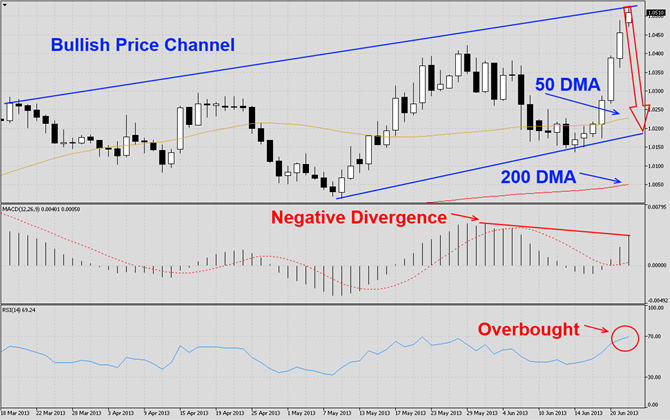

The USDCAD has entered a sharp rally over the past seven trading days as visible in this D1 chart. This currency pair has formed a bullish price channel which is a bullish chart formation, but has now approached its ascending resistance level. The upward move was too strong and too fast which make sit prone to a correction. We believe this pair will correct back down to its ascending support level before it makes another move higher.

MACD has completed a bullish centerline crossover which confirms the bullish chart formation, but has formed a negative divergence which suggests a directional change is likely. Additionally the histogram and moving average have become disconnected and formed a gap which we expect will be closed over the next few reading days. RSI has reached overbought territory and is approaching extreme conditions. A break-down should accelerate the sell-off.

We recommend a short position at 1.0520 with a potential second entry level at 1.0570. We also recommend a stop buy order at 1.0530 in order to hedge the initial short position against a price spike.

Traders who wish to exit this trade at a loss are advised to place their stop loss order at 1.0530. We will not use a stop loss order and execute this trade as recommended. Place your take profit level at 1.0400.

Here are the reasons why we call the USDCAD currency pair lower

- USDCAD has reached its ascending resistance level of its current chart formation

- USDCAD has rallied too much in a short time period which makes it prone to a correction

- MACD has formed a negative divergence and suggests a directional reversal

- RSI is trading in overbought territory and flirts with extreme conditions

- Profit taking before the end of Q2 and H1

- New institutional short positions from swing traders

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.