A wonderful winter day everyone, is the snow falling where you are or do you enjoy sandy beaches? Bitcoin has stopped falling and currently enjoys a solid increase in bullish momentum. Price action completed a breakout above its horizontal support area today and short-covering can push this cryptocurrency back above the $4,000 level rather quick. I am currently watching the $4,384.74 level to be exact which represents the intra-day high recorded on November 29th 2018. This is a very crucial level as a sustained move above it can extend this rally back above $6,500.

Back on December 5th 2018 I mentioned that fundamentals are a lot stronger now than they were a year ago. You can catch up on that post at “Bitcoin - Forex Combo Strategy: Fundamentals Stronger Than Ever”. I pointed out on several occasions that the plunge we saw across the cryptocurrency space was well overdone. Bitcoin recorded an intra-day low of $3,089.47 on December 14th 2018 which is roughly 50% below its previous long-time support level. Technical levels combined with fundamentals and we are now in the early stages of a price action recovery from depressed levels.

The news flow has been a lot more positive as well. Tether released statements which showed that they have the cash pile they claim to have in order to support each Tether by US Dollars. Tether, a stablecoin, has been use din over 30% of Bitcoin transactions and is often referred to the unofficial cryptocurrency bank. Tether came under scrutiny and the US Department of Justice launched an investigation in order to determine if their claims held true. As it appears, Tether indeed has the cash. A separate investigation into price manipulation of Bitcoin using Tether remains open. Tether did make amendments and currently only Bitfinex is allowed to purchase Tether and then redistribute them.

More positive news came out of Switzerland where the Federal Council decided on minimal regulation. A statement read “The Federal Council currently sees no fundamental issues regarding financial market law that specifically concern blockchain/DLT-based applications and would require fundamental adjustments. Swiss financial market law is generally technology-neutral and able to deal with new technologies.” Spencer Bogart of Blockchain Capital and Mike Novogratz from Galaxy Digital spiced up bullish momentum with their outlook for a bright 2019. Cryptocurrency are well poised to extend their rally throughout the end of the year.

