The Final Japanese Leading Index for May was reported at 84.7, and the Final Japanese Coincident Index was reported at 90.2. Forex traders can compare this to the previous Japanese Leading Index for May, which was reported at 91.9 and to the previous Japanese Coincident Index, which was reported at 95.4. The Final German GDP for the first quarter decreased by 1.9% quarterly and 2.2% annualized. Economists predicted a decrease of 1.9% and 2.2% annualized. Forex traders can compare this to the previous first quarter German GDP report, which decreased 1.9% quarterly and by 2.2% annualized.

The German IFO Business Climate Index for May was reported at 79.5. Economists predicted a figure of 78.3. Forex traders can compare this to the German IFO Business Climate Index for April, which was reported at 74.2. The German IFO Current Assessment Index for May was reported at 78.9. Economists predicted a figure of 80.0. Forex traders can compare this to the German IFO Current Assessment Index for April, which was reported at 79.4. The German IFO Expectations Index for May was reported at 80.1. Economists predicted a figure of 75.0. Forex traders can compare this to the German IFO Expectations Index for April, which was reported at 69.4.

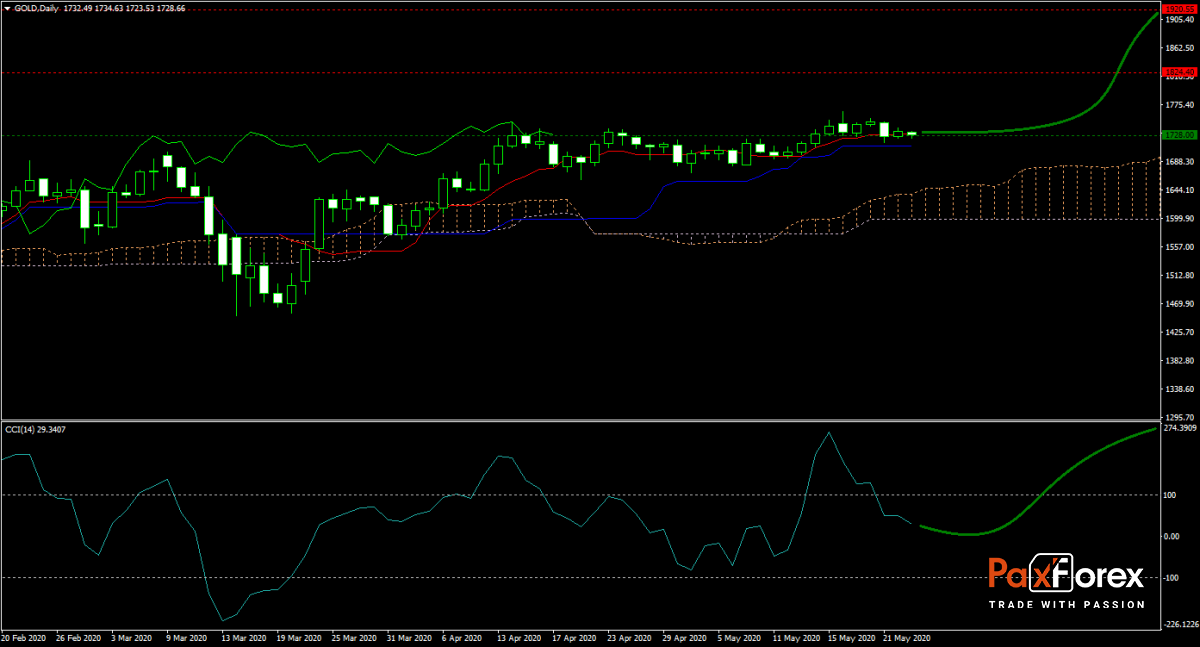

The GOLD/USD forecast remains bullish as traders keep safe-haven demand elevated. New global Covid-19 cases continue to rise, while governments continue to ease lockdown restrictions. US tensions with China are on course to reach new lows after China proposed a sweeping security law for Hong Kong. The Kijun-sen supports price action in gold for more upside, which could lead to a new all-time in this precious metal. Will bulls be able to keep the gradual advance intact? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for Gold remain inside the or breakout above the 1,712.00 to 1,740.00 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1,728.00

- Take Profit Zone: 1,824.40 – 1,920.55

- Stop Loss Level: 1,690.00

Should price action for Gold breakdown below 1,712.00 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1,690.00

- Take Profit Zone: 1,643.00 – 1,659.50

- Stop Loss Level: 1,712.00

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.