When the Bank of England (BOE) had their last Monetary Policy Committee (MPC) meeting on February 8th, market watchers priced in a 51% chance of an interest rate increase in May. Fast forward two weeks and the odds have now jumped to 83%. Central banks in developed markets have been reluctant to increase interest rates since they were slashed to all-time record lows as a result to the global financial crisis from a decade ago. Many have called for the normalization of monetary policy amid fear that low interest rates are already fueling the next debt crisis.

One of the prime reasons given by central bankers around the G-10 has been the absence of inflation and more particularly wage-inflation. While the US Fed has led the efforts through interest rate cuts and quantitative easing programs going into the aftermath of the financial crisis, it appears that the Bank of England may be leading the way out on the inflationary front. With the annualized CPI at 3.0%, the BOE has now received the long awaited increase in wage-inflation which prompted the increase in expectations that interest rates will increase within the next three months. The British Pound Sterling should continue to ride higher against major currencies and retake pre-Brexit referendum levels.

While the prospect of higher interest rates in the UK are a very strong bullish fundamental indicator, many are still careful with Brexit negotiations in full swing. Market participants are now weighing if higher interest rates on the back of wage growth will be sufficient to overcome any negative fallout from Brexit. Canadian Imperial Bank of Commerce strategist Jeremy Stretch noted that 'There’s very much a presumption that if the BOE is right on wage expectation, that will have supportive elements for rates and ultimately for sterling.' He further added that 'If you’re an international investor trying to decide whether you want to be long sterling or not, the news on Brexit negotiations are going to oscillate in the background. All in all, it is becoming difficult for sterling to break through all that noise.'

The British Pound now enjoys a solid tailwind from the prospects of higher interest rates sooner than previously anticipated. The headwind remains lack of clarity on the Brexit front. Forex traders will therefore receive many positive as well as negative news in regards to the British Pound. This will create great trading opportunities short-term as well as long-term. Open your PaxForex trading account today and profit alongside our expert analysts who will guide you through the British Pound storm to a profitable landing.

After the results of the Brexit referendum were announced, the British Pound sold-off heavily as investors fear the unknown. Since then it became the best performing currency in the G-10. How much more can the British Pound advance? That’s the big question on investors mind and the biggest unanswered question remains Brexit and the pending trade deal. Over the past few weeks it appears that the UK has gained the upper hand on negotiations and that the EU will blink first. This would send the British Pound soaring to multi-decade highs. With the Bank of England ready to hike, it is time to Pound your forex account and here are 3 medium-term trades for a profitable outcome.

