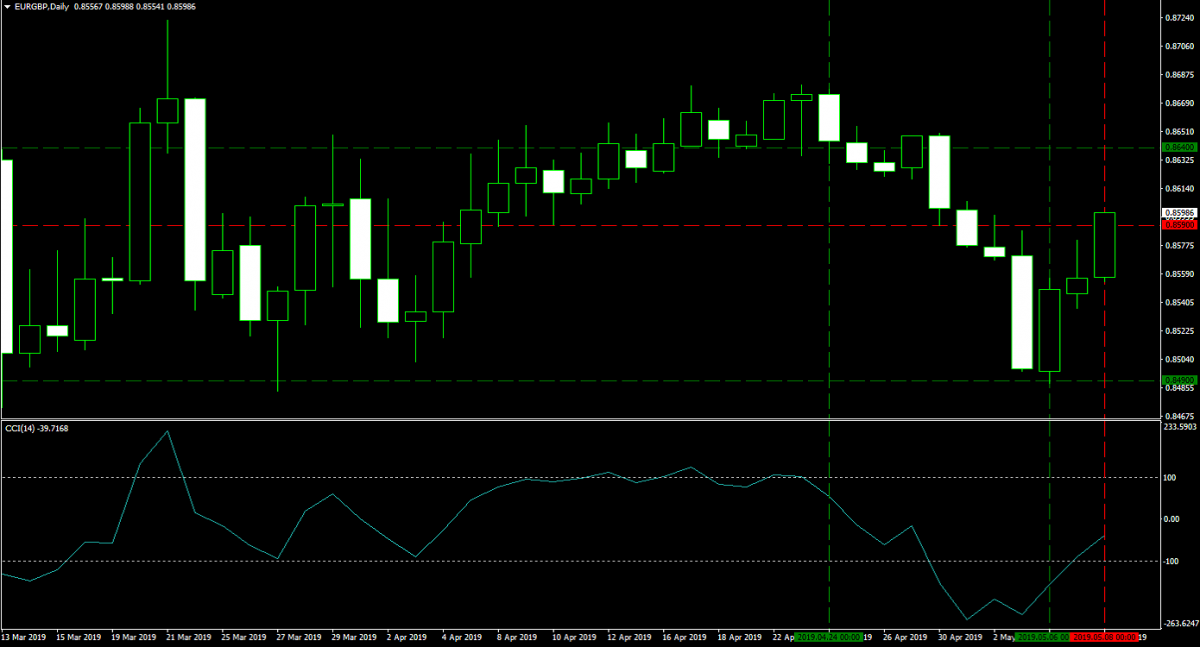

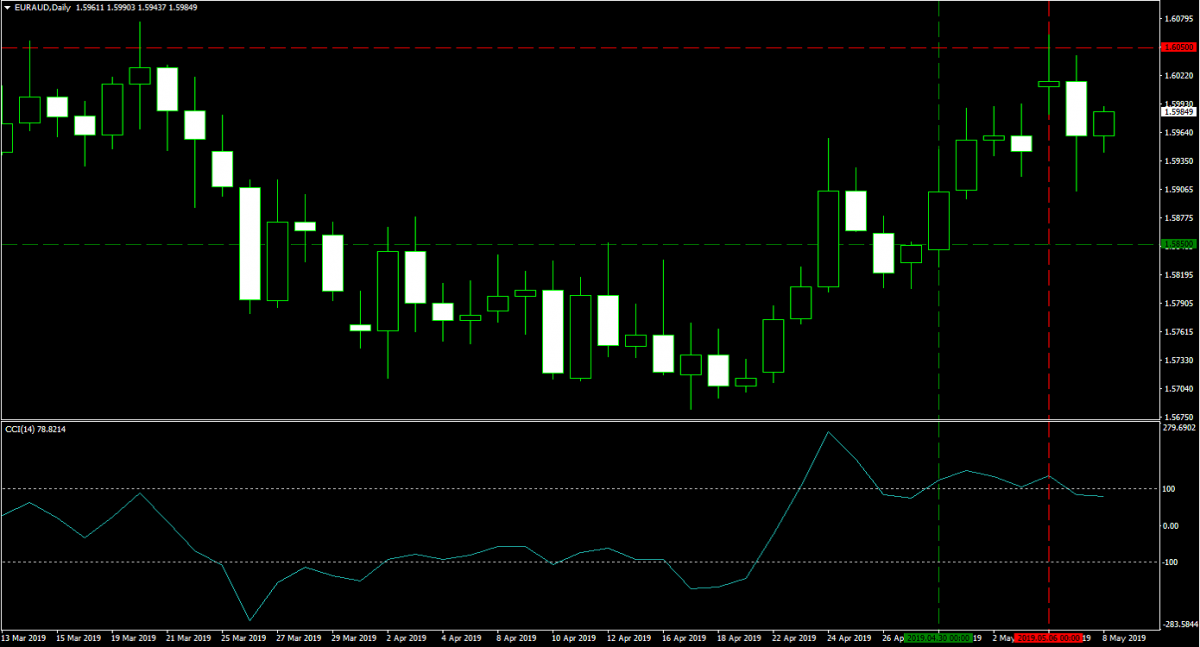

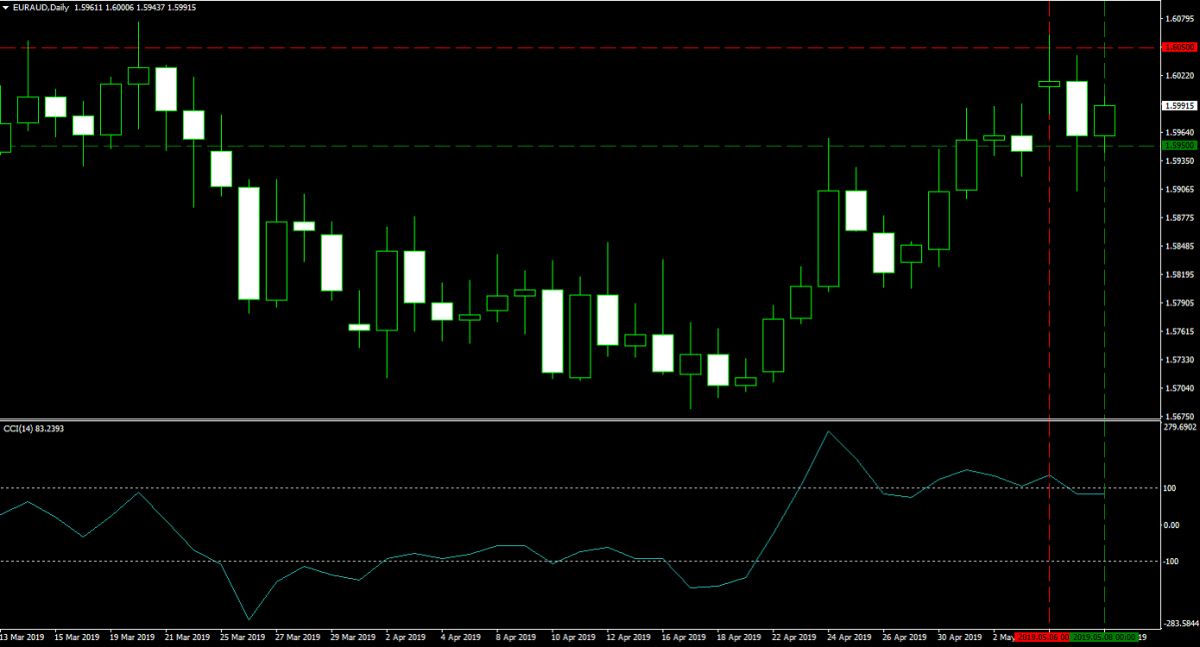

Out of the four open forex positions I had last week, two were closed for a profit and two remain open. After I entered my 150 lots long position in the EURGBP, price action temporarily dropped which caused me to add another 300 lots at May 6th 2019 at 0.8490. Earlier today, May 8th 2019, I closed my 450 lots at 0.8590 for a net profit of 100 pips or $294,509. The stop loss on my 200 lots long position in the EURAUD was triggered at 1.6050 on May 6th 2019 and exited this trade for a profit of 200 pips or $281,580. The two images below show my closed forex positions.