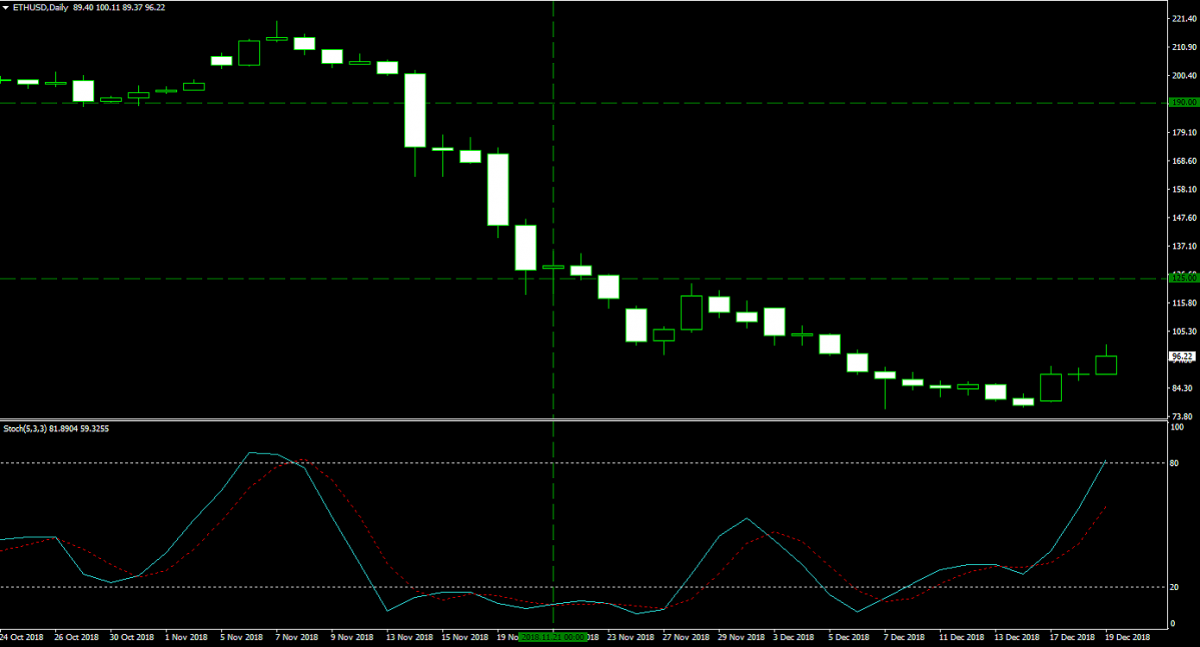

Let’s jump to my portfolio updates. Last week I mentioned that I expect Bitcoin to advance back above $6,000 in the first-quarter of 2019. I currently hold 100 Bitcoins at an average entry price of $5,130. I also expect that Ethereum will push back above $200 which would be great for my long-term investment of 1,500 Ethers which carry an average entry price of $171.67. One big thing I do anticipate for 2019 is a decoupling of price action, meaning that not all cryptocurrencies will move in unison as has largely been the case so far. I have to different entry points into each cryptocurrency as you can see in the image below.

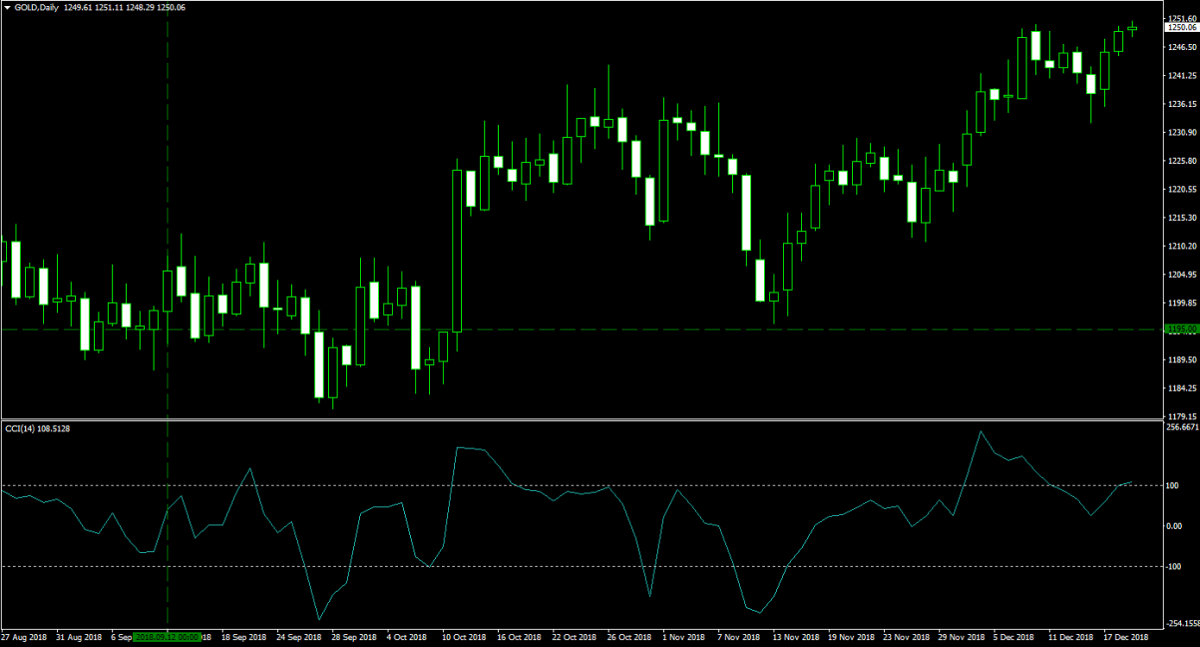

My second long-term investment, Gold, has performed great individually and as a hedge to my overall portfolio. I expect price action to advance further as 2019 shapes up to be a lot more turbulent on the geopolitical landscape coupled with a global economy slowing down sharply. This should further attract bids into this precious metal. I currently hold 100 lots in my PaxForex sub-account which I bought at $1,195 with a margin requirement of $123,179 and a pip value of $100. I am now looking for a breakout above the $1,300 level from where I think we can challenge the $1,500 mark. The image below shows my entry into Gold.

