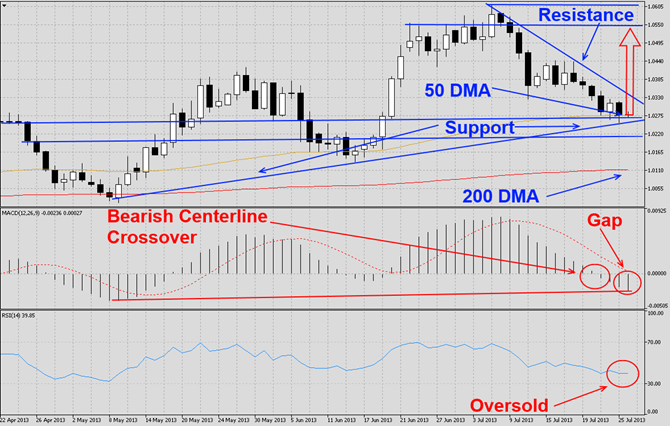

The USDCAD has corrected after it reached a multi-month high as visible in this D1 chart. This currency pair has moved lower and currently rests at solid horizontal as well as ascending support levels which are also enforced by its 50 DMA. We believe the USDCAD will attempt a rally as well as a breakout of its descending resistance level and move higher to either form a head-and-shoulders reversal pattern or a double top, both of which are bearish chart formations.

MACD has completed a bearish centerline crossover which we believe will turn out to be a false crossover and a contrarian sign. The histogram has formed a gap to its moving average which we believe will be closed during the move higher. RSI has reached oversold territory and a breakout should initiate the rally.

We recommend a long position at 1.0250 with a potential second entry level at 1.0100. We also recommend a stop sell order at 1.0175 in order to hedge the initial long position and before adding new positions to this trade.

Traders who wish to exit this trade at a loss are advised to place their stop loss at 1.0150. We will not use a stop loss order and execute this trade as recommended. Place your take profit at 1.0400.

Here are the reasons why we call the USDCAD currency pair higher

- USDCAD has corrected from multi-week highs and currently rests at horizontal as well as ascending support levels

- MACD histogram has gaped away from its moving average and we expect the gap to close

- RSI has reached oversold territory and we see a breakout in the next few trading sessions

- Profit taking in order to realize profits at very strong support levels

- New institutional long positions at robust twin support levels by swing traders

Open your PaxForex Trading Account and add this currency pair to your forex portfolio.