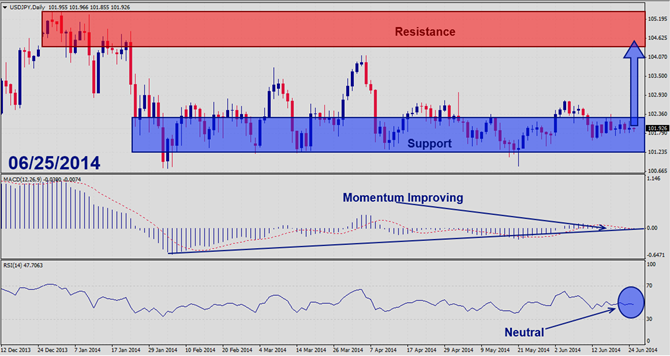

Should price action for the USDJPY remain inside the 101.80 to 102.20 zone the following trade set-up is recommended: Timeframe: D1 Recommendation: Long Position Entry Level: Long Position @ 101.90 Take Profit Zone: 104.70 – 105.10 Stop Loss Level: 101.00 Should price action for the USDJPY breakout above 102.20 the following trade set-up is recommended: Timeframe: D1 Recommendation: Long Position Entry Level: Long Position @ Retracements in the trend; buy orders during dips Take Profit Zone: 104.70 – 105.10 Stop...

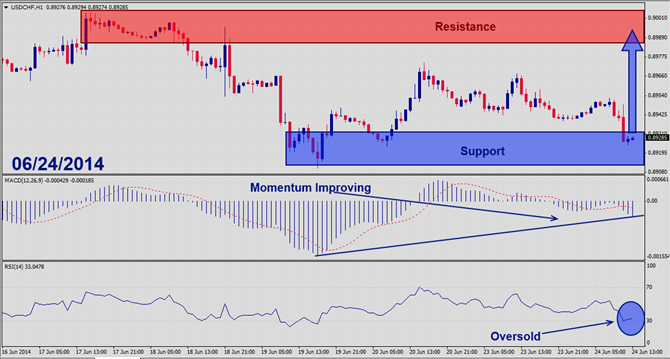

Should price action for the USDCHF remain inside the 0.8920 to 0.8940 zone the following trade set-up is recommended: Timeframe: H1 Recommendation: Long Position Entry Level: Long Position @ 0.8930 Take Profit Zone: 0.8990 – 0.9010 Stop Loss Level: 0.8890 Should price action for the USDCHF breakout above 0.8940 the following trade set-up is recommended: Timeframe: H1 Recommendation: Long Position Entry Level: Long Position @ Retracements in the trend; buy orders during dips Take Profit Zone: 0.8990 – 0.9010 Stop...

This week we saw the most anticipated economic report out of the U.S.; non-farm payrolls. Non-farm payrolls are released every first Friday of the each month for the previous month. Financial markets were very nervous about this report as the Fed is looking to reduce stimulus which was the only driver of the global equity market rally. Forex traders were also anxious to get the official figure after the ADP report, once again, hinted at weakness in the U.S. labor market. The fear was that a number above 200,000, which would be good...

This week was all about jobs, jobs and jobs. On Wednesday we received ADP data which pointed to a slowdown in private sector hiring (Protection against Friday’s Employment Disappointment). Economic data out of the U.S. from GDP figures to manufacturing data point to a much weaker economy. The Eurozone is expected to contract further and economic data out of China as well as Australia point to sluggish growth. The ECB has cut interest rates by 25 basis points to 0.5% in response to a deeper economic contraction primarily due to...

Should price action for the USDJPY remain inside the 101.50 to 101.90 zone the following trade set-up is recommended: Timeframe: W1 Recommendation: Short Position Entry Level: Short Position @ 101.80 Take Profit Zone: 91.60 – 92.00 Stop Loss Level: 103.40 Should price action for the USDJPY breakdown below 101.50 the following trade set-up is recommended: Timeframe: W1 Recommendation: Short Position Entry Level: Short Position @ Retracements in the trend; sell orders during rallies Take Profit Zone: 91.60 – 92.00...