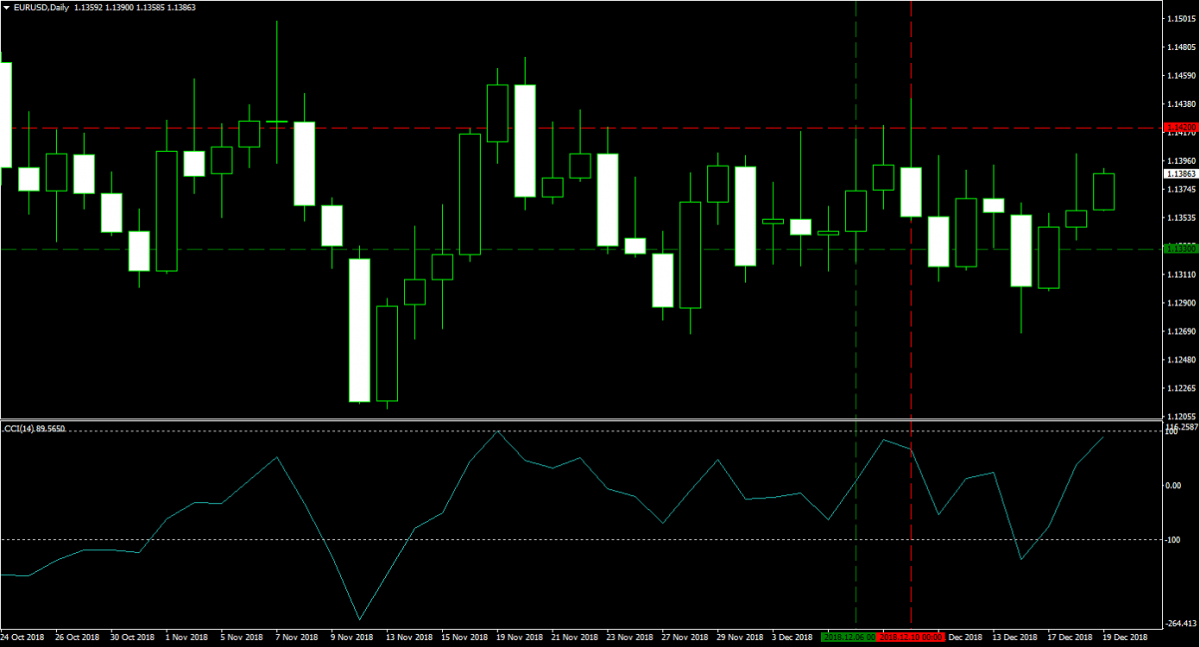

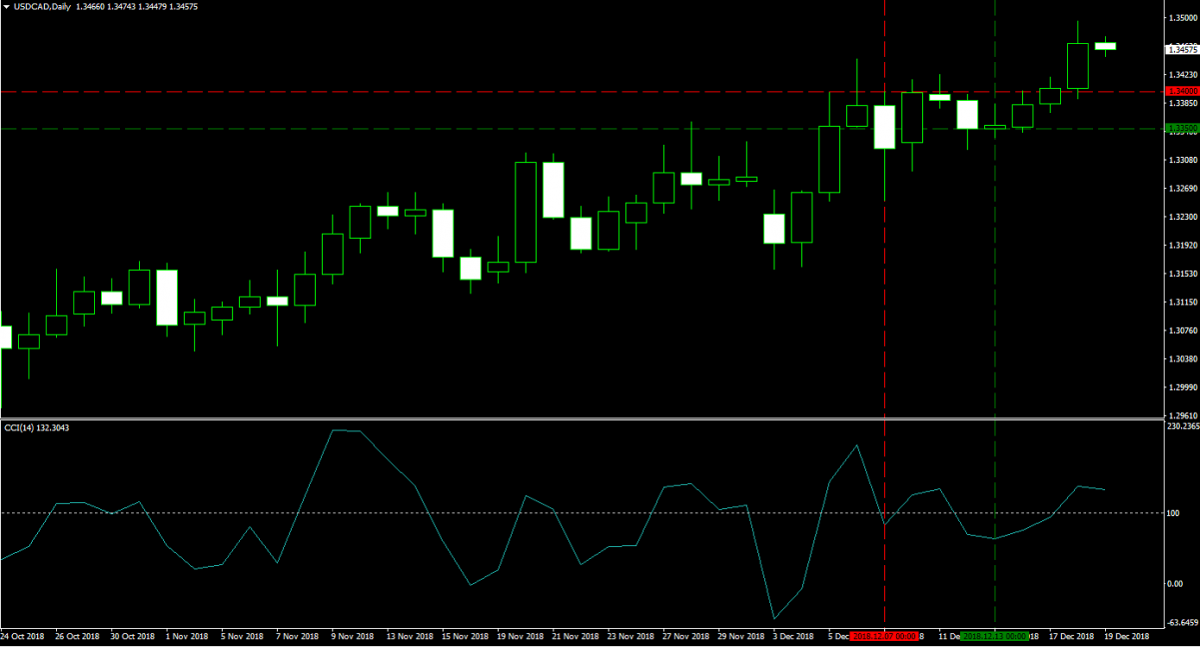

Last week I took two forex positions and both were closed for a profit as my adjusted stop loss orders have been triggered amid an increase in volatility. I bought 25 lots in the EURUSD at 1.1330 on December 6th 2018 and my stop loss was triggered on December 10th 2018 at 1.1420 for a profit of 90 pips or $22,500. I also had a short position in the USDCAD which I took on December 7th 2018, 25 lots at 1.3400, and my stop loss was triggered at 1.3350 on December 13th 2018 for a profit of 50 pips or $9,353. The two images below show the trades with entry and exit levels and times. Remember to always monitor price action and adjust your stop loss in order to secure