Many forex traders tend to overlook the Scandinavian forex market. Some of the reasons for this oversight include the size of the market as compared to major currencies, the liquidity for currency pairs which are traded in the Norwegian Krone, the Danish Krone and the Swedish Krona or the higher spreads which usually come with minor currency pairs. It is a big mistake to single out the Scandinavian economies as there is a lot of profit potential embedded into the currencies which makes it a perfect addition to any forex portfolio which is looking to diversify in order to spread risk around.

One big fundamental change which is coming Norway’s and Sweden’s way is a predicted correction in its red-hot housing market. Norway is heavily dependent on the oil market and as prices slumped last year, the negative economic impact was buffered by the strength in its booming housing market. Last week’s data indicated that a housing recovery is imminent which led investor’s to sell the Norwegian Krone. Norway’s Prime Minister is not worried about the fall in the currency as ‘A weak krone level is pretty good for Norwegian business and competitiveness.’

Housing prices managed a minor recovery in October, but the housing market is currently down 2.0% from its peak. Prior to October, house prices declined for six consecutive months. Planned changes to the stimulus as part of a new budget plan for 2018 in Norway as well as a change in the monetary policy are both expected to have a negative impact on the housing market. The silver lining could be a recovery in the oil sector thanks to an increase in the price of crude. Norway is also trying to reign in lending in order to fight high consumer debt and a bubbling housing market.

PaxForex offers its forex traders a wide range of currency pairs for all three Scandinavian crosses. Take advantage of fast execution and download your MT4 trading platform today. Don’t shy away from minor currency pairs and diversify your trading account by adding the Norwegian Krone, the Danish Krone and the Swedish Krona to your portfolio.

Norway is the only Scandinavian economy which has positive interest rates at an all-time low of 0.50%. Sweden’s interest rate currently stands at -0.50% and Denmark has the lowest interest rate at -0.65%. Norway’s central bank is likely the first one to increase interest rates which is something forex traders needs to keep in mind, especially those who intend longer term trades in the Scandinavian currencies, as it will impact swap rates. Here are three way’s to pip your forex portfolio.

Forex Profit Set-Up #1; Sell GBPNOK - D1 Time-Frame

The GBPNOK puts two ‘troubled’ currencies against each other. On one side is the British Pound which is plagued by Brexit uncertainty and on the other side is the Norwegian Krone which could see a housing market collapse. Keep in mind that the last global financial crisis was sparked by a correction in the US housing market. While Norway is nowhere near the size of the US, a collapse in Norway will have a ripple effect throughout Scandinavia.

The GBPNOK has advanced inside a bullish price channel, but the latest D1 candlestick shows an inverted hammer at a strong resistance level which indicates a reversal is imminent. In addition the CCI has formed a negative divergence while it is trading above the 100 mark. A breakdown below is expected to trigger profit taking which will accelerate downside momentum. Take this trade with PaxForex today and earn profits tomorrow.

