The GBPAUD has rallied sharply over the past few trading weeks as visible in this D1 chart. This currency pair has shown signs of exhaustion, such as the capitulation spike last week which was followed by a sharp reversal as well as the last two daily candlestick formations which are nestled between twin resistance levels. The GBPAUD is currently trapped between horizontal resistance as well as its ascending support line which turned into resistance. We expect to see a further breakdown in this currency pair which should take it...

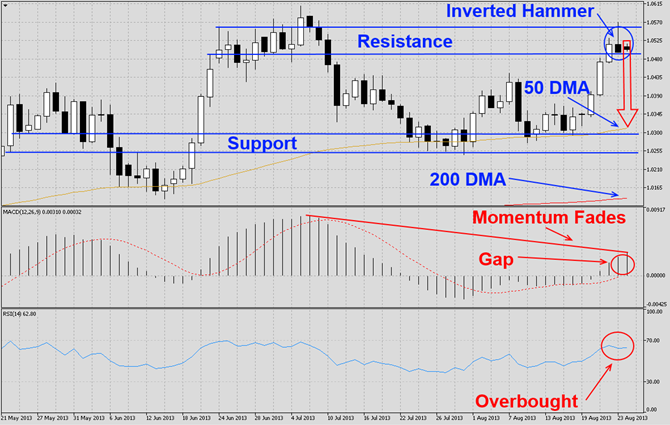

The USDCAD rallied sharply from its strong support level as visible in this D1 chart. This currency pair has now exhausted its rally as it ran into a very strong horizontal resistance zone and the top of its zone would cause the formation of a double top which is also a bearish chart pattern. Additionally we have a very solid inverted hammer candlestick which is a very bearish signal especially given its location at solid resistance levels. We expect this currency pair to correct back down to its support level, but form a higher...

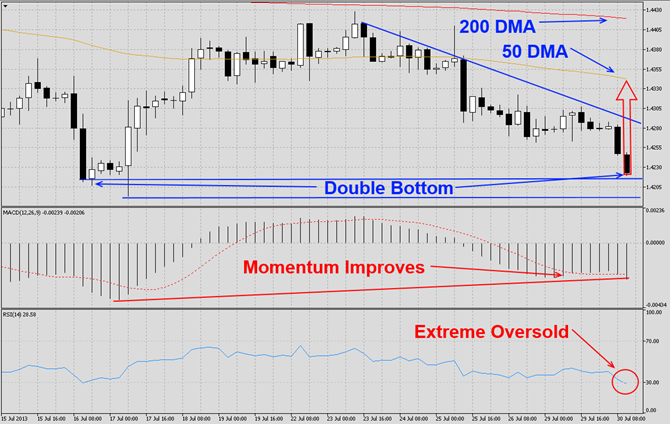

The GBPCHF has corrected sharply after approaching its descending 200 DMA as visible in this H4 chart. This currency pair has now corrected and formed a double bottom. We expect the GBPCHF to stabilize around current levels and launch a rally which will lead to a breakout above its 50 DMA and potentially into its descending 200 DMA. MACD has improved during this correction and has formed a higher low which is a bullish signal. We also expect MACD to inch closer to its centerline during the move higher with a potential bullish...

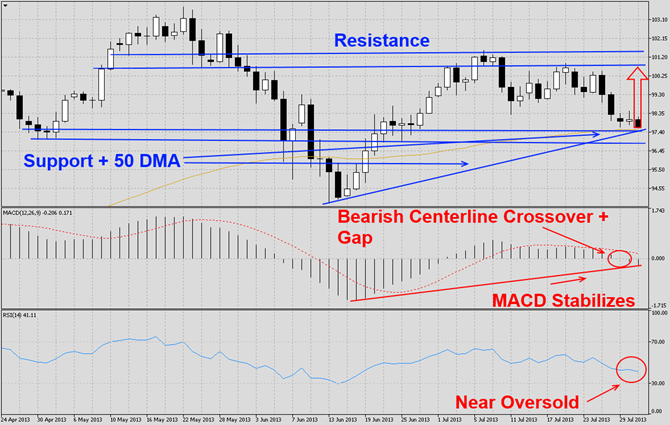

The USDJPY has broken below the key 100 level as visible in this D1 chart. This currency pair has remained in a rectangular chart pattern and is currently trading at its horizontal support level which is enforced by its flat 50 DMA. We expect the USDJPY to stabilize near current levels and stage a rally which should take it back to its horizontal resistance level. MACD has stabilized, but just completed a bearish centerline crossover which could be reversed shortly as the histogram gaped away from its moving average which remains...

This week was a rather quiet week as bullish sentiment for equity markets seems to pause or fizzle out and summer doldrums set in. Earnings as well as economic reports yanked markets both ways, but some key bullish measures have been taken out and further upside will depend on earnings next week. Overall resistance starts to build across the board and the Japanese Yen strengthened especially over the last two trading days and broke through major support which opened the way for further downside. The Australian Dollar continue to...