profits, regardless of the take profit target. Forex trading is volatile and it is always good to secure floating trading profits with a properly placed stop loss order.

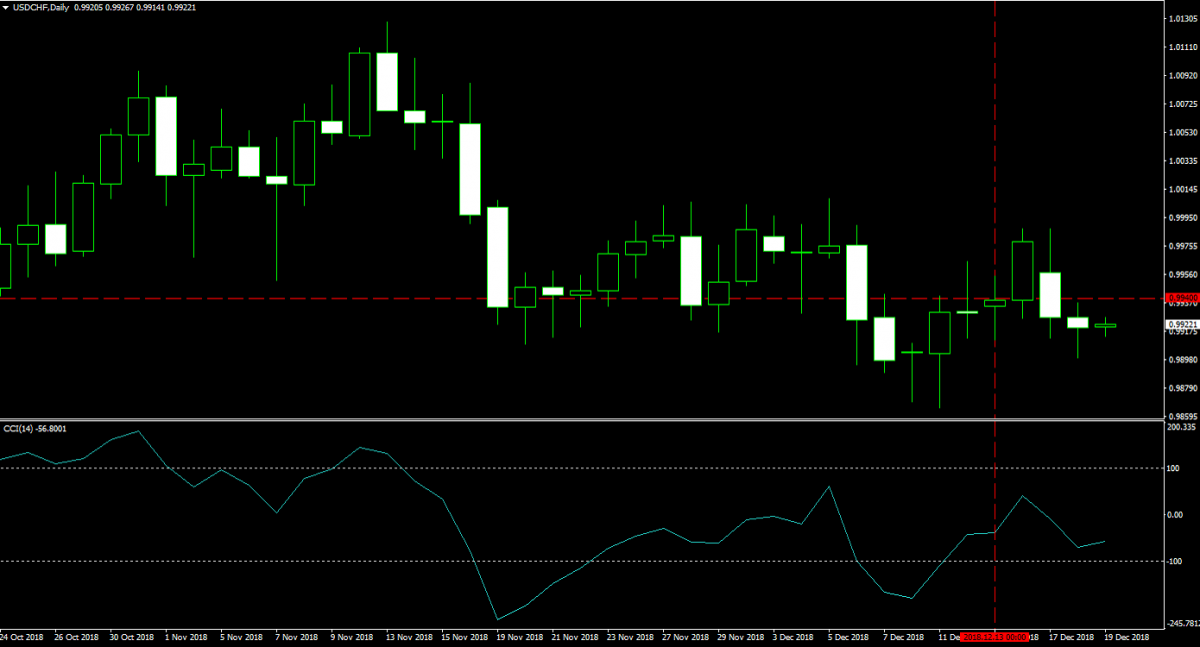

On December 13th 2018 I entered a short position in the USDCHF, 30 lots at 0.9940. The margin requirement was $6,000 with a pip value of $302.34. The original trading recommendation for this trade can be found at “USDCHF Fundamental Analysis – December 13th 2018”. The US Fed will announce its last interest rate decision today so I removed my stop losses until we get more details. This is a bit more risky and I don’t recommend most of you to follow, keep the recommendations level which are rock solid. The image below shows my entry into this trade.

