Fed has left the interest rates unchanged and they will remain at this level for a while, which makes the precious metal cheaper. And in the future unprecedented monetary stimulus from ECB and Fed is likely to reduce demand for gold.

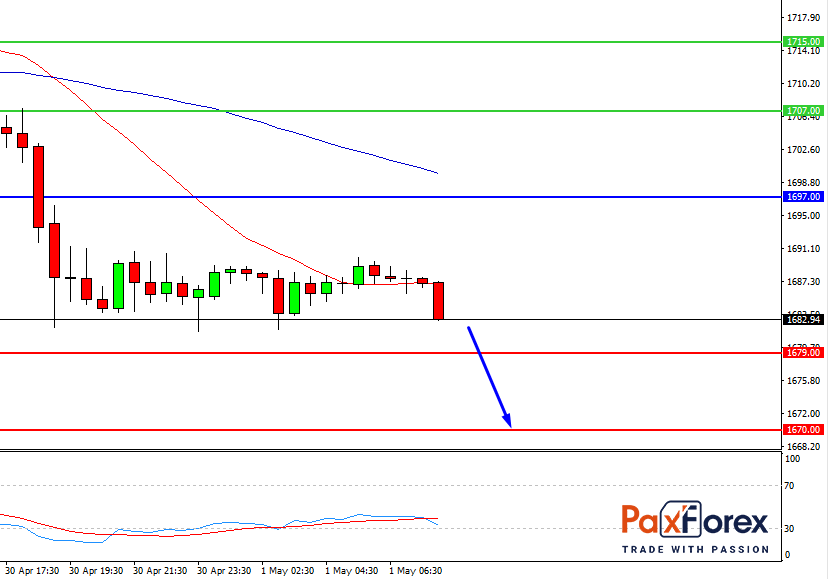

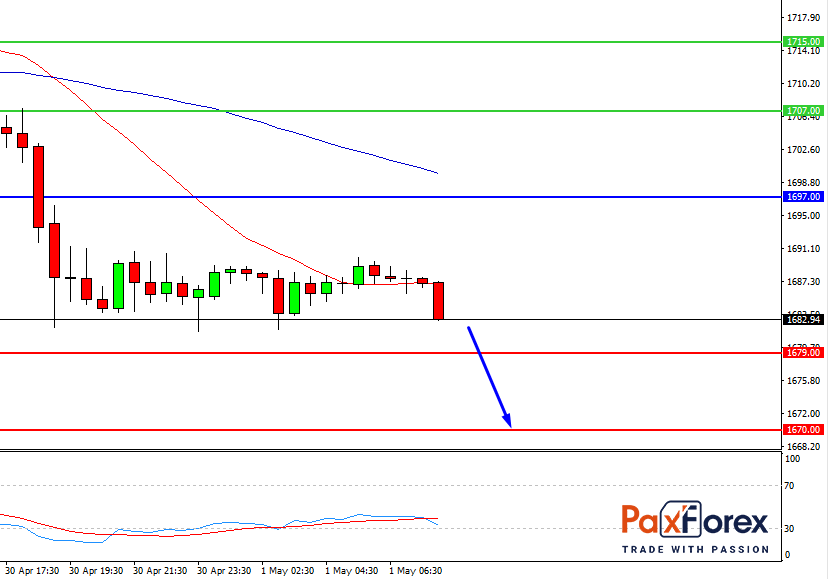

GOLD/USD, 30 min

Pivot: 1687.31

Provided that the price is below 1697.00, please follow these recommendations:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 1687.31

- Take Profit 1: 1679.00

- Take Profit 2: 1670.00

Alternative scenario:

In case of breakout of the level 1697.00 and the consolidation of the price above this level, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 1697.00

- Take Profit 1: 1707.00

- Take Profit 2: 1715.00

Comment:

RSI shows the possibility of a descending trend during the day.

