Welcome back everyone, I am sure most of you wonder how long the correction in Bitcoin as well as other cryptocurrencies will last. Before I answer that question, let me remind you that corrections are necessary for a healthy up-trend. I have mentioned a correction in last week’s post “Bitcoin - Forex Combo Strategy: What’s Next for Jesse Lund?” where I also explained why I took a 500 Bitcoins short position at $8,800. While there is a possibility that we extend this slide down to $6,380, I happily booked my profits at $7,500 earlier today which resulted in a net profit of $650,000. I am not adding to my 100 Bitcoins which I hodl and will remain on the sidelines until the next move materializes. Patience is key to successful trading.

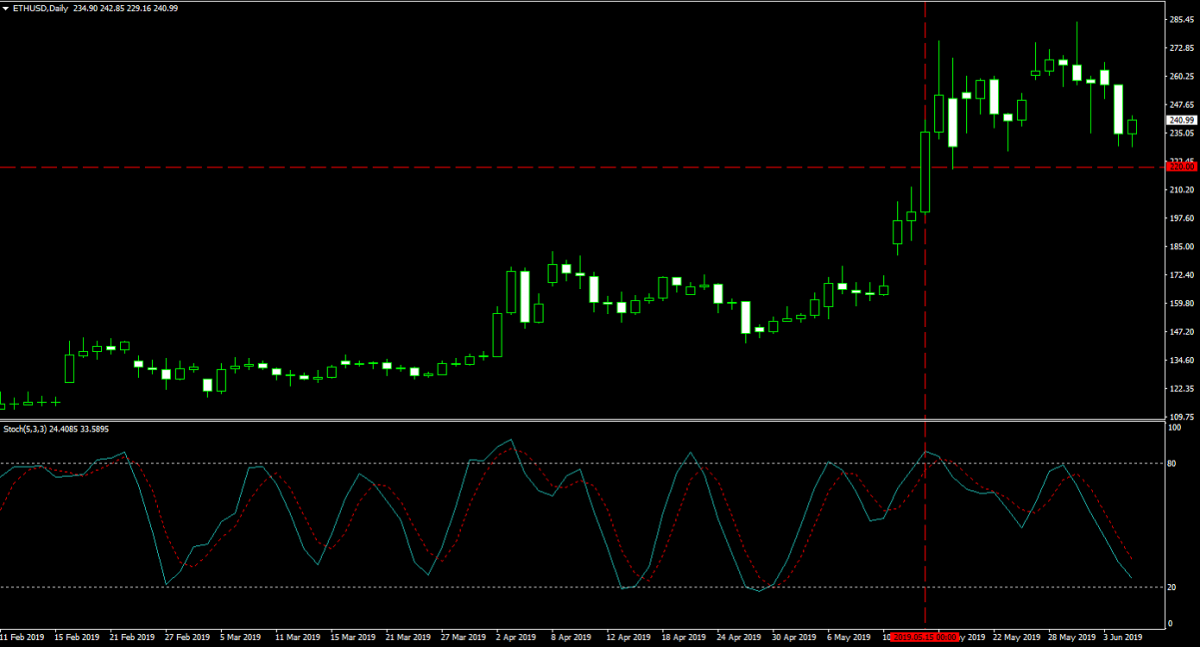

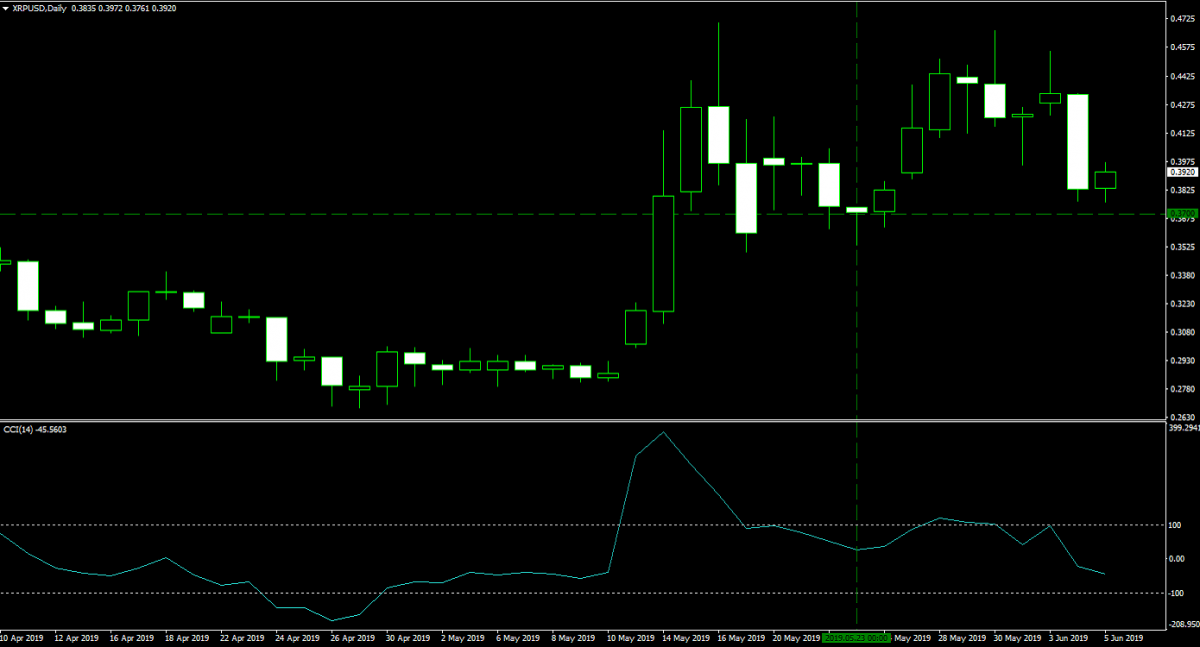

Before I dive into the exciting NEO upgrade, let’s round-up what happened to my cryptocurrency portfolio. As stated, I keep hodling my 100 Bitcoins which I bought on January 14th 2019 at $3,500. My $10,500 price target remains intact and I will close out this position around that level unless circumstances change and result in me revising the price target to the upside. As cryptocurrencies moved to the downside, my 10,000 Ether short position which I took on May 15th 2019 at $220 is moving closer to profitability. I am ready to add another 15,000 Ether short position above $330 if Ethereum will be pulled higher after the end of the current corrective phase. Honestly, I am not sure it will reach that level this year. Ripple pulled back after I bought 5,000,000 Ripple on May 23rd 2019 at $0.3700, but my position remains in the green. The three images show the most recent price action moves across my cryptocurrency portfolio.

