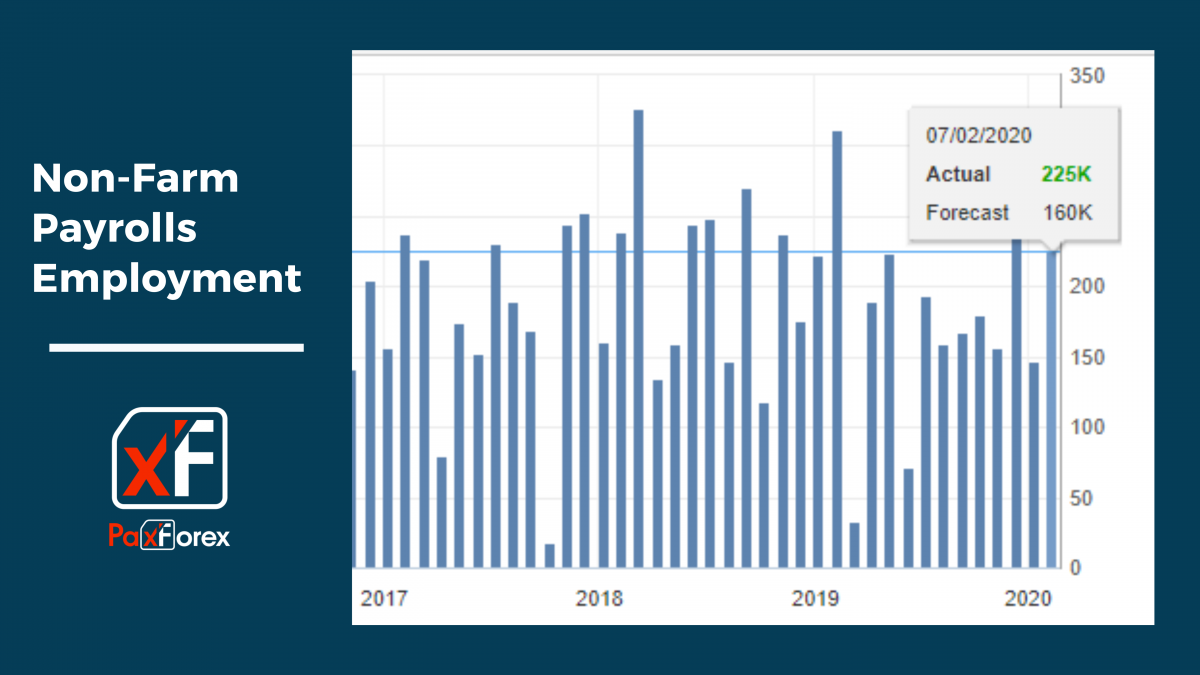

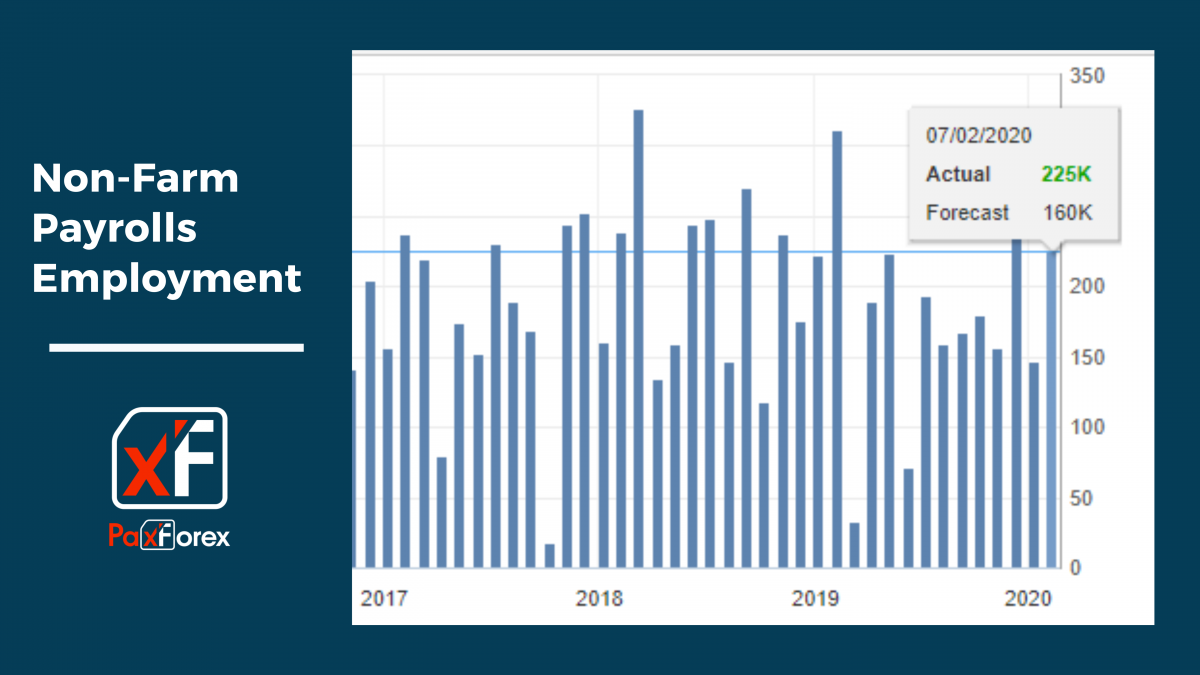

The U.S. Non-farm payrolls report (NFP) coming out this Friday on 06/03/2020 is in the focus of Forex traders as it will be one of the indicators of the impact of the coronavirus on the U.S. economy. Although the US Federal Reserve cut key interest rates by 50 basis points at once to support the country's economy, it does not cancel the risks that may negatively affect the economic stability.

Last data: 225K

Consensus Forecast: 175K

The U.S. labor market remains a pillar of the U.S. economy, with more jobs created last month than expected. Non-farm employment rose by 225k in January compared to expectations of growth of 160k. Although the projected figures are slightly lower than the previous ones, this is not significant at the moment.

In case this forecast comes true, Forex traders should expect the US dollar to grow against its main competitors.

Last data: 0.2%

Consensus forecast: 0.3%

This indicator shows the change in the average hourly wage level for major industries, except agriculture.