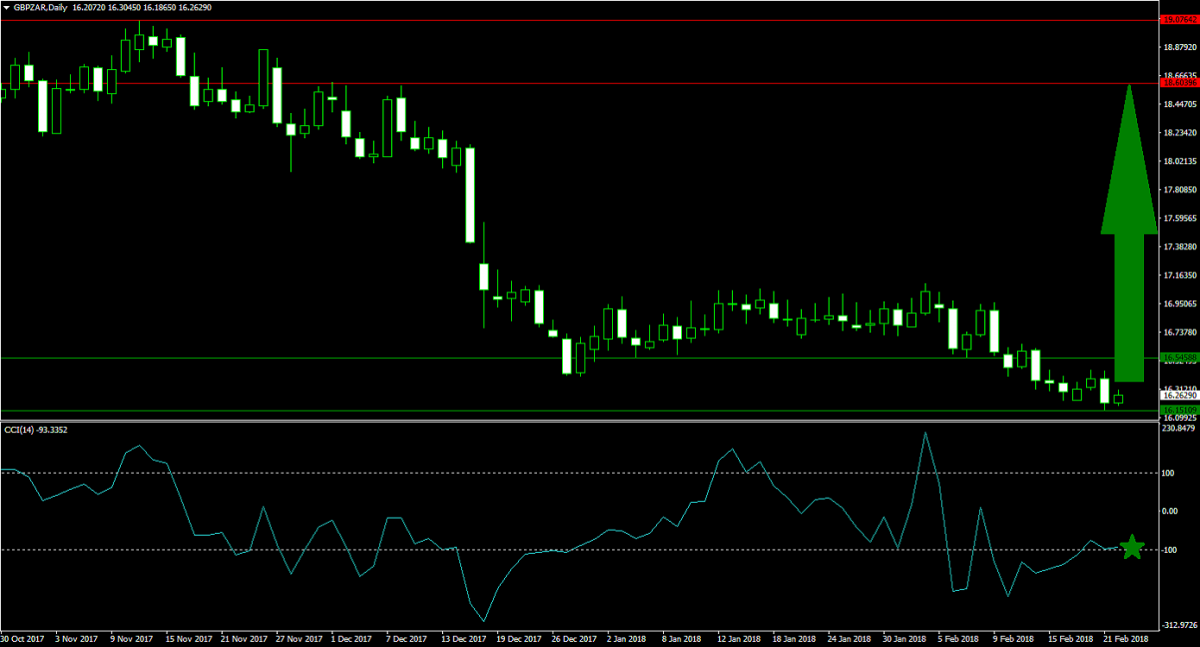

Forex Profit Set-Up #1; Buy GBPZAR - D1 Time-Frame

This trade is great for all forex traders who worry that Brexit will pressure the British Pound lower. South Africa has a greater degree of economic uncertainty which will overcome any negative Brexit news over the remainder of 2018. The fundamental aspect of this GBPZAR trade is covered on the bullish front. From a technical perspective, this currency pair has reached its horizontal support area and bearish momentum is receding. A breakout is anticipated which would allow for a full retracement of the most recent contraction. Forex traders are advised to spread their buy orders inside the 16.1500 and 16.5500 area.

The CCI has formed a positive divergence which is a strong bullish indicator. Adding to bullish pressures for this trade is the breakout above the -100 level which took the GBPZAR outside extreme oversold conditions. The path is now clear to cross above the 0 mark. Download your PaxForex MT4 Trading Platform and enter this trade to your portfolio before it accelerates to the upside.

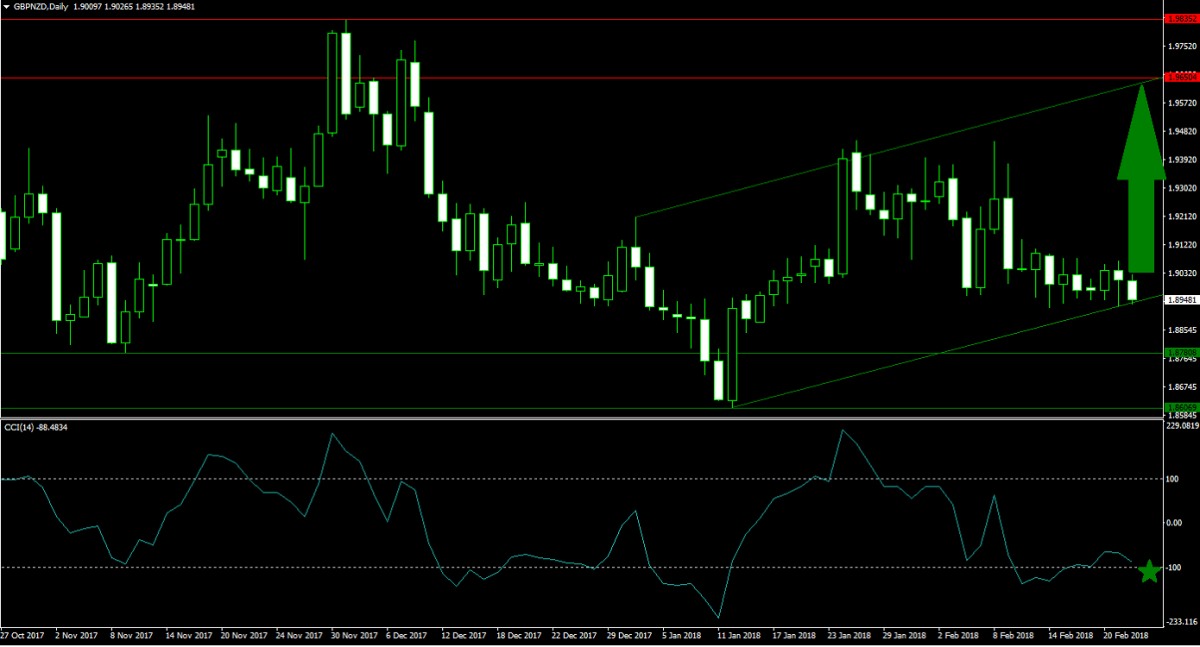

Forex Profit Set-Up #2; Buy GBPNZD - D1 Time-Frame

The GBPNZD already completed a breakout above its horizontal support area and is now at a later stage in its advance than the GBPZAR. The New Zealand economy, heavily dependent on commodity exports, is set to face challenges during the second-quarter of this year as many expect the global economy to cool down. The bullish technical aspect for the GBPNZD is the formation of a bullish price channel which is likely to guide this currency pair back into its horizontal resistance area. Forex traders are advised to buy any dips down to the ascending support line of this bullish chart pattern.

