Welcome back everyone to this week’s edition of my Bitcoin - Forex Combo Strategy. Last week I briefly touched on the Swedish Government hack which for 30 minutes claimed that Sweden has adopted Bitcoin as their official currency. This was obviously incorrect, but Sweden is leading the push into a cashless society and is exploring the issuance of a digital Swedish currency backed by the government. You can read about it in my post “Bitcoin - Forex Combo Strategy: Swedish Government Bitcoin Hack”. Today I want to discuss what happened in Hong Kong in regards to cryptocurrency mining and regulation and I let you decide if you believe the government and its regulators have made a grave mistake or if this is the way forward.

Hong Kong authorities have taken steps to limit cryptocurrency mining by placing the purchase of application-specific integrated circuit mining equipment (ASIC) under the Trade Descriptions Ordinance legislation. This means that it is not possible to simply purchase (ASIC) mining equipment and therefore limits who can mine cryptocurrencies which require special hardware. There are other cryptocurrencies, such as Ethereum, which can be mined using a graphics processing unit (GPU). It is unclear if GPU units are currently falling under the Trade Descriptions Ordinance legislation as they are used in most personal computers as well as laptops and the gaming industry is dependent on them. In case Hong Kong decides to leave them out it create an unfair advantage to all cryptocurrencies which don’t require ASIC mining equipment. Should they be included, it will provide an unfair environment for the gaming industry.

One thing is clear: the attitude towards cryptocurrencies is changing. Will it be for the better for the worse? Hong Kong is a key hub for financial technology and innovation. Taking steps to make it harder for cryptocurrency companies to do business there will only result them in moving towards a business friendly country. Hong Kong has always been know as a friendly regulatory environment which is why many firms moved part of their teams there. It is a Special Administrative Region of China, but with plenty of autonomy when it comes to laws and regulations. China floated the idea to ban cryptocurrency mining so is Hong Kong making changes in order to align it closer to the favored approach to the cryptocurrency sector by China?

At present, cryptocurrencies are not regulated in Hong Kong and enjoy a free environment to prosper and grow. This is soon to change as Hong Kong’s regulator, the Securities and Futures Commission (SFC), is proposing a new framework which will initially focus on cryptocurrency exchanges. Ashley Alder, the CEO of the SFC, noted that “Those exchanges that want to be regulated by us will be set apart from those that don’t. This is essentially an opt-in approach for exchanges and platform operators, and they will first explore the conceptual framework with us in a strict sandbox environment.” The SFC claims this is a necessary step in order to protect investors. There have been plenty of examples in other regulated asset classes which show that regulation was not only unable to protect against fraud and scams, but actually harmed the entire industry. The US is a great example where regulated exchanges and brokers have scammed clients and were shut down.

While some point out that this means cryptocurrencies are starting to be accepted as a new asset class, unnecessary regulation is a mistake. The President of the Bitcoin Association of Hong Kong, Leo Weese, added that “While Hong Kong was a better place when it did not bother such platforms, it was inevitable this day would come. Exchanges will likely maintain parts of their teams in Hong Kong, but work harder to convince the public of a new narrative that places them outside the SAR.” Hong Kong appears to be taking steps which will see an exodus of cryptocurrency related talent, business and income. One recent example is the cancellation of Bitmain’s IPO in the Hong Kong Stock Exchange. Bitmain is the biggest manufacturer of ASIC mining equipment.