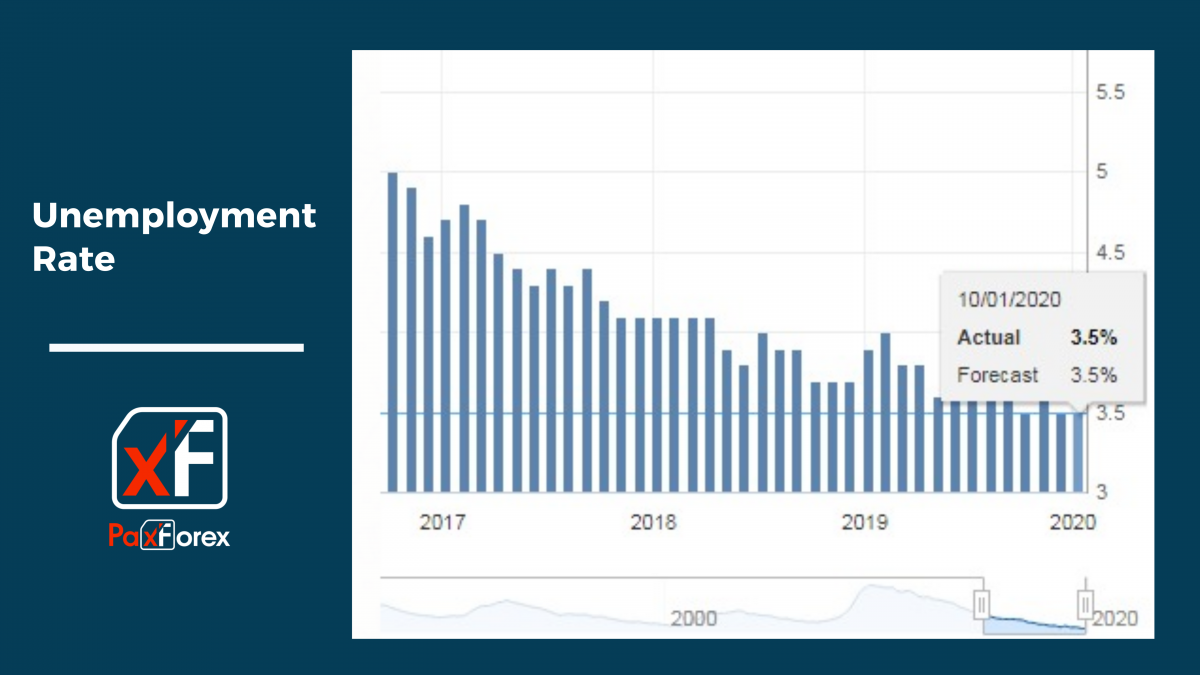

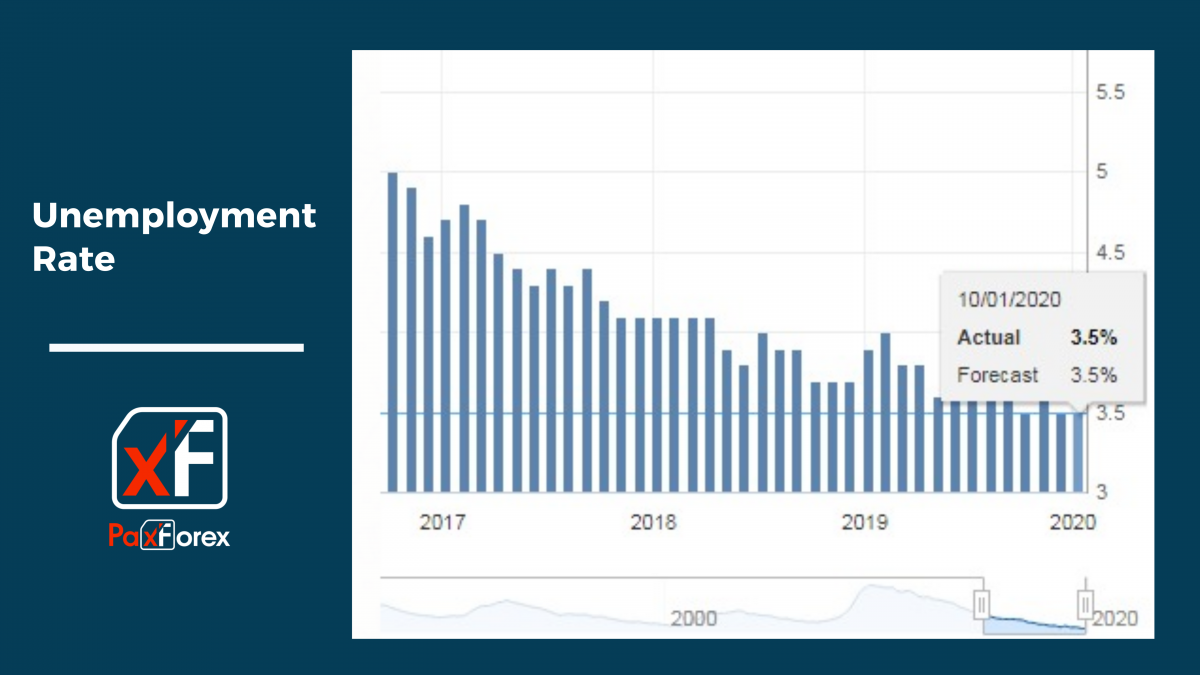

Past data: 3.6%

Consensus forecast: 3.6%

The unemployment rate in the USA remains at a historically low level of 3.6%, although it is not the lowest. According to the FOMC statements, the virus epidemic does not threaten the U.S. economy, but the regulator cut interest rates in order to reinsure and support the economy.

In the last release of the data, the movement on the EUR/USD currency pair at the moment made 20 points.

But it also caused a general mid-term movement of 194 points:

The more interesting course of events took place on the asset, which closely correlates with the EUR/USD currency pair - gold. At the moment of publication, the asset prices rose by 122 points or $12 per ounce.

We are one of the fastest growing Forex Brokers in the Market. Trade with PaxForex to get the full Forex Trading experience which is based on...

- The Reliability on all Assets in the Market

- Trusted Worldwide for over a Decade

- Live Multi-Lingual Online Support 24/5