A quintet of hackers took over the official Twitter handle of Sweden’s ruling Social Democrats on April 15th 2019 and tweeted about Bitcoin. The group convinced Twitter that they are the Swedish government which involved changing phone numbers, e-mails as well as submitting ID’s. Twitter was fooled and the hackers tweeted that the Swedish government is abandoning the Swedish Krona in favor of Bitcoin. One of the deleted tweets stated “We have abolished the Swedish krona and replaced it with Bitcoin. Time to buy.” While Twitter restored the account, this could be the start of a trend which worries central banks and governments the most when it comes to cryptocurrencies. Welcome to this week’s post! It has been an exciting start to spring and I think we will see more great projects announced and more fundamentally positive developments will be announced as we approach summer.

Cryptocurrencies were introduced in 2009 after the global financial crisis and meant to replace fiat currencies controlled by governments who pile on debt, print money and ruin the economy for future generations. Fiat currency is often not worth the paper it is printed on and the vision has always been to replace government controlled fiat currency by decentralized cryptocurrencies. Peer-to-peer transaction in complete privacy, quick and without complicated and often unfair practices by big global institutions. Many blame banks for their reckless, greedy behaviours and if nothing else, customers should have a choice.

Governments are continuing to fight hard against cryptocurrencies as it would see them lose control over money flows. Often those those governments hide behind security reasons and act as if they want to protect consumers. Then there are those governments who embrace the new technology, such as Switzerland or Estonia, who are leading the push for more acceptance. The US is lagging this process, but as I pointed out in last week’s post “Bitcoin - Forex Combo Strategy: The US Token Taxonomy Act”, changes are proposed in order to close the gap. While many governments may try to prevent the spread of cryptocurrencies, it is unlikely they will stop this trend as acceptance grows and more people get involved.

Sweden is an interesting case as it has been at the forefront of an economy which is becoming cashless. This has worried the central bank for quite some time. Sweden has started to abandon cash and continues to do so. This can be viewed as an intermediary step to replace cash altogether. Some have called for the creation of a virtual Swedish Krona, which would become a centralized cryptocurrency in a sense. It would most likely lack the privacy as it would be controlled by the central bank. The Swedish government doesn’t want to rely on the private sector to provide the infrastructure of its key financial system, but does understand the move away from cash.

Martin Floden, the Deputy Governor of the Swedish central bank, cautioned against falling behind and letting the private sector be in full charge. During a speech at the World Economic Forum last year he pointed out that “If cash stopped working, it would leave all individuals to rely on the private sector for access to money and payment methods. It would be a historical change without precedence.” Traditional payment providers like Visa and MasterCard gave done a great job garnering negative press and are lazed with lawsuits as they cheated clients with fees. MasterCard is currently faced with a $18.25 billion lawsuit in the UK and Sweden wants to make sure it innovates, but retains a certain degree of control.

While the hackers succeeded for 30 minutes to declare Bitcoin the new official currency of Sweden, it is important to point out how the fundamentals are slowly changing in favor of cryptocurrencies. The reason behind this week’s hack was to raise awareness more than anything else. One of the hackers cited that the motivation behind the hack was “I simply think socialism is wrong. I have always had a strong right attitude and think that if you can’t earn your own money then you are just lazy.” Sweden has long operated with socialism at its heart, but the younger generation is turning away from this and demands changes across the board. Overall I think this is yet another step towards cryptocurrency implementation which will ultimately benefit the price of the right coins.