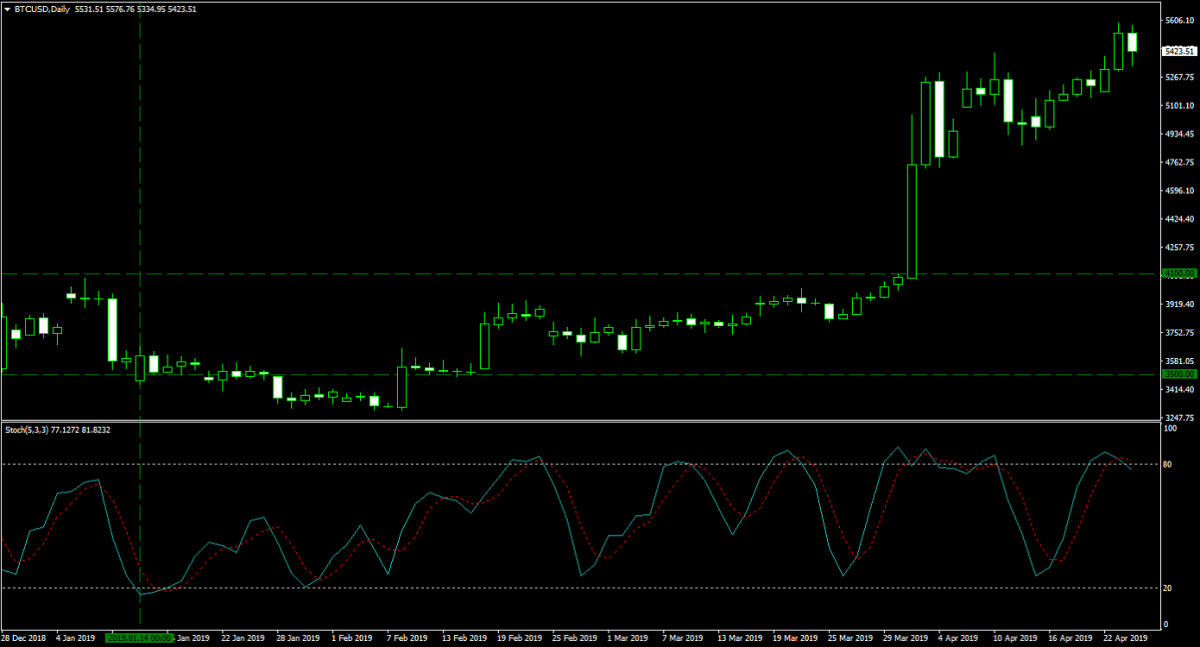

As I have pointed out last week, I think we are in for a breather in the sharp advance of cryptocurrencies which were led by Bitcoin. On the bright side, Bitcoin is not leading the reversal and remains well supported at current levels. We may slide further as traders book floating trading profits, but I think the overall uptrend will remain intact for Bitcoin. This is good news for my 200 Bitcoins which carry an average entry price of $4,315. My 6,000,000 Ripple which carry an average entry price of $0.2975 have come under pressure after failing to hold above the $0.3500. I think the sell-off has been overextended and that we soon will see a move back above the $0.3000 level. Everyone who has been waiting for the right time to buy Ripple should take advantage of price action below $0.3000. I planned to take a short position in Ethereum, but I think I missed my chance this time around. The two images below show my cryptocurrency holdings.

Gold has stabilized at support levels around $1,275 which is where I bought 100 lots for a margin requirement of 127,367 with a pip value of $100. I am bullish on this precious metal as I believe that the global economy is headed for a recession sooner that most economists and analysts have currently predicted. This will put upside pressure on Gold and I continue to believe that we will breach the $1,500 level to the upside. The image below shows my Gold trade.

