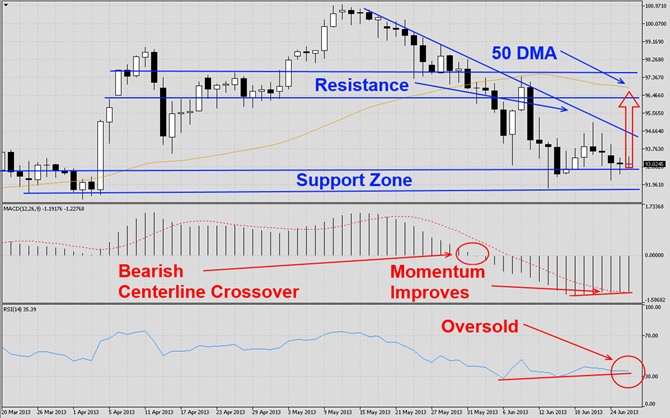

The CADJPY has corrected sharply as visible in this D1 chart. It has broken down below its 50 DMA and the correction has been halted by this currency pair’s strong support zone. The Japanese Yen has rallied strongly over the past four weeks and we expect traders to lock in profits which will start a short covering rally and push this currency pair past its descending resistance line and back towards horizontal resistance levels which are enforced by its 50 DMA.

MACD has completed a bearish centerline crossover, but bearish momentum has started to deteriorate and we believe it will gather strength during the short covering rally. RSI is trading in oversold territory after it broke out from extreme conditions and a breakout from oversold territory opens the path for a much stronger rally back into horizontal resistance.

We recommend a long position at 93.00 with a potential second entry at 91.00. We also recommend a stop sell order at 92.25 in order to hedge the initial long position and before adding new long positions to this trade.

Traders who wish to exit this trade at a loss are advised to place their stop loss order at 92.25. We will not sue a stop loss order and execute this trade as recommended. Place your take profit target at 95.00.

Here are the reasons why we call the CADJPY currency pair higher

- CADJPY is trading at strong support zone

- Price action indicates this currency pair attempts to stabilize

- MACD indicates bearish momentum is fading

- RSI is trading in oversold territory after it broke out from extreme conditions

- Short covering rally in order to lock in profits before the end of Q2 + H1

- New institutional long positions based on strong support zone

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.