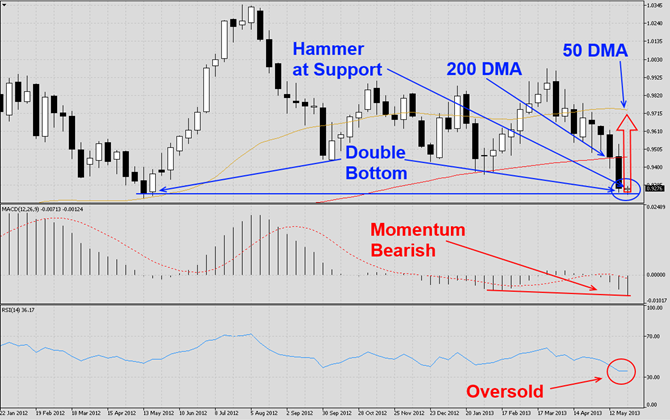

The AUDCHF has corrected sharply after reaching a multi-week high as visible in this W1 chart. This currency pair has broken down below its 50 DMA as well as 200 DMA and formed a double bottom chart pattern which is a bullish sign, especially on the longer time frames such as W1 and M1. The latest weekly candlestick which has formed indicates a hammer at support which is another strong bullish trading signal. We expect stability to form around current levels and expect a rally which should retest the 200 DMA and potentially fizzle out around the 50 DMA.

MACD indicated bearish pressures, but the moving average has crossed over into bullish territory briefly which was the first sign that bulls have attempted to at least stabilize the decline in this currency pair. The correction below its 200 DMA has forced MACD further into bearish territory and this indicator is disconnected from its own moving average. We expect bearishness to fade and MACD to return back to the centerline. RSI has dropped into oversold territory and flirts with a breakout which will fuel the rally.

We recommend a long position at 0.9265 which will be an add-on trade to our previous long position which we took on May 21st at 0.9490. We also recommend a stop sell order at 0.9215 in order to hedge against a more violent capitulation sell-off.

Traders who wish to exit this trade at a loss are advised to place their stop loss level at 0.9200. We will not use a stop loss order and execute this trade as recommended. We have adjusted our take profit level for this trade to 0.9425.

Here are the reasons why we expect the AUDCHF currency pair to rally

- The AUDCHF has formed a double bottom formation visible in its W1 chart

- Current price action is trading at major support levels

- The latest candlestick has formed a hammer at support

- MACD indicates last week may have been a capitulation sell-off

- RSI is trading in oversold territory and is flirting with a break-out

- Short-covering rally will add steam to the rally

- More stable economic news out of Australia

Open your PaxForex trading Account and add this currency pair to your forex portfolio.