The CCI, a momentum indicator, has confirmed the bullish price channel as it advanced in unison with the ascending support line. It has also pushed above the -100 mark which has attracted further buy orders into this trade. The Daily Fundamental Analysis provided by PaxForex offers all forex traders the best fundamental trade set-ups which can boost your account by over 500 pips every month.

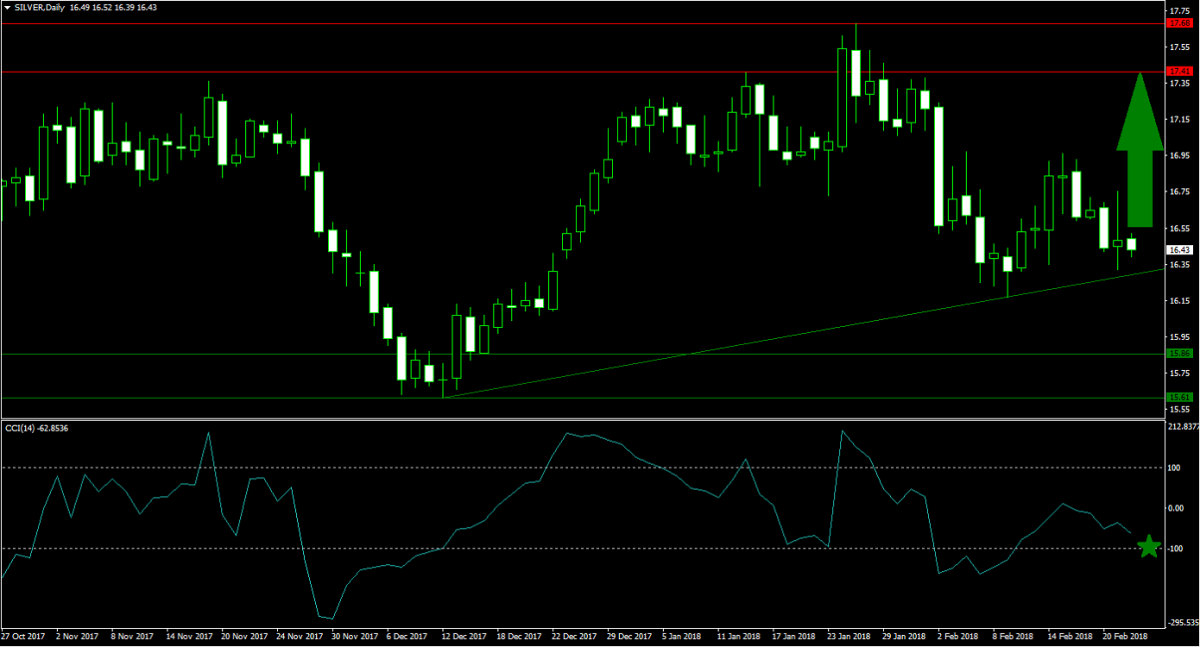

Forex Profit Set-Up #3; Buy Silver - D1 Time-Frame

Since we are ‘pounding’ our forex accounts this week in order to capture the expected continuation of the advance in the British Pound moving forward, it is always smart to hedge against short-term risks. We are going to protect our account with this Silver buy recommendation and away from the crowded Gold trade. An ascending support level is pushing this commodity higher which is set to challenge its horizontal resistance area. A breakout should be anticipated for a potentially bigger upswing.

The CCI already completed a breakout above the -100 level and forex traders should watch out for a crossover above the 0 mark. This would result in a momentum change from bearish to bullish and further add bullish pressures. The Daily Forex Technical Analysis highlights the most profitable trades each day, which will help all forex traders add pips to their portfolio performance.

To receive new articles instantly Subscribe to updates.