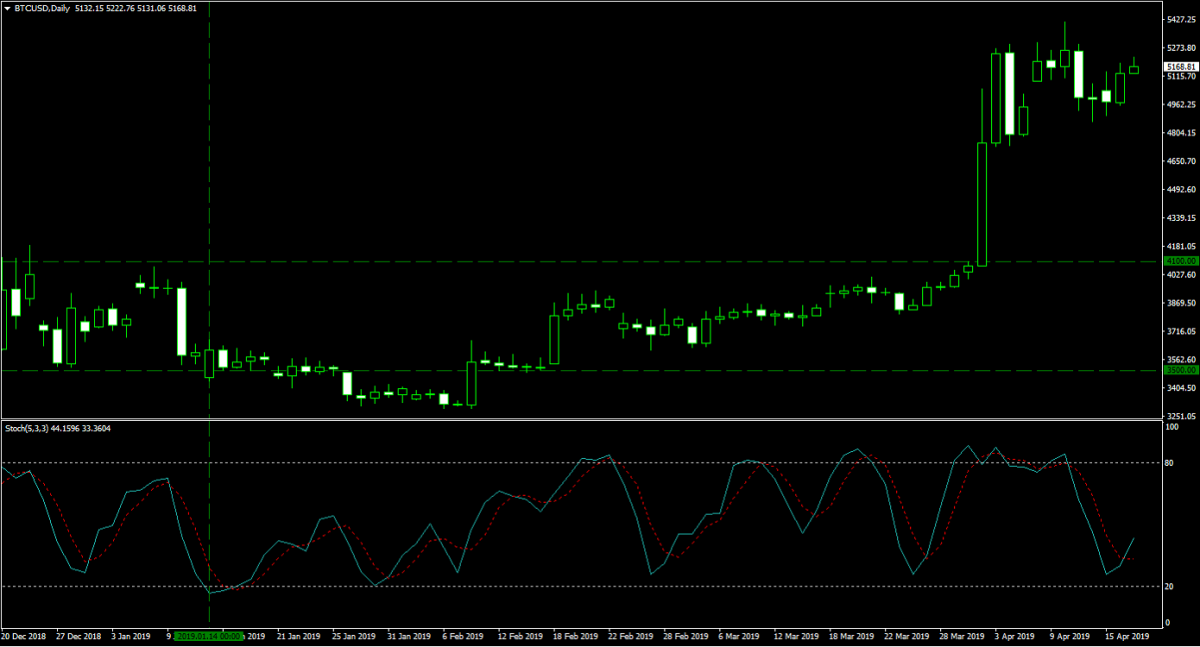

Cryptocurrencies have held on to their bullish momentum, led by Bitcoin. While some profit taking should be accounted for, I think we can see this rally extend further. I am looking for a short-term contraction at which point I may re-enter the Ethereum trade, but for now I am maintaining my 200 Bitcoins at an average entry price of $4,315 and my 6,000,000 Ripple at an average entry price of $0.2975. As long as Bitcoin can maintain its position above $5,000, more traders are likely to be sucked into the vortex which can push price action further to the upside. Other cryptocurrencies receive a boost from the overall Bitcoin bullishness, but I think as this market matures further we will see a disconnect in price action. Good coins will rise, while bad coins will fall and in most extreme cases cease to exist. The two images below show my entries.