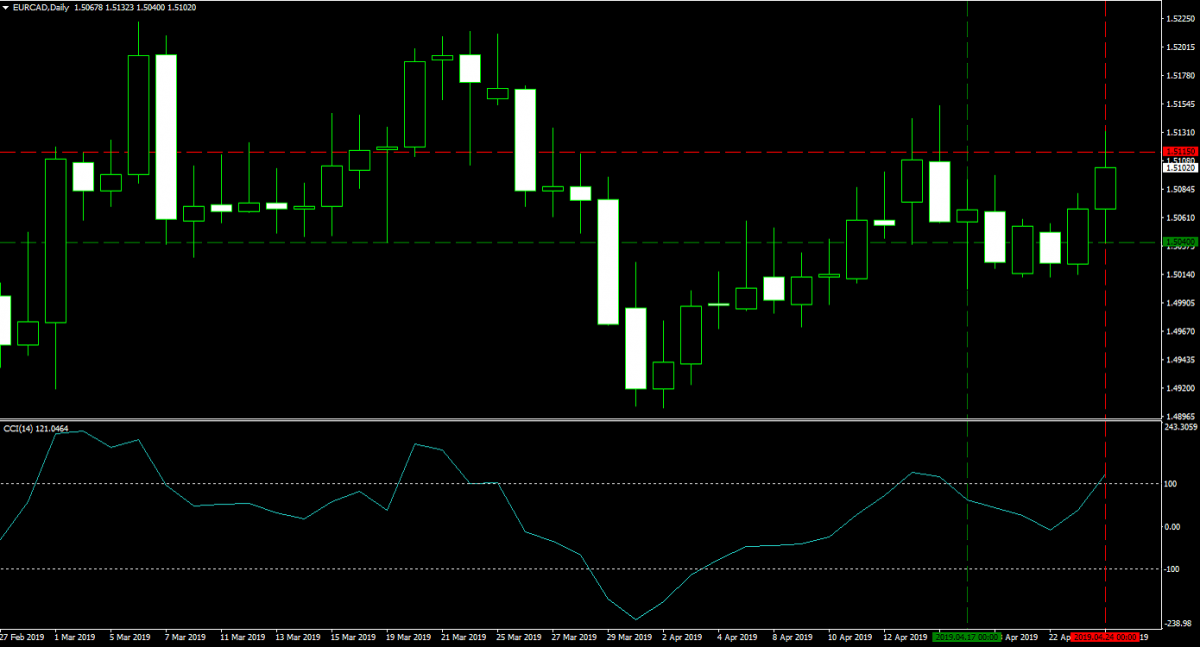

Last week I ended my update with three open forex positions, each with a lot size of 125. All three of them were closed today April 24th 2019: two for a profit and one for a loss. My GBPUSD short position was closed through a stop loss at 1.2940 for a profit of 150 pips or $187,500. My EURCAD long position was closed at 1.5115, also through a stop loss order, for a profit of 75 pips or $70,270. My NZDUSD short position was closed at 0.6650 for a loss of 80 pips or $100,000. The three images below show my closed trades.

