Source: PaxForex Premium Analytics Portal, Fundamental Insight

Chinese exports for November surprised to the upside, but imports disappointed, resulting in a spike in its trade surplus. Global supply chains continue to adjust despite attempts of meaningful rotation out of China. The world’s second-largest economy and global leader across many sectors solidified its position as a reliable manufacturing partner, trumping the US attempt to derail its progress.

With central banks continuing to print fiat money and devalue their currencies, together with a spike in global debt to record highs. The debt-to-GDP ratio is rallying towards 400%, well-above catastrophic levels. With the Covid-19 pandemic resulting in more severe government measures and lasting longer than expected, 2021 GDP may disappoint while debt will soar past estimates.

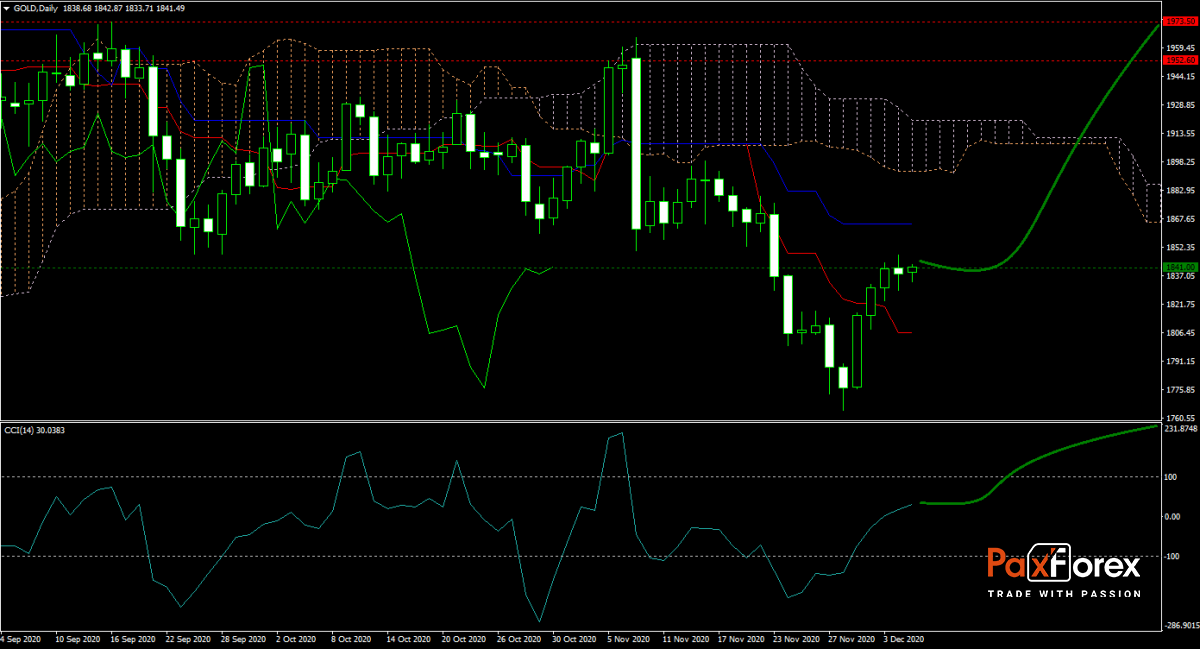

The forecast for the GOLD/USD remains bullish after price action reversed from its sell-off below 1,800. The Tenkan-sen and Kijun-sen started to trend sideways, suggesting bearish pressures are fading. With Covid-19 depressing global economic output, safe-haven assets like gold remain in demand. This precious metal is expected to accelerate above its Ichimoku Kinko Hyo Cloud. Can bulls gather enough power to push the XAU/USD into its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for XAU/USD remain inside the or breakout above the 1,829.00 to 1,848.00 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1,841.00

- Take Profit Zone: 1,952.60 – 1,973.50

- Stop Loss Level: 1,806.00

Should price action for XAU/USD breakdown below 1,829.00 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1,806.00

- Take Profit Zone: 1,760.35 – 1,776.60

- Stop Loss Level: 1,829.00

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.