Speaking of green, I really like the new Neo upgrade which has been implemented into its main-net. It goes by the name of Byzantine Fault Tolerance mechanism or dBFT 2.0 and is a new iteration of its consensus algorithm. This upgrade will provide users with immediate transaction finality after only one confirmation which takes 15 seconds. It also has a commit phase of consensus which tackles forking issues through a step which forced node assignment to new blocks. It further allows for failed nodes to be reintegrated into the network. The commit phase of consensus puts Neo on a different track than Bitcoin and Ethereum which rely on the proof-of-work (PoW) protocol where miners can compete for the next block.

This slows down overall transaction speed and increases costs. Ethereum relies on PoW to create and validate new blocks which can result transaction reversals which is one reason Ethereum is not well suited for institutional financial transactions. Ripple has taken the leadership role in that sector and now Neo is competing. Erik Zhang, the creator of of the first dBFT protocol, added “With this improvement, dBFT will have more strict finality. Users only need to wait for one confirmation (15 seconds) to ensure the irreversibility of the transactions and prevent double-spending. This is very suitable for financial applications.”

Neo’s main-net was introduced this past Monday, June 3rd 2019, and now runs on version v2.10.2. The new dBFT 2.0 algorithm is rumored to be a key development for Neo 3.0, the blockchain’s next major upgrade which promises major breakthroughs in the area of mass commercial usage. Zhang stated that “When we talk about Neo 3.0 being ready for large-scale commercial use, we mean it provides the possibility to run large-scale applications with blockchain technology. In the future, we'd like to see applications such as YouTube, Alipay, and gaming giants like Tencent and Blizzard run on blockchain, and Neo 3.0 will allow these big organizations to do that.” I think Neo is definitely on the right track and I expect it to take market share moving forward.