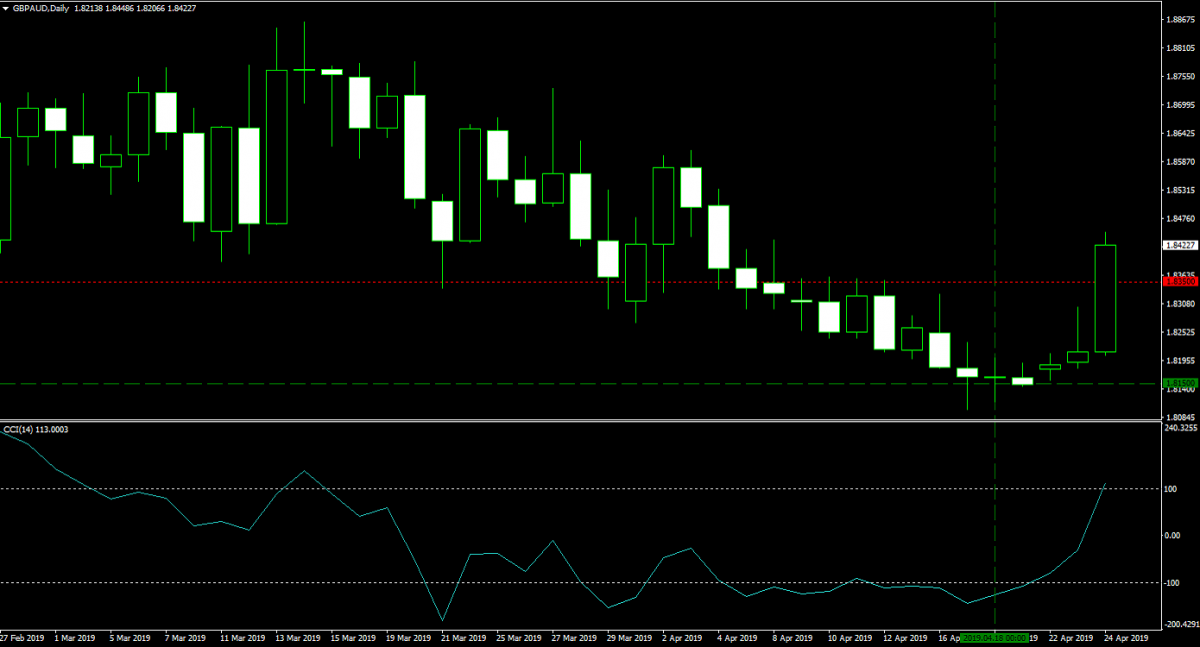

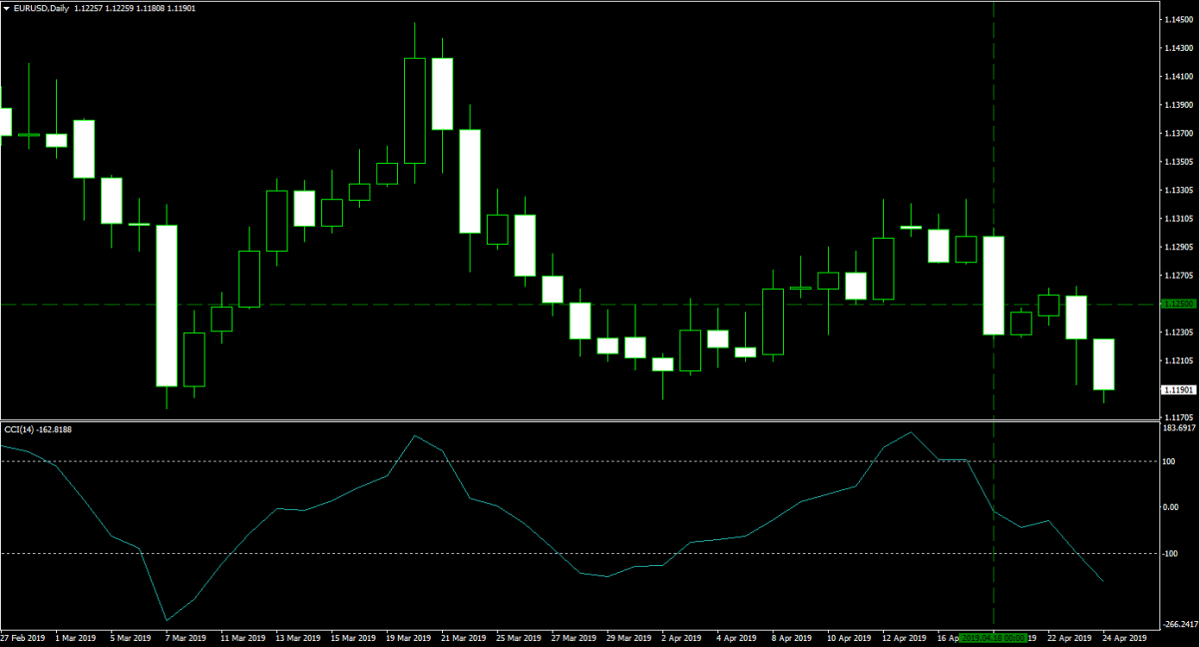

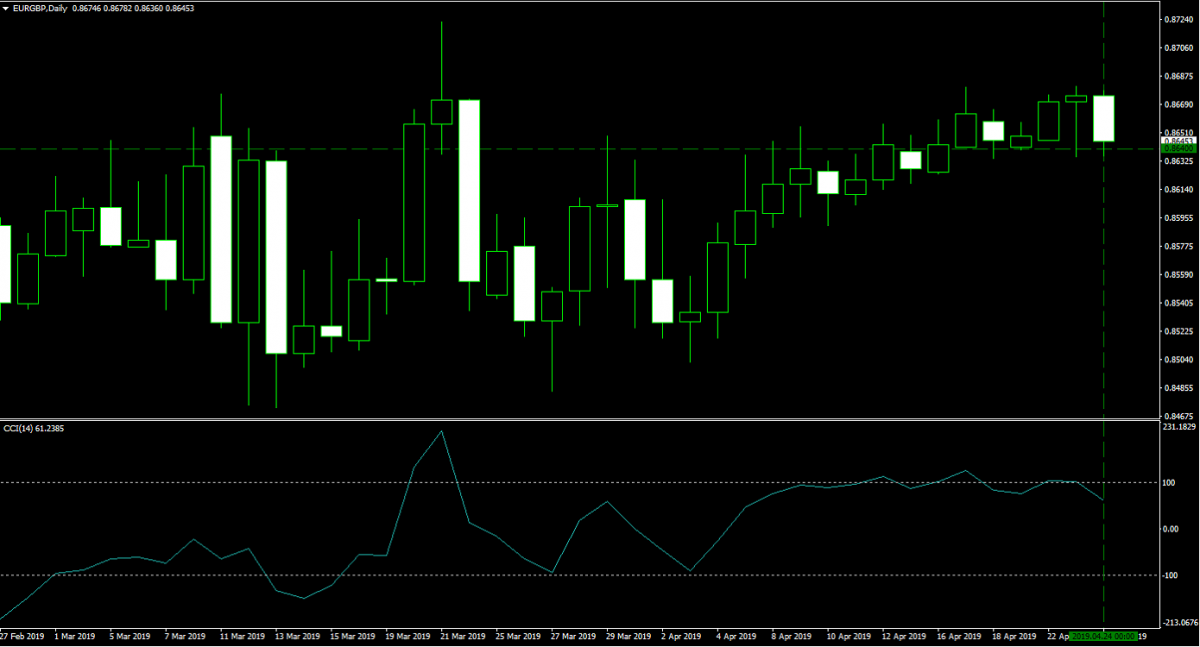

On April 18th 2019 I bought 150 lots in the GBPAUD at 1.8150 according to this trading recommendation “GBPAUD Fundamental Analysis – April 18th 2019”. The margin requirement was $38,838 with a pip value of $1,053.36. As price action spiked earlier today I moved my stop loss level to 1.8350 for a guaranteed profit of 200 pips or $210,672. On the same day I also added a 150 lots long position in the EURUSD at 1.1250 for a margin requirement of $33,569 and a pip value of $1,500. You can read the trading recommendation at “EURUSD Fundamental Analysis – April 18th 2019”. Earlier today, April 24th 2019, I bought 150 lots in the EURGBP at 0.8640. The margin requirement was $33,569 with a pip value of $1,941.90 and you can get the original trading recommendation at “EURGBP Fundamental Analysis – April 24th 2019”. The three images below show my three new forex entries.

Here is a summary of my Bitcoin - Forex Combo portfolio: I hodl 200 Bitcoins worth $1,084,352 and 6,000,000 Ripple worth $1,756,200 with a total cash portfolio worth $3,855,260 and 100 lots of Gold worth $148,167. I also have the following three 150 lots forex positions open: a GBPAUD long position worth $325,352, a EURUSD long position worth -$53,431 and a EURGBP long position worth $43,279. My total Bitcoin - Forex Combo portfolio is worth $7,159,179, up $173,878 from last week and close to it’s all-time high of $7,254,667. We may see a bit more weakness, but I think Bitcoin will extend its gains. What do you think about measures taken by Hong Kong? Feel free to follow me and my Bitcoin - Forex Combo Strategy and start to build your own profitable portfolio. Take the first two steps today by subscribing to my Bitcoin - Forex Combo Strategy and by opening your PaxForex Trading Account where you earn more pips per trade!

To receive new articles instantly Subscribe to updates.