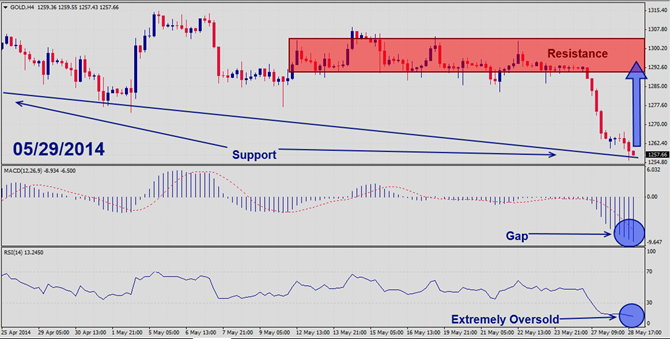

Should price action for Gold remain inside the 1,256 to 1,260 zone the following trade set-up is recommended: Timeframe: H4 Recommendation: Long Position Entry Level: Long Position @ 1,257 Take Profit Zone: 1,294 – 1,300 Stop Loss Level: 1,240 Should price action for Gold breakout above 1,260 the following trade set-up is recommended: Timeframe: H4 Recommendation: Long Position Entry Level: Long Position @ Retracements in the trend; buy orders during dips Take Profit Zone: 1,294 – 1,300 Stop Loss Level: 1,240...

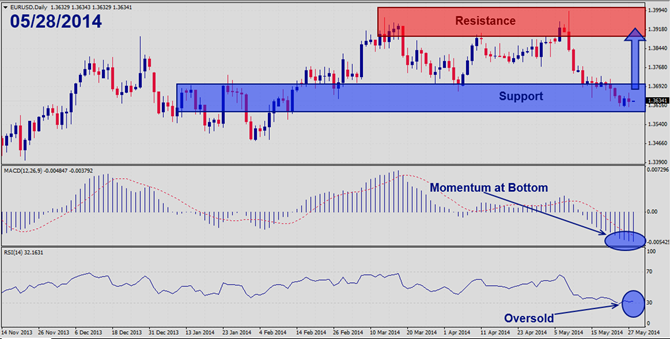

Should price action for the EURUSD remain inside the 1.3610 to 1.3640 zone the following trade set-up is recommended: Timeframe: D1 Recommendation: Long Position Entry Level: Long Position @ 1.3620 Take Profit Zone: 1.3910 – 1.3940 Stop Loss Level: 1.3500 Should price action for the EURUSD breakout above 1.3640 the following trade set-up is recommended: Timeframe: D1 Recommendation: Long Position Entry Level: Long Position @ Retracements in the trend; buy orders during dips Take Profit Zone: 1.3910 – 1.3940 Stop...

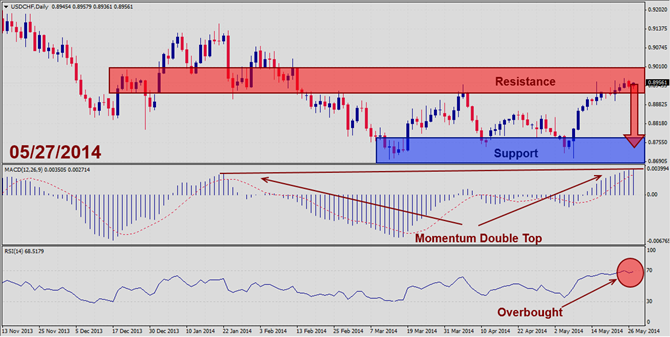

Should price action for the USDCHF remain inside the 0.8930 to 0.8970 zone the following trade set-up is recommended: Timeframe: D1 Recommendation: Short Position Entry Level: Short Position @ 0.8960 Take Profit Zone: 0.8710 – 0.8740 Stop Loss Level: 0.9060 Should price action for the USDCHF breakdown below 0.8930 the following trade set-up is recommended: Timeframe: D1 Recommendation: Short Position Entry Level: Short Position @ Retracements in the trend; sell orders during rallies Take Profit Zone: 0.8710 – 0.8740...

PaxForex closed the third trading week with 1,160 pips in net profits after closing two trading positions; the net profits came from two closed gold short positions while no forex trades were closed during the week. This boosted net profits for May to 5,185 pips. We had the following five trading recommendations this week: Monday, May 19th – GBPUSD May 19th 2014; Short @ 1.6720 and 1.6840; Long @ 1.6825 and 1.6840 Tuesday, May 20th – USDCHF May 20th 2014; Short @ 0.8885 and 0.8935 Wednesday, May 21st – EURUSD May 21st 2014;...

Supply and demand is the simple concept behind all price movements in the forex market and no two fundamental economic indicators are better suited to measure supply and demand than capital and trade flow. Capital flow measures the money that is flowing in and out of an economy for investment purposes. As money flows in and out of an economy the supply of demand for that economy’s currency rises and falls. This causes the value of that currency to rise and fall as well. Just as the importing or exporting of goods shifts the...