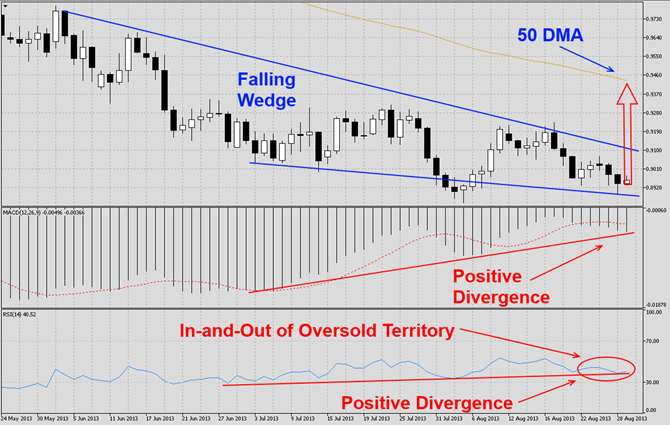

The AUDUSD has been under pressure for several trading months as visible in this D1 chart. This currency pair has broken down through all major support levels and corrected over 1,600 pips, but has now formed a falling wedge formation which is a bullish chart pattern. We expect this currency pair to launch a breakout from its current bullish chart pattern and rally back into its ascending 50 DMA. A breakout above that level would clear the way for another run at parity.

MACD has shown improvement in momentum during the sharp sell-off and has now formed a positive divergence which is another bullish indicator. We expect MACD to complete a bullish centerline crossover during the rally. RSI is trading in and out of oversold territory which indicates strength at current levels while it also formed a positive divergence.

We recommend a long position at 0.8880 which would be an addition to our two previous long positions we took on May 28th and June 25th at 0.9630 and 0.9230 respectively. We also recommend a stop sell order at 0.8800 with a take profit target of 0.8700.

Traders who wish to exit this trade at a loss are advised to place their stop loss level at 0.8780. We will not use a stop loss order and execute this trade as recommended. Place your take profit level for all long positions at 0.9450.

Here are the reasons why we call the AUDUSD currency pair higher

- The AUDUSD currency pair has been under pressure for an extended period of time, but has now formed a falling wedge formation which is a bullish chart formation

- MACD has indicated an improvement in momentum and formed a positive divergence which is another bullish sign

- RSI has formed a positive divergence as well and is trading in and out of oversold territory

- Profit taking in order to lock in trading profits after a solid correction

- New long positions by institutional swing traders at stable support levels

- AUD strength on the back of better than expected economic performance out of China

- USD weakness thanks to the US Fed

Open your PaxForex Trading Account and add this currency pair to your forex portfolio.