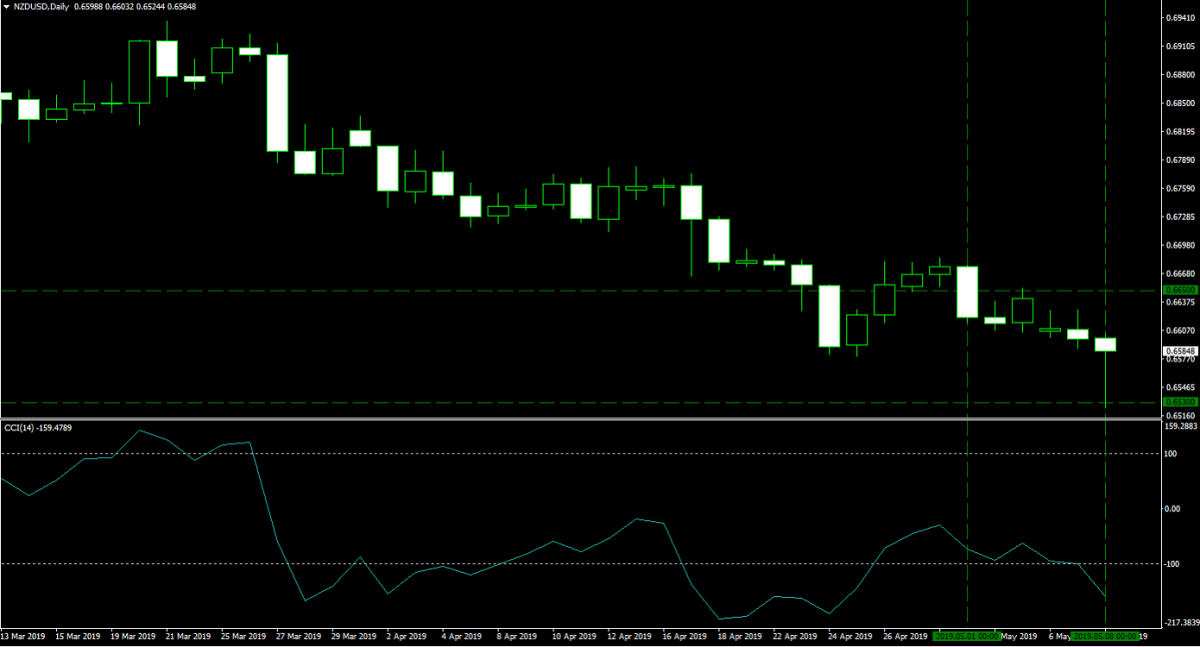

My 200 lots AUDUSD long position which I took on April 26th 2019 at 0.7025 for a margin requirement of $28,158 and with a pip value of $2,000.00 remains unchanged and open. It has been trading in and out of profitability and after the RBA decided to keep interest rates unchanged and surprised markets, I will keep monitoring what will happen to the AUDUSD. The risks to the downside remain limited. Remaining with interest rates, the RBNZ cut interest rates by 25 basis points to 1.50% which temporarily plunged the New Zealand Dollar. I added a 400 lots long position at 0.6530 for a margin requirement of $53,199 and with a pip value of $4,000 to my existing 200 lots long position which I bought at 0.6650 for a margin requirement of $26,600 and with a pip value of $2,000. I am heavily exposed to a bullish New Zealand Dollar position, but have plenty of cash reserves to trade this with patience. I see limited downside risk, but will cut my losses should we drop below 0.6500. The two images below show my open trades which carried over from last week’s update.