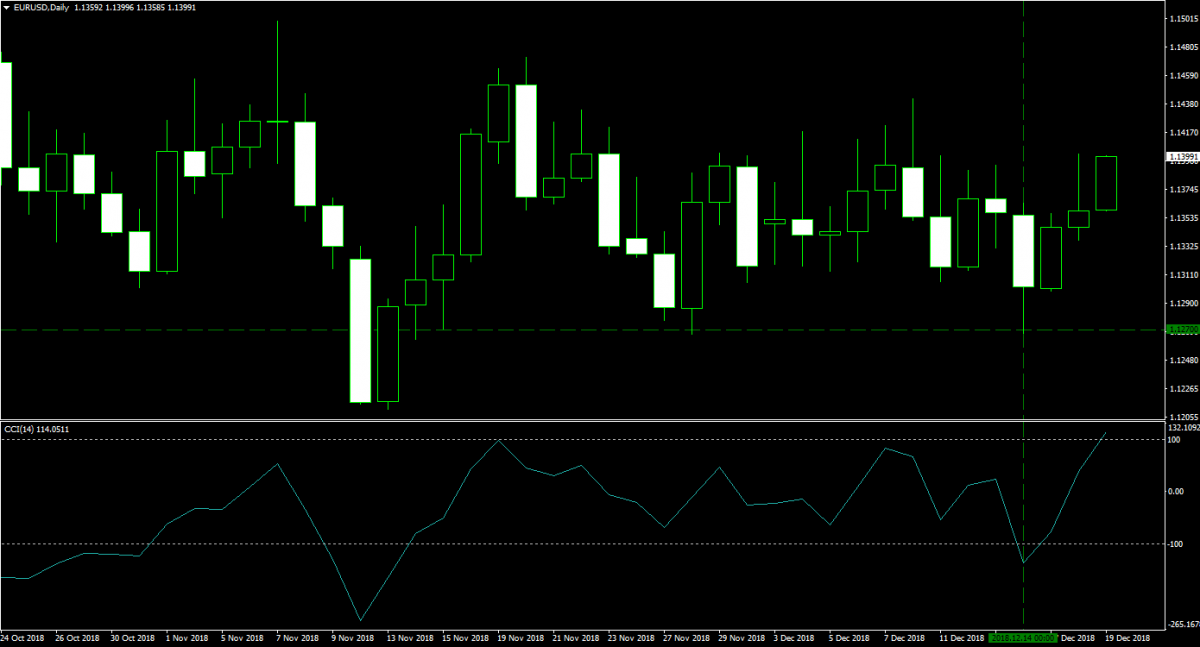

Thanks to the volatility I was able to re-enter my EURUSD long position on December 14th 2018. I did a swing trade so bear with me here. The original recommendation called for a long position as you can read at “EURUSD Fundamental Analysis – December 14th 2018”, but mentioned a short entry if price action breaks below 1.1330. On that day we had some wild swings so I did take a short position at 1.1320, 30 lots with a margin requirement of $6,812 and a pip value of $300.00. I did put a take profit at 1.1270 which has been a very strong support level over the past month. At this level I also placed a buy order for 50 lots. My short position was closed rather shortly after I took it for a profit of $15,000. At the same time my buy order was executed at 1.1270, 50 lots with a margin requirement of $11,354 and a pip value of $500. I adjusted my stop loss to 1.1370 which guarantees me a profit of 100 pips or $50,000. The image below shows my long position in the EURUSD.

