What is the Essex Express and how does it impact forex trading? It is a commuter train which is shared by several key traders from different banks such as the Swiss bank UBS, the Japanese bank MUFG Bank and UK banks Barclays and RBS. Inside the train, they created a forex trading cartel in order to influence market prices. Another forex trading cartel created by traders on the Essex Express was the “Three-Way-Banana-Split” operated by traders from Swiss bank UBS, UK banks Barclays and RBS and US banks Citigroup and JPMorgan who collaborated in a chat room by that name.

The Swiss competition regulator Comco now slapped a fine totalling 90 million Swiss Francs, split across all banks with the exception of UBS which brought the trading cartel to light and evaded charges. Citigroup was fined 28.5 million Swiss Francs, Barclays 27 million, RBS 22.5 million, JPMorgan 9.5 million and MUFG Bank 2.5 million. Swiss banks Julius Bär & Co. AG and Zürcher Kantonalbank were under investigation which was concluded, but Comco didn’t specify if those two banks would be fined or were cleared of any wrongdoing. It took regulators several years to investigate and confirm wrongdoing in Europe and the US.

The Swiss fines come after five of the involved banks agreed to pay €1.07 billion to EU regulators for manipulating the forex market. The Three-Way-Banana-Split cartel was active for six years while the Essex Express operated between 2009 and 2012. Since 2013 a series of investigative articles triggered regulators to take a closer look at the forex market to date this resulted in fined of $11.8 billion across the globe plus $2.3 billion in restitution to traders who were faced with losses as a result of cartel behaviour by banks.

Online forex trading has been impacted by this as well which is another reason that trading with a prime forex broker like PaxForex is crucial to the long-term success of traders. Open your PaxForex Trading Account now and join our fast growing group of successful forex traders who enjoy the best trading conditions in the forex market!

While representatives at the charged banks didn’t respond to the fines as of yet, Credit Suisse stated that it “Is cooperating fully with Comco’s probe and intends to vigorously contest the substance of the allegations. A number of other regulators have concluded their FX-related inquiries without taking any enforcement action against Credit Suisse.” Charged banks may appeal the fines at the Federal Administrative Court, but are unlikely to do so as they accepted a leniency deal offered by the regulator for a reduced fine. Comco added that “Sanctioned banks have committed not to conclude such agreements in the future.” The Essex Express was fined 90M Swiss Francs and here are three trades which will make your performance look more than fine!

Forex Profit Set-Up #1; Buy EURCHF - D1 Time-Frame

This currency pair just completed a breakout above its horizontal support area and price action is now trapped between its primary ascending support level as well as its secondary descending resistance level. The Euro currently enjoys the tailwind of better-than-expected data and bullish momentum is sufficient for a second breakout in the EURCHF. This would elevate price action into its next horizontal resistance level which is being approached by its primary descending resistance level. Forex traders are advised to buy any dips in the EURCHF down into the lower band of its horizontal support area.

The CCI moved out of extreme oversold conditions and bullish momentum continues to build up. An extension of the uptrend is favored to push this technical indicator above the 0 level for a bullish momentum crossover. Download your PaxForex MT4 Trading Platform, get your MetaTrader 4 login and start earning money with the help of our expert analysts!

Forex Profit Set-Up #2; Buy Silver - D1 Time-Frame

The Swiss economy and therefore the Swiss Franc are heavily exposed to the commodity sector, a fact many forex traders are unaware of or ignore. While Gold can often become a crowded trade, Silver offers plenty of the same hedging capabilities as Gold and remains as ignored as the exposure of Switzerland to commodities. This precious metal pushed above its horizontal support area and is now challenging its primary descending resistance level. Bullish momentum should result in a breakout which can take Silver back into its next horizontal resistance level. Forex traders are recommended to buy and dips down to the lower band of its horizontal support area.

The CCI spiked into extreme overbought territory, but started to retreat from its highs. Any dip below 100 would represent a great buying opportunity as this momentum indicator is expected to make new highs. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you to over 500 pips in profits per month!

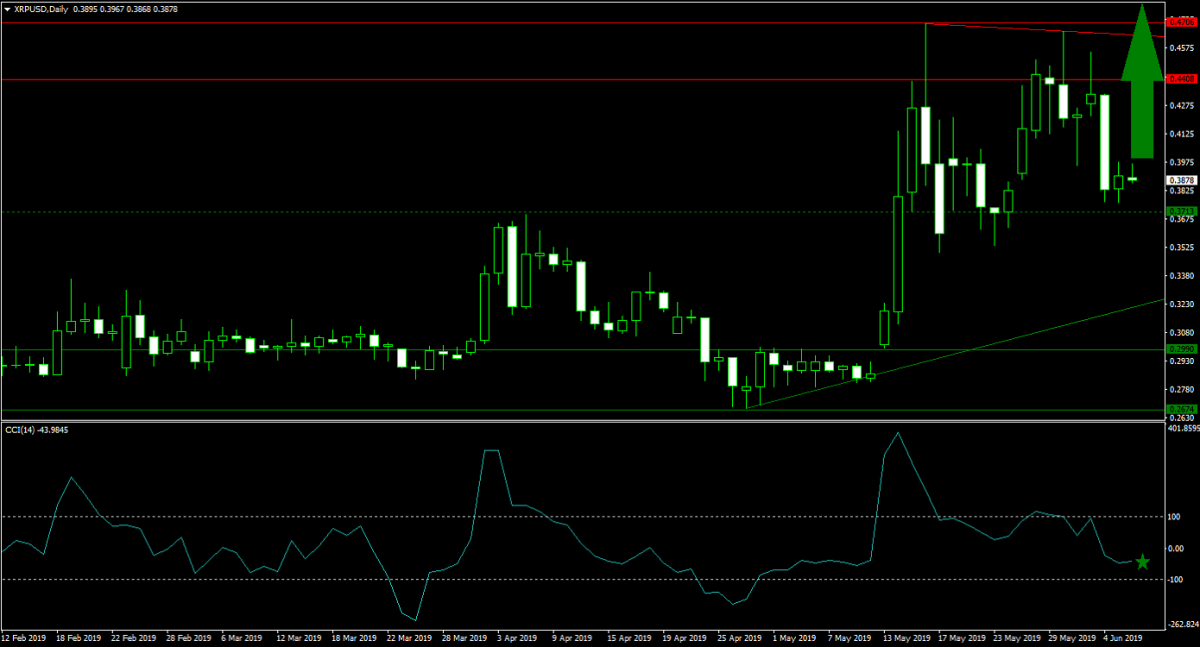

Forex Profit Set-Up #3; Buy Ripple - D1 Time-Frame

Switzerland is a major financial center and with Ripple being at the forefront of adoption across many banks, it deserves a closer look. Price action just completed a necessary pull-back from its most recent intra-day high and dropped down to its horizontal support level. As bullish momentum is on the rise, this cryptocurrency is expected to attempt another breakout above its horizontal resistance area from where more upside is predicted. This would also push Ripple above its primary descending resistance level. Buying any dips down to its primary ascending support level remains the favored trading approach.

The CCI plunged from deep inside extreme overbought conditions to below the 0 mark which concluded a bearish momentum crossover, but has since started to recover and is now anticipated to move back above 0. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades and profits of our expert analysts!

To receive new articles instantly Subscribe to updates.