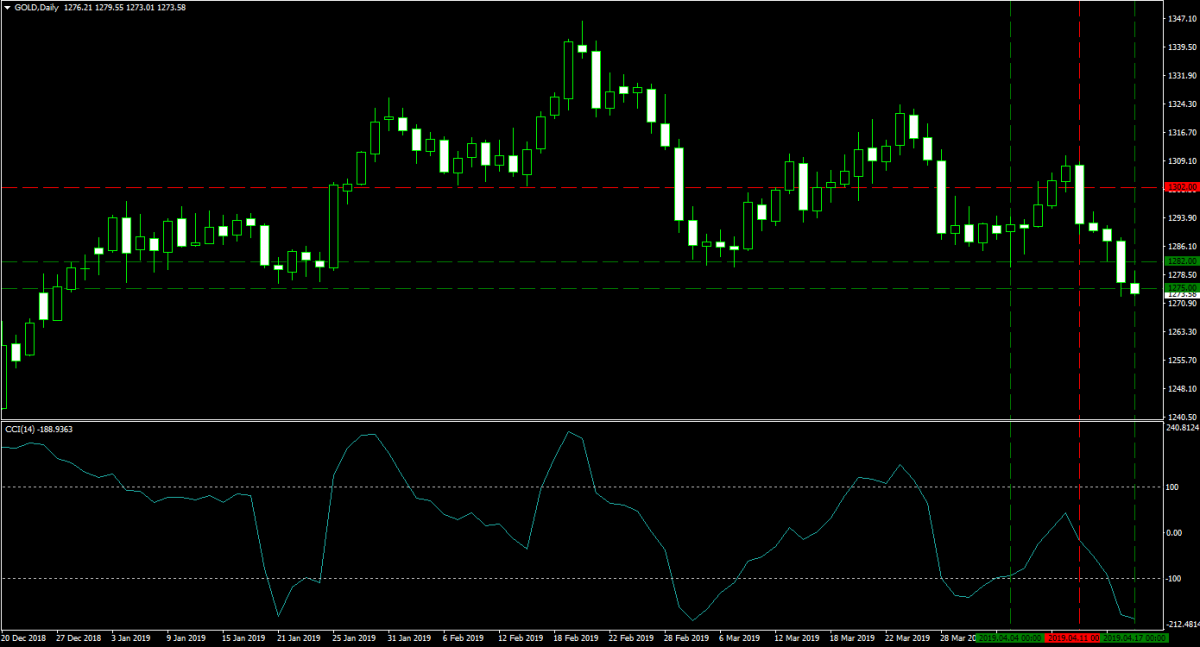

As risk appetite around the globe increased since my last update, Gold prices tanked. My adjusted stop loss was triggered at $1,302.00 on April 11th 2019 which allowed me to exit my long position at a profit of 2,000 pips or $200,000. Earlier today, April 17th 2019, I re-entered my long position in Gold. I bought 100 lots at 1,275.00 for a margin requirement of $127,367 and with a pip value of $100. The image below shows my entry, exit and new entry into Gold.

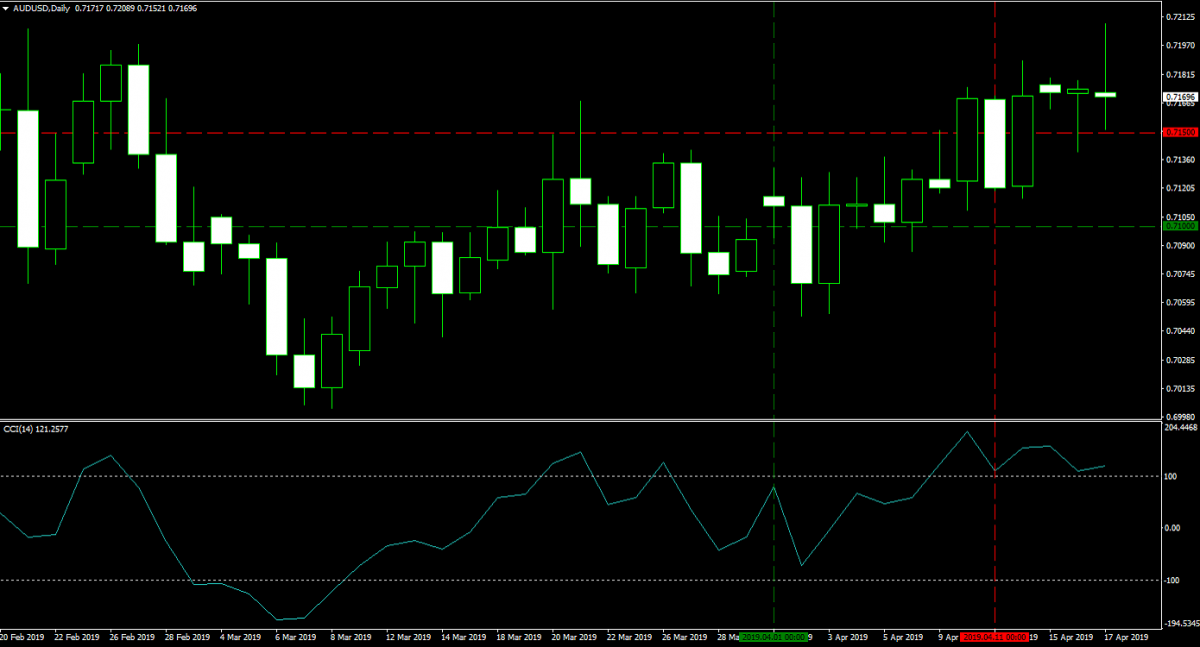

Last week I finished my update with six open forex positions, al of which have been closed since then. Two for a profit and four for a loss in what has been my worst trading week since I started using my Bitcoin - Forex Combo Strategy. Losses are part of trading and those who claim to never record losses are either lying or not trading. My two closed positions for a profit were my 125 pips AUDUSD long position which was closed on April 11th 2019 at 0.7150 for a profit of 50 pips or $62,500 and my 125 lots EURUSD long position which was closed on April 12th 2019 at 1.1320 for a profit of 100 pips or $125,000. The two images below show my closed positions.