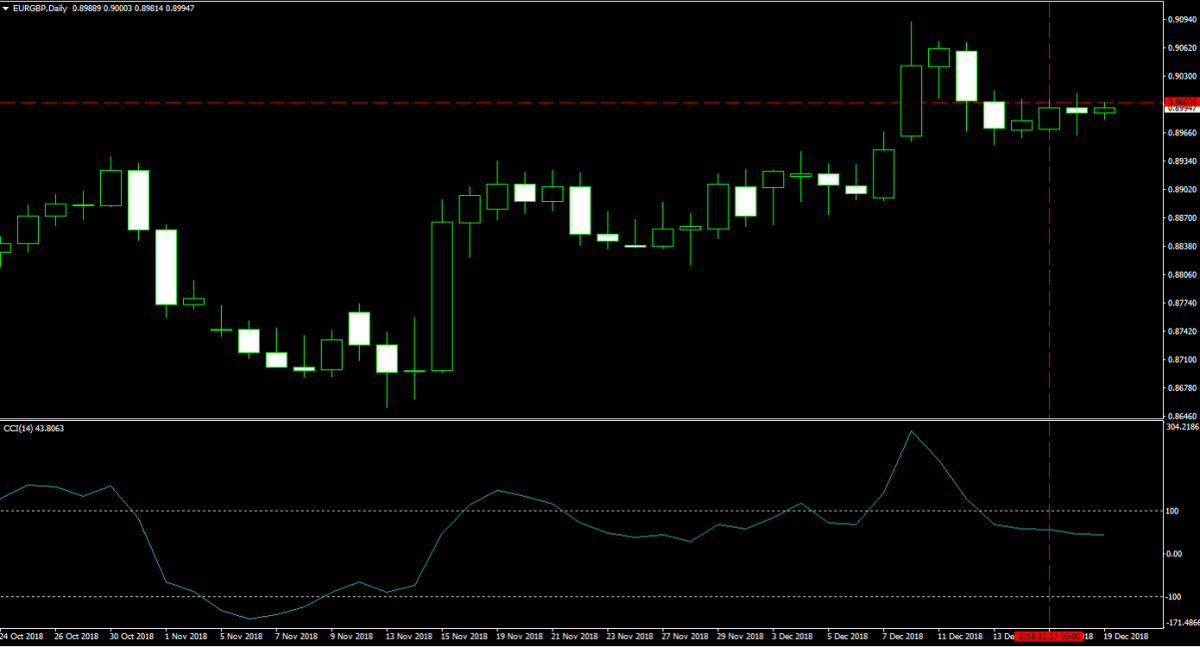

I added a short position in the EURGBP on December 17th 2018, 30 lots at 0.9000. This trade carries a margin requirement of $6,813 and a pip value of $380.13. You can follow up on the trading recommendation at “EURGBP Fundamental Analysis – December 17th 2018”. The image below shows my entry.

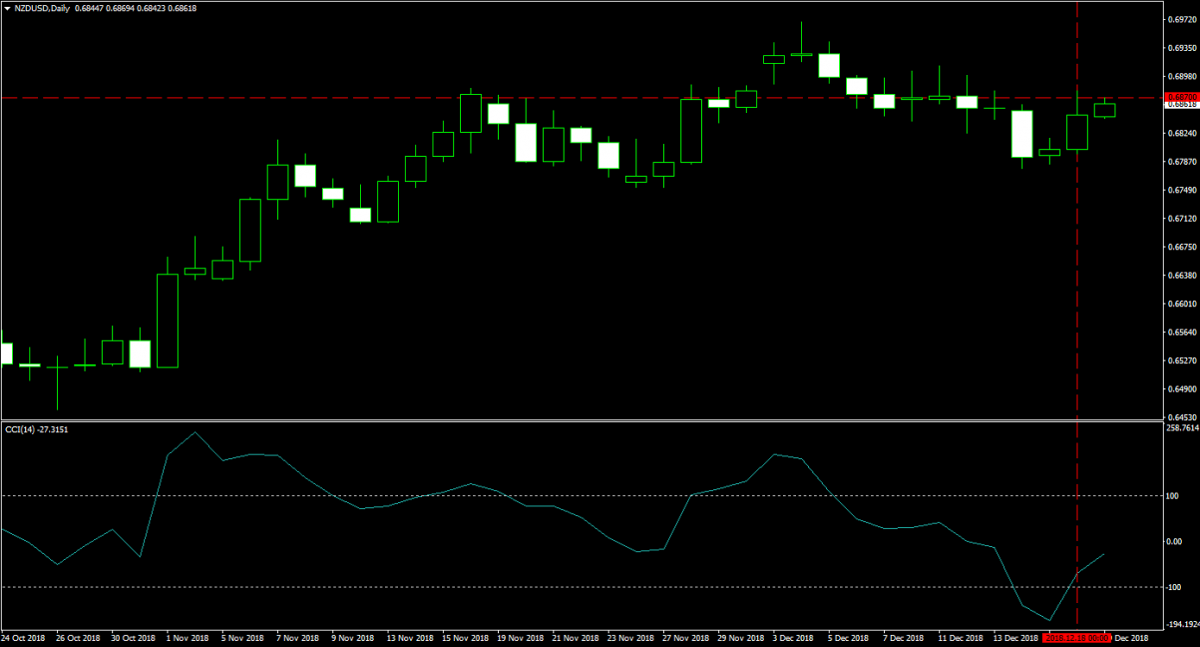

On December 18th 2018 I added a short position in the NZDUSD according to the trading recommendation which you can find at “NZDUSD Fundamental Analysis – December 18th 2018”. I sold 30 lots at 0.6870 for a margin requirement of $4,116 and a pip value of $300.00. You can see my entry in the image below.

