Japanese Buying Foreign Bonds for the period ending February 28th was reported at ¥523.4B, and Japanese Buying Foreign Stocks was reported at -¥745.0B. Forex traders can compare this to Japanese Buying Foreign Bonds for the period ending February 21st, which was reported at ¥397.3B and to Japanese Buying Foreign Stocks, which was reported at -¥68.1B. Foreign Buying Japanese Bonds for the period ending February 28th was reported at -¥489.7B, and Foreigners Buying Japanese Stocks was reported at ¥200.3B. Forex traders can compare this to Foreign Buying Japanese Bonds for the period ending February 21st, which was reported at ¥656.3B and to Foreigners Buying Japanese Stocks, which was reported at -¥279.4B.

The Australian Trade Balance for January was reported at A$5,210M. Economists predicted a figure of A$4,800M. Forex traders can compare this to the Australian Trade Balance for December, which was reported at A$5,376M. The German Markit Construction PMI for February was reported at 55.8. Forex traders can compare this to the German Markit Construction PMI for January, which was reported at 54.9.

US Initial Jobless Claims for the week of February 29th are predicted at 217K, and US Continuing Claims for the week of February 22nd are predicted at 1,725K. Forex traders can compare this to US Initial Jobless Claims for the week of February 22nd, which were reported at 219K and to US Continuing Claims for the week of February 15th, which were reported at 1,724K. Final US Non-Farm Productivity for the fourth-quarter is predicted to increase by 1.3% quarterly, and Unit Labor Costs are predicted to increase by 1.4% quarterly. Forex traders can compare this to previous US Non-Farm Productivity for the third quarter, which increased by 1.4% quarterly and to Unit Labor Costs, which increased by 1.4% quarterly.

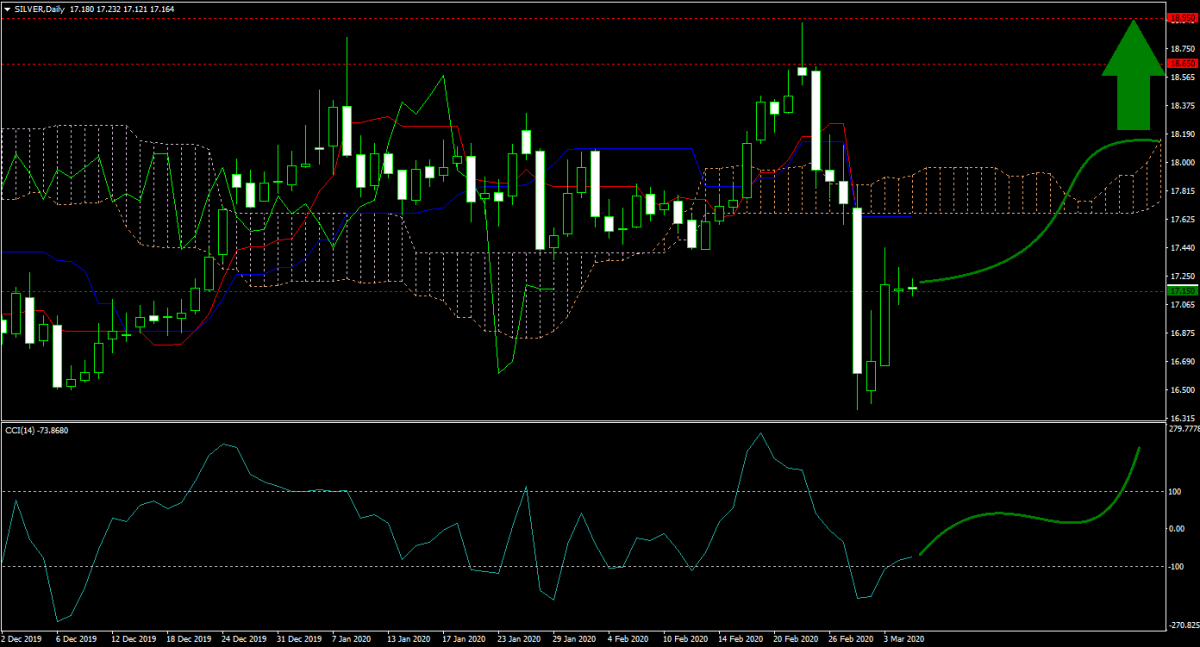

US Factory Orders for January are predicted to decrease by 0.1% monthly. Forex traders can compare this to US Factory Orders for December, which increased by 1.8% monthly. Silver retained its bullish momentum, and the forecast favors more upside, partially driven by safe-haven demand. Will bulls spike this precious metal to the upside or can bears pressure price action into a breakdown?

Should price action for Silver remain inside the or breakout above the 17.000 to 17.300 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 17.150

- Take Profit Zone: 18.650 – 18.950

- Stop Loss Level: 16.850

Should price action for Silver breakdown below 17.000 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 16.850

- Take Profit Zone: 16.000 – 16.350

- Stop Loss Level: 17.000

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.