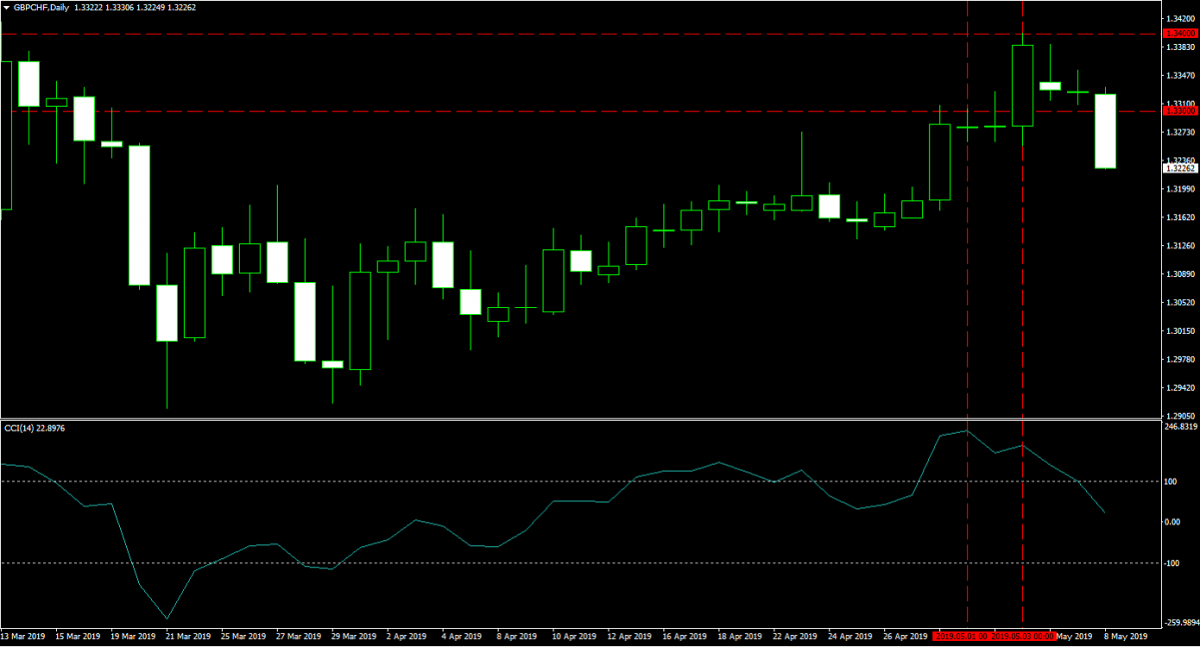

On May 1st 2019 I sold 200 lots in the GBPCHF at 1.3300 according to this trading recommendation “GBPCHF Fundamental Analysis – May 2nd 2019”. The margin requirement was $52,357 with a pip value of $1,966.05. Price action advanced a bit further and on May 3rd 2019 I added another 400 lots to my shot position at 1.3400 for a margin requirement of $104,714 with a pip value of $3,932.09. As I am sitting on a strong cash balance I may conduct more of these multiple-entry trades which you have seen over the pas week. The image below shows last week’s net addition to my forex portfolio.

I took a 200 lots short position in the EURAUD at 1.6050 on May 6th 2019, as I exited my long position, for a margin requirement of $44,976 and with a pip value of $1,407.90. Price action plunged the following day and my stop loss was triggered earlier today, May 8th 2019, at 1.5950 for a profit of 100 pips or $140,790. The trading recommendation can be found at “EURAUD Fundamental Analysis – May 6th 2019”. The image below shows my completed trading position.

Here is a summary of my Bitcoin - Forex Combo portfolio: I hodl 200 Bitcoins worth $1,156,824 and 6,000,000 Ripple worth $1,717,200 with a total cash portfolio worth $5,186,259 and 100 lots of Gold worth $257,667. I also have the following three forex positions open: a 200 lots AUDUSD long position worth -$25,842, a 600 lots NZDUSD long position worth $139,799 and a 600 lots short position in the GBPCHF worth $933,659. My total Bitcoin - Forex Combo portfolio is worth $9,356,566, up $1,542,195 from last week and at a new all-time high. I am now approaching the $10M mark in my Bitcoin - Forex Combo portfolio. This has been my best one-week gain in 2019 which was powered by my forex trades as my cryptocurrency positions have been quietly trading near support or resistance levels. As I pointed out last week, this allows me to boost my lot sizes which enhances my profits. Act today and open your PaxForex Trading Account where you can follow my Bitcoin - Forex Combo Strategy and earn more profits per trade!

To receive new articles instantly Subscribe to updates.