Source: PaxForex Premium Analytics Portal, Fundamental Insight

Gold retreated from a new all-time high as profit-taking dropped price action back below the $2,000 level. Optimism over Covid-19 vaccines assisted the sell-off, but more government assistance out of the US and the additional debt load keeps demand elevated. Central banks have printed money to combat the pandemic, devaluating their currencies, driving risk-averse traders into the safety of gold. Since it is priced in US Dollars, weakness in the currency adds to upside momentum for this precious metal.

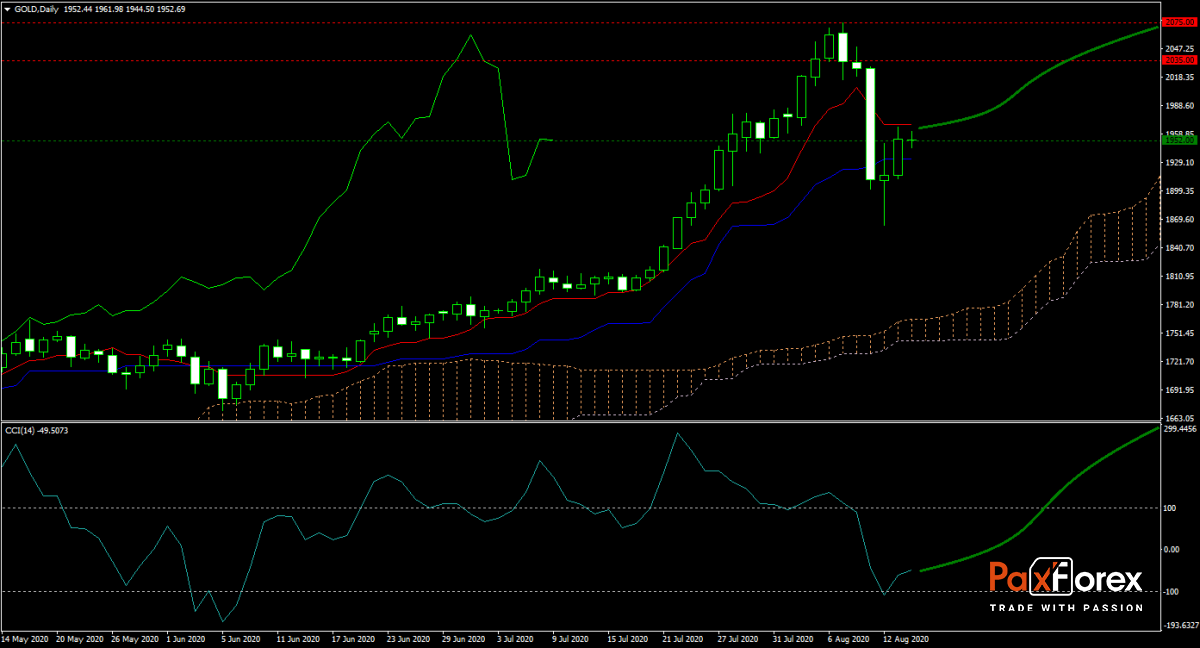

The forecast for the GOLD/USD turned bullish after the sell-off, with the global economic recovery anticipated to represent a slow overall ascend following a strong initial reversal against low comparisons. Price action is located between its Kijun-sen and its Tenkan-sen, with the Ichimoku Kinko Hyo Cloud ascending. Will bulls force gold back into its horizontal resistance area and pressure for new all-time highs? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for GOLD/USD remain inside the or breakout above the 1,933.00 to 1,969.00 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1,952.00

- Take Profit Zone: 2,035.00 – 2,075.00

- Stop Loss Level: 1,913.00

Should price action for XAU/USD breakdown below 1,933.00 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1,913.00

- Take Profit Zone: 1,863.70 – 1,880.90

- Stop Loss Level: 1,933.00

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.