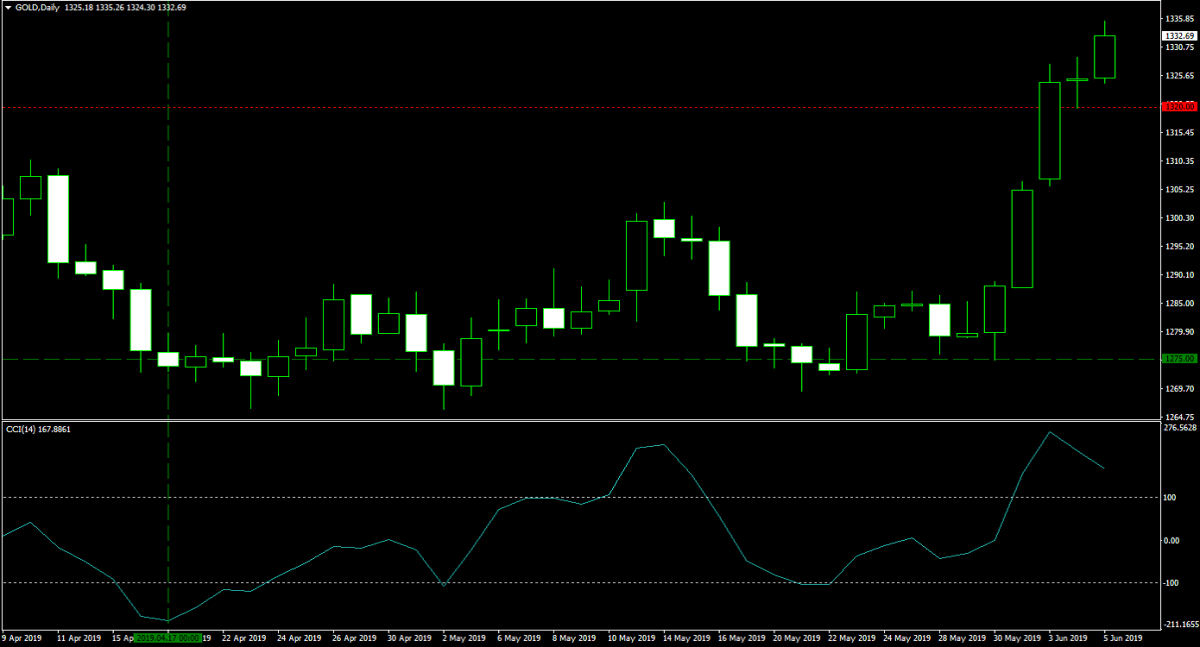

Since we are on the right track, my portfolio enjoyed a major boost since last week’s upgrade. Let me start with Gold which accelerated to the upside as I expected. After it pushed above the $1,300 mark it kept soaring and I believe there is more space to the upside for this precious metal to conquer. This has elevated the value of my 100 lots of Gold which I bought at $1,275.00 on April 17th 2019 for a margin requirement of $127,367 with a cent value of $100. I have moved my stop loss to $1,320. The image below shows the spike in price action as well as my newly added stop loss.

This brings me to the forex trading part of my Bitcoin - Forex Combo Strategy where I was finally able to exit my AUDUSD and NZDUSD positions for a profit earlier today, June 5th 2019. I closed both my AUDUSD trades at 0.7000 which resulted in a profit of $333,524 and both my NZDUSD trades were closed at 0.6630 for a net profit of $439,799. I stuck with both trades as it took a bit longer for fundamentals as well as a short-covering rally to emerge, but it was well worth the wait. The two images show my closed trades.

I still have tow open positions in my portfolio in regards to the Euro. I have a 200 lots EURGBP short position taken at 0.8680 on May 14th 2019 for a margin requirement of $44,730 with a pip value of $2,568.48 and a 400 lots short position taken at 0.8830 on May 22nd 2019 for a margin requirement of $89,357 with a pip value of$5,061.60. I think the upside is exhausted and that this currency pair is ready for a price action reversal. In addition I have a 200 lots EURJPY long position taken at 122.750 on May 20th 2019 for a margin requirement of $44,678 with a pip value of $1,812.25 and a 400 lots long position taken at 121.75 on May 29th 2019 for a margin requirement of $89,156 with a pip value of $3,656.57. This trade is turning around and I may be able to close it soon for a profit. It depends on which forex trading strategies you prefer to execute, but you need to know when to make exceptions to the rules. The two images below show my open positions.

Since I reduced my forex investment just today, I didn’t add any new positions to my portfolio. I did shore up my cash balance which allows me to enter new trades. Since I am still carrying a heavy exposure to the Euro, the British Pound and the Japanese Yen, I will not be adding new positions in currency pairs which have any of them as either their base or quote currency. I will monitor developments in the cryptocurrency sector closely and seek new entry opportunities on the long and short side while I am sure to add to my forex portfolio over the next few trading sessions.

Here is the summary of my Bitcoin - Forex Combo portfolio: I hodl 100 Bitcoins worth $776,225, a 10,000 Ethereum short position worth $1,903,700, a 5,000,000 long position in Ripple worth $1,964,500, a 100 lots Gold position worth $712,867 and a total cash portfolio worth $8,259,091. In addition I have the following forex positions on my portfolio: a 600 lots EURGBP short position worth -$518,238 and a 600 lots EURJPY long position worth $130,346. My total Bitcoin - Forex Combo portfolio is worth $13,228,491, up $2,115,677 from last week’s value of $11,112,814 and at a new all-time high. The past week has been a great example of how being patient and not driven by emotions can lead to great results. Please rake a look at the forex trading site of PaxForex where I run my main trading accounts because I earn more cash per pip. Open your PaxForex Trading Account today and follow my Bitcoin - Forex Combo Strategy. Feel free to comment below with any questions you may have and I will be happy to help you get started!

To receive new articles instantly Subscribe to updates.