The US may announce tariffs on as much as $200 billion worth of Chinese imports, on top of the $50 billion already in place, as soon as this week. On Thursday a public commenting period ends, and sources in the White House stated that President Trump would like to move soon after that. China has already vowed to retaliate in kind as the US-China trade war is set to deepen. With US elections in November, where some analysts predict that Republicans may lose the House of Representatives to Democrats, China is in a great position. Patience has the upper hand and Trump appears isolated in Congress.

The biggest loser in this trade war may ultimately be the US consumer. As Trump slapped tariffs on Chinese imports, as well as EU imports, prices will increase across the board for US consumers. This could severely derail the US economy which depends heavily on consumers borrowing money from banks to spend in the economy. Debt driven consumerism represents the backbone of the US economy. The Chinese consumer has slowed down activity if judged by the decrease in retail sales below 9.0% annualized this year. One of the biggest issues for the Chinese consumer remains soaring rents across big cities.

Are Chinese consumers ready to defend the economy against Trump? While retail sales have contracted, and the Chinese government’s quarterly household survey showed an increase in spending. Retail sales don’t cover enough of the shopping to gauge the Chinese consumer accurately. Tommy Xie, Economist at the Overseas-Chinese Banking Corporation, points toward solid overseas tourism numbers and noted that 'if you look at spending on overseas tourism, which is a good indicator of how wealthy people feel about themselves and how optimistic they are, the number is quite sound.'.

Overseas tourism for the first-half of 2018 increased by 15% to 71.3 million, which suggests consumers who have upgraded into the middle-class of the Chinese economy continue to spend. Which consumers will have a bigger positive impact on their respective economy in the course of this trade war? Open your PaxForex Trading Account now and join our growing community of profitable forex traders.

While the consumer is expected to feel a negative impact from the trade war, the Chinese consumer appears to be ready to defend its economy against Trump while many US consumers favor access to cheaper products from China. UBS Head of Chinese Economic Research, Wang Tao, pointed out that 'Continued improvement in household credit access, and the continuation of reforms focusing on supporting job creation and improving the social safety net should support real consumption growing at 6-7 percent in the next few years.'. Chinese consumers are ready to defend the economy and here are three forex trades to invite profits into your trading account.

Forex Profit Set-Up #1; Sell EURHKD - D1 Time-Frame

The rally in the EURHKD lost steam after price action approached its horizontal resistance level, and a reversal followed. This currency pair is now trapped between its primary and secondary resistance levels which are expected to guide the EURHKD further to the downside and back into its horizontal support area. Forex traders are advised to sell any rallies into its secondary descending resistance level as downside potential currently exceeds upside risk and bearish sentiment is on the rise.

The CCI retreated from extreme overbought territory and is now approaching the 0 mark. A push below it would result in a momentum change from bullish to bearish and is anticipated to result into a new influx of sell orders. Download your PaxForex MT4 Trading Platform today and access the profitable world of forex trading through PaxForex, where you earn more per pip thanks to tight spreads.

Forex Profit Set-Up #2; Buy AUDCAD - D1 Time-Frame

Price action in the AUDCAD stabilized after reaching its horizontal support area from where bearish momentum is being depressed. This currency pair is now trading just below the upper band of its horizontal support area and a breakout is expected to materialize. The AUDCAD is anticipated to push past primary and secondary descending resistance levels until it can challenge its next horizontal resistance level. Forex traders are recommended to place their buy orders just below the upper band of its horizontal resistance area.

The CCI already advanced out of extreme oversold conditions, below the -100 mark, and bullish momentum should suffice to push this technical indicator above the 0 level for a bullish momentum change. A positive divergence has formed as well which represents a string bullish trading signal. Follow the PaxForex Daily Forex Technical Analysis section and simply copy-paste our trading recommendations into your own portfolio!

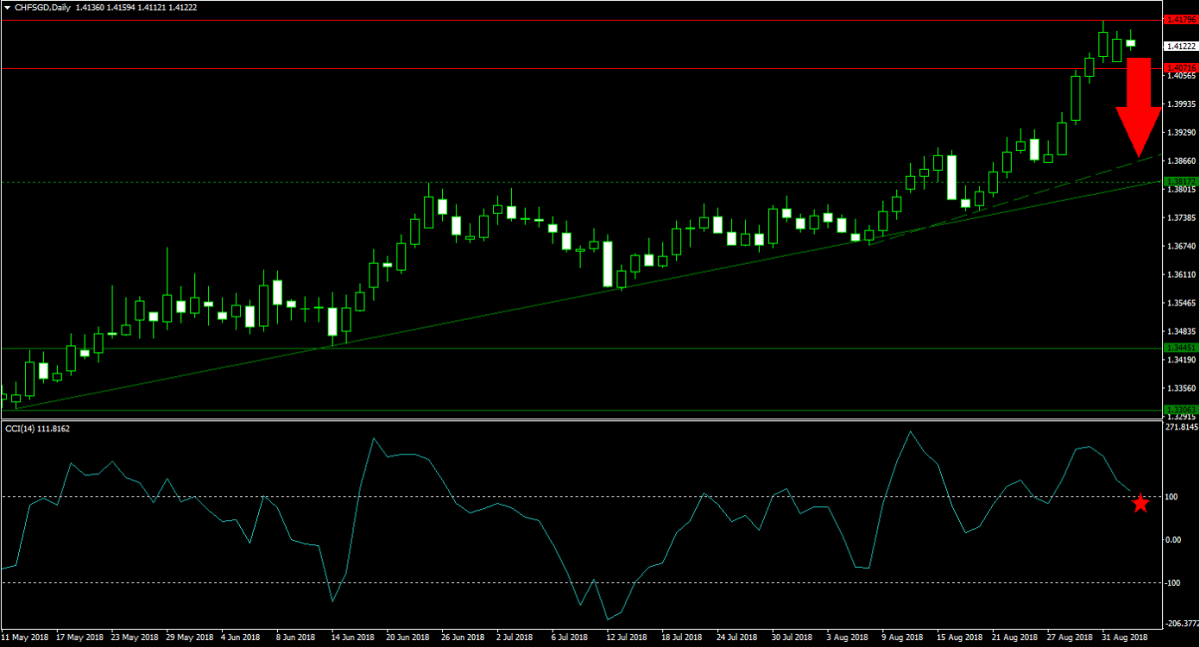

Forex Profit Set-Up #3; Sell CHFSGD - D1 Time-Frame

A spike in the CHFSGD took it directly into its horizontal resistance area from where bullish sentiment is receding. A breakdown is expected to unfold and take price action into a triple support level; the primary ascending support, the secondary ascending support level the the horizontal support level are all within close proximity to each other. Forex traders should spread their sell orders inside its horizontal resistance area in order to take advantage of the anticipated contraction in the CHFSGD.

The CCI remains in extreme overbought territory, but momentum is weakening and expected to lead to a breakdown from where a profit taking sell-off is likely to follow. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the exciting world of forex trading. Earn over 500 pips per week simply by placing our recommended trades into your own forex trading account.

To receive new articles instantly Subscribe to updates.