We may have already reached peak interest rates in the US after the Federal Reserve gave into pressures by President Trump and abandoned its interest rate increase campaign. The US central bank was under severe criticism for hiking interest rates four times in 2018 and not only from the White House. The minority view is that the economy is unable to perform in the current low interest rate environment and that more stimulus is needed. Fears have grown that as interest rates rose throughout 2018, that it will derail the sluggish economic recovery.

At the same time that interest rates increased, calls for a global recession have risen and economic data around the world has pointed towards a much steeper slowdown that many economists and analysts predicted. Some argue that the potential for a recession is why the US Fed raised interest rates, in order to be able to lower them. With no ammunition left in their arsenal following the 2008 global financial crisis, the Fed as well as other central banks have backed themselves into a corner. A decade of stimulus has done little to create the type of economic growth which would support a normalization of interest rates.

Comparisons to 1998 are now drawn as today’s environment is rather similar. The economy is expanding, but well below potential. Inflation is absent and the S&P500 is recording new all-time highs. In 1998 the US Fed cut interest rates in an attempt to shield the US economy from economic problems in Europe and Asia. This of course paved the way for the dot-com bubble to burst and burn many traders and investors alike. Fast forward to today and the steeper slowdown in the Eurozone economy as well as flaring up trade wars and it may lead to an interest rate cut in 2019, a scenario which hasn’t been priced into markets.

The US Dollar has pushed to multi-month highs against many currencies, but what will an interest rate cut do to price action? Bond traders have started to price in such a cut this year, but forex traders appear to have ignored this scenario. Open your PaxForex Trading Account today and start building a profitable forex portfolio with the help of our expert analysts!

Will low inflation trigger an interest rate cut by the Fed? Charles Evans, the Chicago Fed President, noted that “I think the answer has to be yes. If core inflation were to move down to, let’s just say, 1.5 percent, this is actually restrictive in holding back inflation, and so that would naturally call for a lower funds rate, at least so that it was accommodative.” James Bullard, the St. Louis Fed President, added “To the extent we’ve got low inflation in an environment with sub-4 percent unemployment, I think that that’s indicative of the fact that we don’t have an active Phillips curve in this environment, and you have to look to other channels for signals about inflation. The other channel you need to look at is inflation expectations. Those don’t look that good either, and so I am a little concerned about this.” We may have experienced US interest rates peak, but here are three forex trades which will push your balance to new peaks!

