Source: PaxForex Premium Analytics Portal, Fundamental Insight

The New Zealand Performance of Services Index for March was reported at 52.4. Forex traders can compare this to the New Zealand Performance of Services Index for February, reported at 49.7.

The Japanese Trade Balance for March was reported at ¥663.7B. Economists predicted a figure of ¥490.0B. Forex traders can compare this to the Japanese Trade Balance for February, reported at ¥215.9B. The Japanese Adjusted Trade Balance for March was reported at ¥0.30T. Forex traders can compare this to the Japanese Adjusted Trade Balance for February, reported at -¥0.01T. Exports for March increased by 16.1% annualized and Imports by 5.7% annualized. Economists predicted an increase of 11.6% and 4.7%. Forex traders can compare this to Exports for February, which decreased by 4.5% annualized, and to Imports which increased by 11.8% annualized.

Final Japanese Industrial Production for February decreased by 1.3% monthly and by 2.0% annualized. Forex traders can compare this to Japanese Industrial Production for January, which increased by 3.1% monthly and decreased by 5.3% annualized. Capacity Utilization for February decreased by 2.8% monthly. Forex traders can compare this to Capacity Utilization for January, which increased by 3.2% monthly.

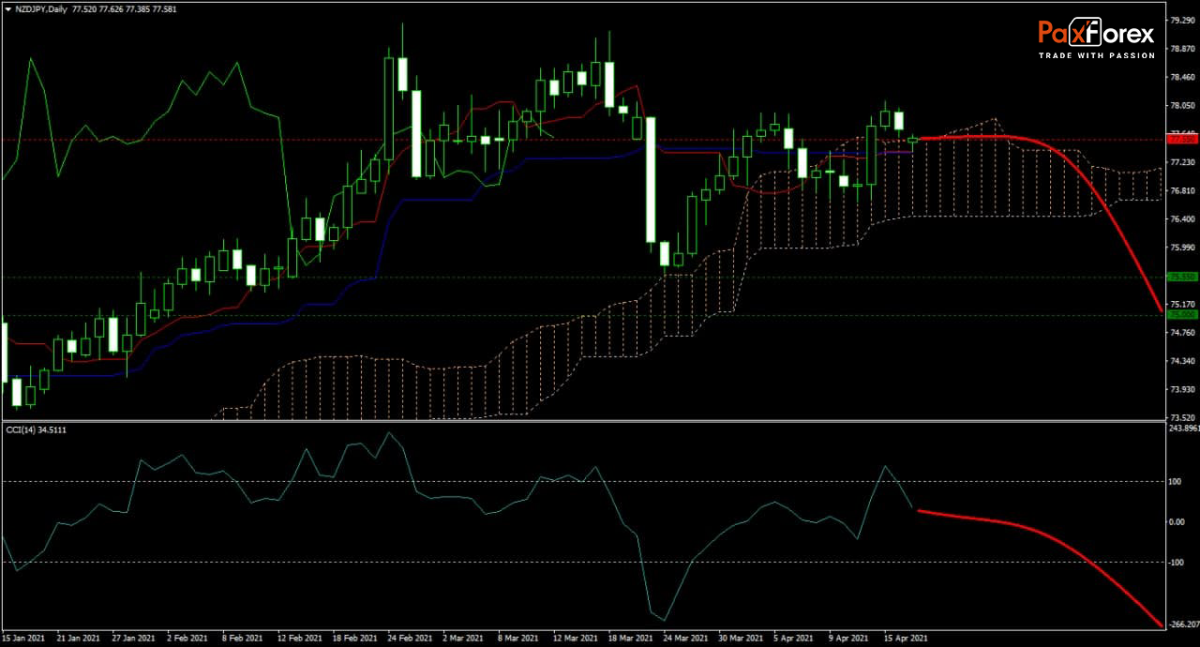

The forecast for the NZD/JPY remains bearish with rising global risks. The double-mutation in the latest Indian strain of Covid-19 is likely to spread globally, and hopes for an open summer season are misplaced. After price action created three lower high, the Ichimoku Kinko Hyo Cloud ended its ascend and started to narrow. The Kijun-sen and Tenkan-sen flatlined, and the next move is likely to the downside. Following the move out of extreme overbought territory by the CCI, more downside is expected to lead price action into a correction. Will bears continue to gather strength and force the NZD/JPY into a bigger sell-off?

Should price action for the NZD/JPY remain inside the or breakdown below the 77.400 to 77.900 zone, the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 77.550

- Take Profit Zone: 75.000 – 75.550

- Stop Loss Level: 78.350

Should price action for the NZD/JPY breakout above 77.900, the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 78.350

- Take Profit Zone: 79.150 – 79.550

- Stop Loss Level: 77.900

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.