Key levels:

| Resistance | Support |

| 1715.00 | 1679.00 |

| 1707.00 | 1670.00 |

| 1697.00 | 1658.00 |

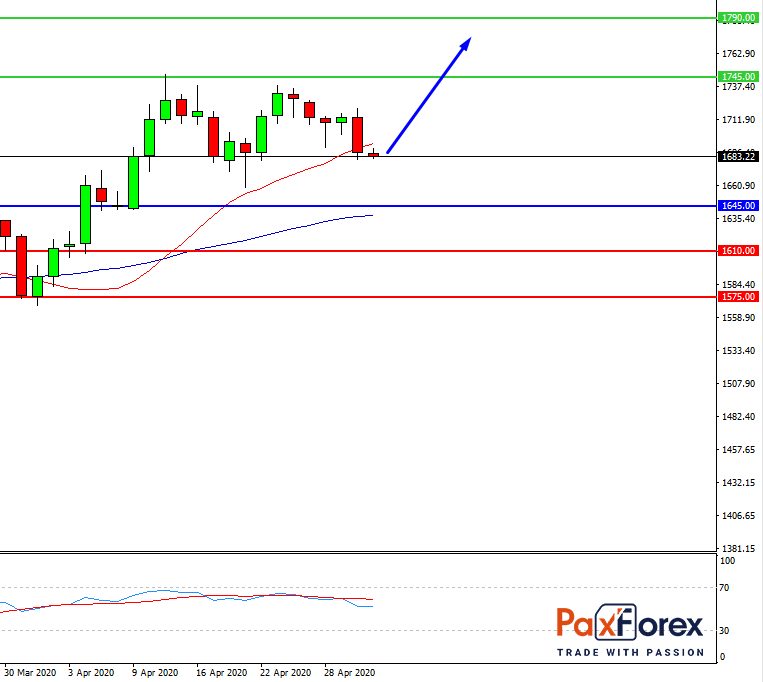

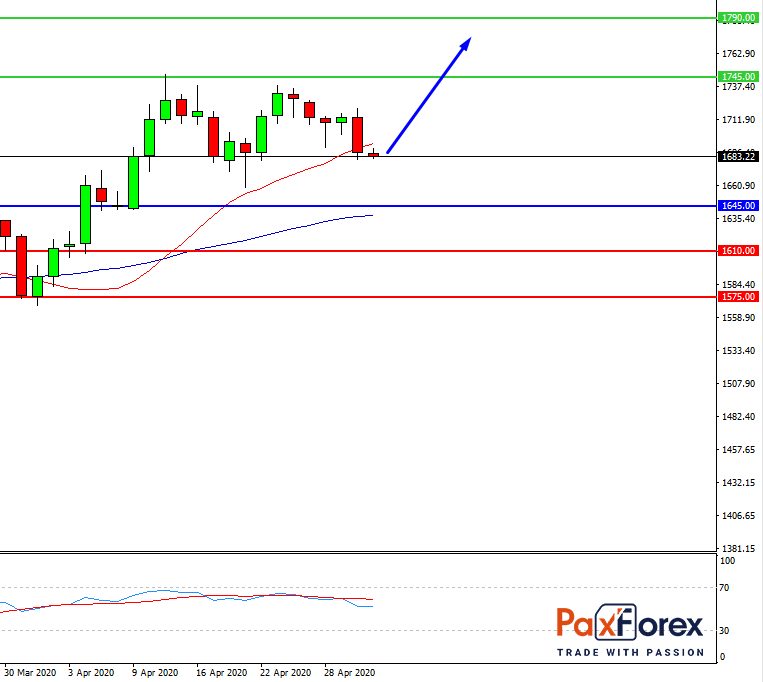

GOLD/USD, D1

Pivot: 1709.62

As long as the price is above 1645.00, please follow these recommendations:

- Time frame: D1

- Recommendation: long position

- Entry point: 1709.62

- Take Profit 1: 1745.00

- Take Profit 2: 1790.00

Alternative scenario:

In case of breakdown of the level 1645.00 follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 1645.00

- Take Profit 1: 1610.00

- Take Profit 2: 1575.00

Comment:

RSI shows an upward trend in the medium term.

Key levels:

| Resistance | Support |

| 1835.00 | 1645.00 |

| 1790.00 | 1610.00 |

| 1745.00 | 1575.00 |

We are one of the fastest growing Forex Brokers in the Market. Trade with PaxForex to get the full Forex Trading experience which is based on...

- The Reliability on all Assets in the Market

- Trusted Worldwide for over a Decade

- Live Multi-Lingual Online Support 24/5