NZD/USD is trading above 0.61 after yesterday's quiet holiday which undermined market liquidity. Analysts of ANZ Bank fear that the positions of the kiwi are vulnerable and the pair may gradually give up positions, as now the markets are laying in the prices of improvement in New Zealand, and the slowdown in the global economy will adversely affect the rate of kiwi.

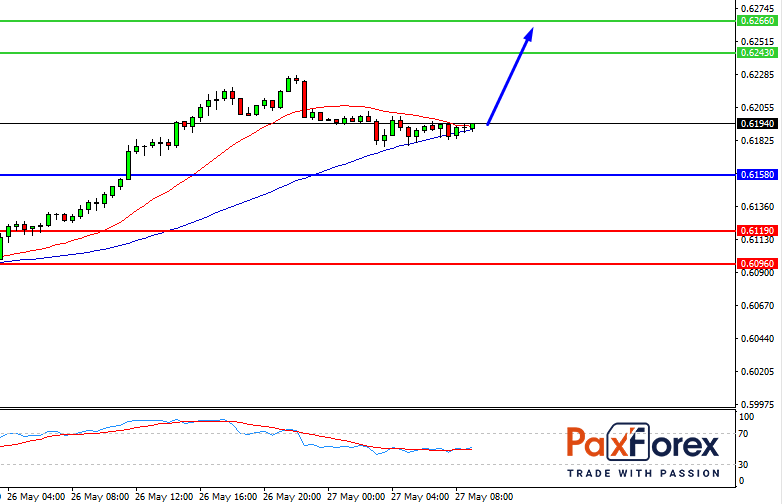

NZD/USD, 30 min

Pivot: 0.6195

Analysis:

Provided that the currency pair is traded above 0.6158, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 0.6195

- Take Profit 1: 0.6243

- Take Profit 2: 0.6266

Alternative scenario:

In case of breakdown of the level 0.6158 follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 0.6158

- Take Profit 1: 0.6119

- Take Profit 2: 0.6096

Comment:

RSI is above 50. MACD is below its signal line and positive. The pair can recover. Moreover, the pair is traded at 20 mA (0.6199), but above 50 mA (0.6184).

Key levels:

| Resistance | Support |

| 0.6289 | 0.6158 |

| 0.6266 | 0.6119 |

| 0.6243 | 0.6096 |

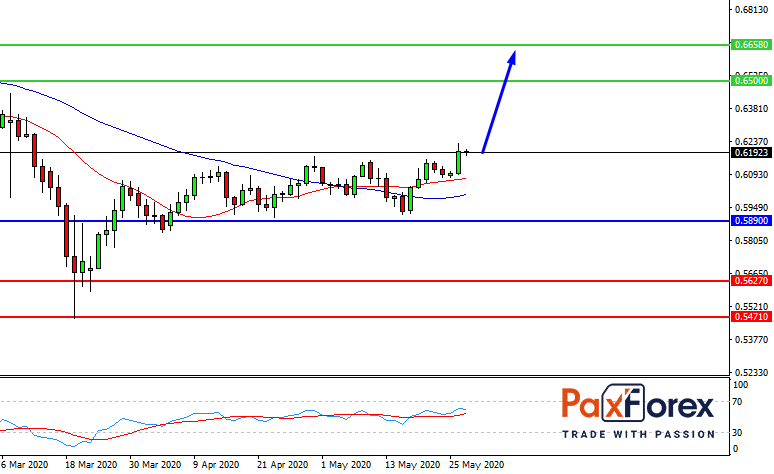

NZD/USD, D1

Pivot: 0.6180

Analysis:

While the price is above 0.5890, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 0.6180

- Take Profit 1: 0.6500

- Take Profit 2: 0.6658

Alternative scenario:

If the level 0. 5890 is broken-down, follow the recommendations below.

- Time frame: D1

- Recommendation: short position

- Entry point: 0.5890

- Take Profit 1: 0.5627

- Take Profit 2: 0.5471

Comment:

RSI is above 50. MACD is positive and above the signal line. The configuration is positive. Moreover, the pair is above its 20 and 50 MA (0.6075 and 0.5997 respectively).

Key levels:

| Resistance | Support |

| 0.6817 | 0.5890 |

| 0.6658 | 0.5627 |

| 0.6500 | 0.5471 |