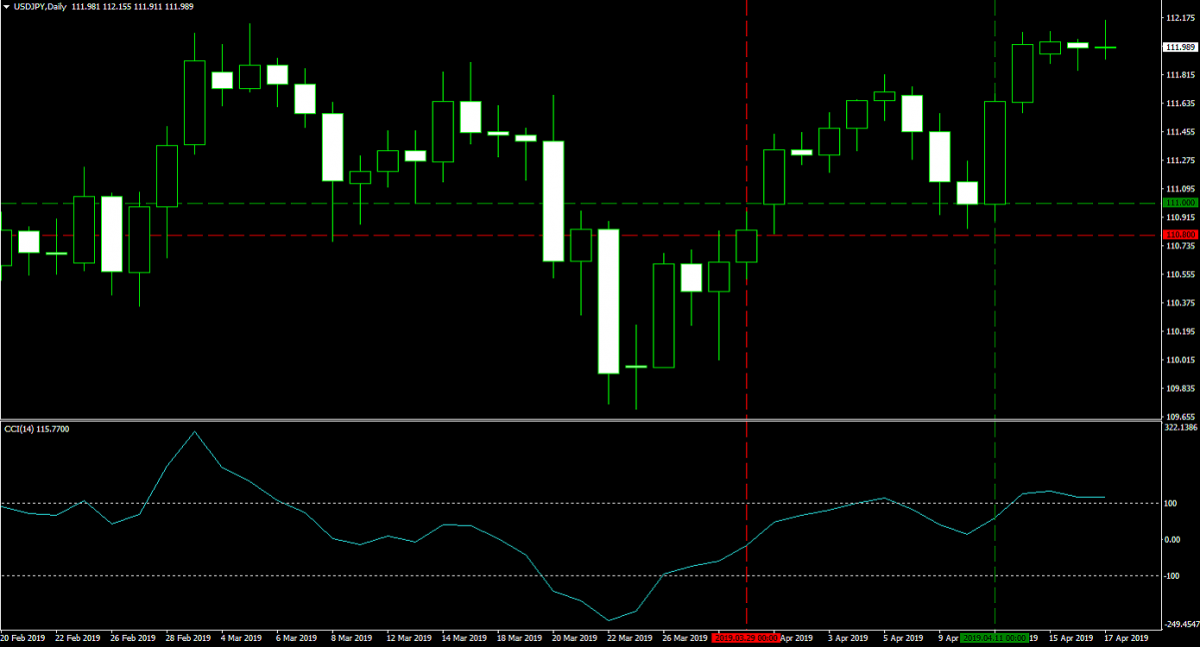

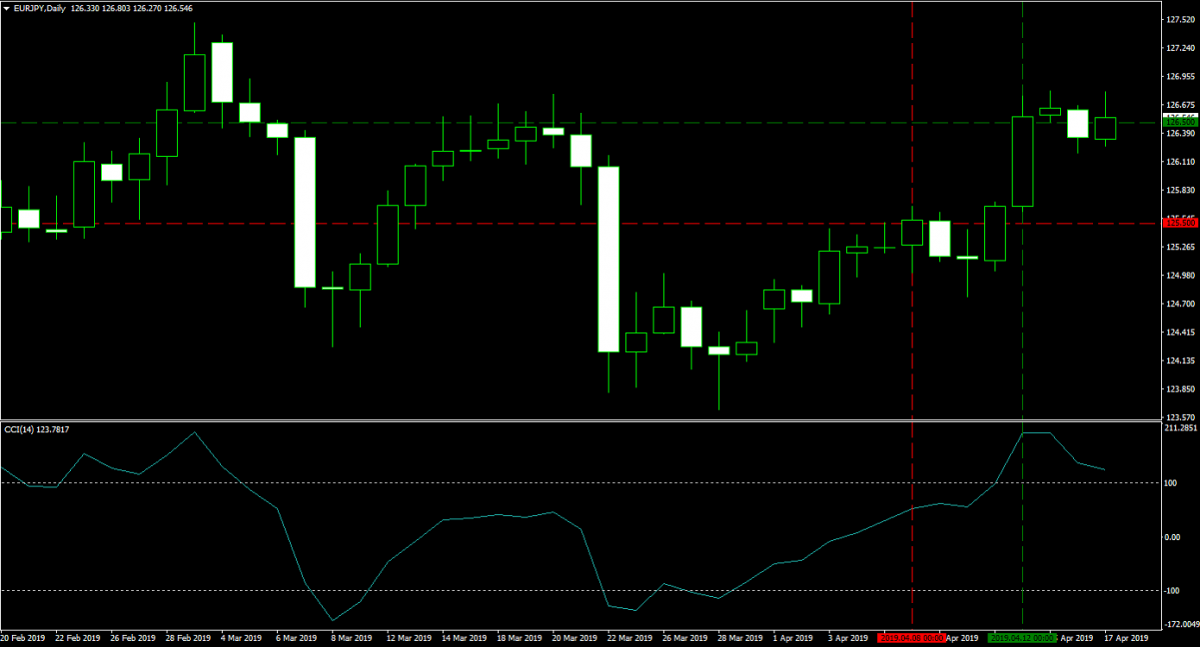

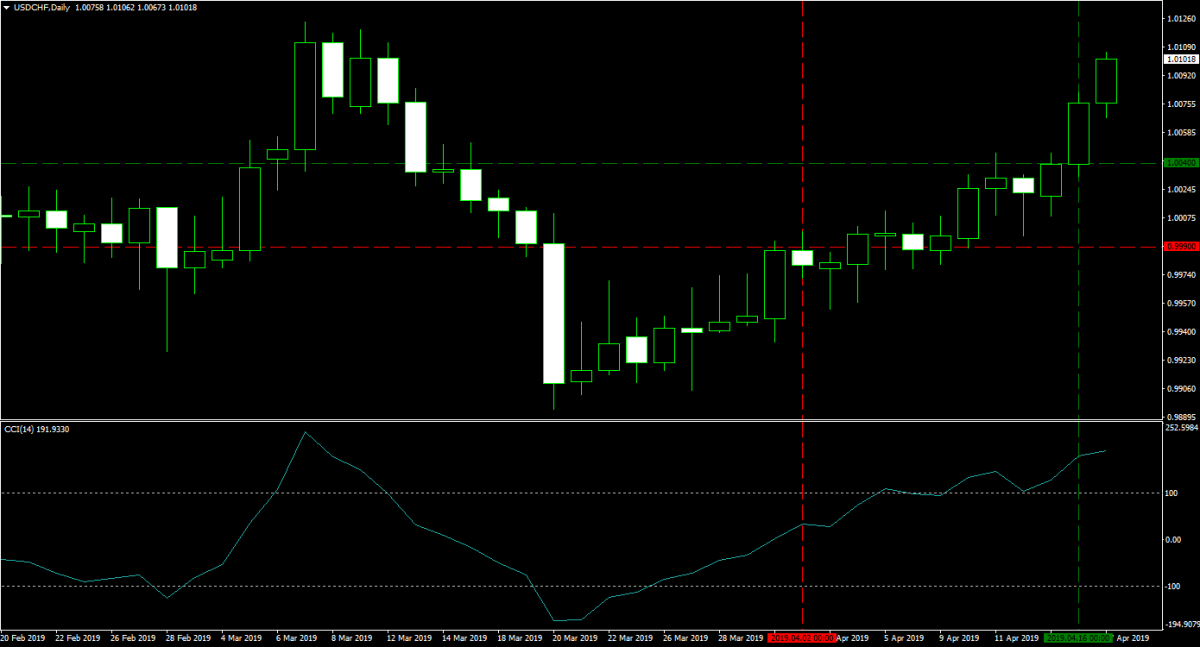

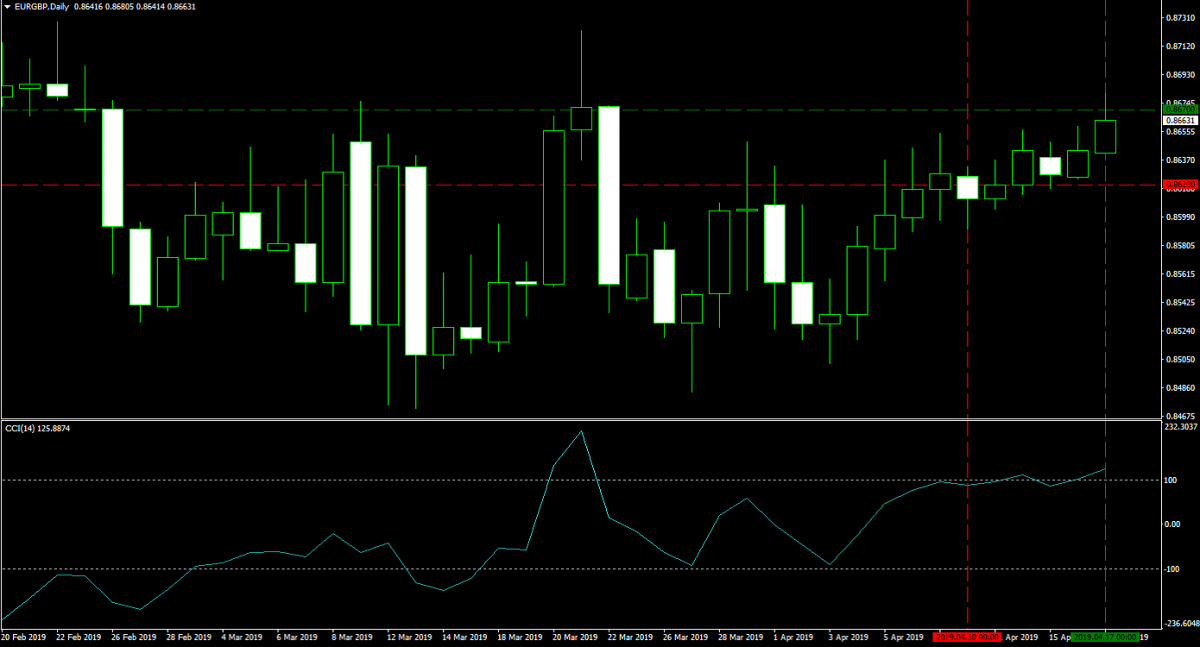

On April 11th 2019 my 125 lots USDJPY short position was closed at 111.000 for a loss of 20 pips or $22,450. On April 12th 2019 my 125 lots EURJPY long position was closed at 126.500 for a loss of 100 pips or $112,404. On April 16th 2019 my 125 lots USDCHF short position was closed at 1.0040 for a loss of 50 pips or $62,759. Earlier today, April 17th 2019, my 125 lots EURGBP short position was closed at 0.8670 for a loss of 50 pips or $81,776. The four images below show my closed forex trades for a loss.

