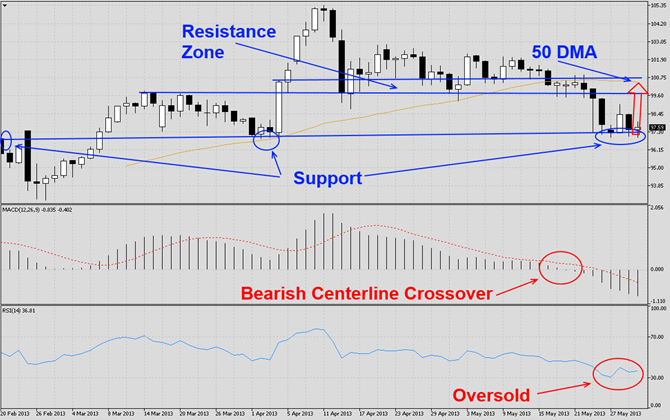

The AUDJPY currency pair has broken down below its 50 DMA as visible in this H4 chart after reaching a peak which was marked with a candlestick hammer formation and a subsequent melt-down in price action. This currency pair currently trades in at major support which indicates an imperfect triple bottom from which we believe it will rally back into its resistance zone which is also enforced by its 50 DMA.

MACD has completed a bearish centerline crossover and momentum remains in very bearish territory and disconnected from its moving average which indicates the current sell-off has been overdone and a potential counter-trend rally may take place before an overall downtrend may resume. RSI is trading in oversold territory and is in stable condition. Watch out for a breakout from current levels which should push this currency pair higher.

We recommend a long position at 97.30 with a potential second entry level at 95.30. We also recommend a stop sell order at 96.50 in order to hedge against a potential capitulation sell-off in this currency pair.

Traders who wish to exit this trade at a loss are advised to place their stop loss level at 96.50. We will not use a stop loss for this trade and execute the trade as recommended. Place your take profit level at 100.30.

Here are the reasons why we call the AUDJPY currency pair higher

- AUDJPY has corrected below its 50 DMA and formed a triple bottom

- Current price action is located at strong support levels

- Last four H4 candlestick formations indicate that this currency pair is gathering strength at support

- MACD offers counter-trend signal and suggest a rally

- RSI is trading in oversold territory and has stabilized

- Profit taking which will start a short-covering rally

- New long positions at strong support levels by institutional investors and traders

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.