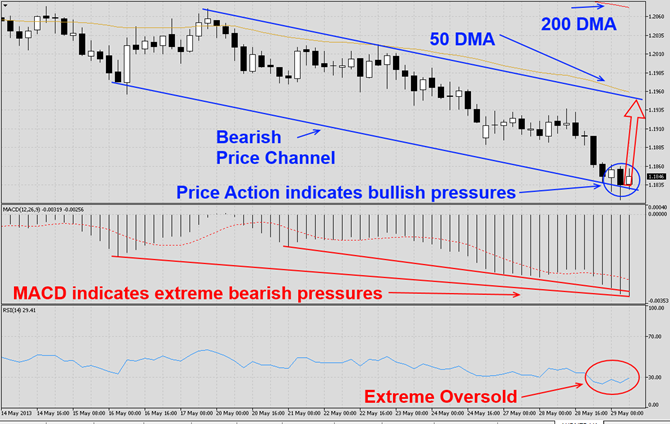

The AUDNZD currency pair has been stuck in a bearish price channel as visible in this H4 chart. After this currency pair briefly pierced its 50 DMA to the upside it started to contract and currently trades at its descending support level from its current chart formation. The last three H4 candlestick formations indicate the build-up in bullish pressures for this currency pair which should initiate a counter-trend rally and allow this currency pair to rally back into its ascending resistance level of its current chart formation which is also enforced by its descending 50 DMA.

MACD confirms the bearish price channel as momentum has declined together with price action. The extreme bearishness in MACD is a counter-trend indicator as we expect a reversal back above its moving average. RSI has corrected down into extreme oversold territory, but currently flirts with a break-out into oversold territory which should start the rally higher.

We recommend a long position at 1.1855 which will be an add-on trade to two previous long positions we took on April 18th and May 22nd at 1.2189 and 1.1974 respectively. We also recommend a stop sell order at 1.1795 in order to hedge against a potential capitulation sell-off.

Traders who wish to exit this trade at a loss are advice to place their stop loss order at 1.1795. We will not use a stop loss order and execute this trade as recommended. We have adjusted our take profit target for all open long positions to 1.2000.

Here are the reasons we call the AUDNZD currency pair higher

- AUDNZD trades at descending support levels of current bearish pattern

- Price action indicates bullish pressures build-up

- MACD offers counter-trend indicator

- SI is trading in extreme oversold territory and flirts with a break-out

- Profit taking which will lead to a short-covering rally

- Bargain hunters and hedge funds will seek to hedge their other AUD positions with this currency pair

Open your PaxForex Trading Account and add this currency pair to your forex portfolio.