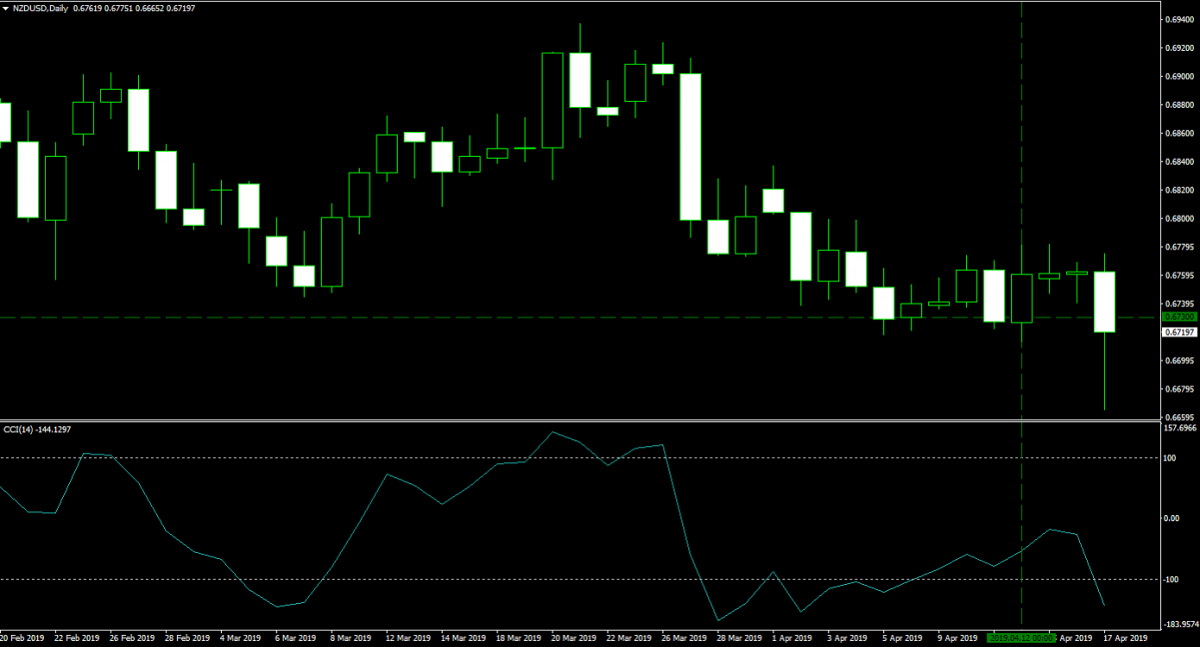

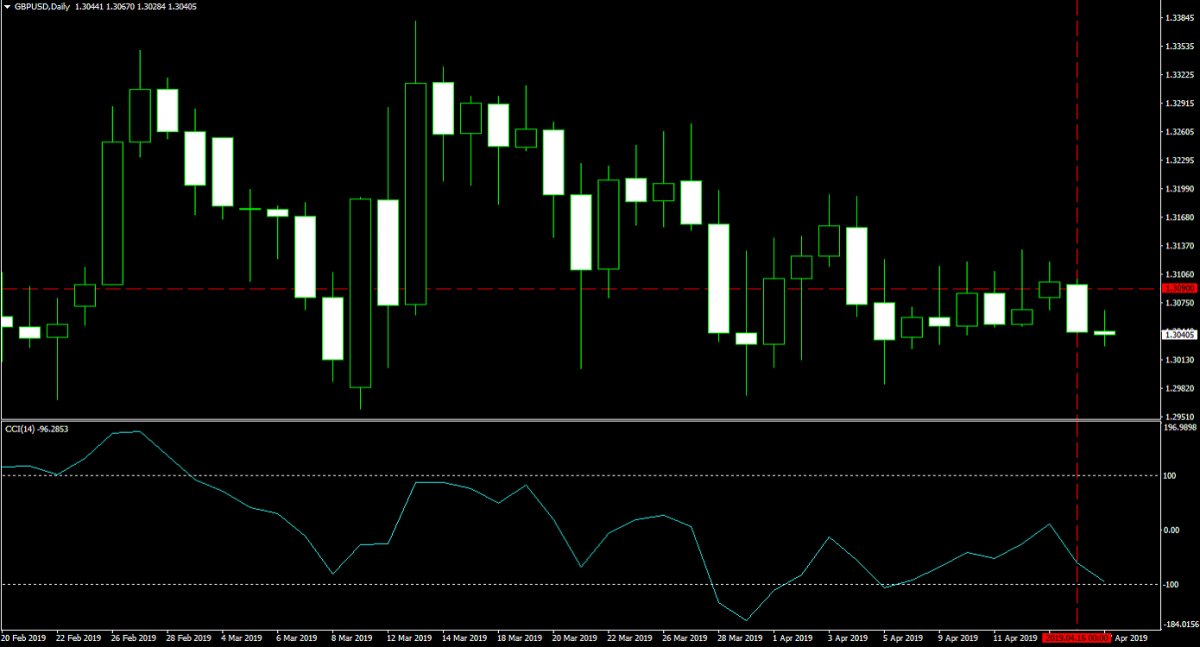

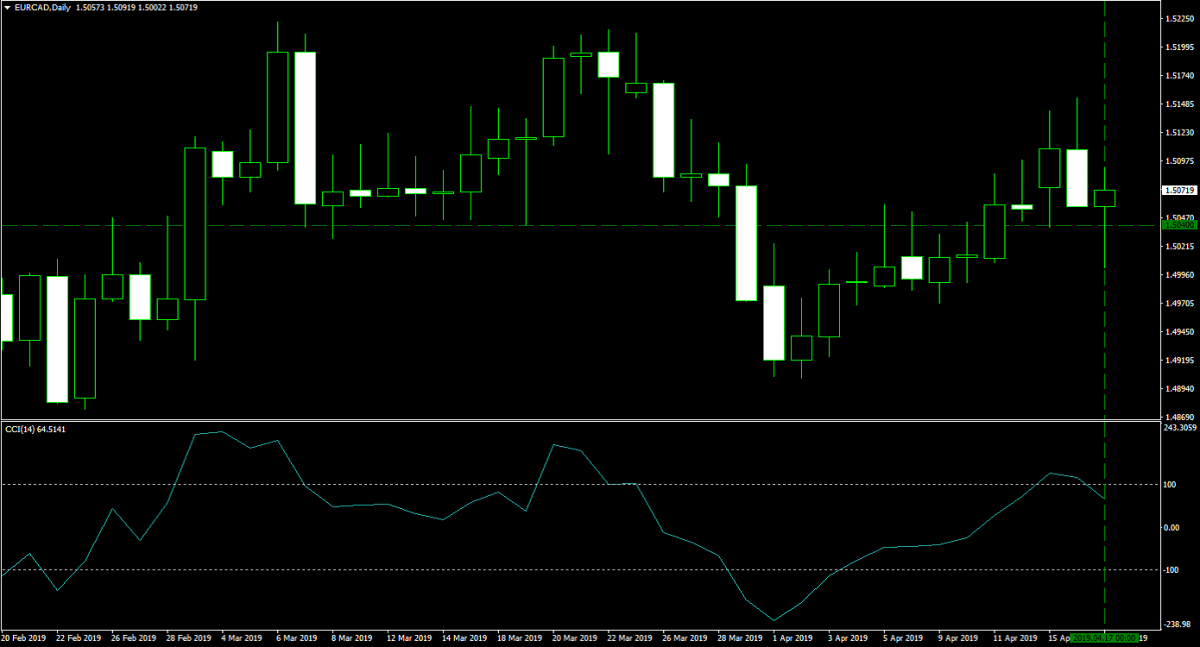

I added a 125 lots long position in the NZDUSD at 0.6730 on April 12th 2019. The margin requirement was $16,800 with a pip value of $1,250. You can read the trading recommendation at “NZDUSD Fundamental Analysis – April 12th 2019”. On April 16th 2019 I added a 125 lots short position in the GBPUSD at 1.3090 for a margin requirement of $32,604 and with a pip value of $1,250. I acted on this trading recommendation “GBPUSD Fundamental Analysis – April 16th 2019”. Today I added a 125 lots long position in the EURCAD at 1.5040 according to this trading recommendation “EURCAD Fundamental Analysis – April 17th 2019”. The margin requirement was $28,247 with a pip value of $936.94. The three images show my new forex positions.

Here is a summary of my Bitcoin - Forex Combo portfolio: I hodl 200 Bitcoins worth $1,035,686 and 6,000,000 Ripple worth $1,944,000 with a total cash portfolio worth $3,725,815 and 100 lots of Gold worth $119,667. I also have the following three 125 lots forex positions open: a NZDUSD long position worth $3,050, a GBPUSD short position worth $98,854 and a EURCAD long position worth $58,229. My total Bitcoin - Forex Combo portfolio is worth $6,985,301, down $269,366 from last week’s all-time high of $7,254,667. As I mentioned earlier, I believe the bullish trend in cryptocurrencies will continue. We may pull-back slightly, but that will only represent a good buying opportunity to add to existing positions. This is a great time to open your own PaxForex Trading Account in order to create a solid revenue stream by following my Bitcoin - Forex Combo strategy. Come on board and join our fast growing community of profitable traders!

To receive new articles instantly Subscribe to updates.