Forex market is a young and developing market of currency exchange, whose daily turnover exceeds all the financial markets of the world. Unlike the equity market, where investors often only invest with the institutional investors, (like mutual funds) or other individual investors, there are extra participants who trade on the forex market for the whole different reasons than those on the equity market. The currency market includes transactions in spot forex currency pairs, forward contracts, currency futures, OTC currency options, and exchange-traded options on currency futures.

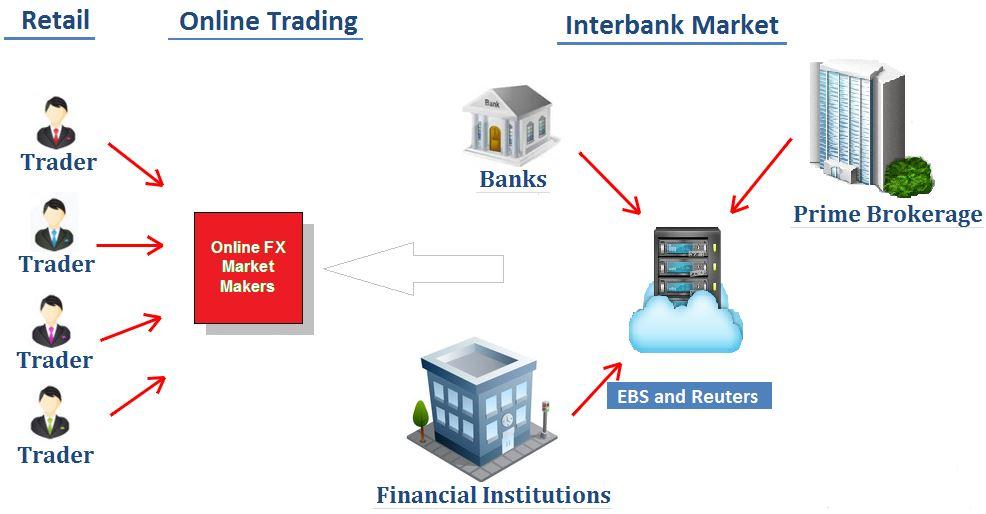

The currency exchange takes place on a very large scale and this market has a global presence as currency exchange market participants are from all around the globe. There are various participating entities taking part in forex trading. The main players or the main market participants in currency exchange are Central Banks, largest investment firms, multinational commercial companies, hedge funds, mutual funds, insurance companies and retail forex brokers etc.

Most of the daily currencies transactions are made by investors. These investors, be they investment companies, insurance companies, banks, or others, are making currency transactions to realize a greater return on their investments or holdings. Many of these companies are responsible for managing the savings of others. Pension plans and mutual funds buy and sell billions of dollars’ worth of assets daily. Banks, in the temporary possession of the deposits of others, do the same. Insurance companies manage large portfolios that act as their capital to be used to pay off claims on accidents, casualties, and deaths.

Traders are perhaps the most diverse group of market participants. Their influence depends on the capital they have at their disposal and how high up the hierarchy their liquidity is sourced from, meaning they can be located almost anywhere on the forex food chain. One thing, however, does unite all traders; the forex market is not something they use as a tool to help them conduct their everyday business, for them the forex market is their business. Traders are not interested in using the forex market to hedge against the risk of future purchases or even to actually take possession of the currencies they trade. Traders are only concerned with profiting from price fluctuations, and what better market for them to trade on than the largest and most liquid in the world?

Forex attracts more people day after day because of the fact that many people want to benefit from rate fluctuations. However, before you start working, you must receive basic knowledge that will help you in this work. As the world’s largest marketplace, averaging over $5 trillion in daily turnover, the forex market is a premier financial venue. Millions of individuals around the globe manage risk, speculate on exchange rate fluctuations and attempt to secure profit from actively engaging in forex.

To receive new articles instantly Subscribe to updates.