Timeframe: D1 Recommendation: Short Position

Entry Level: Short Position @ 102.50

Hedge Level: Stop Buy Order @ 104.00 (Take Profit Level @ 105.00)

Take Profit Zone: 100.00 – 100.50

Stop Loss Level: 104.00 (We will not use a stop loss order and execute this trade as advised below)

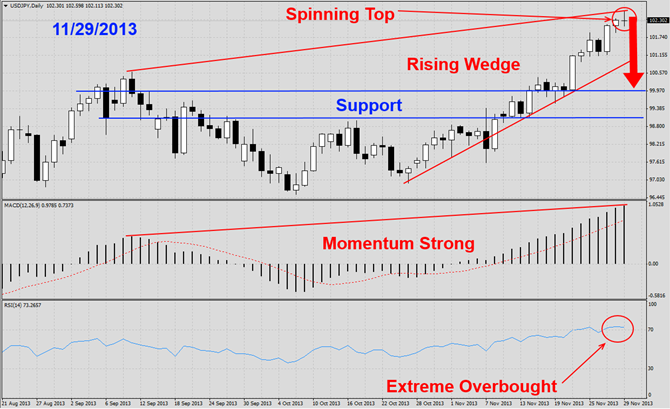

The USDJPY has rallied after it broke out from its previous horizontal resistance zone as visible in this daily chart (D1). This currency pair has now formed a rising wedge formation which is a reversal pattern and marked by red lines in the above chart. Additionally the current candlestick pattern formed a spinning top at resistance, marked by a red circle, which is another strong bearish signal. We expect the USDJPY to correct back down into its horizontal support zone which is marked in blue.

MACD shows strong momentum, but we expect the histogram to start trading below its moving average once the correction is complete. RSI is trading in extreme overbought territory and a breakdown should fuel the correction.

We recommend a short position at 102.50. We also recommend a stop buy order at 104.00 with a take profit target of 105.00 in order to hedge our short position and before adding new short positions to this trade. This will be an addition to our previous short position.

Traders who wish to exit this currency trade at a loss are advised to place their stop loss order at 104.00. We will not use a stop loss order and execute this trade as recommended. Place your take profit order at 100.00.

Here are the reasons why we call the USDJPY currency pair lower:

- The USDJPY currency pair has formed a rising wedge formation which is a bearish chart pattern

- MACD shows strong momentum, but we expect a bearish histogram,-moving average crossover

- RSI is trading in extreme overbought territory and a breakdown should fuel the correction

- Profit taking in order to realize trading profits which should add to bearish pressures

- New short positions by institutional swing traders

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.