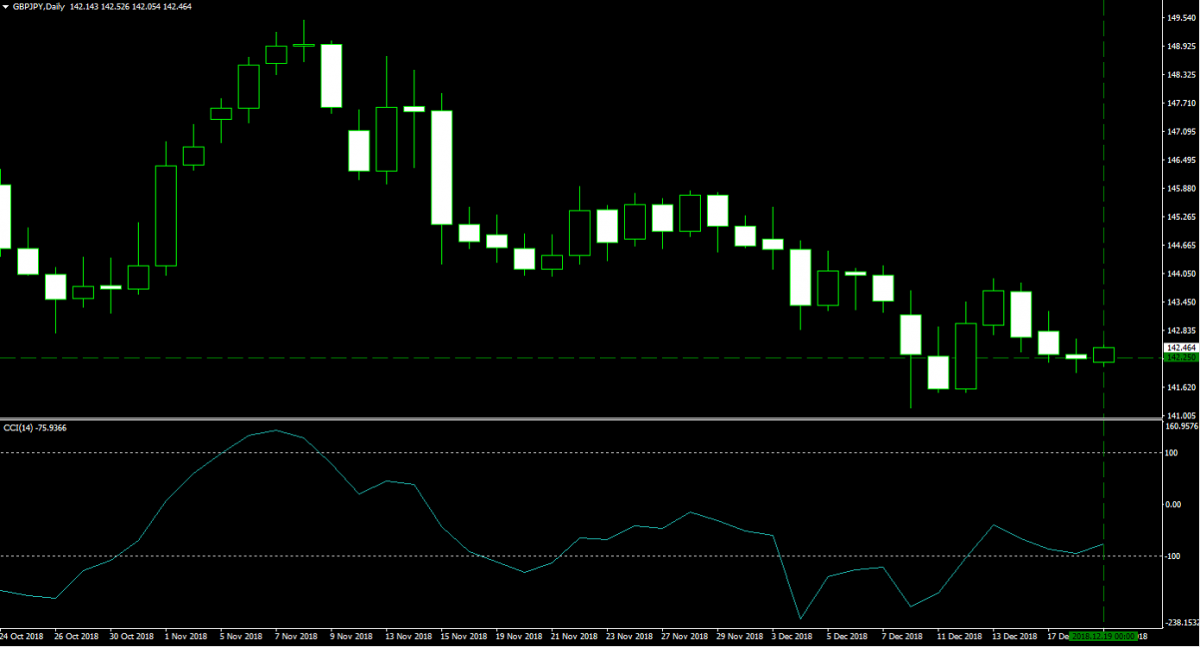

This morning, December 19th 2018, I added a long position in the GBPJPY. I bought 30 lots at 142.250 according to this trading recommendation “GBPJPY Fundamental Analysis – December 19th 2018”. This trade carries a margin requirement of $7,603 and a pip value of $267.00 and the image below shows my position.

Finally, my total portfolio update. My 100 Bitcoins are worth $367,100 and my 1,500 Ethers are worth $144,750 while my 100 lots Gold position is worth $669,679. I have five forex trades open as I write this update. A 30 lots short position in the USDCHF worth $12,047, a 50 lots long position in the EURUSD worth $74,854, a 30 lots short position in the EURGBP worth $8,714, a 30 lots short position in the NZDUSD worth $6,216 and a 30 lots long position in the GBPJPY worth $11,608. I also have a total cash position worth $94,180. This gives me a total portfolio value of $1,389,148 which is up $211,545 as compared to last week. I am now very close to eclipse my all-time high of $1,395,899. Open your PaxForex Trading Account now and grow your balance the same way I do by using my Bitcoin - Forex Combo Strategy!

To receive new articles instantly Subscribe to updates.