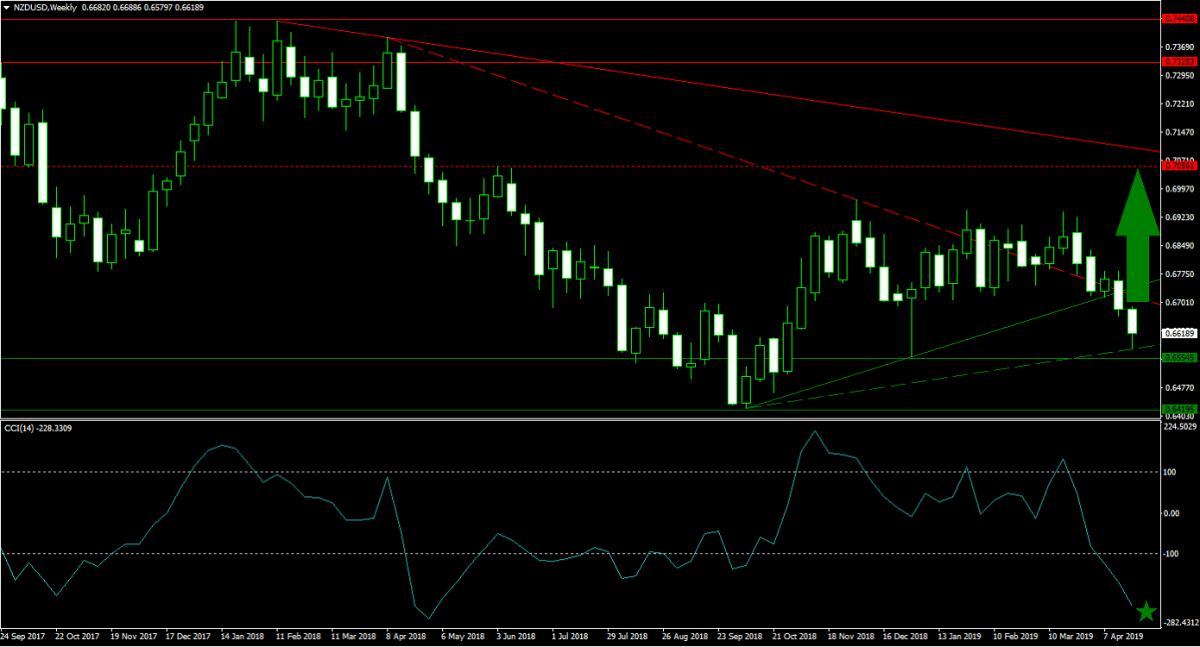

Forex Profit Set-Up #1; Buy NZDUSD - W1 Time-Frame

The past five week saw heavy pressure on the New Zealand Dollar which pushed the NZDUSD close to the upper band of a strong horizontal support area. Its secondary ascending support level is further supplying bullish momentum and this currency pair is on track to stabilize. As forex traders assess the potential of an interest rate cut in the US and a resolution to the trade war between the US and China is on the horizon, a price action reversal is the likely outcome. The NZDUSD is expected to accelerate above its secondary descending resistance level as well as above its primary ascending support level which acts as temporary resistance. This will open the way up into its next horizontal resistance level which is enforced by its primary descending resistance level. Buying the dips down to the upper band of its horizontal support area is the favored trading approach.

The CCI dropped deep into extreme oversold conditions, but as bearish momentum is decreasing this technical indicator is expected to stabilize and reverse. A new low is unlikely to be recorded and the risk remains to the upside. Download your PaxForex MT4 Trading Platform and join our fast growing community of profitable forex traders!

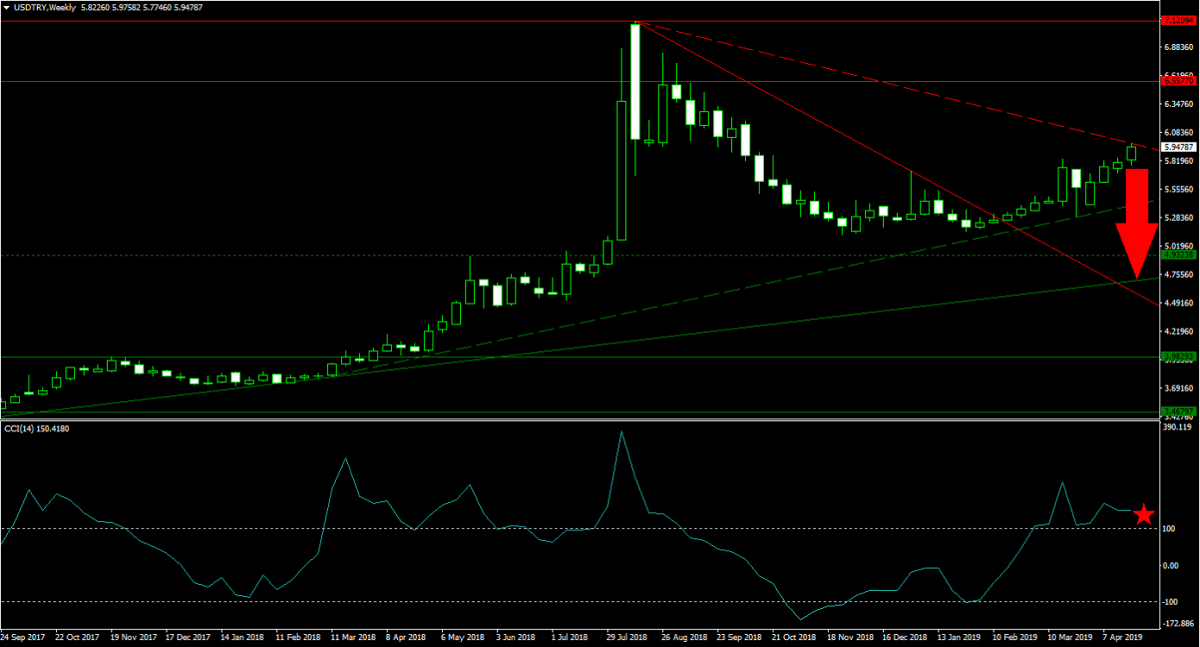

Forex Profit Set-Up #2; Sell USDTRY - W1 Time-Frame

Following a price action recovery off of its secondary ascending support level, the USDTRY has now approached a double resistance level: its secondary descending resistance level as well as its horizontal resistance level. This is expected to lead to a loss in bullish momentum and make this currency pair vulnerable for a sell-off on the back of profit taking. The worsening economic outlook of the US and the potential start of an interest rate reduction cycle are further expected to pressure the US Dollar to the downside. The USDTRY is therefore anticipated to drop back down into its primary ascending support level. A double breakdown, below its secondary ascending support level and below its horizontal support level will precede this move. Forex traders are advised to sell any rallies up into the next horizontal resistance level.

