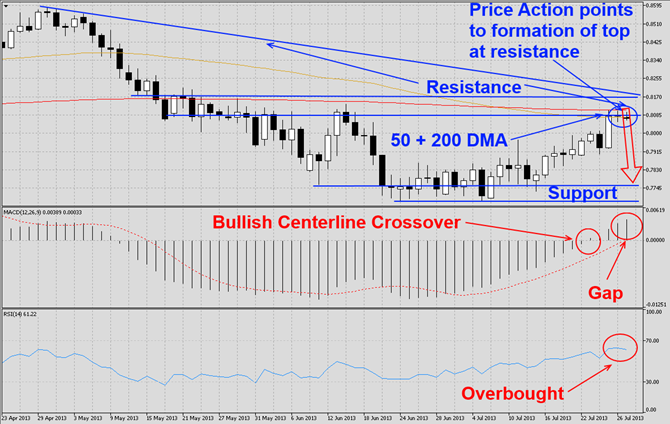

The NZDUSD has rallied from strong support levels as visible in this D1 chart. This currency pair has now ran into quadruple resistance which is made-up of its 50 DMA, 200 DMA, strong horizontal resistance as well as descending resistance from its previous high. Price action indicates that this currency pair is forming a top as the last two daily candlestick patterns formed a star as well as inverted hammer and we expect it to correct back to support levels.

MACD completed a bullish center crossover which we expect to reverse as the histogram gaped away from its moving average which remains in bearish territory. RSI has reached overbought territory and is pending a breakdown which we think will initiate the correction.

We recommend a short position at 0.8100 with a take profit target of 0.7950. This will be an addition to our previous short position which we took on July 19th at 0.7950 and our two long positions which we took on May 16th and May 18th at 0.8185 and 0.8075 respectively.

Traders who wish to exit this trade at a loss are advised to place their stop loss level at 0.8200. We will not use a stop loss level and execute this trade as recommended. Place your take profit target at 0.7950 for both short positions and 0.8185 for both long positions.

Here are the reasons why we call the NZDUSD currency pair lower

- The NZDUSD is currently trading at quadruple resistance levels posted by its 50 DMA, 200 DMA, horizontal as well as descending resistance levels

- MACD histogram gaped away from its moving average which remains in bearish territory

- RSI is trading in oversold territory and is pending a breakdown

- Profit taking after good rally and at major resistance zone

- New institutional short positions by swing traders

Open your PaxForex Trading Account and add this currency pair to your forex portfolio.