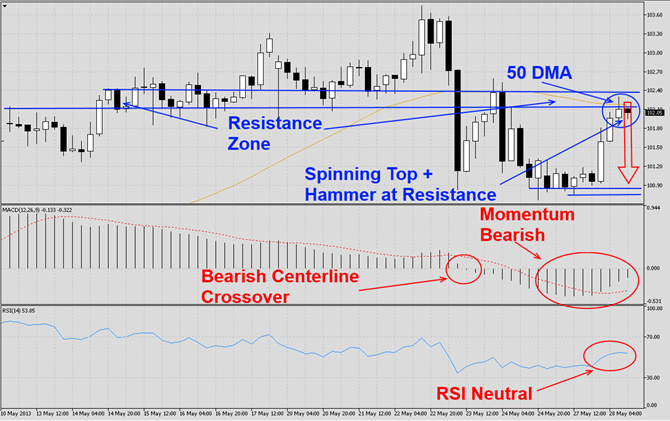

The USDJPY completed a major reversal trade on Thursday of last week. Today we witnessed a snap higher as visible in the H4 chart. Currently there are bullish as well as bearish forces acting on this currency pair which partially explains the increased volatility. This currency pair has formed a strong resistance zone above the 102 level which is also being enforced by its declining 50 DMA. The last two H4 candlesticks have formed a spinning top as well as a hammer formation at resistance which confirms overall bearishness.

MACD has completed a bearish centerline crossover and momentum confirms overall bearishness for this currency pair. We expect a small bounce before the downtrend in momentum continues. RSI is trading in neutral territory and does not offer any signal, but we expect a continuation of the downtrend which will push the RSI into oversold territory.

We recommend a short position at 102.20 with a potential second entry at 103.70. We also recommend a stop buy order at 103.00 in order to hedge the initial short position.

Traders who wish to exit this trade at a loss are advice to place their stop loss level at 103.00. We will not use a stop loss order and execute this trade as recommended. Place your take profit level 100.70.

Here are the reasons why we call the USDJPY currency pair lower

- USDJPY experienced a major reversal trade last Thursday

- USDJPY is trading in strong resistance zone

- Last two candlestick formations indicate bearish pressures

- MACD completed bearish centerline crossover and momentum remains bearish

- RSI expected to contract further

- Position squaring as well as profit taking

- More hawkish comments from the Bank of Japan

- Economic data which will indicate U.S. Dollar weakness

Open your PaxForex Trading Account today and add this currency pair to your forex portfolio.