The CCI is trading in extreme overbought territory, but well off of its previous high in a sign that bullish momentum is not as strong as during previous rallies. A drop below the 100 mark is likely to trigger a new wave of selling. Subscribe to the PaxForex Daily Fundamental Analysis and follow our expert analysts to over 500 pips in monthly profits!

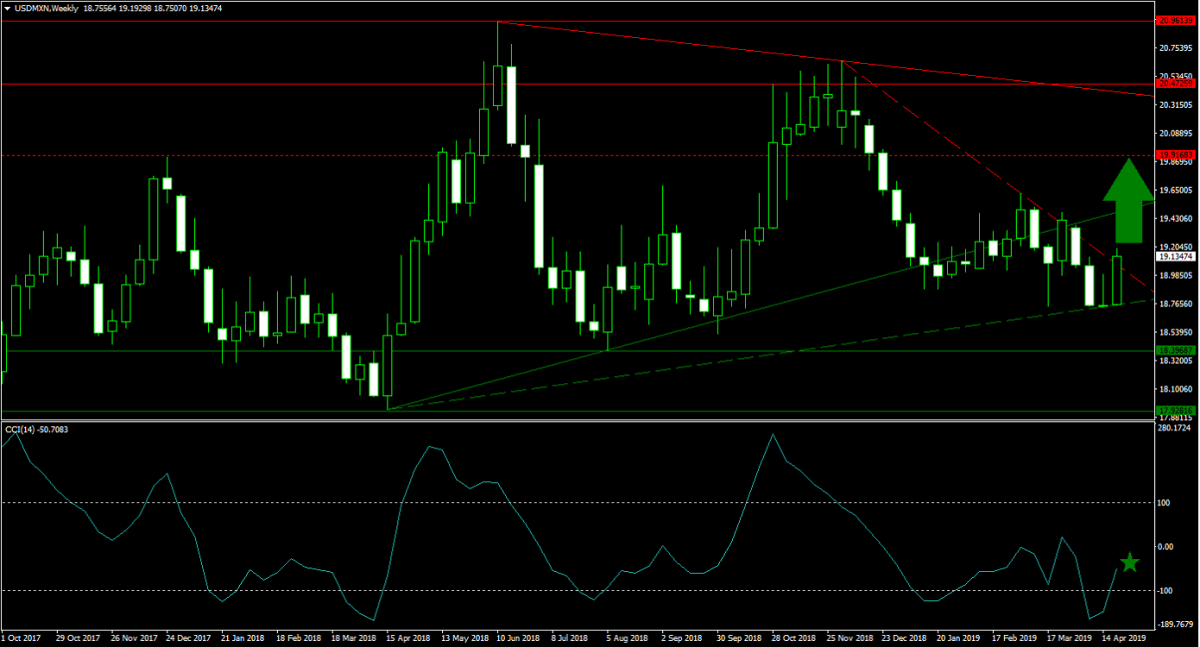

Forex Profit Set-Up #3; Buy USDMXN - W1 Time-Frame

Forex traders looking to add to their bullish US Dollar positions can take advantage of the USDMXN which offers plenty of US Dollar upside potential. Price action started to recover this week after stabilizing at its secondary ascending support level. The current move higher also pushed this currency pair above its secondary descending resistance level as bullish momentum is on the rise. The USDMXN is now favored to extend its rally and complete a breakout above its primary ascending support level which currently acts as temporary resistance. This would enable a move into its next horizontal resistance level. Forex traders are recommended to buy any dips down into its secondary ascending support level.

The CCI has already recovered from extreme oversold conditions and this momentum indicator is favored to extend its advance until it can push above the 0 mark. Follow the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own forex account!

To receive new articles instantly Subscribe to updates.