Trading forex means that participants engage into transactions in the world’s largest and most liquid financial market. Over $6 trillion exchange hands every single trading day in this decentralized market and unlike equity markets, the forex market is open for business 24 hours from Monday through Friday. This is one of the biggest reasons why forex trading has increased in popularity and attracted many retail traders from all over the world. It has taken the position of possibly the most sought after part-time job, as traders are not bound by operating hours and can trade according to their schedule.

Another reason why more and more traders open accounts with forex brokers is the small capital requirements to get started. Unlike other markets which require larger sums in order to trade, new forex accounts can be opened from as little as $1. The majority of new traders understand that such a deposit will not get them anywhere and a preferred starter account is often opened with a deposit between $100 and $200 with follow-on deposits. Leverage is added on top of that which gives traders a foundation from where they can grow their account.

The most efficient way to grow your account is through placing accurate trades. This in combination with small add-on deposits should form the foundation for traders to increase their balance over time. In order to to successfully trade, one needs to develop a strategy and while this may sound very simple it is a task which will require time as well as patience. First a traders needs to decide if a fundamental or a technical approach suits their overall trading personality. This can often be achieved through trial and error. Fundamental traders should not ignore technical aspects and technical traders need to be aware of fundamental developments as well.

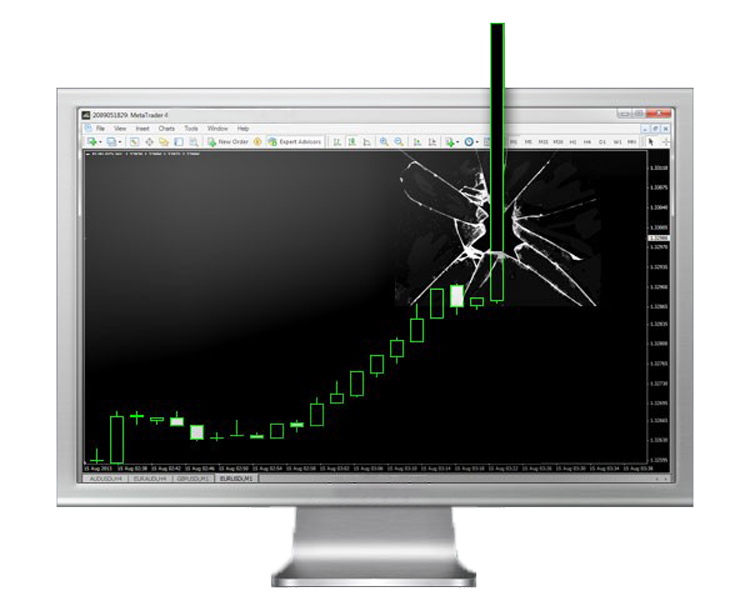

When a technical strategy is favored, there are plenty of indicators to chose from; very few even entertain the idea of creating a forex strategy without indicator. Price action is a very familiar term to the majority of new and seasoned traders, but the purest form of price action trading and strategies does not rely on indicators. Forex traders simply look at the chart, often illustrated with candlesticks, and make trading decisions based on it. This is also called naked trading as nothing clutters the chart and one can focus on price action only.

When it comes to indicators they either lag price action, hence the term lagging indicators, or they lead price action which is why they are termed leading indicators. A lagging indicator means that what the indicator reveals is already priced in. Many traders therefore dismiss lagging indicators as irrelevant. A leading indicator is supposed to reveal where price action may be headed, but given the lack of reliability in many trading scenarios makes a leading indicator less trustworthy. When it comes to creating a trading strategy which is viable it is important to receive more than just one trading signal from different sources.

Since various trading signals are required, many don’t understand how a forex chart free of indicators can result in a profitable trading strategy. In order tor receive multiple trading signals for a currency pair, new traders often clutter their charts which will increase the likelihood of trading signals. This approach results in losses for the strategy. Trading signals should come natural and not be forced by applying many indicators. On top of that many indicators measure the same aspects like momentum or oversold/overbought levels. Using duplicate indicators can make a strategy less accurate as key aspects are missing.

When creating a forex strategy without indicator, the traders will rely purely on price action. Candlestick charts are the preferred set-up as it gives plenty of insight of what is happening to price in a given time period. The three most common trading signals which will be delivered by this approach come from candlestick formations, candlestick positions as well as chart patterns. This combination can result in very powerful and accurate trading signals. In order to round up this strategy, forex traders should keep an eye out on fundamentals in order to time their entries with the greatest possible efficiency.

To receive new articles instantly Subscribe to updates.