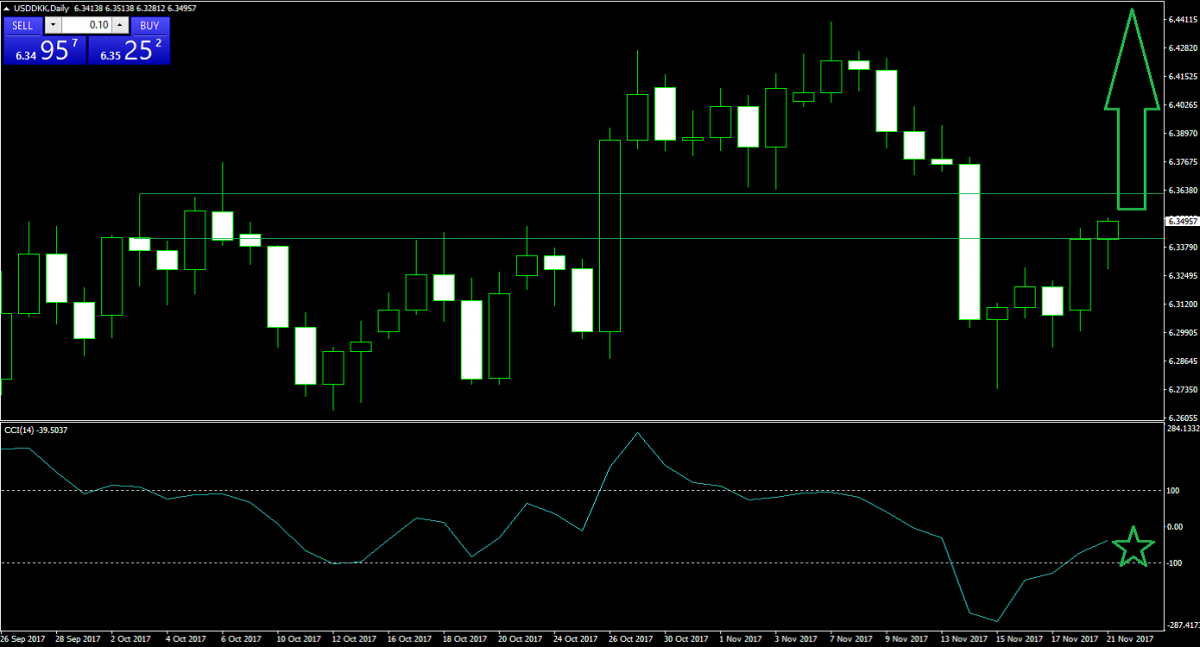

Forex Profit Set-Up #2; Buy USDDKK - D1 Time-Frame

This currency pair is currently in the midst of a bounce higher after collapsing to a low 6.27385. The sell-off was sharp and lasted five trading sessions as forex traders reacted to the potential correction in the Norwegian housing market. The advance from its low has taken the USDDKK back inside of a solid support area from where more upside should be expected, especially as short-covering will be replaced by new net long positions.

The CCI has already completed a breakout above the -100 mark which resulted in a change of momentum for this currency pair. PaxForex offers excellent trading conditions for all its traders, regardless of where they are on their path to create a sustainable income from trading forex.

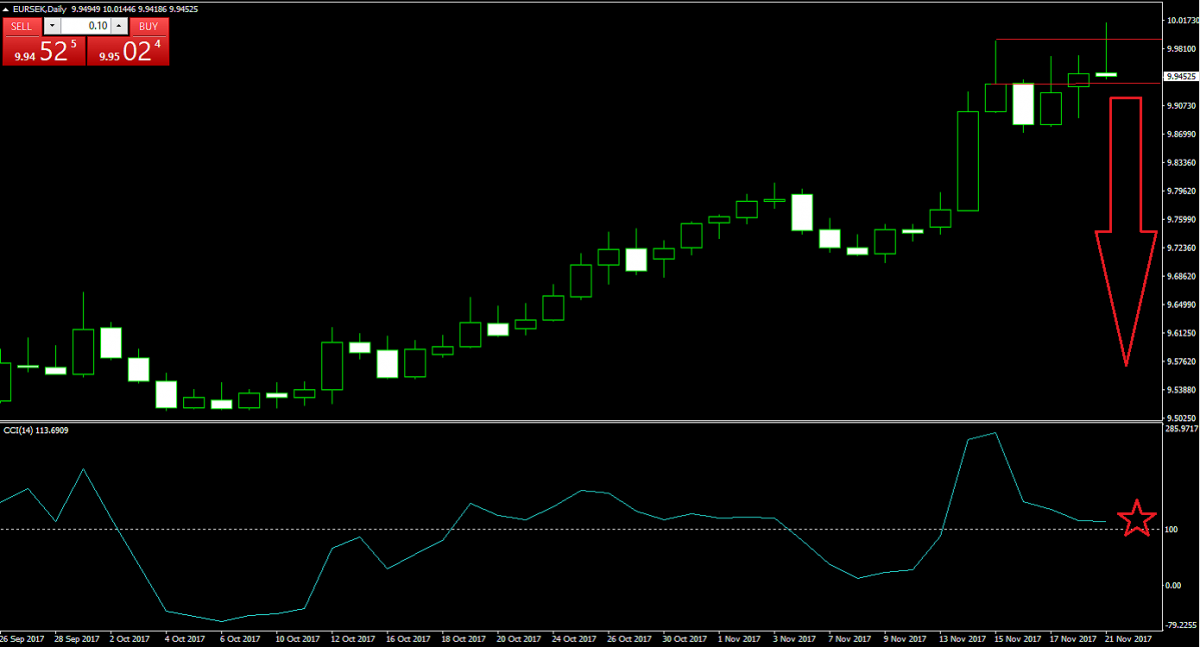

Forex Profit Set-Up #3; Sell EURSEK - D1 Time-Frame

The EURSEK offers the biggest profit potential from our three Scandinavian themed currency trades. Upward momentum is currently being depleted inside of a horizontal resistance area which rejected a breakout. The latest candlestick has formed an inverted hammer inside of its resistance area which further points towards a collapse in the up-trend. A 50% correction from the advance is expected at which point price action needs to be evaluated further.

The CCI continues to trade above the 100 mark, an indication of an extreme overbought condition, but is well off of its most recent high. A breakdown below 100 is predicted to flood this currency pair with a wave of sell orders. Stay informed with daily trading recommendations from PaxForex.

To receive new articles instantly Subscribe to updates.