According to Andy Haldane, Chief Economist of the Bank of England:

- The incoming data turned out to be a bit better than the scenario of the Central Bank.

- In the 2nd quarter the drawdown of the British economy may exceed 20%.

- Survey results reflect some stabilization, moderate recovery in costs and business sentiment

- No one's predicting a sharp bounce.

- Recovery can be V-shaped but at very slow recovery rates.

- Employment rates may not return to "previous" levels until 2023.

- The Central Bank is studying the effects of negative interest rates

- The key aspects that need to be considered are the impact of such rates on the financial sector and confidence in the economy.

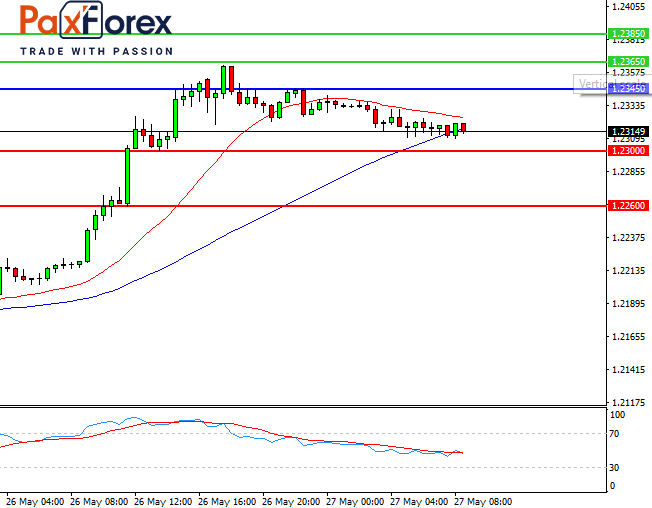

GBP/USD, 30 min

Pivot: 1.2203

Analysis:

Provided that the currency pair is traded below 1.2345, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 1.2312

- Take Profit 1: 1.2300

- Take Profit 2: 1.2260

Alternative scenario:

In case of breakout of the level 1.2345, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 1.2345

- Take Profit 1: 1.2365

- Take Profit 2: 1.2385

Comment:

RSI shows the possibility of a downtrend during the day.

Key levels:

| Resistance | Support |

| 1.2385 | 1.2300 |

| 1.2365 | 1.2260 |

| 1.2345 | 1.2220 |

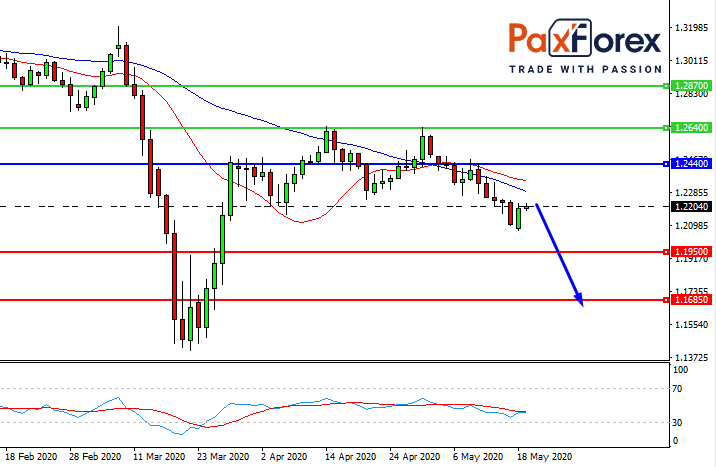

GBP/USD, D1

Pivot: 1.2184

Analysis:

While the price is below 1.2440, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 1.2184

- Take Profit 1: 1.1950

- Take Profit 2: 1.1685

Alternative scenario:

If the level 1.2440 is broken-out, follow the recommendations below.

- Time frame: D1

- Recommendation: long position

- Entry point: 1.2440

- Take Profit 1: 1.2640

- Take Profit 2: 1.2870

Comment:

RSI shows the possibility of a downtrend in the medium term.

Key levels:

| Resistance | Support |

| 1.2870 | 1.1950 |

| 1.2640 | 1.1685 |

| 1.2440 | 1.1430 |

We also advise you to pay attention to the following currency pairs for intra-day trading:

AUD/USD – buy above 0.6625 with 0.6675 and 0.6695 as Take Profit targets. Alternative scenario - if the level of 0.6625 is broken-down, you should consider selling with the targets 0.6600 and 0.6575 as Take Profit.

USD/CAD - short positions below 1.3825 with 1.3745 and 1.3720 targets as Take Profit. Alternative scenario - if the level of 1.3825 is broken-out, buy with the targets 1.3860 and 1.3890 as Take Profit.

EUR/USD – sell below 1.0975 with 1.0930 and 1.0915 targets as Take Profit. Alternative scenario - if the level 1.0975 is broken-out, buy with the TP 1.0995 and 1.1010.